Plasmid DNA Manufacturing Market Growth, Trends, and Key Players by 2034

Plasmid DNA Manufacturing Market Size

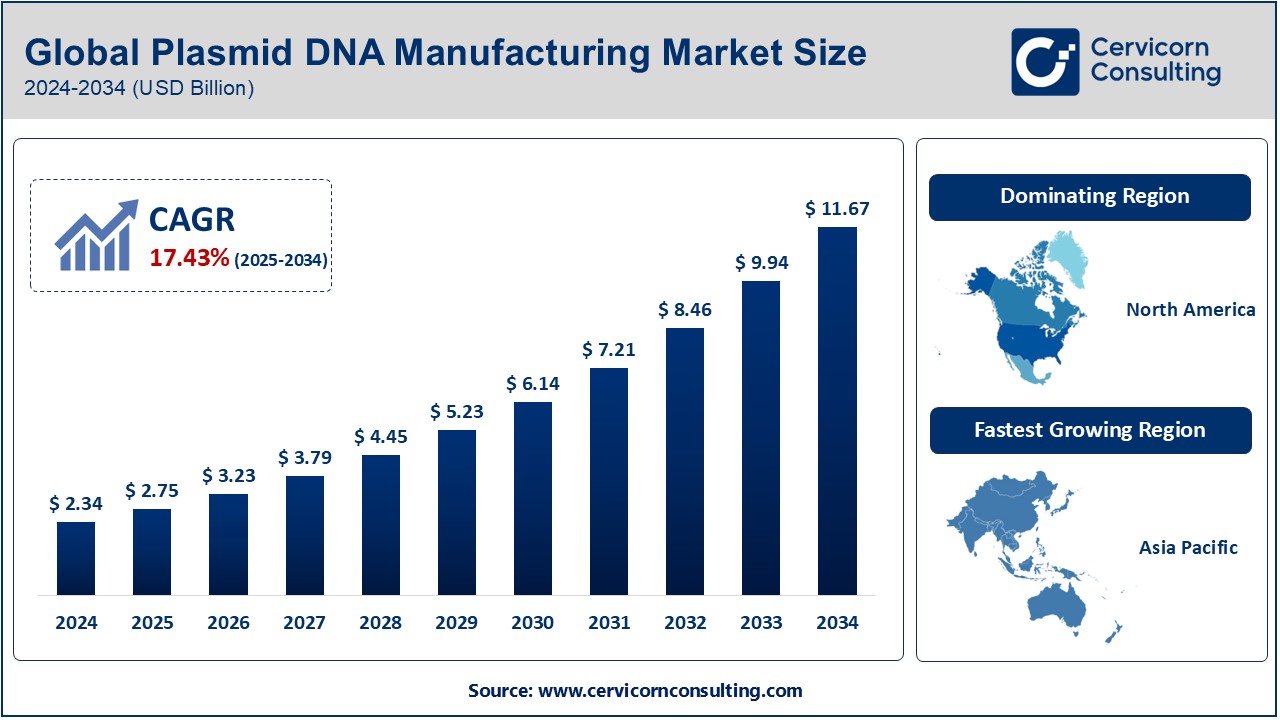

The global plasmid DNA manufacturing market was worth USD 2.34 billion in 2024 and is anticipated to expand to around USD 11.67 billion by 2034, registering a compound annual growth rate (CAGR) of 17.43% from 2025 to 2034.

What is the Plasmid DNA Manufacturing Market?

The plasmid DNA (pDNA) manufacturing market revolves around the production and supply of high-quality plasmid DNA used for various applications in gene therapy, vaccines, cell therapy, and molecular biology research. Plasmid DNA serves as a critical component in advanced therapeutic development, including messenger RNA (mRNA) vaccines, CAR-T therapies, and gene editing tools like CRISPR. The demand for plasmid DNA has grown significantly due to its essential role in cutting-edge medical advancements and biotechnology applications.

Why is Plasmid DNA Manufacturing Important?

Plasmid DNA manufacturing is pivotal in supporting the growth of the gene and cell therapy industry. Plasmid DNA is required for producing viral vectors, non-viral gene therapies, and mRNA-based vaccines. The COVID-19 pandemic underscored the importance of high-quality plasmid DNA in vaccine production, driving advancements in large-scale GMP-compliant manufacturing. The rising prevalence of genetic disorders, cancer therapies, and vaccine development further highlights the significance of plasmid DNA in modern medicine.

Growth Factors Driving the Plasmid DNA Manufacturing Market

The plasmid DNA manufacturing market is experiencing rapid growth due to several factors, including the increasing adoption of gene and cell therapies, rising investments in biopharmaceutical R&D, advancements in synthetic biology, and the growing prevalence of genetic disorders. The demand for high-quality, large-scale GMP-compliant plasmid DNA for viral vector production and non-viral gene delivery further propels the market. Additionally, supportive regulatory frameworks, government funding, and collaborations between biopharmaceutical companies and contract development and manufacturing organizations (CDMOs) contribute to market expansion.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2518

Plasmid DNA Manufacturing Market Top Companies

1. Akron Biotech

- Specialization: Plasmid DNA manufacturing, cell therapy, and regenerative medicine solutions

- Key Focus Areas: Viral vector production, gene therapy, cell therapy, GMP-compliant pDNA manufacturing

- Notable Features: Cutting-edge bioprocessing technologies, flexible manufacturing capabilities, and regulatory compliance

- 2024 Revenue (approx.): $250 million

- Market Share (approx.): 10%

- Global Presence: North America, Europe, Asia-Pacific

2. Cobra Biologics & Pharmaceutical Services

- Specialization: Advanced biologics manufacturing, including plasmid DNA and viral vector production

- Key Focus Areas: Gene therapy, immunotherapy, cell therapy, GMP plasmid DNA production

- Notable Features: Integrated CDMO services, strong regulatory support, extensive experience in ATMP manufacturing

- 2024 Revenue (approx.): $200 million

- Market Share (approx.): 8%

- Global Presence: Europe, North America

3. Aldevron

- Specialization: Plasmid DNA, mRNA, and gene therapy manufacturing

- Key Focus Areas: Large-scale plasmid DNA production for gene therapy, CAR-T, and vaccine applications

- Notable Features: High-purity GMP-grade plasmid DNA, proprietary technology, scalability

- 2024 Revenue (approx.): $600 million

- Market Share (approx.): 20%

- Global Presence: North America, Europe, Asia-Pacific

4. Plasmidfactory GmbH

- Specialization: High-quality plasmid DNA production for research and therapeutic applications

- Key Focus Areas: CRISPR applications, gene therapy, mRNA production

- Notable Features: Proprietary mini-circle technology, high-quality GMP plasmid DNA

- 2024 Revenue (approx.): $100 million

- Market Share (approx.): 4%

- Global Presence: Europe, North America

5. Vigene Biosciences

- Specialization: Plasmid DNA, viral vector production, gene therapy manufacturing

- Key Focus Areas: AAV, lentivirus, and retrovirus production, GMP plasmid DNA

- Notable Features: End-to-end viral vector manufacturing, strong CDMO capabilities

- 2024 Revenue (approx.): $300 million

- Market Share (approx.): 12%

- Global Presence: North America, Asia-Pacific, Europe

Leading Trends and Their Impact

- Surging Demand for Gene Therapy: The increasing focus on gene therapy has led to heightened demand for GMP-compliant plasmid DNA, driving innovation in scalable production technologies.

- Adoption of Synthetic Biology: Advances in synthetic biology are improving plasmid design and optimizing gene expression for therapeutic applications.

- Automation and Digitalization: Automated bioprocessing and AI-driven quality control are enhancing efficiency in plasmid DNA manufacturing.

- Expansion of CDMO Partnerships: Collaboration between biopharmaceutical companies and CDMOs is streamlining production and ensuring regulatory compliance.

- Government Funding and Regulatory Support: Increasing investments from governments and regulatory agencies are accelerating market growth.

Successful Examples of Plasmid DNA Manufacturing Around the World

- Pfizer-BioNTech COVID-19 Vaccine: The large-scale production of plasmid DNA played a critical role in the development of mRNA vaccines, showcasing its significance in modern medicine.

- Novartis’ CAR-T Therapy (Kymriah): Plasmid DNA is essential in CAR-T cell manufacturing, enabling targeted cancer treatments.

- Bluebird Bio’s Gene Therapy: The company’s gene therapy for rare genetic disorders demonstrates the vital role of high-quality plasmid DNA in precision medicine.

- CRISPR Therapeutics: CRISPR-based gene editing therapies rely on plasmid DNA for targeted modifications in genetic research and clinical applications.

Regional Analysis: Government Initiatives and Policies Shaping the Market

North America

- United States: Strong government support through initiatives like the National Institutes of Health (NIH) funding for gene therapy research. The FDA’s streamlined approval process for cell and gene therapies is accelerating market growth.

- Canada: Increasing investments in biomanufacturing infrastructure and collaborations between academic institutions and biotech firms.

Europe

- Germany: Home to leading biotech firms, with strong regulatory support and funding from the European Medicines Agency (EMA).

- United Kingdom: Government-backed initiatives such as the UK Biobank and investment in Advanced Therapy Medicinal Products (ATMPs) drive market expansion.

- France: Expanding gene therapy research, supported by government funding and strategic partnerships with global biotech companies.

Asia-Pacific

- China: Significant government investments in biotech innovation and gene therapy manufacturing, fostering a rapidly growing plasmid DNA market.

- Japan: Strong regulatory support for regenerative medicine, boosting demand for high-quality GMP plasmid DNA.

- India: Emerging as a biopharma manufacturing hub with increased investments in vaccine production and gene therapy research.

Latin America

- Brazil: Expanding biopharmaceutical industry with government initiatives to enhance biotechnology and genetic research capabilities.

- Mexico: Increasing collaborations between academic institutions and biotech firms to promote plasmid DNA manufacturing.

Middle East & Africa

- United Arab Emirates: Investments in healthcare innovation and biopharma manufacturing to strengthen the region’s gene therapy sector.

- South Africa: Growing interest in biotechnology and genetic research, supported by government-backed initiatives.

The plasmid DNA manufacturing market is poised for rapid growth, driven by advancements in gene therapy, increasing demand for mRNA vaccines, and strong regulatory support across regions. With major players expanding their global footprint and leveraging cutting-edge technologies, the industry is set to play a transformative role in the future of biotechnology and precision medicine.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Contract Development and Manufacturing Organization (CDMO) Market Size, Trends, and Growth Outlook (2024-2034)