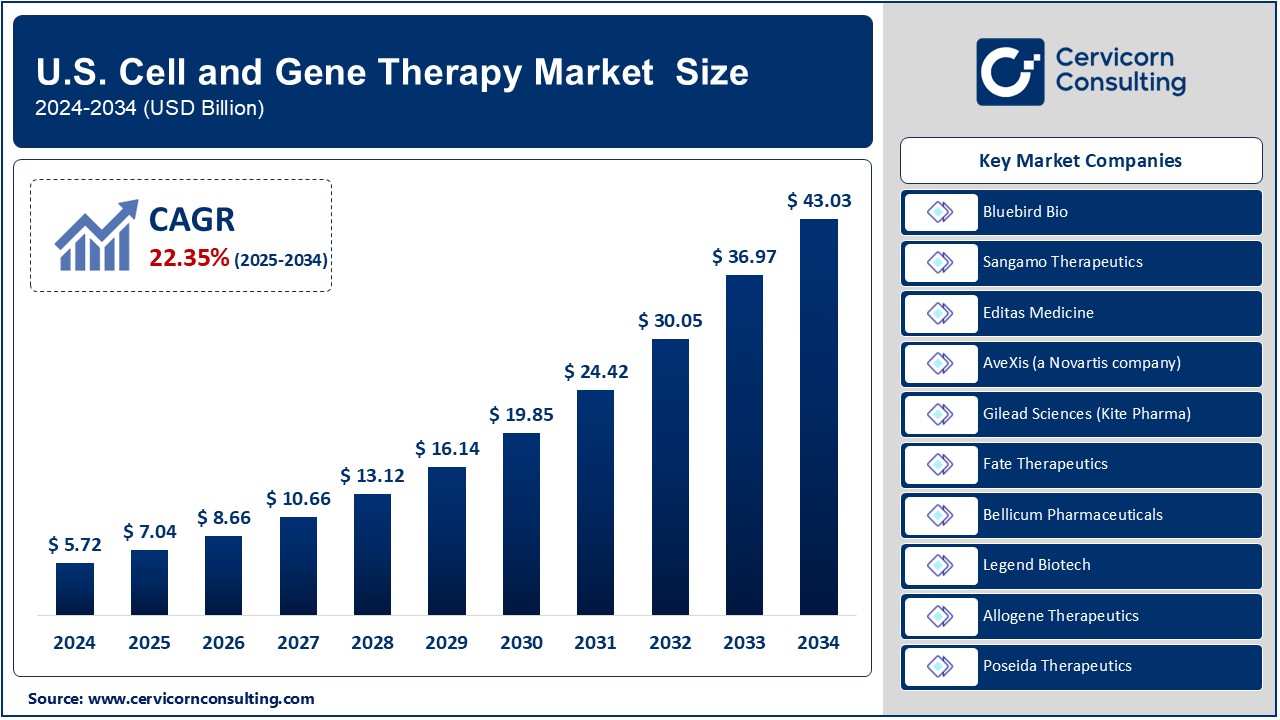

U.S. Cell and Gene Therapy Market Growing to USD 43.03 Billion by 2034

U.S. Cell and Gene Therapy Market Size

The U.S. cell and gene therapy market was worth USD 5.72 billion in 2024 and is anticipated to expand to around USD 43.03 billion by 2034, registering a compound annual growth rate (CAGR) of 22.35% from 2025 to 2034.

What is the U.S. Cell and Gene Therapy Market?

The U.S. cell and gene therapy market represents a dynamic and rapidly evolving segment of the healthcare industry. It focuses on developing innovative treatments that modify or replace genetic material or use living cells to treat or prevent diseases. This market encompasses therapies that leverage cutting-edge technologies like CRISPR-Cas9, viral vectors, and autologous or allogeneic cells. These therapies are applied across various medical conditions, including cancer, rare genetic disorders, and autoimmune diseases.

Why is the U.S. Cell and Gene Therapy Market Important?

The importance of the U.S. cell and gene therapy market lies in its transformative potential to address unmet medical needs. Unlike traditional treatments that merely alleviate symptoms, cell and gene therapies target the root causes of diseases, offering the possibility of long-term or permanent cures. This approach has significant implications for improving patient outcomes, reducing healthcare costs, and driving innovation in biopharmaceuticals. Furthermore, the U.S. market serves as a global hub for research and development (R&D), with its advanced regulatory frameworks, robust funding ecosystems, and world-class institutions fostering rapid advancements in the field.

Growth Factors in the U.S. Cell and Gene Therapy Market

The U.S. cell and gene therapy market is witnessing robust growth due to several factors, including technological advancements in genetic engineering, increased investment in R&D, favorable regulatory support from agencies like the FDA, and a growing pipeline of therapies targeting rare and complex diseases. The rising prevalence of chronic and genetic disorders, coupled with an increasing awareness of innovative therapies, further drives market expansion. Additionally, partnerships between biopharmaceutical companies, academic institutions, and government bodies are accelerating the development and commercialization of these therapies.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2550

U.S. Cell and Gene Therapy Market: Top Companies

1. Bluebird Bio

- Specialization: Gene therapy for severe genetic disorders and rare diseases.

- Key Focus Areas: Beta-thalassemia, sickle cell disease, and cerebral adrenoleukodystrophy (CALD).

- Notable Features: Bluebird Bio has been a pioneer in developing lentiviral vector-based gene therapies. Its product, Zynteglo, is among the first FDA-approved gene therapies for beta-thalassemia.

- 2024 Revenue (Approx.): $450 million.

- Market Share (Approx.): 8%.

- Global Presence: Bluebird Bio has a strong presence in North America and Europe, with ongoing expansion into emerging markets.

2. Sangamo Therapeutics

- Specialization: Genomic medicines using zinc finger nuclease (ZFN) technology.

- Key Focus Areas: Hemophilia A, Fabry disease, and inherited metabolic disorders.

- Notable Features: Sangamo’s proprietary ZFN platform offers precision gene editing capabilities, positioning it as a leader in gene regulation therapies.

- 2024 Revenue (Approx.): $350 million.

- Market Share (Approx.): 6%.

- Global Presence: Sangamo has strategic collaborations with global pharmaceutical companies like Pfizer and Sanofi, enhancing its international footprint.

3. Editas Medicine

- Specialization: CRISPR-based gene editing technologies.

- Key Focus Areas: Genetic eye disorders, oncology, and rare diseases.

- Notable Features: Editas Medicine is a pioneer in CRISPR-Cas9 applications, with a strong pipeline of therapies targeting genetic blindness and cancer.

- 2024 Revenue (Approx.): $400 million.

- Market Share (Approx.): 7%.

- Global Presence: Primarily focused on the U.S. market but actively exploring global partnerships.

4. AveXis (a Novartis company)

- Specialization: Gene therapies for neurological disorders.

- Key Focus Areas: Spinal muscular atrophy (SMA) and other neurodegenerative diseases.

- Notable Features: AveXis developed Zolgensma, a groundbreaking gene therapy for SMA, which has become one of the most expensive yet life-changing treatments globally.

- 2024 Revenue (Approx.): $1.2 billion.

- Market Share (Approx.): 15%.

- Global Presence: AveXis operates under Novartis’ extensive global network, ensuring broad accessibility to its therapies.

5. Gilead Sciences (Kite Pharma)

- Specialization: Cell therapies, particularly CAR-T therapies.

- Key Focus Areas: Oncology, including lymphomas and leukemia.

- Notable Features: Kite Pharma’s CAR-T therapy, Yescarta, has revolutionized cancer treatment by offering personalized immunotherapy solutions.

- 2024 Revenue (Approx.): $2 billion.

- Market Share (Approx.): 25%.

- Global Presence: Gilead’s Kite Pharma has a well-established global supply chain and manufacturing facilities, ensuring widespread distribution.

Leading Trends and Their Impact

1. Increasing Adoption of CAR-T Therapies: Chimeric Antigen Receptor (CAR)-T therapies have gained significant traction in treating hematologic malignancies. Companies like Gilead Sciences and Bristol-Myers Squibb are investing heavily in expanding CAR-T applications to solid tumors, which could drastically broaden the market scope.

Impact: Enhanced focus on CAR-T therapies is likely to drive higher adoption rates, increase market revenue, and improve survival rates for cancer patients.

2. Technological Advancements in Gene Editing: CRISPR-Cas9 and other gene-editing tools have opened new avenues for targeted therapies. These technologies are becoming more precise and cost-effective, enabling their application in a wider range of diseases.

Impact: The adoption of advanced gene-editing tools accelerates drug development timelines, reduces costs, and facilitates personalized medicine.

3. Expansion into Rare Disease Therapies: Many companies are focusing on orphan diseases, given their high unmet need and attractive market exclusivity periods under the Orphan Drug Act.

Impact: Targeting rare diseases ensures high-profit margins and fosters innovation in tackling previously untreatable conditions.

4. Advanced Manufacturing Technologies: Innovations like modular manufacturing and automation are improving scalability and reducing production costs for cell and gene therapies.

Impact: Improved manufacturing efficiencies ensure faster commercialization and lower treatment costs, expanding patient access.

Successful Examples of U.S. Cell and Gene Therapy

1. Zolgensma (AveXis/Novartis): Approved by the FDA in 2019, Zolgensma is a gene therapy for spinal muscular atrophy (SMA). It delivers a functional copy of the SMN1 gene to address the root cause of SMA, offering a potential one-time cure.

2. Yescarta (Kite Pharma/Gilead Sciences): Yescarta is a CAR-T cell therapy for certain types of non-Hodgkin’s lymphoma. It has demonstrated high efficacy in patients who were unresponsive to traditional treatments.

3. Luxturna (Spark Therapeutics): This gene therapy targets inherited retinal diseases caused by RPE65 gene mutations, offering a groundbreaking treatment for genetic blindness.

4. Breyanzi (Bristol-Myers Squibb): Breyanzi is another CAR-T cell therapy approved for large B-cell lymphoma, showcasing the expanding applications of CAR-T technologies.

Government Initiatives and Policies Shaping the Market

1. Accelerated Approval Pathways: The U.S. Food and Drug Administration (FDA) has introduced programs like Breakthrough Therapy Designation and Regenerative Medicine Advanced Therapy (RMAT) designation to expedite the approval process for cell and gene therapies.

Impact: These programs shorten development timelines and facilitate faster patient access to innovative treatments.

2. Funding Initiatives: Government agencies such as the National Institutes of Health (NIH) and the Department of Defense (DoD) have significantly increased funding for cell and gene therapy research.

Impact: Enhanced funding supports basic research and early-stage development, fostering innovation in the field.

3. Public-Private Partnerships: Collaborations between government bodies, academic institutions, and private companies are accelerating advancements in cell and gene therapy.

Example: The NIH’s Somatic Cell Genome Editing (SCGE) program aims to develop tools and technologies to improve the safety and efficacy of genome editing.

4. Medicare and Medicaid Policies: Revised reimbursement policies are addressing the high costs of cell and gene therapies, making them more accessible to patients.

Impact: Improved reimbursement frameworks encourage wider adoption and reduce the financial burden on patients.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Cell and Gene Therapy Market Trends, Growth & Insights 2024-2033