Generative AI in Healthcare Market Revenue, Global Presence, and Strategic Insights by 2034

Generative AI in Healthcare Market Size

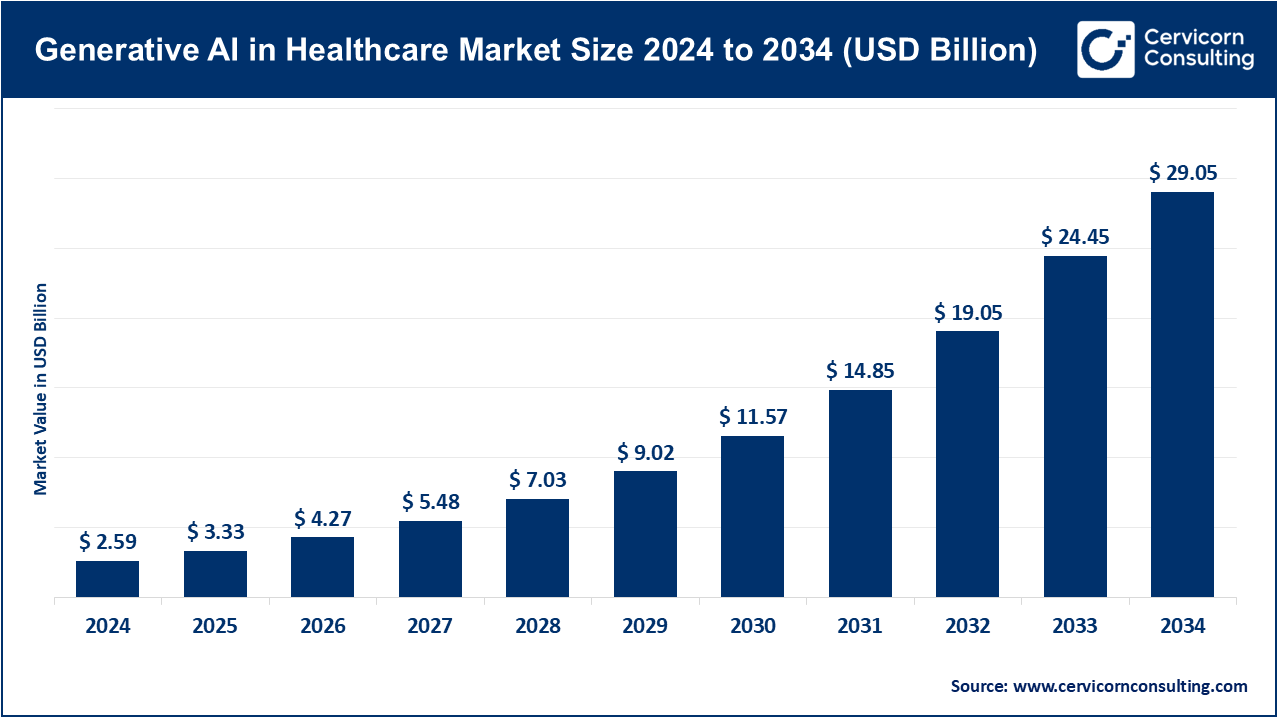

The global generative AI in healthcare market size was worth USD 2.59 billion in 2024 and is anticipated to expand to around USD 29.05 billion by 2034, registering a compound annual growth rate (CAGR) of 27.34% from 2025 to 2034.

Growth Factors

The generative AI in healthcare market is growing due to several interlinked drivers: soaring volumes of unstructured medical data, rising clinician burnout that demands automated documentation workflows, rapid enhancement in LLM capabilities, availability of cloud computing infrastructure, strong capital inflow from investors, and increasing digital transformation initiatives across hospitals and pharmaceutical companies. Government policies and regulatory clarity in major regions have further encouraged responsible AI development and adoption. Health systems under cost pressure are turning to AI to streamline operations, while pharmaceutical companies rely on generative algorithms to accelerate research pipelines. Taken together, these forces are expected to push the market toward sustained high double-digit growth throughout the next decade.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2428

What Is the Generative AI in Healthcare Market?

The generative AI in healthcare market comprises technologies and solutions that create new content—such as clinical notes, diagnostic reports, patient education materials, synthetic health records, and molecular structures—using advanced AI models. Key product categories include:

- Ambient clinical documentation (AI scribes, note creation)

- Medical LLMs for clinical question answering and decision support

- Synthetic healthcare data platforms for safe research and model training

- Generative imaging tools for radiology, pathology, and ophthalmology

- Drug discovery and molecular generation systems

- Patient engagement chatbots and care navigation assistants

Commercially, it includes SaaS tools for hospitals, APIs for developers, enterprise AI platforms for payers, and discovery tools for pharmaceutical and biotechnology firms.

Why the Market Is Important

Generative AI is transforming healthcare by addressing long-standing challenges:

- Reducing documentation burden: Physicians spend excessive time on charting. Generative AI automates summaries, freeing clinicians to focus on patient care.

- Improving diagnostic accuracy: Multimodal AI models help radiologists and clinicians review images and records more quickly and thoroughly.

- Accelerating drug discovery: Generative tools propose novel molecules, optimize synthesis routes, and reduce R&D cycle time.

- Supporting patients: AI chatbots provide understandable explanations of medical terms, post-discharge instructions, and chronic disease guidance.

- Enhancing data access: Synthetic data allows research insights without violating privacy regulations, enabling collaboration across institutions.

Collectively, these advantages make generative AI a strategic priority for healthcare modernization worldwide.

Key Company Profiles

1. Google LLC

Specialization

Medical LLMs (Med-PaLM, MedLM), cloud AI services, multimodal research models.

Key Focus Areas

- Clinical question-answering

- Documentation assistance

- Healthcare analytics

- Deployment through Google Cloud

Notable Features

- Med-PaLM and MedLM models built specifically for medical applications

- Strong partnerships with health systems and research institutions

- Secure, scalable cloud architecture

2024 Revenue & Market Share

- Alphabet reported approximately $350 billion in 2024 revenue.

- Healthcare-specific revenue is not separately disclosed.

- Holds significant indirect share as a platform provider.

Global Presence

Global cloud infrastructure, healthcare partnerships across North America, Europe, and Asia.

2. OpenAI, Inc.

Specialization

Foundation LLMs (GPT series), enterprise APIs, and safety-tuned model deployments for healthcare.

Key Focus Areas

- Content generation in clinical and administrative workflows

- Triage bots and patient support tools

- Healthcare app integrations through APIs

Notable Features

- Large developer ecosystem

- Enterprise-grade fine-tuning options

- Broad adoption across digital health startups

2024 Revenue & Market Share

- Reported annualized revenue in 2024 was roughly $5.5 billion.

- Healthcare-specific revenue not separately disclosed.

Global Presence

Widely integrated across healthcare software platforms in the U.S., Europe, and APAC.

3. Abridge AI, Inc.

Specialization

Ambient clinical scribing and medical conversation summarization.

Key Focus Areas

- Automating EHR-ready medical notes

- Structuring clinical conversations

- Enhancing clinical coding and billing

Notable Features

- Deeply trained on medical language

- Integrations with Epic and other major EHRs

- Used widely across large U.S. health systems

2024 Revenue & Market Share

- Private company with revenue estimated in the tens-to-hundreds of millions (various reports).

- One of the fastest-growing clinical documentation AI vendors.

Global Presence

Primarily U.S., expanding to international enterprise deployments.

4. IBM

Specialization

Enterprise AI, cloud services, and consulting solutions for healthcare.

Key Focus Areas

- AI-enabled analytics

- Hybrid cloud for hospitals

- Compliance-focused infrastructure

Notable Features

- Decades of expertise in enterprise IT

- Strong in security, governance, and regulatory compliance

- Broad healthcare customer base

2024 Revenue & Market Share

- Total 2024 revenue approximately $62.8 billion.

- Healthcare revenue embedded across business units.

Global Presence

Significant presence in North America, Europe, Asia-Pacific, and emerging markets.

5. Watson Health Corporation / Merative

Specialization

Healthcare data analytics, imaging analytics, and decision-support tools.

Key Focus Areas

- Clinical analytics

- Claims data intelligence

- Imaging-related AI solutions

Notable Features

- Strong historical data assets

- One of the earliest large-scale healthcare AI brands

- Relaunched as Merative after divestiture

2024 Revenue & Market Share

- Previously reported around $1 billion during IBM ownership.

- Currently private with undisclosed revenue.

Global Presence

Widespread customer base across the U.S., Europe, and Asia.

Leading Trends and Their Impact

1. Ambient AI for Clinical Documentation

Ambient AI tools automatically summarize clinician–patient conversations, creating accurate EHR notes.

Impact: reduces burnout, increases patient-facing time, and improves documentation quality.

2. Domain-Tuned Medical LLMs

Models specifically trained on medical corpora outperform general-purpose models in accuracy and reliability.

Impact: safer, more precise clinical decision support.

3. Synthetic Healthcare Data

Generative models create realistic synthetic datasets that preserve statistical patterns without exposing patient identities.

Impact: accelerates AI research, enables multi-institution collaboration, and supports regulatory compliance.

4. Multimodal Models for Imaging + Text

These models analyze radiology images along with clinical histories.

Impact: improves detection, speeds reporting, and reduces radiologist workload.

5. AI-Driven Drug Discovery

Generative models propose novel molecular structures and optimize simulations.

Impact: cuts early-stage drug discovery timelines significantly.

6. Improved AI Governance and Safety Frameworks

Model explainability, ongoing monitoring, and human-in-the-loop oversight are becoming mandatory.

Impact: increases trust and adoption in clinical environments.

Successful Global Examples

Abridge Deployments Across Major U.S. Health Systems

Enterprise implementations at leading health systems show strong reductions in clinician documentation time and improved accuracy of clinical notes. These deployments have accelerated adoption of generative AI scribes.

Google Med-PaLM Trials and Integrations

Med-PaLM and MedLM have been tested in real clinical settings, demonstrating strong performance in medical reasoning tasks and initial pilot use for clinical workflows.

Radiology Report Generation with Generative AI

Hospitals around the world now use models that automatically draft radiology reports from imaging studies, accelerating turnaround times and reducing workload.

Pharma Partnerships for Molecule Generation

Pharmaceutical companies collaborate with AI firms to generate molecular structures and run in silico simulations, significantly speeding the discovery pipeline.

Global Regional Analysis — Government Initiatives and Policies

United States

- FDA AI/ML SaMD Framework: Clarifies how AI systems used for diagnostics and decision support will be regulated.

- Impact: Encourages responsible innovation while requiring transparency, risk management, and performance monitoring.

- Federal digital health incentives: Programs supporting EHR modernization and interoperability align well with generative AI adoption.

European Union

- EU AI Act (2024): Classifies healthcare AI as high-risk, requiring strict oversight, documentation, audits, and human supervision.

- Impact: Creates strong guardrails that ensure safety but raise compliance costs for vendors.

- Emphasis on privacy: GDPR shapes data-sharing policies, making synthetic data increasingly important.

India and Asia-Pacific

- India’s National AI Strategy & digital health ecosystem: Promotes AI for diagnostics, imaging, telemedicine, and public health infrastructure.

- Emerging public-private partnerships accelerate real-world generative AI pilots in radiology and primary care.

- Other APAC countries including Singapore and South Korea offer AI sandboxes, healthcare innovation grants, and regulatory guidance frameworks.

- Impact: Rapid adoption potential in regions seeking to improve access and scale care efficiently.

Cross-Border Considerations

- Privacy regulations restrict free movement of clinical data, encouraging synthetic data and federated learning.

- High-risk classification of medical AI globally increases demand for governance, auditability, and safe deployment architectures.

- Vendor strategies increasingly include localization, region-specific model tuning, and compliance alignment.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Digital Transformation in Chemical Market Revenue, Global Presence, and Strategic Insights by 2034