Composites Market Revenue, Global Presence, and Strategic Insights by 2035

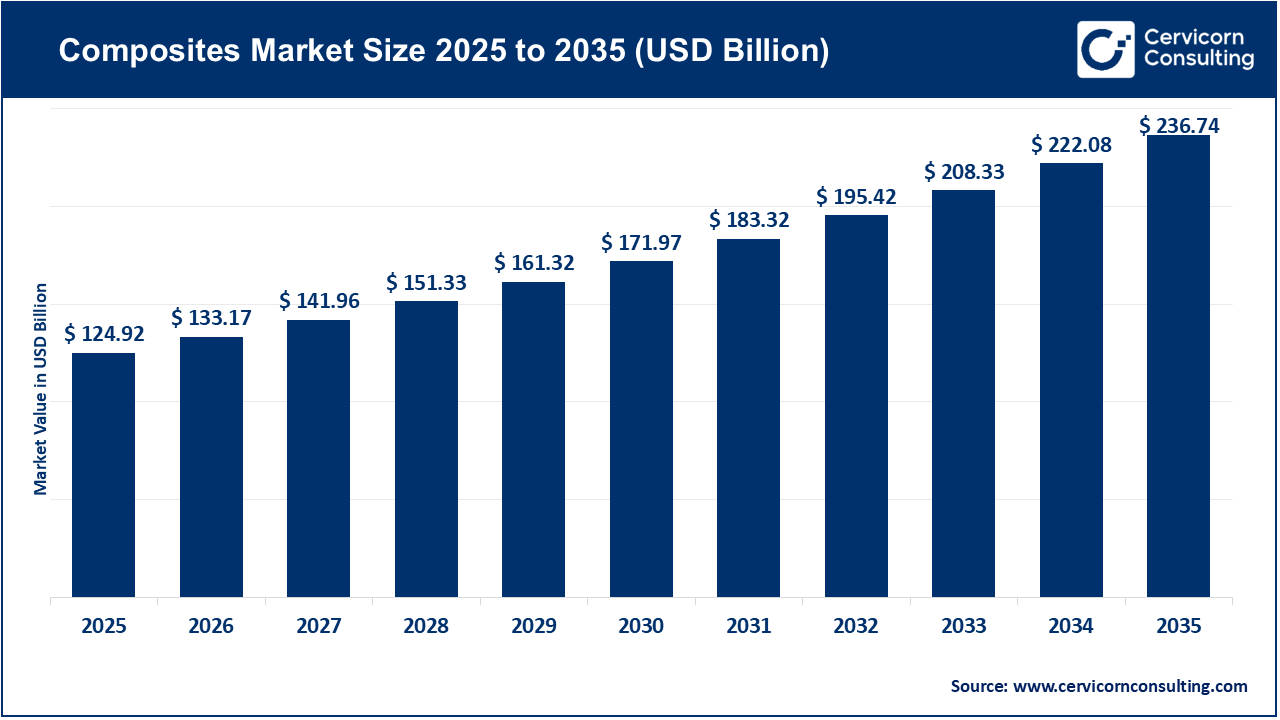

Composites Market Size

The global composites market size was worth USD 124.92 billion in 2025 and is anticipated to expand to around USD 236.74 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% from 2026 to 2035.

Growth Factors

The composites market is growing due to a combination of technological, economic, and environmental forces: rising demand for lightweight materials in automotive and aerospace sectors to meet fuel-efficiency and emission standards; rapid expansion of renewable energy, particularly wind power, which requires massive composite turbine blades; increased use of composites in electric vehicles for battery enclosures, body panels, and crash structures; advancements in automated composite manufacturing that reduce time, cost, and waste.

Growing adoption of composites in buildings and infrastructure for corrosion resistance, longevity, and reduced maintenance costs; government policies promoting clean mobility, renewable energy, and sustainable manufacturing; and continuous R&D investments in thermoplastic composites, recyclability, and high-performance fiber systems. Together, these drivers bind into a strong long-term growth engine for the global composites market.

What Is the Composites Market?

The composites market consists of engineered materials created by combining two or more constituent materials—typically a reinforcement (such as carbon fiber, glass fiber, or aramid) and a matrix (like epoxy, polyester, vinyl ester, or high-performance thermoplastics). The resulting composite material offers superior properties compared to its individual components, including high strength-to-weight ratio, corrosion resistance, fatigue resistance, and design flexibility.

The market spans raw materials (fibers, resin systems, additives), intermediate products (fabrics, prepregs, laminates), and end-use components across aerospace, automotive, wind energy, construction, marine, consumer goods, electrical/electronics, sports equipment, and industrial systems. It also includes tooling solutions, manufacturing technologies (like resin transfer molding, autoclave processing, automated fiber placement), and engineering services.

Why Is It Important?

Composites are important because they enable performance gains that traditional metals cannot achieve. Their lightweight nature helps reduce fuel consumption and emissions in automotive and aerospace sectors—critical requirements as global regulations tighten. In renewable energy, composites enable the production of larger, more efficient wind turbine blades, improving energy capture and lowering cost per kilowatt-hour. Their corrosion and fatigue resistance makes them ideal for infrastructure, marine, and chemical environments, reducing lifetime maintenance costs. Emerging recyclable thermoplastic composites also align the industry with global sustainability goals. By allowing engineers to integrate multiple functions into a single structure—strength, insulation, thermal stability, and durability—composites unlock new design possibilities and improve efficiency across industries.

Top Companies in the Composites Market

Below are the key global leaders shaping the composite materials landscape, including their specialization, focus areas, notable features, 2024 revenues, market positions, and global presence.

1. Toray Industries, Inc.

Specialization: Carbon fiber, advanced composite materials, prepregs, textile fibers.

Key Focus Areas: Aerospace composite systems, automotive lightweight structures, pressure vessels, wind energy components, carbon fiber recycling technologies.

Notable Features: Toray is widely recognized as the world leader in carbon fiber production, with vertically integrated capabilities from polymer precursor to finished composite components.

2024 Revenue: ¥2,464.6 billion (consolidated).

Market Share & Global Presence: Toray holds a significant share of the global carbon fiber market and operates in Japan, the U.S., Europe, and multiple Asian regions, supporting aerospace OEMs and industrial sectors worldwide.

2. Hexcel Corporation

Specialization: High-performance carbon fiber, prepregs, honeycomb structures, and engineered composite products.

Key Focus Areas: Commercial and military aerospace programs, helicopter structures, wind turbine materials, automotive advanced composites.

Notable Features: Hexcel is a major supplier of composite materials to leading aircraft platforms and invests heavily in automated manufacturing technologies.

2024 Revenue: $1.903 billion.

Market Share & Global Presence: Hexcel is one of the top global suppliers for aerospace composites and operates across North America, Europe, and Asia.

3. Owens Corning

Specialization: Glass-fiber reinforcements, fiberglass composites, insulation, roofing systems.

Key Focus Areas: Building materials, industrial composite reinforcements, infrastructure solutions, corrosion-resistant systems.

Notable Features: A long-standing leader in glass fiber technology, Owens Corning is a dominant supplier in construction and industrial composites.

2024 Revenue: $11.0 billion (total company revenue).

Market Share & Global Presence: Owens Corning has strong manufacturing footprints in North America, Europe, and Asia, making it one of the largest global producers of glass-fiber materials.

4. DuPont

Specialization: High-performance polymers, adhesives, films, and engineered materials used in composite systems.

Key Focus Areas: Electronics, transportation, aerospace materials, industrial adhesives, and protective applications.

Notable Features: DuPont’s materials—especially high-temperature polymers, advanced adhesives, and films—are widely integrated into composite designs and manufacturing.

2024 Revenue: $12.386 billion.

Market Share & Global Presence: DuPont has a global presence across the Americas, EMEA, and APAC, with its engineered materials used across automotive, industrial, and electronic composite applications.

5. Cytec Industries (Now Solvay Composite Materials)

Specialization: Epoxy resin systems, cyanate ester resins, aerospace adhesives, and advanced prepregs.

Key Focus Areas: Military and commercial aerospace, industrial composites requiring high-temperature resistance, structural adhesives.

Notable Features: A pioneer in aerospace resin systems, Cytec’s technologies now strengthen Solvay’s extensive portfolio of specialty composite materials.

2024 Revenue (Solvay): €4.686 billion (underlying net sales).

Market Share & Global Presence: Solvay’s global footprint spans Europe, North America, and Asia, making it a key supplier to aerospace, automotive, and industrial sectors.

Leading Trends and Their Impact

1. Electrification and Lightweighting in Automotive

As electric vehicles become mainstream, composites play a critical role in enhancing driving range by reducing vehicle mass. Composite battery enclosures and structural components also offer better crashworthiness and thermal resistance. This trend is pushing automakers to adopt thermoplastic composites that support automation and faster production cycles.

2. Growth of Utility-Scale Wind Energy

Wind turbine blades are among the largest composite structures in the world. As blade length surpasses 100 meters for offshore installations, demand for large-volume glass fiber, specialty resins, and fatigue-resistant composites continues to rise. This trend drives capacity expansions at fiber and resin manufacturers globally.

3. Automation and Digital Manufacturing

Automated fiber placement, robotic layup, digital twins, and advanced curing technologies significantly reduce waste and manual labor. Automation expands composites usage into high-volume applications like automotive and consumer goods.

4. Thermoplastic Composite Adoption

Thermoplastic composites offer faster cycle times, weldability, and recyclability, making them increasingly attractive for automotive and electronics. Their reprocessability is crucial as industries shift toward circular manufacturing models.

5. Material Innovations: Nanocomposites and Hybrids

Hybrid fiber systems (e.g., carbon + glass) and nano-reinforced composites improve damage tolerance, stiffness, and electrical conductivity. These innovations open new opportunities in aerospace interiors, drones, electronics housings, and protective gear.

6. Regionalization of Supply Chains

Manufacturers are localizing critical composite supply chains to reduce reliance on imports, improve resilience, and respond to geopolitical risks. This has led to new composite plants in North America and Asia, particularly for carbon fiber and specialty resins.

Successful Global Examples of Composite Applications

Aerospace

Aircraft such as the Boeing 787 Dreamliner and Airbus A350 feature composite fuselages and wings, reducing weight by up to 20% and improving fuel efficiency. These platforms showcase the reliability and performance superiority of advanced carbon-fiber composites.

Wind Energy

Modern wind turbines rely on huge composite blades made primarily from glass fiber and epoxy resins. Their strength, flexibility, and fatigue resistance are essential for long-term operation in harsh offshore conditions.

Automotive / Electric Vehicles

Composite-intensive electric supercars and high-end EVs use carbon-fiber body structures, battery housings, and aerodynamic components to achieve higher efficiency and performance.

Infrastructure and Construction

Composites are increasingly used in bridge rehabilitation, corrosion-resistant piping, and rebar replacements. Their long lifespan and resistance to rust make them ideal for coastal regions and chemically harsh industrial environments.

Marine Engineering

Composite boat hulls, propellers, and offshore structures offer higher durability and lower maintenance compared to metals, making them standard in commercial shipbuilding and naval applications.

Global Regional Analysis & Government Policies Shaping the Market

North America

- Strong incentives for clean energy and EV manufacturing.

- Federal and state support for domestic composite production (carbon fiber, wind turbine materials).

- Growing investment in aerospace composites for defense and commercial programs.

- Increasing regulations on recyclability, driving demand for thermoplastic composites.

Europe

- Aggressive renewable-energy and emissions-reduction targets.

- Leadership in offshore wind energy drives demand for larger blades and advanced materials.

- EU circular-economy policies push for composite recycling technologies.

- Funding programs support advanced materials R&D and local production.

Asia-Pacific

- China is a global hub for composite manufacturing, especially for wind energy, automotive parts, and industrial applications.

- Japan (home to Toray) leads in high-performance carbon fiber innovation.

- India is expanding composite manufacturing for wind blades, EV components, and infrastructure through government incentives.

- South Korea and Southeast Asia are emerging hubs for marine and industrial composites.

Latin America

- Growth tied to wind power development and infrastructure improvements.

- Several nations promote renewable energy projects, increasing demand for composite blades and industrial composite systems.

Middle East & Africa

- Construction megaprojects and corrosion-resistant infrastructure drive adoption of composite pipes, tanks, and reinforcements.

- Renewable-energy goals in countries like UAE and Saudi Arabia stimulate wind and solar infrastructure, indirectly boosting composite material demand.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Cosmetic Dentistry Market Revenue, Global Presence, and Strategic Insights by 2035