Cosmetic Dentistry Market Revenue, Global Presence, and Strategic Insights by 2035

Cosmetic Dentistry Market Size

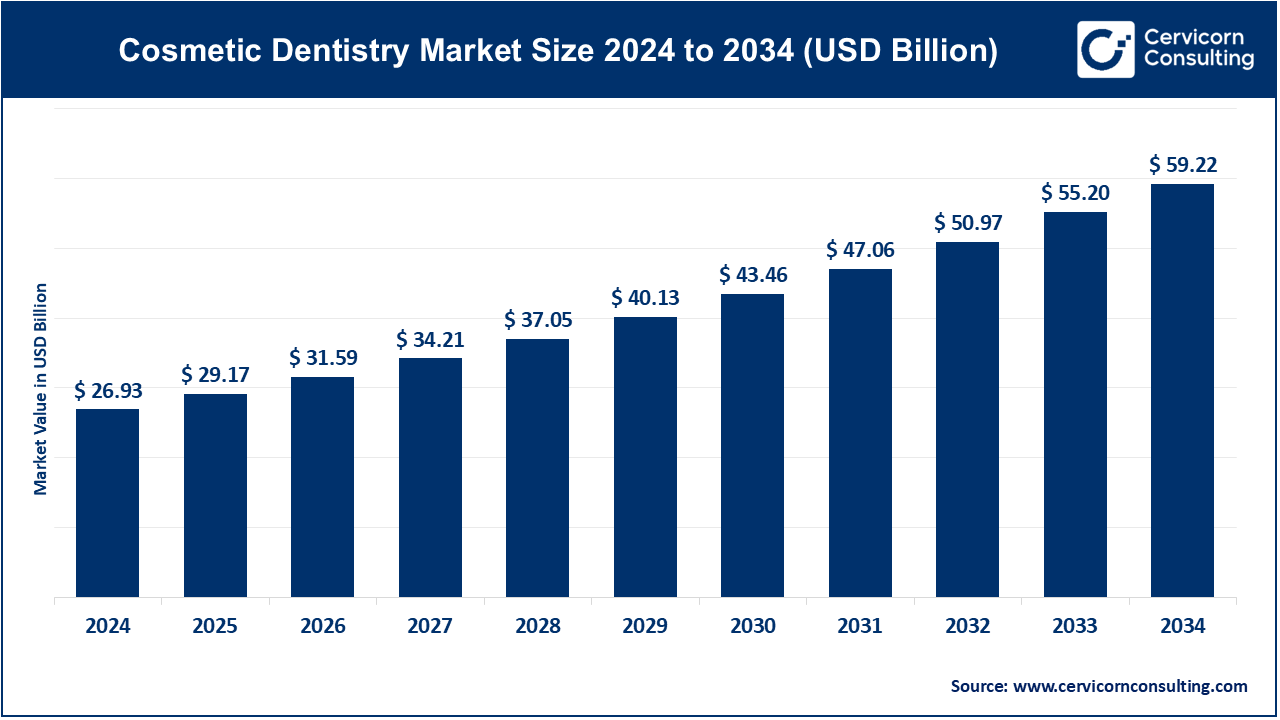

The global cosmetic dentistry market size was worth USD 26.93 billion in 2024 and is anticipated to expand to around USD 59.22 billion by 2034, registering a compound annual growth rate (CAGR) of 8.19% from 2025 to 2034.

What Is the Cosmetic Dentistry Market?

Cosmetic dentistry refers to dental procedures and treatments designed primarily to improve the appearance (rather than the function) of teeth, gums, and overall smile. Unlike strictly restorative dentistry, which focuses on health and structural repair, cosmetic dentistry emphasizes aesthetics — including tooth alignment (e.g., clear aligners), whitening, veneers, crowns, implants designed for an attractive smile, bonding, and contouring. The cosmetic dentistry market therefore encompasses the global industry of products, services, and technologies used in these procedures: from equipment (like intraoral scanners and CAD/CAM systems) and consumables (veneers, bonding agents), to clinical services offered by dental practices.

Growth Factors Driving the Cosmetic Dentistry Market

The cosmetic dentistry market is being propelled by a combination of rising aesthetic consciousness, growing disposable incomes, and increased social‑media influence encouraging “smile makeovers”; technological advances such as digital smile design, 3D printing, CAD/CAM workflows, and AI-guided treatment planning are making cosmetic treatments faster, more precise, and more accessible; minimally invasive procedures (like clear aligners and laser whitening) are gaining popularity; the rise of dental tourism — especially in regions with lower-cost high-quality dental care — is expanding access; regulatory shifts and mercury‑amalgam phase-downs are pushing adoption of biocompatible ceramics and composite resins; and the proliferation of dental service organizations (DSOs) and general practitioners embracing aesthetic dentistry is broadening the consumer base.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2368

Why Cosmetic Dentistry Is Important

Cosmetic dentistry is important for several interrelated reasons:

- Psychosocial Impact: A person’s smile is closely tied to self-esteem, social interactions, and perceived professionalism. Improving dental aesthetics can boost confidence, improve quality of life, and contribute to better mental well-being.

- Preventive Health Link: Many cosmetic procedures overlap with restorative and preventive dentistry — for instance, correcting misalignment or replacing missing teeth not only looks better but also improves oral hygiene, reduces risk of periodontal disease, and enhances function.

- Economic Value: For dental practices, cosmetic treatments often generate higher-margin revenue than basic restorative work, supporting business growth. For the industry, the cosmetic dentistry market is a rapidly expanding segment with room for innovation, especially in digital workflows and materials.

- Access & Globalization: As medical and dental tourism grows, cosmetic dentistry becomes a key driver for cross-border healthcare. Patients travel to get affordable yet high-quality smile makeovers, which fosters global competition and dissemination of advanced techniques.

- Technological Advancements: The integration of CAD/CAM, intraoral scanning, AI planning, and 3D printing in cosmetic dentistry is pushing the frontier of personalized dental care, lowering costs, shortening treatment times, and improving outcomes.

Top Cosmetic Dentistry Companies: Profiles

Here are major players in the cosmetic dentistry market — Align Technology, Dentsply Sirona, Danaher Corporation, 3M, and Ivoclar Vivadent AG — along with their specialization, focus, notable features, recent (2024) revenue, market positioning, and global presence.

1. Align Technology, Inc.

- Specialization: Align is best known for its Invisalign® clear aligners, iTero intraoral digital scanners, and exocad CAD/CAM software. It is a leader in digital orthodontics and minimally invasive aligner-based treatment.

- Key Focus Areas: Clear aligner therapy, digital scanning & diagnostics, CAD/CAM services, and expanding access via general practitioners and orthodontists. Align also invests heavily in R&D — including AI-driven treatment planning and polymer science for aligners.

- Notable Features: Align’s ecosystem integrates scanning, treatment planning, and manufacturing. It has a large global trained-practitioner base: by end-2024, it reported 271,600 active Invisalign-trained doctors. In 2024, it manufactured over 2 billion clear aligners. The iTero scanner installed base is also significant, with over 100,000 iTero units sold globally.

- 2024 Revenue: Align reported USD 4.0 billion in total revenue for the fiscal year 2024. The clear aligner segment contributed USD 3.23 billion, while Systems & Services (imaging, CAD/CAM) made USD 768.9 million. Non-GAAP operating margin was 21.8% in 2024.

- Market Share & Global Presence: Align is a dominant player in the clear-aligner segment globally. It has a strong footprint in major regions (Americas, EMEA, APAC) and its products are widely adopted in both specialist orthodontists and general dentistry clinics. Align saw clear aligner volumes increase in EMEA, APAC, and Latin America.

2. Dentsply Sirona Inc.

- Specialization: Dentsply Sirona is a full-line dental equipment and consumables company. It produces CAD/CAM systems (such as CEREC), digital imaging, dental chairs, handpieces, consumable materials (veneers, bonding agents), and other restorative and aesthetic dental products.

- Key Focus Areas: Digital prosthetics and restorative workflow, CAD/CAM chairside solutions, aesthetic ceramics, orthodontic consumables, and integrating digital ecosystems for dentists.

- Notable Features: Legacy in CAD/CAM: Dentsply Sirona’s CEREC system allows same-day restorations (crowns, veneers) chairside. Strong consumables business (resins, bonding agents, preventive products). Extensive global reach: Dentsply Sirona is present in ~ 120+ countries, with manufacturing facilities in many markets.

- 2024 Revenue: Dentsply Sirona had revenue of around USD 3.93 billion in 2024.

- Market Share & Global Presence: Dentsply Sirona is among the most established players in dental equipment and systems, particularly in restorative and aesthetic workflows. Its broad product portfolio captures both the technology side and the material side of cosmetic dentistry.

3. Danaher Corporation

- Specialization: Danaher is a diversified conglomerate in life sciences, diagnostics, and dental. In the dental segment, it focuses on implants, diagnostics, consumables, and orthodontic/implant technology.

- Key Focus Areas: Under Danaher’s dental operations, the company emphasizes implant-based tooth replacement, orthodontic solutions, diagnostics, equipment, and consumables.

- Notable Features: Global distribution serving dental professionals in 130+ countries, strong innovation through R&D and acquisition-driven growth.

- 2024 Revenue: Danaher reported USD 23.9 billion in total revenue (all segments). Within its specialty dental business, nearly 85% of sales come from consumables, services, and parts.

- Market Share & Global Presence: Danaher has strong global reach and a broad portfolio, competing in both high-end implants and high-volume consumables, playing a central role in cosmetic dentistry.

4. 3M Company

- Specialization: 3M offers dental materials (adhesives, bonding agents, composite resins), dental systems & equipment, and consumables.

- Key Focus Areas: Aesthetic dental materials, digital restorative workflows, CAD/CAM materials, minimally invasive cosmetic procedures, and full prosthetic systems.

- Notable Features: Broad materials expertise; innovation in bioactive composites and high-performance adhesives; strategic expansion via acquisitions to bolster its dental materials portfolio.

- 2024 Revenue: Specific 3M cosmetic dental revenue is not usually broken out publicly, but it is considered a key player in cosmetic dentistry.

- Market Share & Global Presence: 3M has a global footprint, supplying dental materials and equipment to dentists, labs, and clinics worldwide. Its materials are foundational to many cosmetic procedures.

5. Ivoclar Vivadent AG

- Specialization: Ivoclar Vivadent is a materials-focused dental company, particularly known for its all-ceramic systems, prosthetic materials (veneers, crowns), furnaces, and aesthetic restorations.

- Key Focus Areas: Chair-side ceramics, high-translucency materials, prosthetic furnaces, aesthetic systems, and advanced restorative materials.

- Notable Features: The IPS e.max line is widely used for veneers and crowns. The company develops high-translucency zirconia and invests in biomimetic ceramics. It has strong global educational outreach.

- 2024 Revenue: Revenue was CHF 856 million, with ~96% exports, reflecting strong global distribution.

- Market Share & Global Presence: Ivoclar is a major player in high-end aesthetic materials. Its solutions are widely used in labs and clinics in Europe, North America, and Asia.

Leading Trends & Their Impact on the Cosmetic Dentistry Market

- Digitalization and CAD/CAM Workflows

Intraoral scanners, digital smile design software, and chairside CAD/CAM milling reduce turnaround time, improve precision, and enable same-day restorations. - 3D Printing

Used to create aligners, temporary crowns, veneers, and surgical guides, enabling customized, cost-effective production. - AI and Treatment Planning

AI improves predictability and reduces human error in orthodontics and smile design. - Minimally Invasive Techniques

Clear aligners, low-prep veneers, laser contouring, and non-surgical whitening increase patient preference. - Material Innovation

Biocompatible ceramics, bioactive composites, and bonding agents improve aesthetics and durability. - Dental Tourism & Access

Patients travel to regions with lower costs for cosmetic procedures, boosting local markets. - Consumer Awareness & Social Media Influence

Social media and celebrity culture increase demand for cosmetic treatments. - Regulatory and Environmental Pressure

Mercury phase-downs and stricter environmental regulations push dentists toward cosmetic alternatives.

Successful Examples from Around the World

- Invisalign’s Global Penetration

Align Technology’s Invisalign system has become mainstream in EMEA, APAC, and Latin America, reaching 19.5 million total patients by end-2024. - Same-Day CAD/CAM Restorations

Many European clinics use Dentsply Sirona’s CEREC system to scan, design, mill, and seat crowns or veneers in a single visit. - Ceramic Dominance in Aesthetic Restorations

Ivoclar’s IPS e.max ceramics are widely used for veneers and crowns in Europe and North America. - Dental Tourism in Asia

Thailand, India, Mexico, and Turkey attract international patients seeking veneers, whitening, and implants at lower cost.

Global Regional Analysis: Government Initiatives, Policies & Market Dynamics

North America (USA & Canada)

- Large share due to high disposable income and strong dental infrastructure. Cosmetic dentistry is largely out-of-pocket. Environmental regulations and medical device approvals support adoption of aesthetic materials and technologies.

Europe

- Mature market with high adoption of digital dentistry. EU cross-border healthcare directives support dental tourism. Mercury-free regulations favor aesthetic materials.

Asia-Pacific

- Fastest-growing region driven by rising middle-class populations, disposable incomes, and high aesthetic awareness. Government initiatives promote medical and dental tourism. Digital adoption is accelerating.

Latin America

- Dental tourism from domestic and international patients fuels cosmetic dentistry growth. Infrastructure support exists, but regulatory consistency varies.

Middle East & Africa

- Growth is concentrated in urban high-income populations. Medical tourism promotion, healthcare infrastructure, and dental education expansion support market growth. Regulatory fragmentation and unequal access remain challenges.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Automotive Aluminum Extrusion Market Revenue, Global Presence, and Strategic Insights by 2034