Cosmetic Chemicals Market Growth Drivers, Trends, Key Players and Regional Insights by 2035

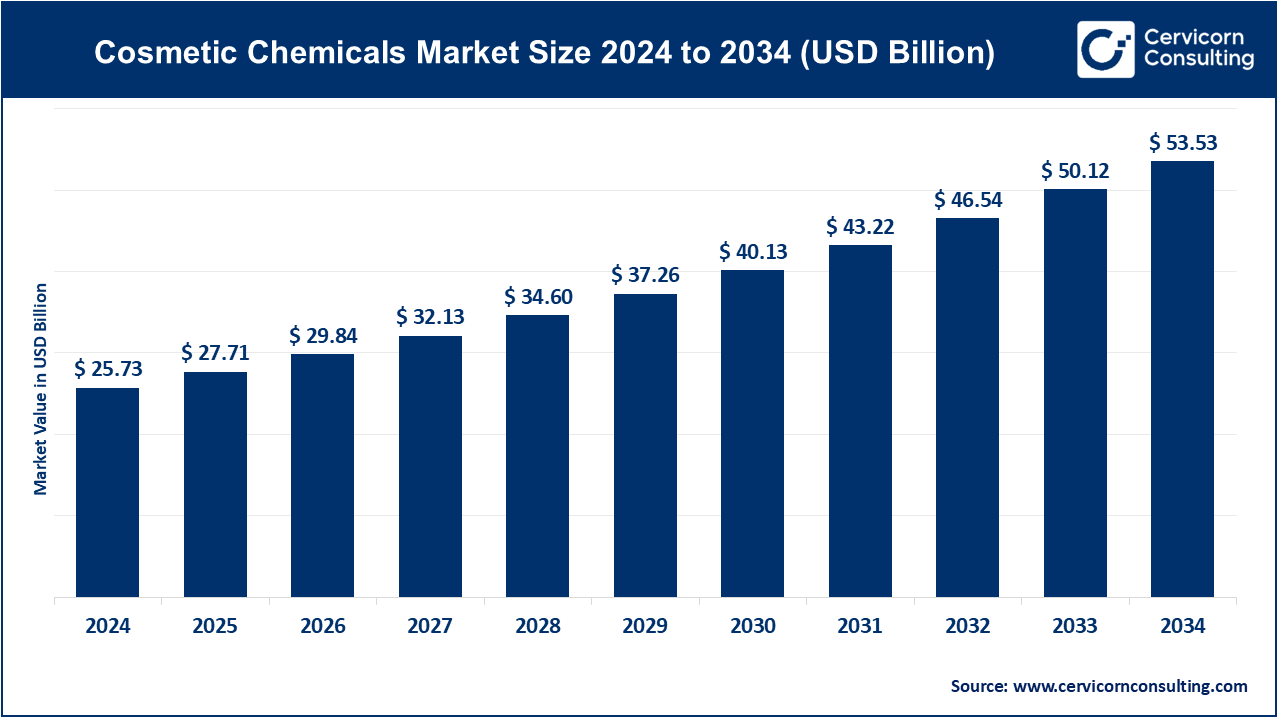

Cosmetic Chemicals Market Size

The global cosmetic chemicals market size was worth USD 25.73 billion in 2024 and is anticipated to expand to around USD 53.53 billion by 2034, registering a compound annual growth rate (CAGR) of 7.60% from 2025 to 2034.

Cosmetic Chemicals Market Growth Factor

The cosmetic chemicals market is being driven by multiple powerful growth factors: growing consumer demand for natural, sustainable, and “clean‑label” beauty products; rising disposable incomes especially in emerging economies; increasing awareness of personal grooming and skin health; the proliferation of e-commerce and social media fueling skincare and makeup consumption; technological advancements in formulation — including microencapsulation, nanotechnology, and multifunctional actives — that enhance efficacy and performance; and stringent regulations driving innovation in safer, eco-friendly ingredients. Combined, these trends are compelling chemical manufacturers to invest heavily in research and development, bio-based feedstocks, and novel delivery systems, thereby accelerating the market’s expansion.

What Is the Cosmetic Chemicals Market?

At its core, the cosmetic chemicals market is the segment of the chemical industry focused on supplying ingredient manufacturers, cosmetic formulators, and beauty brands with raw chemical building blocks and functional ingredients. These ingredients are not consumer-facing per se (although consumers might notice their effects), but rather they go into formulations. For example, a face cream may contain a surfactant to cleanse, a moisturizer (emollient) to smooth, a preservative to prevent spoilage, and an active to target a skin concern. Chemical companies develop and manufacture these ingredient types and sell them to cosmetic product companies, who then convert them into the end consumer products.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2367

Why Is the Cosmetic Chemicals Market Important?

The importance of the cosmetic chemicals market cannot be overstated:

- Foundation of Beauty Products: Without these chemicals, there would be no skin serums, shampoos, lipsticks, or sunscreens. The entire personal care industry depends on the availability, performance, and safety of these ingredients.

- Innovation Engine: Cosmetic chemical suppliers drive innovation through R&D of new actives, bio-based alternatives, encapsulation technologies, and sustainability-focused chemistries. This innovation trickles down into better-performing, safer, more effective, and more environmentally friendly cosmetics.

- Regulatory & Safety Gatekeeper: Ingredient suppliers must meet stringent regulatory requirements (e.g., REACH in Europe), ensuring safety and compliance. This acts as a barrier that elevates quality and trust in cosmetics.

- Economic Impact: This market is a significant part of the specialty chemicals sector, generating high-margin revenue, fostering global trade, and creating jobs in R&D, manufacturing, and logistics.

- Sustainability and Green Chemistry: As consumers demand greener and cleaner beauty, the cosmetic chemical industry evolves. Suppliers are increasingly offering bio-based, biodegradable, and renewable-raw material alternatives, influencing the wider push toward sustainability.

Key Players in the Cosmetic Chemicals Market

Here, we focus on some of the top global chemical companies that have a substantial presence in the cosmetic chemicals space: BASF SE, The Dow Chemical Company, Clariant International Ltd., Evonik Industries AG, and Solvay S.A.

BASF SE

- Specialization: BASF’s Care Chemicals division produces a wide array of cosmetic ingredients, including surfactants, emulsifiers, polymers, emollients, chelating agents, cosmetic active ingredients, and UV filters.

- Key Focus Areas: Sustainability (e.g., bio-based, eco-designed ingredients), digital formulation tools, multifunctional active ingredients. BASF has piloted AI-based tools to predict “skin-feel” and accelerate scale up.

- Notable Features: At in-cosmetics Global 2024, BASF won multiple innovation awards, such as for its Hydrasensyl® Glucan Green beta‑glucan and Epispot™, a blemish‑targeting active.

- 2024 Revenue & Market Share: In 2024 BASF made about USD 4.25 billion in cosmetic-chemical revenues, representing roughly 10.05% market share.

- Global Presence: BASF is deeply global, with production and development sites in all regions.

The Dow Chemical Company (Dow Inc.)

- Specialization: Dow is known for its polymers, emulsifiers, surfactants, and specialty intermediates suited for cosmetic applications.

- Key Focus Areas: Green formulations, upcycled surfactants (e.g., derived from coconut oil), sustainability targets (e.g., carbon neutrality).

- Notable Features: Their ECOLLECT™ range of upcycled surfactants, sustainability-driven R&D, and close partnerships with cosmetic brands to co-develop sensorial polymers.

- 2024 Revenue & Market Share: ReportPrime estimates USD 3.80 billion cosmetic-chemical revenue in 2024, with 8.98% market share.

- Global Presence: As one of the largest chemical companies globally, Dow has a widespread presence across North America, Europe, and Asia.

Clariant International Ltd.

- Specialization: Clariant specializes in specialty ingredients such as preservatives, bio-based glycols, multifunctional boosters, and other care-chemical intermediates.

- Key Focus Areas: Clean-label preservatives (e.g., reducing parabens), bio-based ingredients, acquisitions to strengthen its cosmetics ingredient portfolio.

- Notable Features: In 2025, Clariant launched Nipaguard SCE Vita, a naturally derived preservative with reduced environmental impact.

- 2024 Revenue & Market Share: Clariant’s cosmetic-chemical revenue for 2024 was USD 1.60 billion, giving it 3.79% market share.

- Global Presence: Clariant is headquartered in Switzerland, but markets globally, with strength in Europe, Asia, and emerging markets.

Evonik Industries AG

- Specialization: Evonik is known for silicones, specialty emollients, active cosmetic ingredients, encapsulation technologies, and delivery systems.

- Key Focus Areas: Sustainable and plant-derived actives, high-performance emollients, nano- and micro-encapsulation, and physiologically gentle ingredients.

- Notable Features: Evonik has been launching novel phyto-extracts and trying to drive its Care Solutions plants toward carbon neutrality.

- 2024 Revenue & Market Share: Evonik’s cosmetic-chemical revenue in 2024 was USD 2.10 billion, roughly 4.96% of the market.

- Global Presence: Based in Germany, Evonik sells globally with innovation centers, production facilities, and customer support networks around the world.

Solvay S.A.

- Specialization: Solvay produces rheology modifiers, bio-based silicones, polymers, and other specialty materials for beauty applications.

- Key Focus Areas: Renewable materials, biotechnology-based alternatives to petro-based silicones, traceability via blockchain for certain ingredients.

- Notable Features: Their use of renewable materials and clean-label traceability adds appeal for “green beauty.”

- 2024 Revenue & Market Share: In 2024, Solvay’s cosmetic-chemicals revenue was approximately USD 0.89 billion, representing about 3.26% of the market.

- Global Presence: Headquartered in Belgium, Solvay operates globally, leveraging its R&D and biotech platforms to serve a worldwide customer base.

Leading Trends and Their Impact

- Clean Beauty & Bio-based Ingredients

Consumers increasingly demand natural, bio-based, and environmentally friendly ingredients. Suppliers are responding by developing plant-derived surfactants, biodegradable polymers, and “green” additives. - Multifunctional Ingredients

There is strong demand for ingredients that do more than one thing—e.g., moisturize + deliver actives + provide UV protection. The development of multifunctional actives and formulation tools helps brands create simpler yet more effective consumer products. - Microencapsulation & Nanotechnology

Techniques like encapsulation allow for better stability, controlled release, and improved bioavailability. This is especially useful for actives such as vitamins, peptides, or UV filters, which may be sensitive or require protection before application. - Digitalization & AI in Formulation

Chemical companies are increasingly using AI, machine learning, and digital formulating tools to predict texture, stability, and skin feel, reducing development time and cost while accelerating go-to-market processes. - Regulatory Pressure & Safety

Stricter regulations (e.g., REACH in Europe, bans on certain controversial ingredients) are pushing formulators to seek safer alternatives. Ingredient suppliers are responding with safer preservatives, cleaner UV filters, and transparent supply chains. - Sustainability Credentials & Transparency

Beyond bio-based chemistry, consumers and brands demand transparency in sourcing, traceability, and environmental impact. Approaches like blockchain and lifecycle assessments are becoming more common. - Emerging-Market Growth & E-commerce

With rising incomes in Asia-Pacific, Latin America, and other regions, demand for personal care is surging. Coupled with e-commerce penetration, especially in emerging markets, this trend is fueling growth in demand for cosmetic ingredients globally. - Co-innovation & Brand Partnerships

Chemical companies are partnering more closely with beauty brands to co-develop bespoke actives, performance polymers, or “next-gen” clean actives, reducing time-to-market and enabling innovation.

Successful Examples from Around the World

- BASF’s Innovation at in‑cosmetics Global: BASF won several awards for new ingredients like Hydrasensyl® Glucan Green and Epispot™, underscoring how R&D and functionality create market relevance.

- Clariant–Lucas Meyer Cosmetics Acquisition: In April 2024, Clariant acquired Lucas Meyer Cosmetics, strengthening its active and functional cosmetics portfolio.

- Solvay’s Traceability Initiative: Solvay’s use of blockchain to trace the origin of vanillin and guaiacol provides a clean-label story appealing to consumers and brands.

- Evonik’s Plantagon® Tara Extract: Evonik introduced botanical extracts to meet demand for natural actives with scientifically backed efficacy.

- BASF’s Renewable Energy & EcoBalanced Portfolio: BASF expanded its EcoBalanced portfolio and powered six U.S. Care Chemicals sites with 100% renewable electricity.

Global Regional Analysis: Government Initiatives & Policies Shaping the Market

North America

- Market Position: Dominant, with strong consumer spending on personal care, high innovation demand, and robust regulatory systems.

- Regulation: U.S. FDA regulates cosmetics, relying on ingredient safety testing and voluntary industry standards. State-level regulations (e.g., California) also influence ingredient development.

- Innovation Support: Government-funded research and green chemistry programs encourage sustainable ingredient development.

- Impact on Market: High demand for premium actives, clean-label chemistries, and advanced formulations pushes suppliers to innovate aggressively.

Europe

- Regulation: The EU enforces REACH regulations requiring evaluation of substances used in cosmetics.

- Sustainability Push: European Green Deal and Circular Economy Action Plan encourage bio-based feedstocks and biodegradability.

- Safety Initiatives: Bans or restrictions on hazardous ingredients encourage development of safer alternatives.

- Regional Trends: Growing consumer demand for “clean beauty” fuels R&D in green cosmetic ingredients.

Asia‑Pacific

- Market Growth: Fast-growing due to rising middle-class populations, urbanization, and beauty awareness.

- Government Support: Some Asian governments encourage domestic specialty chemicals production and green chemistry initiatives.

- Import-Export Dynamics: Many cosmetic brands rely on ingredient imports from Western chemical majors, but regional players are emerging.

- Consumer Trends: Regional beauty trends (e.g., K-beauty, J-beauty) drive demand for novel actives, prompting localized production.

Latin America & Middle East / Africa

- Regulatory Landscape: Varies widely, with some strict and some lax regulations.

- Beauty Market Growth: Rising incomes and growing beauty awareness increase demand for cosmetic products.

- Challenges: Limited infrastructure for high-tech ingredient manufacturing; dependency on imports is high.

- Opportunity: Sustainable and affordable cosmetic ingredients can capture growing markets.

Government Initiatives & Policy Drivers

- Chemical Safety Regulations: REACH, TSCA, and other regulations enforce safety and transparency.

- Sustainability and Green Chemistry: Incentives, grants, and tax breaks support bio-based ingredient development.

- Trade Policies: Tariffs and trade agreements influence production locations.

- Research & Innovation Funding: Public-private partnerships fund cosmetic and specialty chemicals R&D.

- Consumer Protection Laws: Strict labeling, consumer rights, and transparency influence formulation and certification.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Energy Recovery Ventilator Core Market Growth Drivers, Trends, Key Players and Regional Insights by 2034