U.S. Biofuels Market Growth Drivers, Trends, Key Players and Regional Insights by 2034

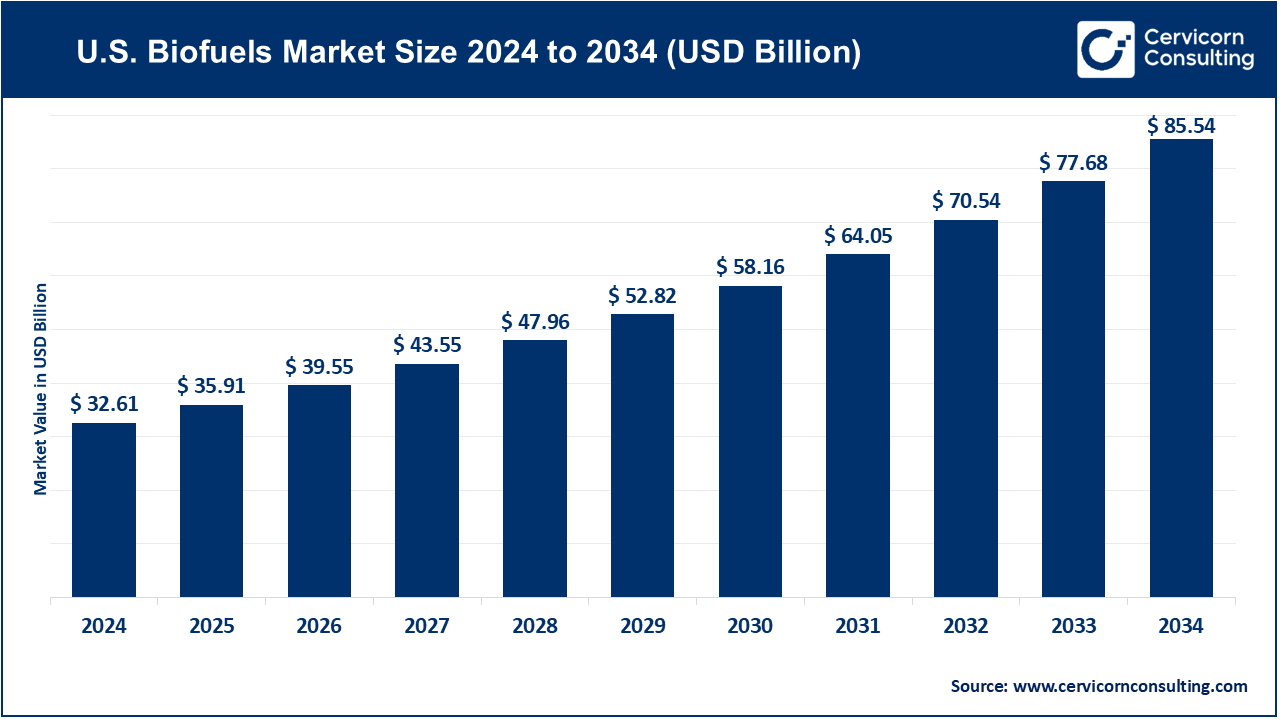

U.S. Biofuels Market Size

The U.S. biofuels market size was worth USD 32.61 billion in 2024 and is anticipated to expand to around USD 85.54 billion by 2034, registering a compound annual growth rate (CAGR) of 11.5% from 2025 to 2034.

Growth Factors

The combined U.S. biofuels market is being driven by a tight interplay of policy incentives such as the Renewable Fuel Standard and tax credits for renewable diesel, sustainable aviation fuel (SAF), and biodiesel; corporate decarbonization commitments; rising demand for low-carbon transport fuels; and technological advances that reduce costs and expand feedstock flexibility. Growth is further propelled by investments from major refiners converting or repurposing existing refining capacity to produce renewable diesel and SAF, improving lifecycle greenhouse-gas performance through carbon capture, and leveraging fluctuating compliance-credit (RIN) values that shape profitability.

Additionally, increasing public and private procurement commitments and state-level blending mandates such as California’s Low Carbon Fuel Standard (LCFS) are creating differentiated regional demand, accelerating investment and driving consolidation among producers.

What is the Combined U.S. Biofuels Market?

The “combined U.S. biofuels market” refers to the integrated industry encompassing liquid bio-based transport fuels in the United States — primarily ethanol, biodiesel, renewable diesel, and sustainable aviation fuel. It also includes the supply chains, feedstock production, refining, distribution, and compliance-credit systems that sustain these fuels. The combined market approach accounts for both production volume and commercial value across these fuels, capturing the interconnected ecosystem of producers, feedstock suppliers, logistics networks, and regulatory frameworks that together form the backbone of America’s renewable liquid fuels industry.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2797

Why It Is Important

The U.S. biofuels market is essential for environmental, economic, and strategic reasons. Environmentally, biofuels can significantly reduce lifecycle greenhouse gas emissions compared with fossil fuels, especially when produced from waste feedstocks or paired with carbon capture technologies. Economically, biofuels strengthen rural economies by supporting feedstock purchases, biorefinery operations, and job creation in agricultural regions.

Strategically, biofuels enhance national energy security by diversifying energy sources and reducing reliance on imported petroleum. They also serve as a practical decarbonization pathway for sectors that are challenging to electrify, such as aviation, shipping, and heavy-duty transport. Through mechanisms like Renewable Identification Numbers (RINs) and state-level programs such as California’s LCFS, biofuels generate tradable credit markets that stimulate private investment and promote compliance with clean energy goals.

Combined U.S. Biofuels Market — Top Companies

Chevron Renewable Energy Group

- Specialization: Chevron Renewable Energy Group, a division of Chevron Corporation, focuses on producing renewable diesel, biodiesel, and SAF. The business originated from Chevron’s acquisition of Renewable Energy Group (REG), positioning Chevron as one of the largest renewable fuel producers in North America.

- Key Focus Areas: Feedstock diversification, integration with refining operations, and large-scale renewable diesel and SAF production.

- Notable Features: Chevron’s vast infrastructure and refining experience provide scale advantages, enabling the company to optimize logistics, reduce production costs, and expand globally. It also focuses on low-carbon intensity pathways and partnerships that integrate renewable fuels into traditional refining systems.

- 2024 Revenue and Market Share: Chevron’s overall revenue remained in the multi-tens of billions of dollars range in 2024, with renewable fuels accounting for a steadily increasing share of total earnings. The company’s renewable fuel operations have a strong U.S. base with expanding global market reach.

Pacific Biodiesel Technologies

- Specialization: Pacific Biodiesel is a pioneer in the biodiesel sector, operating one of the first commercial biodiesel plants in the United States. Headquartered in Hawaii, it specializes in producing biodiesel from used cooking oils and other waste feedstocks.

- Key Focus Areas: Local feedstock collection, sustainable production, and closed-loop community energy models.

- Notable Features: The company operates a fully integrated model where waste oils are collected locally, processed, and sold as renewable diesel to local consumers, reducing transportation emissions and supporting the circular economy. Pacific Biodiesel’s model emphasizes regional energy resilience and sustainability.

- 2024 Revenue and Market Share: Although smaller than large national producers, Pacific Biodiesel’s annual revenue is estimated in the tens of millions of dollars, with approximately six million gallons of production capacity. The company holds a unique position as a community-based, sustainability-driven producer.

POET LLC

- Specialization: POET LLC is the world’s largest ethanol producer, operating dozens of biorefineries across the United States. It is a major player in corn-based ethanol and has invested heavily in next-generation biofuel technologies.

- Key Focus Areas: Ethanol production, co-product optimization (such as animal feed and corn oil), and R&D in cellulosic and low-carbon biofuels.

- Notable Features: POET integrates agricultural partnerships with cutting-edge processing technology to reduce carbon intensity and improve efficiency. It has become a strong advocate for ethanol’s role in decarbonizing transport, promoting higher ethanol blends like E15 and E85.

- 2024 Revenue and Market Share: POET’s private ownership means limited public data, but the company commands the largest share of the U.S. ethanol market. Its production accounts for a substantial portion of the nation’s 16-billion-gallon annual ethanol output. POET also exports ethanol to multiple international markets.

Valero Energy Corporation

- Specialization: Valero Energy Corporation is a leading U.S. refiner that has diversified into renewable diesel and ethanol production through its Diamond Green Diesel joint venture and other operations.

- Key Focus Areas: Renewable diesel and SAF expansion, ethanol manufacturing, and integration of renewable fuels into existing refining infrastructure.

- Notable Features: Valero operates one of the largest renewable diesel production facilities in the world through its Diamond Green Diesel partnership. Its renewable fuels segment has grown rapidly, supported by favorable policy incentives and blending mandates.

- 2024 Revenue and Market Share: Valero reported total revenues of around USD 30.7 billion in 2024, with renewable fuels representing a growing percentage. The company’s renewable diesel production averages several million gallons per day, positioning it as one of the most significant U.S. producers.

Green Plains Inc.

- Specialization: Green Plains Inc. is a leading U.S. ethanol and ag-tech company that focuses on sustainable fuel production and high-value agricultural co-products.

- Key Focus Areas: Ethanol production, renewable feed ingredients, corn oil extraction, and carbon-intensity reduction.

- Notable Features: The company has evolved from a traditional ethanol producer into an integrated bioprocessing company. It emphasizes technology innovation, such as fluidized bed reactors and protein extraction, to diversify revenue and improve plant economics.

- 2024 Revenue and Market Share: Green Plains reported revenues of approximately USD 2.46 billion in 2024. With several biorefineries across the Midwest, it maintains a strong U.S. presence and growing export activities.

Leading Trends and Their Impact

1. Rise of Renewable Diesel and SAF

The market is shifting from conventional biodiesel toward renewable diesel and sustainable aviation fuel. These “drop-in” fuels are compatible with existing engines and infrastructure, providing a seamless transition to low-carbon transport. This shift is reshaping refinery investments, with many traditional petroleum facilities being converted to renewable fuel production.

2. Policy and Credit Market Volatility

Compliance mechanisms such as RINs and LCFS credits play a critical role in determining profitability. Variability in credit values, regulatory adjustments, and Renewable Volume Obligations (RVOs) can cause rapid swings in margins. While such volatility can challenge smaller producers, it also creates opportunities for larger integrated players to hedge and optimize production strategies.

3. Feedstock Diversification

The availability and sustainability of feedstocks are central to the industry’s long-term success. Companies are diversifying away from traditional vegetable oils toward waste oils, animal fats, and cellulosic materials. This not only improves lifecycle emissions but also mitigates competition with food markets and stabilizes input costs.

4. Integration with Carbon Management

Combining biofuel production with carbon capture and utilization (CCU) or storage (CCS) technologies significantly enhances the environmental value of biofuels. Projects incorporating CCS can achieve near-zero or even negative carbon intensity scores, attracting higher credit values and premium offtake agreements, particularly in the SAF sector.

5. Consolidation and M&A

Large oil companies and financial investors are acquiring or partnering with biofuel firms to secure supply chains and accelerate scaling. This consolidation brings efficiency, technological expertise, and financial strength but can also lead to regional concentration and competitive pressures.

Successful Examples Around the World

The U.S. combined biofuels approach has inspired similar integrated models globally:

- Brazil: Brazil’s sugarcane ethanol program is a model of sustained biofuel adoption, combining government policy, agricultural integration, and consumer fuel flexibility. The widespread use of flex-fuel vehicles allows for dynamic ethanol blending, supporting both producers and consumers.

- European Union: The EU has fostered a thriving renewable diesel and SAF industry through clear sustainability standards and waste-based fuel incentives under its Renewable Energy Directive. European producers have successfully leveraged policy stability to build commercial-scale facilities for advanced biofuels.

- California and Oregon (U.S. examples with global influence): Regional programs such as the LCFS in California and the Clean Fuels Program in Oregon have demonstrated how subnational policies can create vibrant low-carbon fuel markets that attract global investment. These programs are studied worldwide as templates for designing carbon-intensity-based incentives.

Global Regional Analysis: Government Initiatives and Policies

United States

The U.S. biofuels market is shaped by federal and state collaboration:

- Renewable Fuel Standard (RFS): This federal program sets annual blending mandates and manages the RIN credit system, which directly influences production economics and investment flows.

- Low Carbon Fuel Standard (LCFS): State-level initiatives, especially in California, reward producers for lowering carbon intensity. These programs have led to concentrated renewable diesel and SAF investments along the West Coast.

- Infrastructure and Tax Incentives: The U.S. government provides tax credits, grants, and loan guarantees to support biofuel infrastructure and encourage innovation in feedstock processing and advanced fuels.

Canada

Canada’s Clean Fuel Regulations and provincial biofuel mandates align closely with U.S. programs, creating a North American low-carbon fuel corridor. U.S. producers frequently export renewable diesel and ethanol to meet Canadian demand.

European Union

The EU’s Renewable Energy Directive (RED II and RED III) sets ambitious renewable fuel targets and sustainability requirements. Its focus on advanced and waste-derived biofuels drives innovation and shapes global feedstock markets.

Asia-Pacific

Japan, South Korea, and Singapore are developing SAF and renewable diesel policies to meet aviation and marine decarbonization targets. Several of these countries import U.S. renewable fuels, making the Asia-Pacific region a critical export market.

Latin America

Brazil’s ethanol success continues to influence neighboring countries, while nations like Argentina and Colombia are expanding biodiesel mandates. These programs show that policy consistency and feedstock availability are vital for sustained growth.

Project Examples Reflecting the Combined Market Model

- Refinery Conversions: Several large petroleum refineries in the U.S. Gulf Coast and West Coast have been converted to renewable diesel and SAF production facilities, illustrating the convergence of fossil and renewable supply chains.

- Ethanol Co-location: Ethanol plants located near major corn-growing regions create synergies between agriculture and energy, exemplified by POET and Green Plains’ integrated biorefining systems. These facilities also supply co-products such as animal feed and corn oil, enhancing profitability and sustainability.

Risks and Opportunities

Risks: The biofuels sector faces challenges including policy uncertainty, fluctuating feedstock costs, and regional overcapacity. Regulatory changes or credit-market volatility can quickly alter plant economics and investment sentiment.

Opportunities: The emergence of SAF and renewable diesel as major growth engines presents vast opportunities. New feedstock technologies, carbon capture integration, and the increasing role of agricultural innovation are expected to strengthen competitiveness and attract further global investment.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Blockchain-Based Electronic Health Record Market Growth Drivers, Trends, Key Players and Regional Insights by 2034