Herbal Extract Market Revenue, Global Presence, and Strategic Insights by 2034

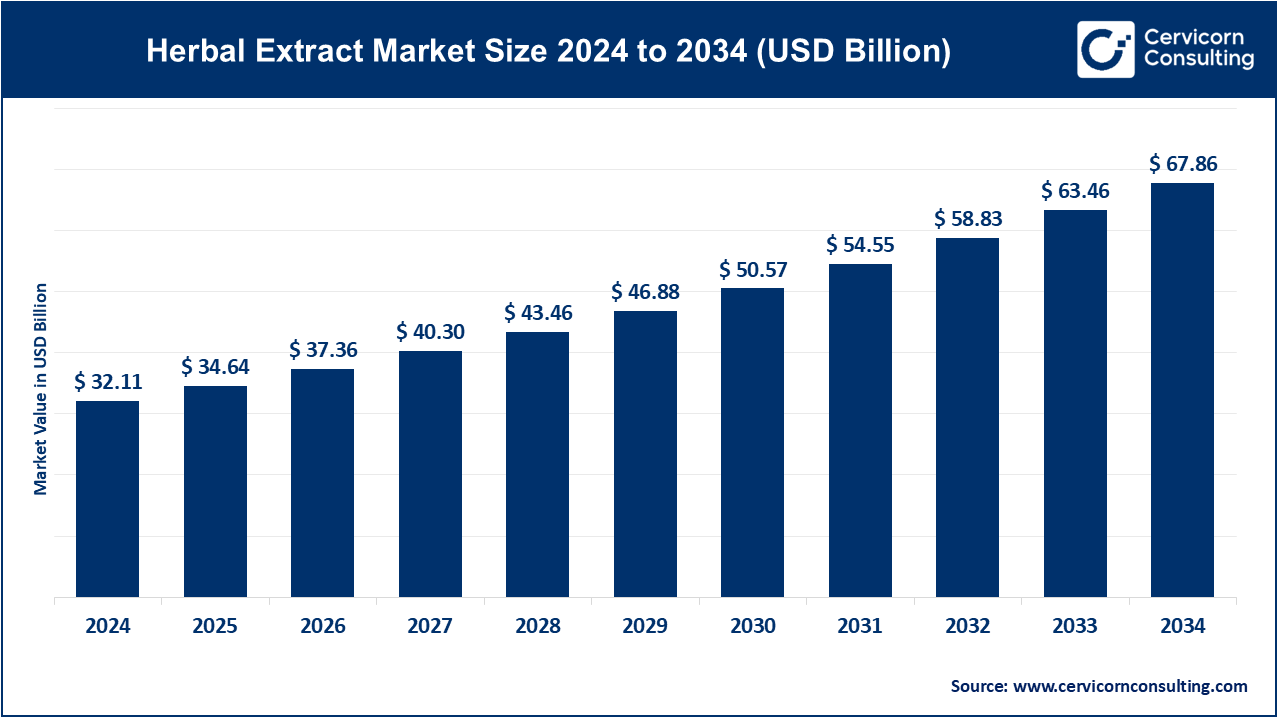

Herbal Extract Market Size

The global herbal extract market size was worth USD 32.11 billion in 2024 and is anticipated to expand to around USD 67.86 billion by 2034, registering a compound annual growth rate (CAGR) of 7.77% from 2025 to 2034.

Herbal Extract Market Growth Factors

The herbal extract market is expanding rapidly due to several converging growth drivers. Increasing consumer preference for clean-label, natural, and plant-based ingredients across food, beverage, personal care, and nutraceutical categories is fueling demand. The rising prevalence of lifestyle diseases such as obesity, diabetes, and cardiovascular disorders has accelerated interest in herbal and functional ingredients that promote wellness. Advanced extraction technologies—such as supercritical CO₂, green solvents, and enzyme-assisted extraction—are improving product yield, purity, and consistency.

Moreover, regulatory harmonization, stricter quality standards, and sustainability certifications are pushing consumers and industries toward trusted, standardized suppliers. Expanding middle-class populations in emerging economies, combined with the growing acceptance of traditional medicine and herbal supplements, are driving further global adoption. Mergers, acquisitions, and strategic collaborations among large ingredient companies are also enhancing R&D capabilities and market reach, solidifying herbal extracts as a mainstream ingredient category in modern formulations.

What Is the Herbal Extract Market?

The herbal extract market encompasses the production, standardization, and sale of concentrated, bioactive compounds derived from plants. These extracts—available in forms such as powders, liquids, oleoresins, essential oils, and tinctures—are used as ingredients in pharmaceuticals, dietary supplements, cosmetics, food, and beverages. Herbal extracts are obtained from various parts of plants, including roots, leaves, seeds, bark, and flowers, using advanced extraction processes to isolate beneficial compounds like flavonoids, alkaloids, polyphenols, and terpenes. By ensuring consistent quality and measurable levels of active compounds, the industry enables reproducible efficacy and safe usage across applications. The market bridges traditional herbal knowledge with modern pharmaceutical and food science, forming a vital component of the broader natural ingredients ecosystem.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2436

Why It Is Important

The importance of the herbal extract market lies in its ability to merge ancient botanical wisdom with modern innovation. Consumers worldwide are increasingly aware of the side effects associated with synthetic ingredients, leading to a significant shift toward natural alternatives. Herbal extracts serve as effective, safe, and sustainable solutions for diverse industries, including nutraceuticals, food and beverage, cosmetics, and pharmaceuticals. In healthcare, standardized extracts help ensure efficacy, reproducibility, and safety, paving the way for evidence-based herbal medicine. In addition, this industry contributes to rural economic development by supporting farming communities that cultivate medicinal and aromatic plants. With rising concerns about sustainability and traceability, herbal extracts also align with global efforts to promote environmentally responsible sourcing and manufacturing practices.

Herbal Extract Market Top Companies

Naturex (Part of Givaudan Group)

Specialization: Naturex is a pioneer in plant-based extracts and natural ingredients for food, health, and beauty applications. Following its acquisition by Givaudan, Naturex became part of one of the world’s leading flavor, fragrance, and natural ingredients companies.

Key Focus Areas: Natural colorants, botanical extracts for wellness, flavor ingredients, and plant-derived active compounds for nutrition and cosmetics.

Notable Features: Deep expertise in botanical sourcing and standardization, extensive R&D, and integration with Givaudan’s global distribution and regulatory infrastructure.

2024 Revenue & Market Share: Naturex operates under Givaudan’s consolidated financials, contributing to its multi-billion-dollar annual revenue from the Taste & Wellbeing and Beauty & Wellbeing divisions.

Global Presence: Headquartered in France, with manufacturing and R&D facilities across Europe, North America, and Asia. The company serves clients worldwide through Givaudan’s extensive network.

Martin Bauer Group

Specialization: Based in Germany, Martin Bauer Group is a global leader in herbal infusions, tea ingredients, and botanical extracts. The company serves the food, beverage, nutraceutical, and pharmaceutical sectors.

Key Focus Areas: Tea and beverage botanicals, standardized extracts for health and wellness, and customized botanical formulations.

Notable Features: A strong focus on sustainability and responsible sourcing, comprehensive traceability programs, and partnerships with farmers worldwide.

2024 Revenue & Market Share: The company’s revenue exceeds €600 million, making it one of Europe’s largest independent botanical suppliers.

Global Presence: With over 3,800 employees, the Martin Bauer Group operates globally, with production facilities and sourcing operations across Europe, Asia, and the Americas.

Indena S.p.A.

Specialization: Headquartered in Italy, Indena is recognized for producing high-quality, standardized plant extracts for pharmaceutical and nutraceutical industries. It is known for its scientific approach and strict regulatory compliance.

Key Focus Areas: Pharmaceutical-grade botanical actives, polyphenols, flavonoids, and clinically supported herbal compounds.

Notable Features: Strong scientific research foundation, extensive clinical validation, and expertise in purity and safety standards.

2024 Revenue & Market Share: While detailed 2024 financials are private, Indena’s historical annual revenue has exceeded €160 million, placing it among the top-tier European herbal extract suppliers.

Global Presence: Indena operates manufacturing facilities in Italy and distributes globally, supplying major pharmaceutical, cosmetic, and nutraceutical brands.

Döhler GmbH

Specialization: Döhler is a Germany-based global producer of natural ingredients, systems, and integrated solutions for the food and beverage industries, including natural colors, flavors, and botanical extracts.

Key Focus Areas: Natural flavorings, functional extracts, colorants, fruit preparations, and sensory solutions for beverages and foods.

Notable Features: Vertically integrated operations, sustainability leadership, and advanced R&D and application labs serving multinational food brands.

2024 Revenue & Market Share: The company’s annual global revenues are estimated to exceed USD 1 billion across its diversified ingredient segments.

Global Presence: Döhler operates in over 30 countries, with 45 production sites and more than 24 application centers worldwide.

Synthite Industries

Specialization: Based in India, Synthite is one of the world’s largest producers of spice oleoresins, essential oils, and natural extracts used in food, flavors, fragrances, and nutraceuticals.

Key Focus Areas: Spice oleoresins, essential oils, natural colors, and value-added plant extracts.

Notable Features: Strong backward integration with farmers, advanced extraction facilities, and a reputation for high-quality, consistent ingredients.

2024 Revenue & Market Share: Synthite’s revenue in 2024 was approximately INR 2,580 crore (USD 300+ million), making it a major global player in the herbal and spice extract market.

Global Presence: The company operates manufacturing facilities in India and has offices and distribution networks across North America, Europe, and Asia, supplying global FMCG and food companies.

Leading Trends and Their Impact

1. Clean-Label and Plant-Based Shift

Consumers are increasingly demanding natural, recognizable ingredients, leading to reformulation of food, beverage, and cosmetic products. This clean-label movement drives demand for botanical extracts as natural alternatives to synthetic additives, promoting transparency and authenticity in branding.

2. Evidence-Based Herbal Ingredients

The rise in clinical research on herbal actives has strengthened the market’s scientific foundation. Manufacturers are investing in standardized, clinically validated extracts to meet consumer and regulatory expectations, leading to higher product credibility and premium pricing.

3. Green Extraction and Sustainability

Environmental awareness is reshaping production methods. Companies are adopting eco-friendly extraction technologies such as CO₂ and solvent-free processes, reducing waste and environmental impact. Sustainability certifications and responsible sourcing programs are becoming crucial market differentiators.

4. Supply Chain Transparency and Traceability

As adulteration risks rise, transparency across the herbal value chain has become critical. Blockchain and digital tracking technologies are being used to verify plant origins and ensure ethical sourcing, fostering trust between suppliers and global buyers.

5. Regional Sourcing and Crop Diversification

Climate change and geopolitical challenges are prompting diversification of cultivation regions for key medicinal plants. Suppliers are investing in new geographies to stabilize raw material supply, encouraging innovation in agronomic research and crop resilience.

6. Consolidation and Strategic Partnerships

Mergers and acquisitions are reshaping the market, with major flavor, fragrance, and ingredient companies acquiring specialist extract producers. This trend enhances R&D capabilities and global market access, accelerating innovation and product development.

Successful Examples of the Herbal Extract Market

- Naturex-Givaudan Integration (Europe): The merger of Naturex into Givaudan’s portfolio has created one of the most comprehensive natural ingredient platforms globally, combining flavor, fragrance, and botanical expertise to meet the growing demand for natural wellness ingredients.

- Synthite Industries (India): Synthite’s success in scaling spice extraction technology has made India a global hub for oleoresins, supplying international flavor houses and FMCG giants while supporting thousands of spice farmers.

- Martin Bauer Group (Germany): Through its sustainability and sourcing initiatives, Martin Bauer has established itself as a model for ethical and transparent botanical ingredient supply, appealing to multinational beverage and nutraceutical brands.

- Indena (Italy): Indena’s scientifically validated extracts, such as standardized curcumin and ginkgo biloba, are benchmarks for pharmaceutical-grade botanical ingredients, setting industry standards for purity and clinical efficacy.

Global Regional Analysis and Government Initiatives

Asia-Pacific

Market Overview: Asia-Pacific dominates both production and consumption of herbal extracts, accounting for more than half of global revenues. The region benefits from its biodiversity, traditional medicine systems, and large-scale cultivation of medicinal and aromatic plants.

Government Policies: India’s Ministry of AYUSH actively supports the standardization and global promotion of Ayurveda-based ingredients, offering incentives for R&D and exports. China integrates herbal medicine into its healthcare system, while Southeast Asian countries like Vietnam and Indonesia are investing in herbal cultivation and extraction infrastructure.

Impact: Government initiatives are strengthening the regional supply chain, ensuring consistent quality, and boosting export potential, positioning Asia-Pacific as a global leader in herbal extract manufacturing.

North America

Market Overview: North America represents one of the fastest-growing markets for herbal extracts, driven by health-conscious consumers and a robust nutraceutical sector. Herbal supplements and plant-based personal care products are key demand drivers.

Government Policies: The U.S. FDA regulates dietary ingredients through Good Manufacturing Practices (GMP), ensuring product safety and labeling accuracy. State-level programs promoting sustainable agriculture also support medicinal plant cultivation.

Impact: Strict quality regulations and consumer demand for clinically validated products create opportunities for premium, science-backed extracts in the U.S. and Canada.

Europe

Market Overview: Europe’s herbal extract market is mature and highly regulated. The demand is strong across the pharmaceutical, nutraceutical, and cosmetic sectors. The continent is home to some of the most advanced flavor and botanical ingredient companies.

Government Policies: The European Union enforces stringent regulations under the Novel Food and Cosmetic Ingredient frameworks. Emphasis on sustainability, traceability, and safety drives investment in R&D and compliance.

Impact: European suppliers lead in sustainability certifications and technological innovation, influencing global standards in quality and transparency.

Latin America and Africa

Market Overview: Both regions are rich in biodiversity, offering unique botanicals for natural health and cosmetic formulations. However, local processing capabilities are still developing.

Government Policies: Governments are increasingly adopting biodiversity protection laws and benefit-sharing frameworks under the Nagoya Protocol to ensure ethical sourcing and community participation. Brazil, for example, supports local processing industries for essential oils and natural extracts.

Impact: Investments in local extraction facilities and sustainable harvesting programs are gradually enabling Latin America and Africa to capture greater value from their natural resources, reducing dependence on raw material exports.

Policy and Regulatory Themes Shaping the Market

- Quality and Standardization: Implementation of GMP standards and pharmacopeial guidelines ensures consistency, purity, and safety, reducing risks of adulteration and contamination.

- Novel Food and Cosmetic Regulations: Stricter approval processes for new botanical ingredients are raising quality benchmarks and creating demand for certified suppliers.

- Sustainability and Biodiversity Laws: Compliance with international frameworks like the Nagoya Protocol encourages fair trade, community benefit-sharing, and sustainable resource use.

- Support for Traditional Medicine: National initiatives such as India’s AYUSH and China’s TCM programs are driving R&D investments, standardization efforts, and export growth.

- Trade and Tariff Policies: Bilateral trade agreements and tariff adjustments influence global supply chains, affecting where extraction and processing facilities are located.

Practical Takeaways for Industry Participants

- For Suppliers: Investing in standardized extraction technology, certification, and traceability systems is critical to maintaining competitiveness and compliance.

- For Brands: Consumers increasingly seek clinically validated, transparent, and sustainable botanical ingredients; aligning with these expectations builds trust and market share.

- For Policymakers: Supporting local cultivation and processing through incentives and infrastructure can generate employment, improve sustainability, and expand export potential.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Infectious Disease Diagnostics Market Revenue, Global Presence, and Strategic Insights by 2034