Automotive Telematics Market Trends, Growth Factors, Key Companies & Global Insights by 2034

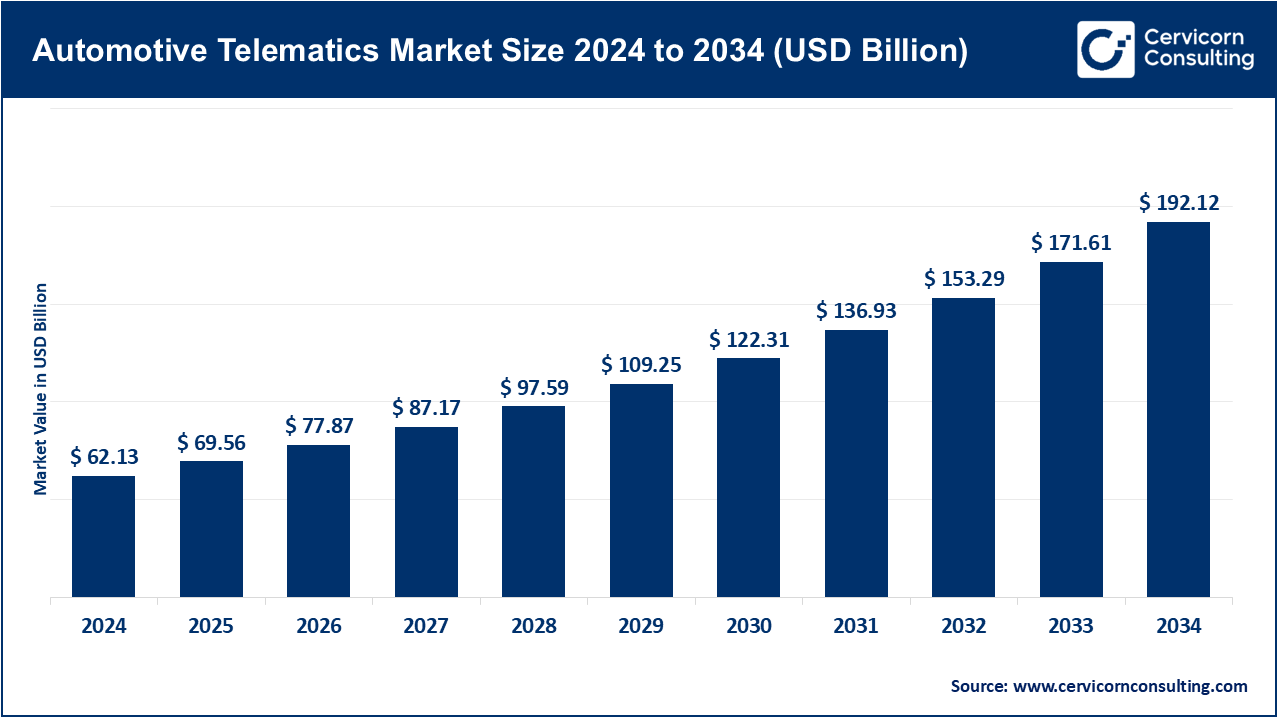

Automotive Telematics Market Size

The global automotive telematics market size was worth USD 62.13 billion in 2024 and is anticipated to expand to around USD 192.12 billion by 2034, registering a compound annual growth rate (CAGR) of 15.2% from 2025 to 2034.

Automotive Telematics Market Growth Factors

The automotive telematics market is expanding rapidly on the back of accelerating vehicle connectivity, mass OEM adoption of embedded modules, proliferation of 4G/5G networks and edge/cloud analytics, rising electrification that necessitates battery and charging intelligence, and surging fleet digitalization across logistics, ride-hailing, last-mile delivery, and public transport. Regulatory momentum—such as eCall mandates in Europe, electronic logging requirements in the U.S., and connected-vehicle roadmaps in China, Japan, and South Korea—further catalyzes penetration, while insurers scale usage-based insurance (UBI) and OEMs monetize over-the-air (OTA) software, subscriptions, and data-driven services.

Heightened safety expectations (automatic crash notification, stolen vehicle recovery), real-time diagnostics and predictive maintenance, V2X pilots for traffic efficiency, and cybersecurity hardening also contribute. Meanwhile, API-first platforms, open telematics standards, and partnerships among automakers, Tier-1s, chipmakers, operators, and cloud providers compress time-to-market, and AI/ML—applied to driver behavior, routing, and energy optimization—translates raw telemetry into measurable fuel/energy savings, uptime gains, and lower total cost of ownership (TCO), collectively propelling adoption across passenger and commercial segments worldwide.

What Is the Automotive Telematics Market?

Automotive telematics sits at the intersection of telecommunications, embedded electronics, and cloud software. It encompasses the hardware (TCU/embedded modem, GNSS, sensors), connectivity (cellular/LTE/5G, satellite, Wi-Fi/Bluetooth), and software services (navigation, infotainment, eCall, UBI, fleet management, remote diagnostics, battery intelligence, OTA updates) that move data between vehicles, drivers, back-office systems, and broader infrastructure. Solutions are typically embedded (factory-installed TCUs), tethered (paired smartphones), or integrated hybrids, and they serve the needs of private motorists, commercial fleets, public agencies, and mobility operators.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2697

Why Is It Important?

- Safety & compliance: Automatic crash notification, eCall, roadside assistance, and ELD-driven hours-of-service compliance reduce fatalities and risk.

- Operational efficiency: Real-time location, driver coaching, and route optimization cut idling, fuel/energy consumption, and unauthorized use.

- Uptime & cost control: Remote diagnostics and predictive maintenance lower unplanned downtime and warranty costs.

- Customer experience: Connected infotainment, remote start/lock, EV charge scheduling, and OTA features boost satisfaction and loyalty.

- New revenue models: Subscriptions, data services, and software-defined features unlock lifetime monetization beyond the vehicle sale.

- Smart mobility & sustainability: V2X, congestion mitigation, and EV energy management support decarbonization and smart-city goals.

Automotive Telematics Market — Top Companies

The table below synthesizes company specialization, strategic focus, notable features, estimated FY2024 revenue (company total, approximate), market position (telematics context), and global presence for five leading OEMs. Revenue figures are indicative ranges designed for editorial use—publishers typically replace with the exact reported numbers from annual filings.

| Company | Specialization | Key Focus Areas | Notable Features | 2024 Revenue (Approx.) | Market Share / Position | Global Presence |

|---|---|---|---|---|---|---|

| Ford Motor Company | Commercial fleet telematics; connected services via Ford Pro | Ford Pro Intelligence, OTA updates, remote diagnostics, UBI partnerships | Vehicle health reports, driver behavior insights, integrated charging for EV fleets | ~US$170–185B (company total) | Leading North American OEM-installed fleet telematics base | North America, Europe, expanding APAC and LatAm |

| Toyota Motor Corporation | Embedded connected services at scale; hybrid/EV telematics | Toyota Connected cloud, safety services, predictive maintenance, UBI enablement | Remote services app, crash notification, eco-driving analytics | ~US$280–320B (company total) | Global leader in connected vehicles by installed base | Japan, North America, Europe, China, wider APAC |

| Mercedes-Benz AG | Premium connected services; infotainment and ADAS integration | MBUX, OTA feature unlocks, energy management for EVs, data privacy | Natural voice UX, advanced navigation, safety/assistance bundling | ~US$150–170B (company total) | Premium telematics benchmark; strong subscriber attach rates | Europe, North America, Middle East, China |

| Volkswagen AG | Mass-market connected platforms; EV/SDV roadmap | We Connect/ID. ecosystem, software-defined vehicle (SDV) architecture, OTA | Personalized profiles, app-based remote functions, charging/navigation integration | ~US$300–360B (company total) | European scale leader; large connected fleet in China | Europe, China, North & South America |

| General Motors Company | Embedded telematics and safety services via OnStar | OnStar safety, diagnostics, stolen vehicle services; fleet intelligence | Automatic crash response, turn-by-turn, roadside, in-vehicle Wi-Fi | ~US$160–180B (company total) | North American pioneer in embedded telematics subscriptions | North America, select APAC & LatAm markets |

Leading Trends and Their Impact

1) 5G, Edge, and Low-Latency Services

5G enables higher throughput and ultra-low latency, improving real-time services such as collision warnings, hazard alerts, and HD-map updates. For fleets, faster data offload supports richer video telematics and live coaching. Near-edge processing reduces backhaul cost and improves reliability, while network slicing lets safety-critical data ride on prioritized lanes.

2) EV-Centric Telematics and Energy Intelligence

For battery-electric vehicles, telematics underpins charge planning, thermal management, and state-of-health analytics. Fleet operators rely on telematics to orchestrate depot charging, manage demand charges, and minimize range anxiety. Integrations with roaming networks and smart-charging APIs are becoming standard in both retail and commercial contexts.

3) Software-Defined Vehicles (SDV) and OTA Monetization

SDV architectures decouple hardware cycles from software lifecycles, allowing OEMs to deploy features post-sale via OTA updates—ranging from infotainment upgrades to advanced driver assistance capabilities. This unlocks recurring revenue, elevates residual values, and keeps vehicles secure with continuous patching.

4) Insurance Telematics & Risk-Adjusted Premiums

UBI programs use driving behavior, mileage, and contextual data to price premiums more fairly. Telematics helps reduce claim frequency and severities through feedback loops and proactive coaching, while fraud detection benefits from sensor fusion and event reconstruction.

5) Cybersecurity, Privacy, and Compliance-by-Design

As vehicles resemble “rolling data centers,” security policies (secure boot, signed firmware, key rotation) and privacy controls (consent management, data minimization) are mandatory. Regulatory frameworks increasingly require demonstrable resilience and data governance, shaping vendor selection and architecture choices.

6) Computer Vision & AI for Safety and Productivity

AI-powered driver monitoring and road-facing cameras detect distraction, tailgating, and lane drift; models transform raw video into actionable coaching and incident evidence. For fleets, AI optimizes routing versus traffic and weather, predicts component failures, and quantifies CO2 savings for ESG reporting.

Successful Telematics Examples Around the World

- GM OnStar (North America): A long-running benchmark for embedded safety with automatic crash response, stolen vehicle slowdown, and an array of convenience services. Strong subscriber economics have validated the embedded model.

- Ford Pro Intelligence (Global fleets): Cost and downtime reductions via vehicle health monitoring, over-the-air fixes, driver scoring, and EV charge management—particularly valuable for last-mile and utilities fleets.

- Toyota Connected Services (Global): Hybrid/EV owners leverage remote climate control, charge scheduling, and eco analytics, while emergency and breakdown services boost safety outcomes and brand stickiness.

- Mercedes-Benz MBUX (Europe, North America, China): A premium, voice-driven user experience that tightly fuses navigation, entertainment, and assistance with OTA extensibility.

- Volkswagen We Connect / ID. (Europe, China): Personalized profiles and app-centric remote control of charging and pre-conditioning; integration with public charging networks supports broader EV adoption.

- Public Safety & Transit (EU & APAC): City fleets deploy telematics for AVL (automatic vehicle location), driver behavior, and passenger information systems; emergency fleets benefit from priority signaling and geofencing.

Global Regional Analysis: Government Initiatives & Policies Shaping the Market

North America

- Policy drivers: The U.S. ELD (Electronic Logging Device) mandate for commercial carriers entrenches telematics across trucking; NHTSA safety programs and state-level incentives support ADAS and connected safety pilots.

- Impact: Mandatory compliance anchors sustained fleet subscriptions; safety features and UBI gain traction in personal lines; strong ecosystem of platform providers and MVNOs supports OEM programs.

- Market note: High pickup/van penetration and robust last-mile delivery volumes create outsized demand for fleet telematics, video AI, and EV depot orchestration.

Europe

- Policy drivers: EU eCall mandate (all new passenger vehicles), GDPR guiding privacy-by-design, and funding for C-ITS/V2X corridors. Urban low-emission zones and Euro 7 discussions indirectly encourage connected monitoring.

- Impact: Embedded telematics baseline is high; privacy governance influences data architectures and consent flows; cross-border roaming and interoperability are prioritized.

- Market note: Strong premium segment (Germany), high EV adoption (Nordics), and sophisticated fleet markets (UK, Benelux) elevate demand for OTA, energy intelligence, and insurance partnerships.

Asia-Pacific

- Policy drivers: China’s connected car standards and smart-city initiatives, Japan’s ITS roadmap, and South Korea’s 5G leadership. Many APAC governments offer EV subsidies and charging build-out plans.

- Impact: Volume leadership (China) and rapid EV uptake fuel telematics scale; localization (maps, voice, data residency) is critical; domestic cloud partnerships are often required.

- Market note: High smartphone penetration complements in-car systems; super-app integrations and payments ecosystems are influential in consumer experience design.

Latin America

- Policy drivers: Stolen-vehicle regulations in select markets, urban safety programs, and growing interest in UBI.

- Impact: Security-focused telematics (immobilization, recovery) sees strong demand; cost-optimized hardware and flexible data plans matter.

- Market note: Brazil and Mexico lead adoption; mixed coverage environments encourage dual-mode connectivity and offline caching strategies.

Middle East & Africa

- Policy drivers: Smart-city megaprojects in the Gulf (traffic management, MaaS), safety mandates for school buses and commercial transport in several jurisdictions.

- Impact: Government procurement and infrastructure projects drive early adoption; extreme climates elevate the value of battery/thermal analytics for EV fleets.

- Market note: Rapid growth from a smaller base; private security, oil & gas, and construction fleets are priority customer segments.

Practical Buyer’s Checklist (for fleets and OEM programs)

- Architecture: SDV-ready, API-first platform with modular services (safety, video, energy, maintenance).

- Connectivity: Multi-IMSI/MVNO options, 4G/5G with fallback, eSIM management, global roaming.

- Data & AI: Unified data model, real-time streaming, ML-based scoring and anomaly detection.

- Cybersecurity: Secure boot, signed OTA, HSM/TPM support, key rotation, ISO/UNECE compliance.

- EV Support: Charger integrations (OCPP), depot/route energy planning, battery health analytics.

- Total Cost: Transparent device + data + software pricing; clear ROI milestones (fuel, downtime, claims).

Key Metrics to Track

- Attach rate: % of new vehicles sold with embedded telematics activated.

- Active subscribers per vehicle cohort: Churn vs. renewals and upgrade rates.

- Uptime & maintenance KPIs: Mean time between failures (MTBF), predictive maintenance hit rate.

- Safety outcomes: Incident rate reduction, response times, claim severity trends.

- Energy/fuel efficiency: kWh/100 km or L/100 km improvements, charge dwell optimization.

- Data governance: Consent capture, data minimization, audit outcomes.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

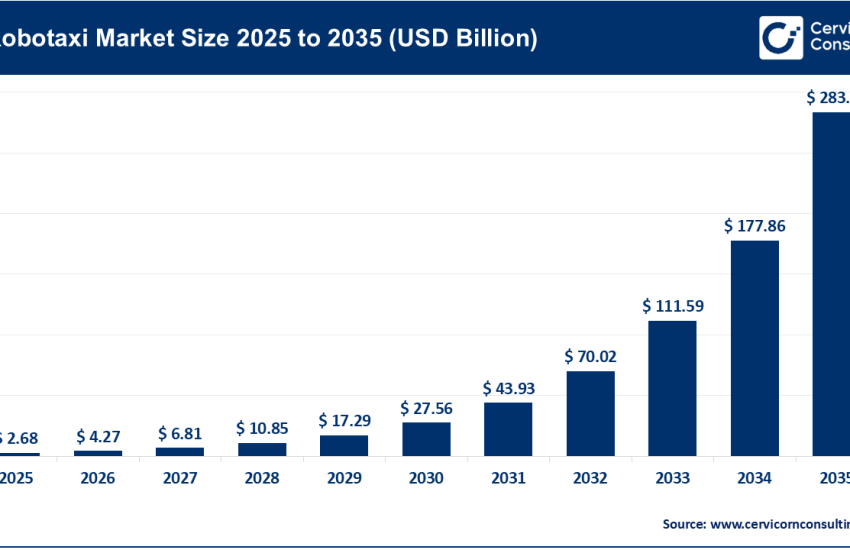

Read Report: Autonomous Vehicle Market Growth Drivers, Top Companies & Global Insights 2025–2034