Plastic Compounding Market Size, Growth, Key Companies, Trends, and Regional Insights 2025-2034

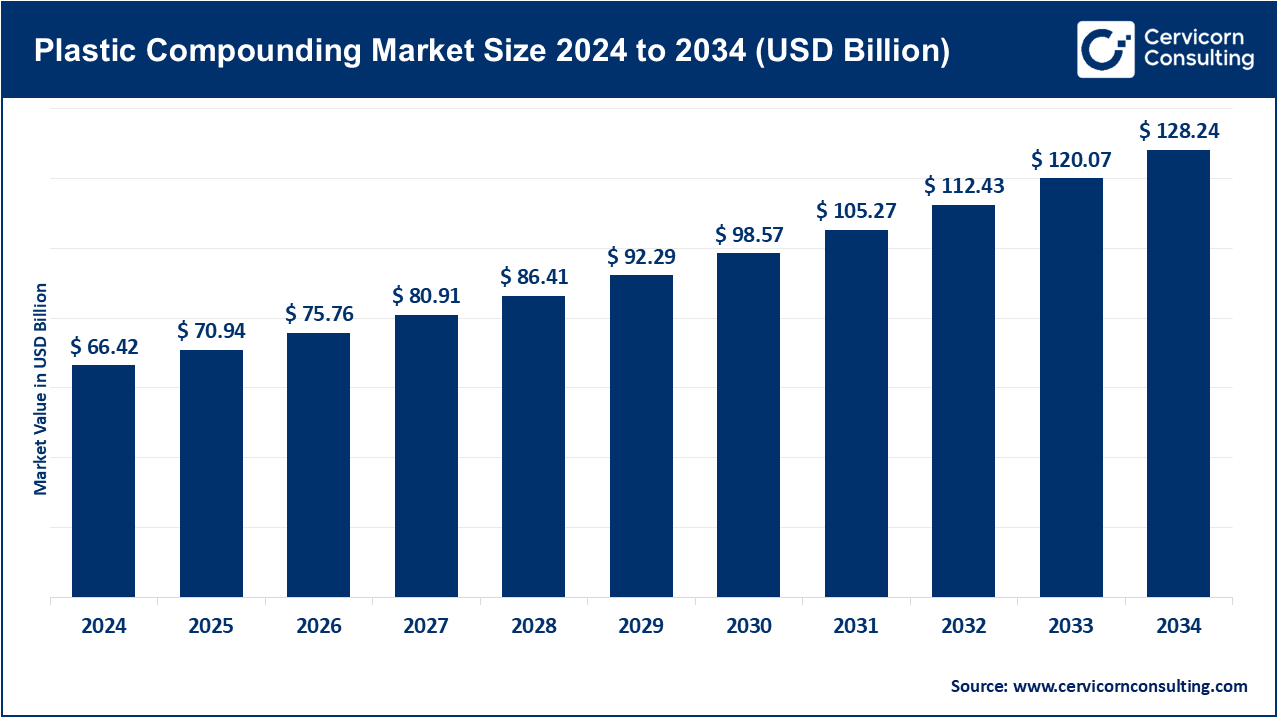

Plastic Compounding Market Size

What is the Plastic Compounding Market?

Plastic compounding is the industrial process of blending base polymers (e.g., PP, PE, PVC, PA, PC, POM, PET, ABS) with additives, reinforcements, fillers, colorants, stabilizers, or recycled/bio-based feedstocks to achieve tailored performance for target applications. Twin-screw extrusion is the workhorse technology, dispersing and distributing ingredients to deliver properties such as impact strength, flame retardancy, UV/thermal stability, electrical/EMI behavior, low VOCs, and precise color/appearance.

The market serves automotive, electrical & electronics, packaging, medical, building & construction, consumer goods, and renewable energy—where compounders translate evolving regulatory, sustainability, and performance requirements into “ready-to-mold” pellets at scale.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2698

Why it matters

Compounding is the “last mile” of polymer innovation and circularity. It:

- Converts commodity or engineering polymers into application-specific materials that meet OEM specifications.

- Enables lightweighting, which directly lowers fuel/electricity consumption in mobility and reduces material intensity in consumer and industrial products.

- Operationalizes circular economy goals by incorporating mechanically/chemically recycled and bio-attributed feedstocks while maintaining performance.

- Acts as a bridge between regulatory policy (recycled content, design-for-recycling) and manufacturable reality, aligning compounding recipes and QA with compliance documentation needed by OEMs across regions.

Plastic Compounding Market Growth Factors

From 2024 to 2034, growth in the plastic compounding market is significantly driven by lightweighting and electrification trends in the automotive sector. This includes the rising demand for EV battery packs, advanced electrical architectures, and thermal management systems, which increasingly rely on glass-fiber-reinforced PA, PBT, and PP compounds. These materials not only reduce vehicle weight but also enhance safety and performance, making them indispensable in the transition toward sustainable mobility.

The electronics sector further accelerates market growth, with miniaturization and reliability requirements across 5G infrastructure, AI datacenters, and power electronics. This shift is boosting demand for flame-retardant, low-warpage, and high-CTI compounds. In parallel, the packaging industry is undergoing a transformation, prioritizing efficiency and sustainability through design-for-recycling, down-gauging, and recycled-content mandates. As a result, compatibilized PCR compounds and mono-material solutions are becoming critical to meet stringent environmental and regulatory standards.

Beyond automotive, electronics, and packaging, growth is also fueled by infrastructure and building modernization, requiring weatherable, UV-stable, and halogen-free compounds, as well as expanding applications in the medical and bioprocessing sectors. Here, demand for sterilizable, low-extractable, and low-leachable compounds for single-use systems is rising sharply. Adding to these dynamics are policy tailwinds, such as the EU’s Packaging & Packaging Waste Regulation, India’s Extended Producer Responsibility (EPR) requirements, and U.S. initiatives on plastics circularity. These policies are converting regulatory pressures into commercial opportunities for advanced, recycled, and bio-attributed compounds. Altogether, these factors are projected to double the overall market value across the decade roughly.

Plastic Compounding Market Top Companies (Profiles)

BASF SE

- Company: The world’s largest chemical company with a broad polymers and additives slate; deep application development networks with OEMs/Tier-1s.

- Specialization: Engineering plastics (Ultramid® PA, Ultradur® PBT), performance additives, colorants, and application-specific compounds for automotive, E&E, packaging, and industrial.

- Key Focus Areas: Lightweighting (metal replacement), battery and e-mobility components, sustainability (recycled/biomass-balanced grades), digital simulation + CAE.

- Notable Features: Global compounding footprint; close co-engineering with customers; mass-balance certification options to decarbonize scope-3 materials.

- 2024 Revenue: €65.3 billion (BASF Group).

- Market Share: Top-tier across multiple engineering plastics families, especially PA and PBT compounds supplied to mobility and E&E.

- Global Presence: Plants and technical centers across Europe, Americas, and Asia.

Covestro AG

- Company: Leading producer of polycarbonate (Makrolon®), PC blends (Bayblend®), TPUs and polyurethane raw materials; strong in E&E, automotive lighting/glazing, healthcare.

- Specialization: High-purity PC and PC blends, more sustainable RE/RP grades using bio-attributed or recycled feedstocks.

- Key Focus Areas: Circular materials (Makrolon® RE, RP), optical clarity with heat resistance, durable medical compounds, aesthetic CMF with sustainability.

- Notable Features: Strong materials database, solution center, and design collaboration with Tier-1s (e.g., smart pillars, lighting, glazing).

- 2024 Revenue: €14.2 billion.

- Market Share: Leadership in polycarbonate and PC blends—key subsegments of engineering plastics compounding.

- Global Presence: Production and technical centers across EU, China, and the U.S.

DuPont

- Company: Multi-industrial materials innovator with strong engineered polymers heritage (Zytel®, Minlon®, Delrin®).

- Specialization: Advanced polyamides and specialty materials for electronics, water, medical packaging, and industrial segments.

- Key Focus Areas: Electronics & industrial recovery, performance and sustainability in high-reliability applications.

- Notable Features: Deep IP and application engineering across nylon families, including glass-reinforced and bio-based long-chain PA compounds.

- 2024 Revenue: ~USD 12.5 billion.

- Market Share: Significant presence in high-spec PA compounds across mobility and electronics.

- Global Presence: Manufacturing and technical centers across the Americas, Europe, and Asia.

Celanese Corporation (North America)

- Company: Engineered Materials leader with a broad portfolio in POM, PBT, PA, and long-fiber reinforced thermoplastics (LFRT).

- Specialization: Celstran®/Compel® LFRT for metal replacement, engineered compounds for automotive, E&E, and industrial applications.

- Key Focus Areas: High-stiffness, crash-capable LFRT; electrification and ADAS components.

- Notable Features: Demonstrated metal-replacement solutions for structural parts with long fibers and advanced additive packages.

- 2024 Revenue: ~USD 10.3 billion.

- Market Share: Among leaders in engineered compounds and LFRT solutions for automotive/industrial globally.

- Global Presence: Compounding sites and technical centers across U.S., EU, and Asia.

Asahi Kasei Corporation

- Company: Diversified Japanese materials innovator active in chemicals, homes, and healthcare.

- Specialization: Engineering plastics such as Leona™ PA66, Xyron™ mPPE, and other engineered polymers.

- Key Focus Areas: High-temperature nylons, mPPE-based compounds with dimensional stability and flame retardants.

- Notable Features: Integration across fibers/chemicals enabling unique compound recipes and processing know-how.

- 2024 Revenue: ¥3,037.3 billion.

- Market Share: Recognized brands in PA and mPPE compounds, particularly strong across Asia automotive/E&E supply chains.

- Global Presence: Manufacturing and tech centers in Japan, China, ASEAN, Europe, and the U.S.

Leading trends and their impact

- Lightweighting & Electrification of Mobility

OEM decarbonization targets are intensifying substitution of metal with glass-fiber-reinforced PA, PBT, and PP compounds in brackets, battery components, thermal housings, and structural modules. EVs also require flame retardancy and dielectric properties critical to battery and power electronics safety. - Circular & Low-Carbon Materials

Brand owners and regulators are demanding recycled content and lower embedded CO₂. Compounders are investing in compatibilizers and stabilizer packages to raise PCR content while preserving flow/impact/appearance. - Design-for-Recycling (DFR) & Mono-Material Packaging

EU regulations are pushing mono-material PET/PP solutions and additive packages that do not hinder recycling. Compounders that can balance performance with recyclability will win packaging specifications. - High-Reliability E&E and Medical

Miniaturization and power density in electronics require flame-retardant, low-warpage, and high-CTI compounds; sterilizable materials are expanding in medical devices. - Digital Engineering & Faster Qualification

Material databases, CAE, and application labs reduce time-to-market by predicting flow, shrink, warpage, and creep—key for thin-wall parts and integrated assemblies.

Successful real-world examples

- Celanese: Celstran®/Compel® LFRT adopted for high-load automotive modules, meeting crash and stiffness requirements while reducing weight.

- Covestro: PC and PC-blend compounds enable durable, heat-resistant, aesthetic components for EV chargers and smart interior elements.

- BASF: Ultramid® compounds selected for battery module housings and cell holders, reducing vehicle weight compared to metals.

- DuPont: Zytel® RS long-chain PAs (partly bio-based) used in radiator end tanks and fluid handling, combining sustainability with durability.

Global regional analysis (with government initiatives & policies shaping the market)

Europe

- Strong pull from automotive, industrial and E&E; rapid packaging policy transformation.

- EU’s Packaging & Packaging Waste Regulation sets recyclability/design standards and binding recycled-content requirements.

- Compounders with validated recycled grades and transparent chain-of-custody gain market advantage.

North America

- Resilient automotive, appliances, and infrastructure markets.

- Federal actions around plastics circularity and state-level EPR policies drive PCR compound demand.

- Opportunity for regional recycled-content compounds that meet stringent electrical and thermal specs.

Asia-Pacific

- Largest global manufacturing hub, with strong automotive and electronics sectors.

- China’s Five-Year Plans emphasize new materials and plastics pollution control.

- Rising demand for high-performance, recyclable compounds in consumer and industrial products.

India

- Fast-growing automotive, appliances, FMCG packaging, and infrastructure markets.

- Plastic Waste Management Rules and EPR amendments require recycled content use and labeling.

- Surge in demand for PCR-PP/PE compounds that meet odor/appearance specs.

Latin America & Middle East/Africa

- Automotive and white goods strong in Mexico/Brazil; infrastructure demand in GCC.

- EPR adoption and global OEM harmonization of sustainability standards influence compound requirements.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Epoxy Resin Market Growth Drivers, Key Companies, Trends and Regional Insights by 2034