Green Ammonia Market Growth Drivers, Top Companies, Trends, and Global Policy Impact (2025-2034)

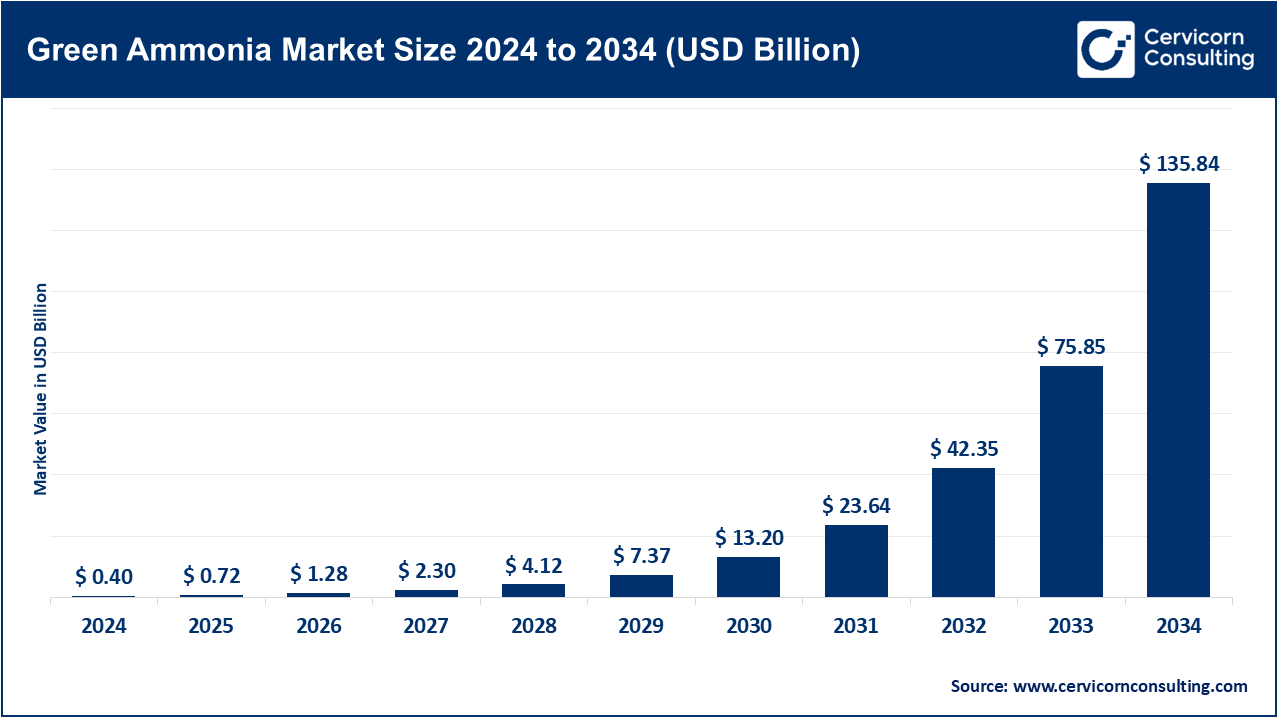

Green Ammonia Market Size

The global green ammonia market size was worth USD 0.40 billion in 2024 and is anticipated to expand to around USD 135.84 billion by 2034, registering a compound annual growth rate (CAGR) of 79.1% from 2025 to 2034.

What is the Green Ammonia Market?

Green ammonia refers to ammonia produced through a 100% renewable and carbon-free process, primarily using hydrogen derived from water electrolysis powered by renewable electricity (wind, solar, or hydropower) and nitrogen extracted from the air. Unlike conventional ammonia—which is typically synthesized from natural gas via steam methane reforming (SMR), emitting significant CO₂—green ammonia represents a sustainable alternative.

This market encompasses technologies, infrastructure, and stakeholders involved in producing, storing, and applying clean ammonia as fuel, fertilizer, and energy storage. It plays a pivotal role in enabling global energy transition toward net-zero emissions by replacing fossil-based ammonia in agriculture, shipping, and industrial processes.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2676

Why is the Green Ammonia Market Important?

- Decarbonization of Agriculture: Green ammonia helps cut emissions from fertilizer production, which accounts for nearly 2% of global CO₂ emissions.

- Clean Maritime Fuel: It offers a carbon-free alternative to bunker fuel in shipping.

- Energy Storage and Hydrogen Transport: Ammonia acts as a stable hydrogen carrier, ideal for long-distance trade and seasonal storage.

- Grid Balancing: Enables conversion of surplus renewable electricity into storable fuel.

- Energy Security: Countries can reduce dependency on fossil imports by producing ammonia domestically using renewables.

Green Ammonia Market Growth Factors

The growth of the green ammonia market is fueled by an urgent global need to decarbonize energy-intensive industries and agriculture, coupled with stringent government policies promoting renewable energy, the declining cost of electrolyzers and renewable electricity, the increasing adoption of carbon pricing mechanisms, and the rise of hydrogen economy initiatives. Significant investments in green hydrogen infrastructure, growing support for clean shipping fuel alternatives, public-private partnerships, and technology advances in ammonia synthesis and electrolysis are further accelerating the market’s expansion.

In addition, the expansion of offshore wind and solar capacity in regions such as the Middle East, Australia, and Northern Europe is catalyzing mega-scale green ammonia production and export projects, which are expected to transform global trade flows and reduce dependency on fossil fuels.

Top Companies in the Green Ammonia Market

1. Siemens Energy

- Specialization: Electrolysis technology (PEM), renewable integration

- Key Focus Areas: Wind-to-ammonia systems, power plant retrofitting

- Notable Features: Projects in Germany and Chile

- 2024 Revenue: ~$450 million from green projects

- Market Share: ~8%

- Global Presence: Europe, Latin America, Asia

2. Yara International ASA

- Specialization: Fertilizers, ammonia trading

- Key Focus Areas: Green fertilizers, maritime fuel

- Notable Features: Green ammonia demo plant in Norway

- 2024 Revenue: ~$650 million

- Market Share: >10%

- Global Presence: Europe, North America, Australia

3. ENGIE

- Specialization: Renewable power, green hydrogen/ammonia

- Key Focus Areas: Export projects in Chile, Australia

- Notable Features: Yuri project partnership

- 2024 Revenue: ~$400 million

- Market Share: ~7%

- Global Presence: Europe, Latin America, Africa

4. Air Products

- Specialization: Industrial gases, infrastructure

- Key Focus Areas: Export mega-projects

- Notable Features: $5B NEOM Project in Saudi Arabia

- 2024 Revenue: ~$900 million

- Market Share: >15%

- Global Presence: USA, Middle East, Asia-Pacific

5. ITM Power PLC

- Specialization: Electrolyzer manufacturing (PEM)

- Key Focus Areas: Electrolysis modules for ammonia plants

- Notable Features: Partnerships with Linde, Snam

- 2024 Revenue: ~$180 million

- Market Share: ~5–6%

- Global Presence: UK, Europe, Middle East

Leading Trends and Their Impact

- Scaling Electrolyzers: Gigawatt-scale systems reduce green hydrogen costs.

- Green Shipping Demand: Ports developing ammonia bunkering infrastructure.

- Regional Hydrogen Alliances: Cross-border trade partnerships forming.

- Digital Twin Optimization: Used for energy management and ESG tracking.

- Carbon Credits: Producers benefit from carbon trading schemes.

Successful Green Ammonia Projects Around the World

- NEOM (Saudi Arabia): $8.4B green ammonia export project producing 1.2M tonnes/year.

- Yara Porsgrunn (Norway): Green fertilizer plant powered by hydropower.

- ENGIE’s Yuri (Australia): Wind and solar-powered ammonia plant.

- Haru Oni (Chile): Siemens-backed pilot for renewable fuel via ammonia.

- Iberdrola-Fertiberia (Spain): Solar hydrogen-to-ammonia project for fertilizers.

Global Regional Analysis and Government Policies

Europe

- Policies: REPowerEU, Fit for 55, Hydrogen Strategy

- Countries: Norway, Spain, Netherlands, Germany

Asia-Pacific

- Policies: Japan & Korea co-firing mandates, India’s Hydrogen Mission

- Projects: Australia’s Yuri, ACME’s Oman plant

Middle East and Africa

- Policies: Export-based hydrogen strategies (KSA, UAE, Egypt)

- Projects: NEOM, Suez Green Hydrogen, Morocco ammonia corridor

North America

- Policies: Inflation Reduction Act (USA), Clean Hydrogen Credits (Canada)

- Projects: Louisiana Ammonia Hub, Texas Hydrogen Valley

Latin America

- Policies: Chile’s Hydrogen Roadmap

- Projects: Haru Oni, Atacama Corridor

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Technical Textile Market Worth USD 238.45 Bn in 2024, to Hit USD 390.62 Bn by 2034