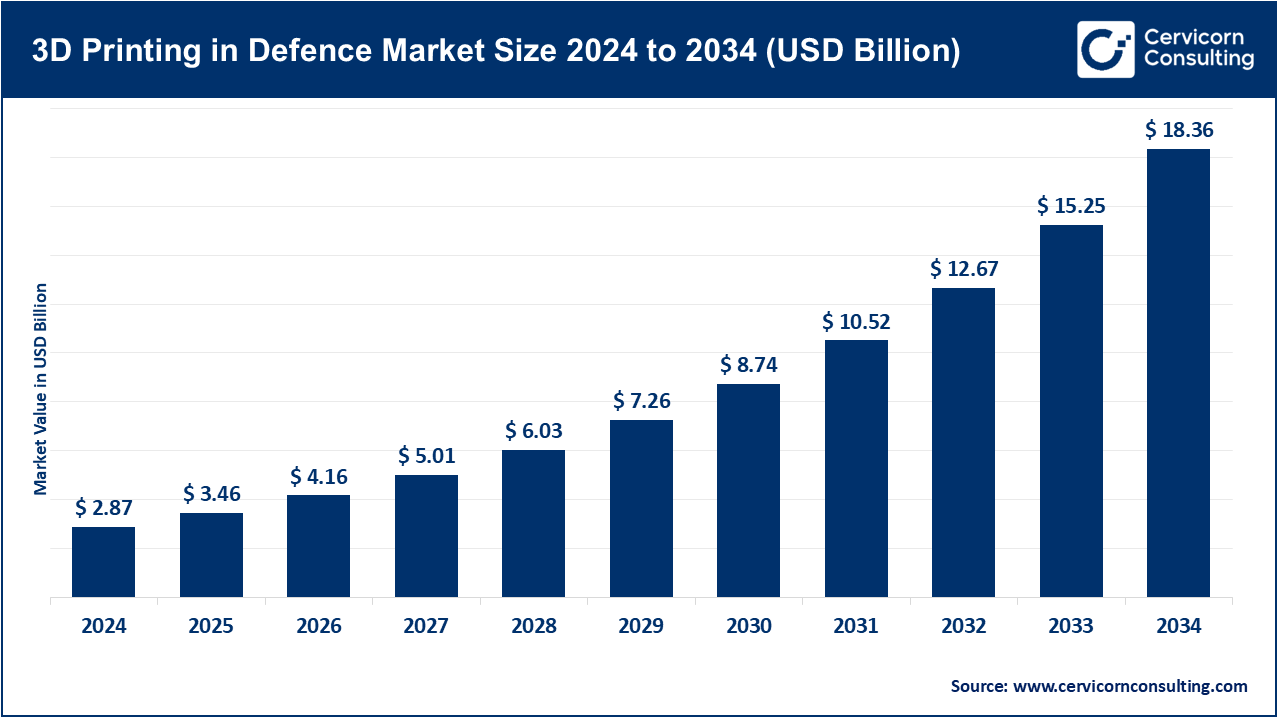

3D Printing in Defence Market Size to Reach USD 18.36 Billion by 2034

3D Printing in Defence Market Overview

The global 3D printing in defence market size was worth USD 2.87 billion in 2024 and is anticipated to expand to around USD 18.36 billion by 2034, registering a compound annual growth rate (CAGR) of 27.21% from 2025 to 2034.

The intersection of additive manufacturing and defense technology is transforming how militaries operate, strategize, and innovate. 3D printing, also known as additive manufacturing, is rapidly becoming a core technology in global defense operations, enabling faster prototyping, decentralized logistics, and field-ready production of critical components. This blog explores the 3D printing in defence market—its importance, leading companies, key trends, regional dynamics, and global success stories shaping the future of military technology.

What is 3D Printing in Defence Market?

The 3D printing in defence market refers to the application of additive manufacturing technologies within military environments for the production of components, equipment, and systems. Unlike traditional manufacturing, 3D printing builds objects layer by layer from digital designs, allowing for the creation of complex geometries, lightweight parts, and mission-specific prototypes. Defense applications range from aircraft components and drone systems to temporary structures, wearable gear, and even medical solutions like battlefield prosthetics. It enhances readiness, reduces downtime, and fosters operational efficiency in critical and remote environments.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2670

Why Is 3D Printing Important in Defence?

3D printing is a game-changer in defense for multiple reasons. It enables on-demand, decentralized production, significantly reducing dependency on global supply chains, especially in warzones or disaster-hit areas. With the ability to print parts in-theater, military units can maintain operational continuity. The technology also allows for rapid prototyping, cost-effective custom part creation, and extending the lifecycle of aging military systems by replicating obsolete components. In addition, it supports innovation in aerospace, weaponry, and unmanned systems by minimizing the constraints of traditional design and production methods.

3D Printing in Defence Market Growth Factors

The 3D printing in defence market is witnessing strong growth due to multiple catalysts. These include the increasing need for faster and cost-effective manufacturing of complex military-grade components, rising global defense budgets, military modernization programs, and growing reliance on unmanned systems and autonomous vehicles. Governments are investing in R&D to improve defense logistics and supply chain resilience. Material innovations such as titanium, composites, and carbon fiber are also enabling lightweight yet durable applications. On-site manufacturing, cyber-resilient digital design, and AI integration are further fueling adoption across global defense agencies.

Top Companies in the 3D Printing in Defence Market

1. Lockheed Martin Corporation

- Specialization: Aerospace and missile systems

- Key Focus Areas: Additive design for aircraft, missile structures, and space-grade components

- Notable Features: Utilizes DED and PBF technologies

- 2024 Revenue: $67 billion (estimated)

- Market Share: 15% of the defense 3D printing sector

- Global Presence: Operations in 50+ countries across North America, Europe, and Asia-Pacific

2. 3D Systems Corporation

- Specialization: Industrial-grade metal and polymer 3D printing solutions

- Key Focus Areas: Turbine components, jet parts, and thermal management systems

- Notable Features: Direct Metal Printing (DMP), advanced software integration

- 2024 Revenue: $590 million

- Market Share: 8%

- Global Presence: Presence in North America, Europe, and the Middle East

3. Desktop Metal, Inc.

- Specialization: High-speed metal 3D printing for military and industrial uses

- Key Focus Areas: On-site, scalable production and rugged defense tooling

- Notable Features: “Shop System” and “Production System” printers

- 2024 Revenue: $250 million

- Market Share: 6%

- Global Presence: North America, NATO allies, and Asia-Pacific

4. SLM Solutions Group AG

- Specialization: Powder Bed Fusion metal printing for aerospace and defense

- Key Focus Areas: Lightweight and corrosion-resistant aerospace components

- Notable Features: Focus on jet engine and naval applications

- 2024 Revenue: $120 million

- Market Share: 4%

- Global Presence: Based in Germany with NATO client footprint

5. Stratasys Ltd.

- Specialization: Polymer-based 3D printing for military simulation and field gear

- Key Focus Areas: UAV components, protective equipment, and custom fixtures

- Notable Features: FDM and PolyJet technology leadership

- 2024 Revenue: $640 million

- Market Share: 9%

- Global Presence: Active in over 30 countries including DoD partnerships

Leading Trends and Their Impact

- On-Demand Manufacturing: Mobile 3D labs allow battlefield production of critical parts, minimizing logistical delays.

- Materials Innovation: Military-grade polymers and metal alloys improve strength, thermal resistance, and weight savings.

- Cybersecurity Focus: Secure CAD file management and encrypted design sharing are vital for mission security.

- Sustainability Push: 3D printing reduces material waste and supports greener defense logistics.

- AI-Driven Optimization: AI-based generative design and simulation tools enhance structural efficiency and speed of deployment.

Successful Examples of 3D Printing in Defence Worldwide

- USA: U.S. Navy uses shipboard 3D labs to print replacement parts mid-mission; Army prints drone wings and medical gear.

- UK: BAE Systems prints Eurofighter parts to reduce costs and increase aircraft readiness.

- Israel: Israel Aerospace Industries prints airframe parts for UAVs to reduce mission weight.

- India: Local startups help the Army produce spare parts for tanks in high-altitude zones.

- Russia: 3D printed submarine and aerospace parts using metal-based AM technologies.

- China: Titanium components in stealth fighters produced through 3D printing for weight and radar signature reduction.

Global and Regional Analysis of the 3D Printing in Defence Market

North America

- Countries: United States, Canada

- Key Drivers: DoD initiatives like JAMMEX, $500M+ in annual AM investments

- Focus: Aerospace, naval systems, battlefield deployment

Europe

- Countries: Germany, UK, France, Italy

- Key Initiatives: EU’s AMable & EDF programs, Eurofighter support via additive technologies

- Focus: Submarines, fighter jets, AI-integrated AM production

Asia-Pacific

- Countries: China, India, Japan, South Korea

- Key Programs: “Atmanirbhar Bharat” (India), “Made in China 2025” (China)

- Focus: UAVs, exoskeletons, stealth technologies

Middle East & Africa

- Countries: UAE, Israel, Saudi Arabia

- Key Developments: UAE investing in mobile AM labs; Israel’s UAV sector driving adoption

Latin America

- Countries: Brazil, Argentina

- Key Initiatives: Pilot 3D printing projects in military aircraft and tooling support

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: 0Industry 4.0 in Aerospace and Defense Market Size Worth USD 86.71 Billion by 2034