Asthma Treatment Market Size, Revenue Share, and Forecast to 2034

Asthma Treatment Market Size

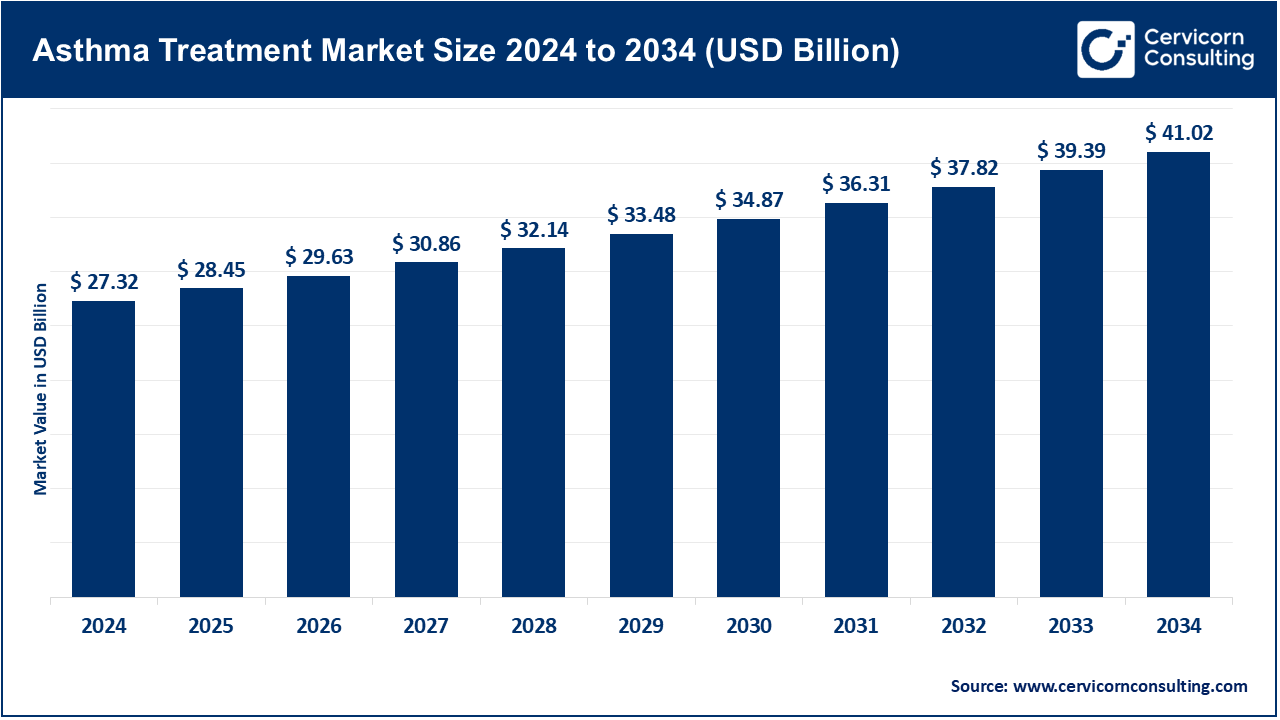

The global asthma treatment market size was worth USD 27.32 billion in 2024 and is anticipated to expand to around USD 41.02 billion by 2034, registering a compound annual growth rate (CAGR) of 5.9% from 2025 to 2034.

What is the Asthma Treatment Market?

The asthma treatment market encompasses the development, production, marketing, and distribution of various products aimed at the management and control of asthma symptoms and exacerbations. These include controller medications (such as inhaled corticosteroids, long-acting beta-agonists, leukotriene modifiers), rescue inhalers (short-acting bronchodilators), biologics (monoclonal antibodies targeting specific immune pathways like IL-5, IL-4, and IgE), nebulizers, and digital inhaler technologies. The market spans across pharmaceuticals, medical devices, and digital health segments, supporting millions of patients globally in managing both mild and severe asthma.

Asthma—a chronic inflammatory condition affecting the airways—is incurable but can be effectively managed. The rising prevalence of asthma, especially in urbanized and industrialized settings, coupled with increasing awareness, improved healthcare access, and innovation in drug delivery technologies, has fueled the market’s rapid development. The market addresses both acute care needs and long-term disease control, aligning with broader trends toward personalized and precision medicine.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2660

Why is the Asthma Treatment Market Important?

Asthma affects over 339 million people globally (according to WHO), and its burden continues to rise due to pollution, lifestyle changes, and poor air quality. The importance of the asthma treatment market lies in its potential to reduce morbidity and mortality, improve quality of life, and lower healthcare costs by preventing hospitalizations and emergency room visits. In low- and middle-income countries, where asthma is often underdiagnosed and undertreated, the market has critical implications for public health equity.

Moreover, the market plays a crucial role in biopharmaceutical innovation, with biologics revolutionizing treatment for patients with severe eosinophilic asthma. The incorporation of smart inhalers, wearables, and AI-driven health monitoring technologies are expanding the scope of asthma care into digital therapeutics, further enhancing disease tracking, adherence, and remote patient monitoring.

Asthma Treatment Market Growth Factors

The asthma treatment market is witnessing robust growth due to several interlinked factors, including the rising global incidence of asthma, driven by urban pollution, industrial emissions, smoking, and lifestyle changes; technological innovations in drug delivery systems, such as smart inhalers and digital health integration; strong R&D pipelines, especially in biologics and precision medicine for severe asthma phenotypes; favorable reimbursement policies and increasing healthcare expenditure globally; growing awareness and education programs, particularly in emerging markets; and governmental initiatives for chronic disease management and clean air policies. Together, these dynamics are propelling sustained investment and expansion in the asthma treatment ecosystem.

Top Companies in the Asthma Treatment Market: Overview

1. AstraZeneca

- Specialization: Biologics, Inhalation Therapies, Precision Medicine

- Key Focus Areas: Severe eosinophilic asthma, Type 2 inflammation, personalized respiratory care

- Notable Features: Market-leading biologic—Fasenra (benralizumab), Symbicort inhaler

- 2024 Revenue: Estimated $5.1 billion from respiratory segment (Fasenra: ~$1.6B)

- Market Share: Approx. 14.5% of global asthma treatment market

- Global Presence: Strong in North America, Europe, Asia-Pacific; expanding in Latin America

2. Teva Pharmaceutical Industries Ltd.

- Specialization: Generic and branded respiratory therapies

- Key Focus Areas: Affordable asthma medication, generic inhalers, digital health

- Notable Features: ProAir Digihaler – FDA-approved digital inhaler with sensor technology

- 2024 Revenue: ~$2.2 billion from respiratory care (includes branded & generics)

- Market Share: ~8.2% globally

- Global Presence: Broad global footprint with particular strength in the U.S. and Europe

3. GlaxoSmithKline plc (GSK)

- Specialization: Inhaled corticosteroids, combination therapies, biologics

- Key Focus Areas: Long-acting combination therapies, anti-IL5 biologics

- Notable Features: Advair, Trelegy Ellipta, Nucala (mepolizumab)

- 2024 Revenue: Estimated $4.7 billion from respiratory portfolio

- Market Share: ~13% in asthma therapeutics

- Global Presence: Operations in over 150 countries with strong institutional partnerships

4. Boehringer Ingelheim International GmbH

- Specialization: Prescription asthma and COPD medications

- Key Focus Areas: Dual bronchodilation, inhalation devices, chronic management

- Notable Features: Spiriva, Respimat inhaler technology

- 2024 Revenue: ~$2.9 billion in respiratory segment

- Market Share: ~10% globally

- Global Presence: Europe, North America, Asia-Pacific, and growing interest in BRICS nations

5. Roche Holding AG (Genentech)

- Specialization: Biologics for severe asthma and allergy-related conditions

- Key Focus Areas: Monoclonal antibody therapies, IgE modulation, eosinophilic inflammation

- Notable Features: Xolair (omalizumab)—pioneering biologic for allergic asthma

- 2024 Revenue: ~$1.8 billion from asthma biologics (mainly Xolair)

- Market Share: ~6.5% globally

- Global Presence: Broad reach through Genentech in the U.S. and partnerships globally

Leading Trends and Their Impact on the Asthma Treatment Market

- Rise of Biologic Therapies

Biologics targeting IL-4, IL-5, and IgE pathways have transformed care for moderate-to-severe asthma, providing personalized approaches and reducing corticosteroid dependency. Products like Fasenra, Nucala, and Xolair are now frontline therapies for patients unresponsive to traditional drugs. - Smart Inhalers and Digital Therapeutics

Integration of sensors and Bluetooth technology into inhalers allows for real-time monitoring, medication adherence tracking, and remote patient management. Companies like Teva and Propeller Health are reshaping treatment paradigms with these innovations. - Environmental and Lifestyle Initiatives

Increasing recognition of air pollution’s role in asthma has sparked public-private collaborations for cleaner environments. This is driving investments in preventive care, environmental monitoring, and early intervention programs. - Focus on Pediatric Asthma Management

Pediatric asthma is gaining attention due to its impact on school attendance, quality of life, and long-term health. Drug formulations are increasingly designed for child-friendly administration, such as flavored oral leukotriene inhibitors or spacer-compatible inhalers. - Precision Medicine and Genomic Profiling

Asthma heterogeneity is pushing a shift from “one-size-fits-all” to phenotype-specific treatments, enabled by genomic profiling and biomarkers. This fosters innovation in companion diagnostics and targeted interventions.

Successful Examples of Asthma Treatment Market Initiatives Around the World

- United Kingdom: National Health Service (NHS)

NHS England’s rollout of smart inhalers and digitally-enabled asthma action plans has demonstrated a 20–30% improvement in adherence and significant reductions in emergency admissions. - United States: Propeller Health Partnerships

Collaborations between health insurers and Propeller Health have led to decreased ER visits by 57% among asthma patients using digitally monitored inhalers. - Australia: Asthma Australia Community Programs

Their initiative “Asthma Buddy” and air quality alerts have empowered self-management, particularly in remote and underserved areas. - India: Mobile Health for Rural Asthma

mHealth applications developed by Indian start-ups like HealthPlix and mFine provide affordable asthma risk screening and remote doctor consultations in rural settings, bridging care gaps.

Global Regional Analysis and Government Policies Shaping the Asthma Treatment Market

North America

- Market Size (2024): ~$10.2 billion

- Key Drivers: High disease awareness, insurance coverage, strong biologics uptake

- Government Policies: U.S. CMS supports biologics reimbursement; FDA fast-tracks innovative therapies

- Trends: Integration of AI-driven adherence tools, broad Medicaid access to biologics

Europe

- Market Size (2024): ~$8.5 billion

- Key Drivers: Universal healthcare access, early diagnosis, air quality directives

- Government Initiatives: EU Green Deal targeting pollution reduction; NHS smart inhaler rollout

- Trends: Focus on value-based care, clinical outcomes, and cost-effectiveness

Asia-Pacific

- Market Size (2024): ~$6.8 billion

- Key Drivers: Rising urbanization, pollution, underdiagnosed asthma burden

- Notable Initiatives: Japan’s universal coverage for asthma biologics; China’s Healthy China 2030 initiative

- Trends: Rapid growth in generic and biosimilar markets, telehealth asthma management

Latin America

- Market Size (2024): ~$2.9 billion

- Key Drivers: Urban air pollution, lack of access to specialized care

- Policy Focus: Brazil and Mexico expanding public access to basic asthma meds

- Trends: Growing partnerships with NGOs for mobile asthma clinics

Middle East and Africa

- Market Size (2024): ~$1.5 billion

- Key Drivers: Desert pollution, indoor air quality, under-reporting

- Government Actions: Saudi Vision 2030’s healthcare goals include chronic respiratory management

- Trends: Increasing demand for low-cost inhalers, health education campaigns

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Point of Care Molecular Diagnostics Market Size, Growth, Companies, Trends, and Regional Outlook by 2034