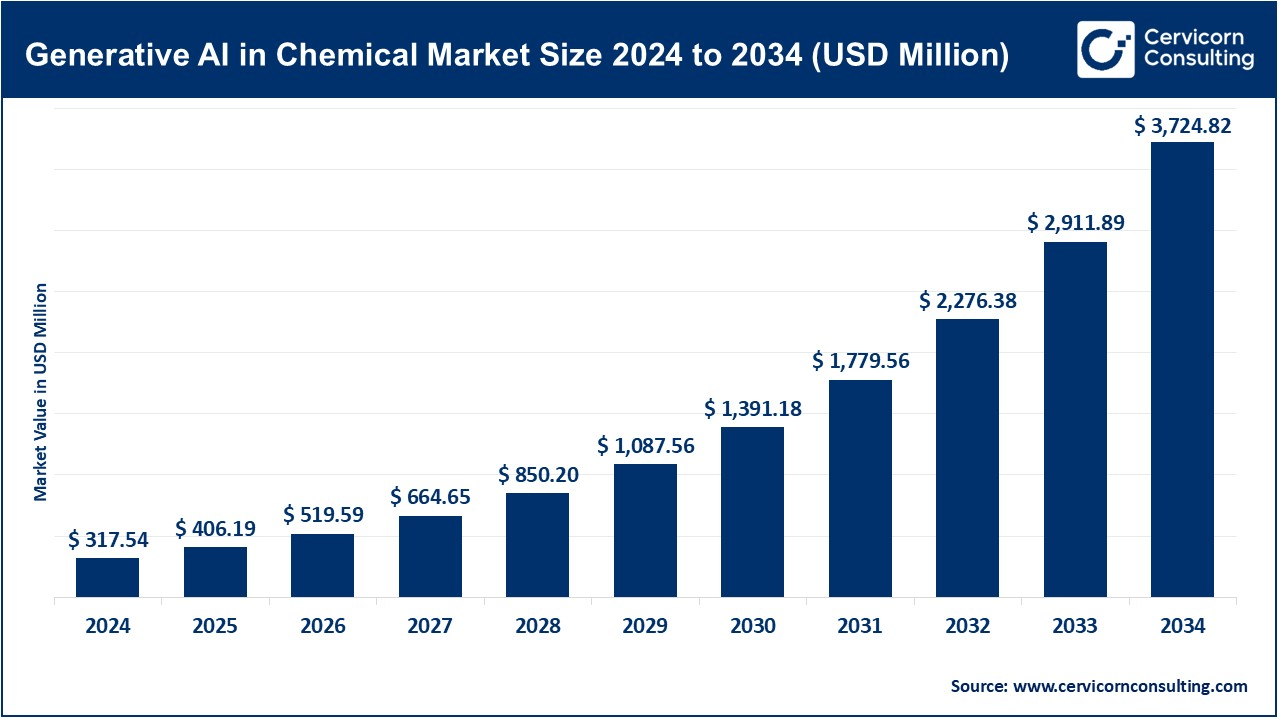

Generative AI in Chemical Market Size to Reach USD 3.72 Billion by 2034

Generative AI in Chemical Market Size

The global generative AI in chemical market is experiencing significant growth, projected to expand from USD 317.54 million in 2024 to USD 3,724.84 million by 2034, at a compound annual growth rate (CAGR) of 27.91%.

What is Generative AI in the Chemical Market?

Generative AI in the chemical market refers to the use of advanced machine learning models, particularly those capable of generating new molecular structures, to accelerate chemical discovery, development, and optimization. Unlike traditional rule-based systems, generative AI can create entirely novel compounds by learning from vast datasets of chemical reactions, molecular properties, and synthetic pathways. This AI-driven approach is transforming the way chemists design molecules for applications ranging from pharmaceuticals and agrochemicals to industrial materials and specialty chemicals.

Generative AI leverages deep learning models such as Variational Autoencoders (VAEs), Generative Adversarial Networks (GANs), and Transformer-based architectures to generate molecular graphs and predict synthesis routes, physical properties, and bioactivity profiles. These systems not only reduce the time and cost associated with R&D but also enable the identification of high-performing molecules that would be nearly impossible to discover using traditional methods.

Why Is It Important?

The chemical industry is under immense pressure to innovate rapidly while addressing growing concerns around sustainability, safety, and cost-effectiveness. Traditional chemical discovery processes are often slow, expensive, and limited by human intuition. Generative AI introduces a paradigm shift by automating the exploration of chemical space, accelerating hypothesis testing, and drastically improving hit-to-lead and lead optimization phases.

This technology is crucial for developing next-generation materials, bio-based alternatives, energy-efficient catalysts, and low-impact agrochemicals. In pharmaceuticals, generative AI significantly cuts down the average 10–15 year drug development cycle by enabling in silico design, rapid synthesis prediction, and property optimization, potentially saving billions in R&D expenditure. Additionally, it enhances safety by reducing the need for extensive in vivo testing.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2642

Generative AI in Chemical Market Growth Factors

The generative AI in chemical market is experiencing rapid growth driven by several converging factors including the explosion of chemical and biological data, advancements in computational infrastructure, increased demand for faster and cost-efficient R&D, and a growing emphasis on sustainable chemical production. Strategic collaborations between AI companies and chemical manufacturers, rising venture capital investment, supportive government policies promoting AI in science, and the integration of cloud computing and high-performance GPUs further contribute to this growth. As the chemical industry faces increasing pressure to innovate sustainably, generative AI emerges as a game-changer capable of navigating vast chemical spaces, reducing development timelines, and improving cost-efficiency, thereby positioning itself as a vital tool in the future of chemistry.

Top Companies in the Generative AI in Chemical Market

1. Schrödinger, Inc.

- Specialization: Physics-based simulation and machine learning for drug and materials design

- Key Focus Areas: Drug discovery, molecular property prediction, high-throughput virtual screening

- Notable Features: Integrates quantum mechanics with generative models for chemical accuracy

- 2024 Revenue: ~$205 million

- Market Share: Estimated 18% in AI-driven chemistry tools

- Global Presence: Headquartered in New York, with operations in Europe, Asia, and India

2. Insilico Medicine

- Specialization: AI-driven drug discovery and aging research

- Key Focus Areas: De novo molecular generation, biomarker development, target discovery

- Notable Features: End-to-end AI platform integrating generative chemistry with biology and clinical trial design

- 2024 Revenue: ~$140 million

- Market Share: Around 13% in AI molecular generation

- Global Presence: Offices in the U.S., China, and the UAE

3. BenevolentAI

- Specialization: AI for drug discovery and development

- Key Focus Areas: Disease understanding, target identification, compound design

- Notable Features: Combines generative models with biomedical knowledge graphs

- 2024 Revenue: ~$95 million

- Market Share: Approximately 10%

- Global Presence: UK-based with additional facilities in the U.S. and Europe

4. Exscientia

- Specialization: AI-designed small molecules for precision medicine

- Key Focus Areas: Oncology, immunology, CNS disorders

- Notable Features: AI-human hybrid loop enabling real-time design feedback

- 2024 Revenue: ~$125 million

- Market Share: Estimated 12%

- Global Presence: Based in Oxford, UK, with operations in Austria, Japan, and the U.S.

5. Cyclica

- Specialization: Polypharmacology and AI-driven drug discovery

- Key Focus Areas: Drug repurposing, off-target profiling, de novo design

- Notable Features: Ligand Design platform using a combination of generative AI and proteome-wide data

- 2024 Revenue: ~$60 million

- Market Share: Estimated 6%

- Global Presence: Headquartered in Toronto, Canada, with global academic and commercial partnerships

Leading Trends and Their Impact

1. Multi-Modal AI Integration

AI models are now being integrated with physical simulations, omics data, and clinical outcomes to create multi-modal platforms. These systems provide holistic insights across the drug discovery lifecycle, from molecular design to patient stratification. This trend accelerates development while reducing failure rates.

2. Synthetic Accessibility Scoring

Generative AI now incorporates synthetic feasibility into its design algorithms, ensuring the molecules it generates are not only potent but also synthesizable using existing techniques. This minimizes wasted effort on impractical molecules and shortens the lead optimization cycle.

3. AI-Driven Green Chemistry

With regulatory and ESG pressures intensifying, generative models are being trained to prioritize environmentally benign synthesis routes and bio-based inputs, helping companies adhere to global sustainability targets.

4. Foundation Models and Transformers

Large-scale foundation models (akin to GPT in NLP) are being developed for chemistry, such as OpenBioML or ChemGPT, enabling the reuse of pretrained models across a variety of chemical tasks—massively improving productivity and reproducibility.

5. Decentralized and Open Science Models

Collaborative ecosystems such as MELLODDY, involving multiple pharmaceutical giants and AI labs, demonstrate how federated learning and secure data sharing can drive collective innovation without compromising proprietary data.

Successful Examples of Generative AI in Chemical Market

- Insilico Medicine’s DSP-1181: This AI-designed molecule targeting idiopathic pulmonary fibrosis entered clinical trials in less than 18 months, compared to the industry average of 4–5 years.

- Exscientia’s Partnership with Sanofi: Generated molecules for oncology and immunology targets have moved into clinical development stages with significantly improved selectivity profiles.

- Schrödinger’s Materials Platform: Used to design next-gen OLED materials and battery components with enhanced performance, shortening development cycles by up to 70%.

- BenevolentAI’s ALS Treatment Discovery: Leveraged generative AI to identify a novel hypothesis for treating ALS, leading to new therapeutic directions.

- Cyclica’s Ligand Express: Used by academic and pharma collaborators for drug repurposing during the COVID-19 pandemic, highlighting generative AI’s flexibility and speed.

Global Regional Analysis: Government Initiatives and Policies Shaping the Market

North America

- United States: The U.S. leads the global market due to strong VC activity, research infrastructure, and regulatory support. Initiatives like the NIH’s AI for Drug Discovery and the FDA’s Emerging Technology Program are instrumental.

- Canada: Through institutions like CIFAR and programs like the Pan-Canadian AI Strategy, the Canadian government actively supports AI in scientific innovation, including chemical discovery.

Europe

- United Kingdom: The UK is a frontrunner with companies like Exscientia and BenevolentAI. UKRI’s investments in AI for health and chemical sciences further bolster this domain.

- Germany & France: These countries are investing in HPC clusters and AI research to support materials science and pharmaceuticals, backed by the European Commission’s Horizon Europe initiative.

Asia-Pacific

- China: The Chinese government is pouring billions into AI research. Projects like China’s “AI + Drug Discovery” initiative aim to make the country a leader in next-gen drug development using AI, with strong state-enterprise partnerships.

- Japan: Focused on integrating generative AI into materials science for advanced electronics and catalysis, supported by NEDO and METI initiatives.

Middle East

- UAE & Saudi Arabia: Building AI centers and funding international collaborations, including partnerships with Insilico Medicine and other generative AI startups, to leapfrog into bioeconomy leadership.

Latin America & Africa

- Early-stage adoption with increasing academic interest. Government-backed bio-innovation parks in Brazil and South Africa are beginning to explore AI-driven discovery platforms in partnership with global entities.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Generative AI in IT Operations Market to Reach USD 29.91 Billion by 2034