Nuclear Materials Market Size, Growth Outlook, and Future Trends (2024–2034)

Nuclear Materials Market Size

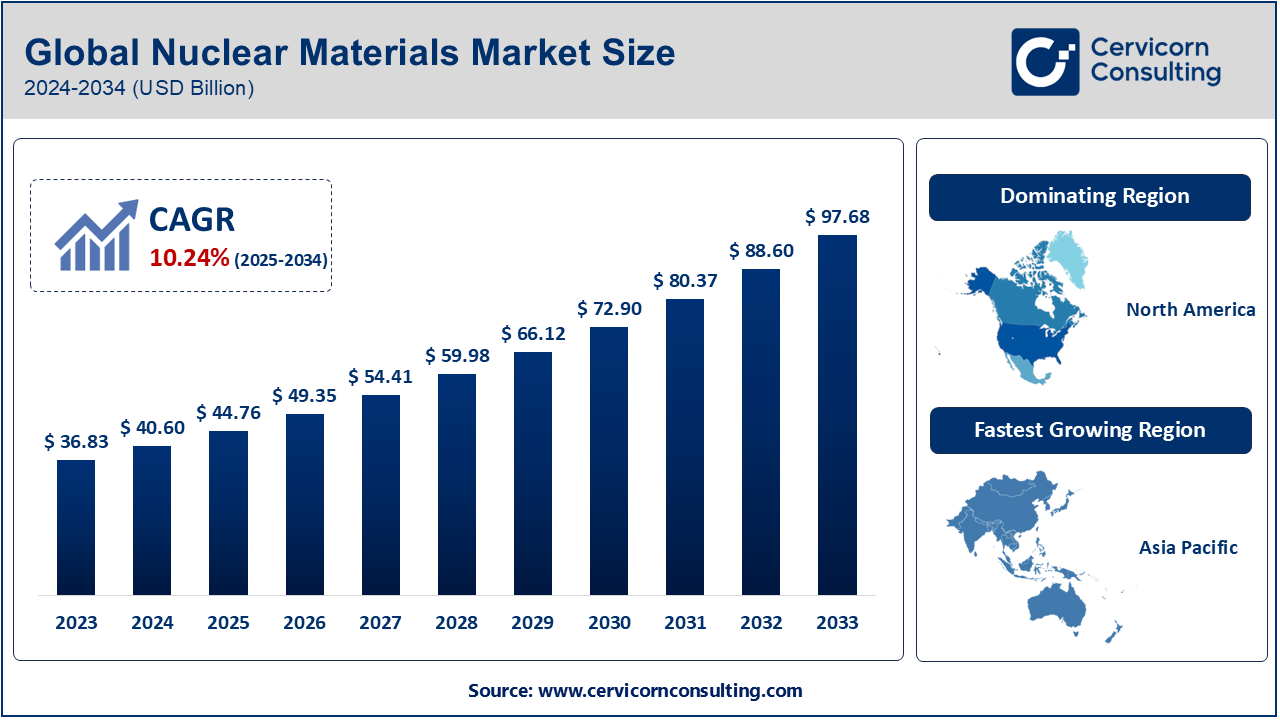

The global nuclear materials market was worth USD 36.83 billion in 2024 and is anticipated to expand to around USD 97.68 billion by 2034, registering a compound annual growth rate (CAGR) of 10.24% from 2025 to 2034.

What is the Nuclear Materials Market?

The nuclear materials market encompasses the mining, processing, enrichment, and distribution of substances essential for nuclear energy generation, medical applications, defense technologies, and industrial uses. Key materials include uranium, plutonium, thorium, and various isotopes used in reactors and research applications. This market represents a crucial backbone for the nuclear industry, supporting sectors like nuclear power generation, nuclear medicine, space exploration, and national defense.

The supply chain in this sector is sophisticated, involving multiple stages: from extraction (mining) to milling, conversion, enrichment, fabrication of fuel assemblies, and recycling or disposal. Companies in this market also invest heavily in research to innovate safer, more efficient, and environmentally sustainable materials and processes.

Why is the Nuclear Materials Market Important?

The importance of the nuclear materials market cannot be overstated.

First, nuclear energy is a significant contributor to the world’s electricity generation, offering a low-carbon alternative crucial for combating climate change. In 2023, nuclear power accounted for about 10% of global electricity production, according to the International Energy Agency (IEA). Secondly, medical isotopes derived from nuclear materials are indispensable in diagnostic imaging and cancer treatments, saving millions of lives annually. Furthermore, defense sectors rely on enriched nuclear materials for strategic deterrence, and space missions (such as NASA’s Mars rover) depend on nuclear batteries fueled by isotopes like plutonium-238.

In a world increasingly focused on energy security, carbon neutrality, and technological advancement, the role of nuclear materials is expanding beyond traditional reactors to small modular reactors (SMRs), advanced fusion research, and deep space exploration.

Nuclear Materials Market Growth Factors

The nuclear materials market is witnessing robust growth fueled by the rising global demand for low-carbon energy sources amid intensifying climate change concerns, renewed investments in nuclear infrastructure by both emerging and developed economies, technological innovations in small modular reactors (SMRs) and advanced nuclear technologies, escalating needs for nuclear medicine applications, rising governmental support and strategic stockpiling initiatives, geopolitical factors driving energy independence, and evolving public perception of nuclear energy as a clean, reliable power source; additionally, advancements in uranium mining techniques, recycling of spent fuel, and proliferation of research in thorium and fusion-based materials are further stimulating the market’s expansion.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2622

Nuclear Materials Market Top Companies

1. Kazatomprom

-

Specialization: Uranium production and marketing

-

Key Focus Areas: Natural uranium mining, nuclear fuel cycle services

-

Notable Features: World’s largest uranium producer by volume; partnerships with international nuclear corporations (e.g., Orano, Cameco)

-

2024 Revenue: Estimated at $4.2 billion

-

Market Share: ~23% of global uranium production

-

Global Presence: Operations mainly in Kazakhstan; partnerships spanning Asia, Europe, and North America

2. Cameco Corporation

-

Specialization: Uranium production, refining, and conversion services

-

Key Focus Areas: Fuel manufacturing, uranium enrichment, long-term supply contracts

-

Notable Features: Supplies 20% of global uranium requirements outside Kazakhstan

-

2024 Revenue: Estimated at $2.9 billion

-

Market Share: ~16% of global uranium production

-

Global Presence: Headquarters in Canada; facilities in the U.S., Canada, and Kazakhstan; clients worldwide

3. Orano (formerly Areva)

-

Specialization: Nuclear fuel cycle (mining, conversion, enrichment, recycling)

-

Key Focus Areas: Decommissioning services, recycling used fuel, nuclear logistics

-

Notable Features: Expertise in closed fuel cycles and recycling technologies

-

2024 Revenue: Estimated at $4.5 billion

-

Market Share: ~15% in the global nuclear services sector

-

Global Presence: Strong presence in Europe, Africa (Niger mines), and Asia

4. Uranium One (subsidiary of Rosatom)

-

Specialization: Uranium mining and exploration

-

Key Focus Areas: International uranium sales, joint ventures

-

Notable Features: Among the top five uranium producers globally

-

2024 Revenue: Estimated at $1.8 billion

-

Market Share: ~9% of global uranium output

-

Global Presence: Kazakhstan, Tanzania, Namibia, and the United States

5. ARMZ Uranium Holding (AtomRedMetZoloto)

-

Specialization: Uranium mining and processing

-

Key Focus Areas: Exploration, production, and processing within Russia

-

Notable Features: Major supplier for Russian domestic nuclear reactors

-

2024 Revenue: Estimated at $1.5 billion

-

Market Share: ~7% of global uranium production

-

Global Presence: Primarily Russia with strategic partnerships internationally via Rosatom

Leading Trends and Their Impact on the Nuclear Materials Market

-

Renaissance of Nuclear Power:

With a global pivot toward net-zero emissions, nuclear is reemerging as a critical energy source. Countries like China, India, France, and the UK are heavily investing in new reactors.

Impact: Boosts long-term demand for uranium, zirconium alloys, and other specialized materials. -

Small Modular Reactors (SMRs):

SMRs promise to reduce costs, construction times, and enhance safety. Major SMR projects (e.g., NuScale, Rolls-Royce SMR) are under development.

Impact: Expands the market scope for specialized low-enriched uranium (LEU) and innovative nuclear materials. -

Thorium and Advanced Fuel Research:

Thorium reactors, less prone to meltdown and proliferation risks, are gaining research traction.

Impact: Drives diversification within the market beyond conventional uranium fuels. -

Recycling and Reprocessing of Nuclear Fuel:

Technologies like MOX (mixed oxide fuel) recycling reduce waste and make better use of available materials.

Impact: Increases profitability and sustainability for companies like Orano and Rosatom. -

Strategic Stockpiling and Geopolitical Tensions:

Rising geopolitical risks are pushing nations to secure stable, domestic nuclear material supplies.

Impact: Governments and utilities are signing long-term contracts, stabilizing demand. -

Medical Isotope Innovation:

New nuclear materials are enabling breakthroughs in medical diagnostics and therapies (e.g., Lutetium-177, Actinium-225).

Impact: Creates niche high-value market segments beyond energy.

Successful Examples of the Nuclear Materials Market Around the World

-

China’s Nuclear Expansion:

China has the world’s fastest-growing nuclear program, with over 24 reactors under construction and a goal to triple its capacity by 2030. Chinese companies are sourcing uranium globally and investing in advanced fuel research. -

France’s Nuclear Recycle Model:

France successfully recycles 96% of its spent nuclear fuel at facilities like La Hague. This closed-loop system conserves resources and minimizes nuclear waste. -

Canada’s CANDU Reactor Fuel Flexibility:

CANDU reactors use natural (unenriched) uranium, reducing reliance on enrichment infrastructure and promoting fuel diversity. -

U.S. Advanced Reactor Programs:

Initiatives like the U.S. Department of Energy’s Advanced Reactor Demonstration Program (ARDP) are driving innovation in fuel types, including TRISO particles and molten salt fuels. -

Kazakhstan’s Uranium Leadership:

Kazakhstan, through Kazatomprom, has become the world’s top uranium producer while pioneering in-situ recovery (ISR) methods to minimize environmental impact.

Regional Analysis Including Government Initiatives and Policies Shaping the Market

North America (U.S., Canada)

-

Government Initiatives:

-

Inflation Reduction Act (2022) provides support for zero-carbon technologies, including nuclear.

-

U.S. Strategic Uranium Reserve aims to secure domestic supply chains.

-

Canadian SMR Roadmap promotes development of small modular reactors.

-

-

Impact: Favorable policy frameworks are reviving investments in mining, processing, and SMR projects.

Europe (France, UK, Russia)

-

Government Initiatives:

-

France plans to construct at least six new reactors by 2050.

-

The EU included nuclear in its taxonomy for sustainable activities, boosting green investments.

-

Russia’s Rosatom continues to be a global leader in nuclear export projects (e.g., Turkey’s Akkuyu plant).

-

-

Impact: Europe’s commitment to low-carbon energy ensures strong demand for nuclear materials, with innovation in recycling and fast breeder reactors.

Asia-Pacific (China, India, Japan)

-

Government Initiatives:

-

China’s Five-Year Plan targets a 70 GW nuclear capacity by 2035.

-

India is developing indigenous thorium-based reactors under its Advanced Heavy Water Reactor (AHWR) program.

-

Japan’s restart of idled reactors post-Fukushima under tighter safety standards.

-

-

Impact: Asia-Pacific is the fastest-growing region for nuclear materials demand, backed by supportive policy, infrastructure investment, and R&D spending.

Latin America (Argentina, Brazil)

-

Government Initiatives:

-

Brazil’s Angra 3 nuclear project aims for completion by 2027.

-

Argentina is collaborating with China on the construction of a new Hualong One reactor.

-

-

Impact: Emerging markets are progressively investing in nuclear capacity, driving regional demand for nuclear materials and expertise.

Middle East and Africa (UAE, Saudi Arabia, South Africa)

-

Government Initiatives:

-

The UAE’s Barakah nuclear plant (first in the Arab world) is fully operational.

-

Saudi Arabia has expressed intent to explore nuclear power for peaceful purposes.

-

South Africa operates the continent’s only nuclear plant, Koeberg, with plans for expansion.

-

-

Impact: As energy diversification becomes critical, nuclear programs are gaining traction, presenting new opportunities for uranium suppliers and service providers.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Single-Use Vape Battery Market Size, Growth Trends, and Key Players [2024-2034]