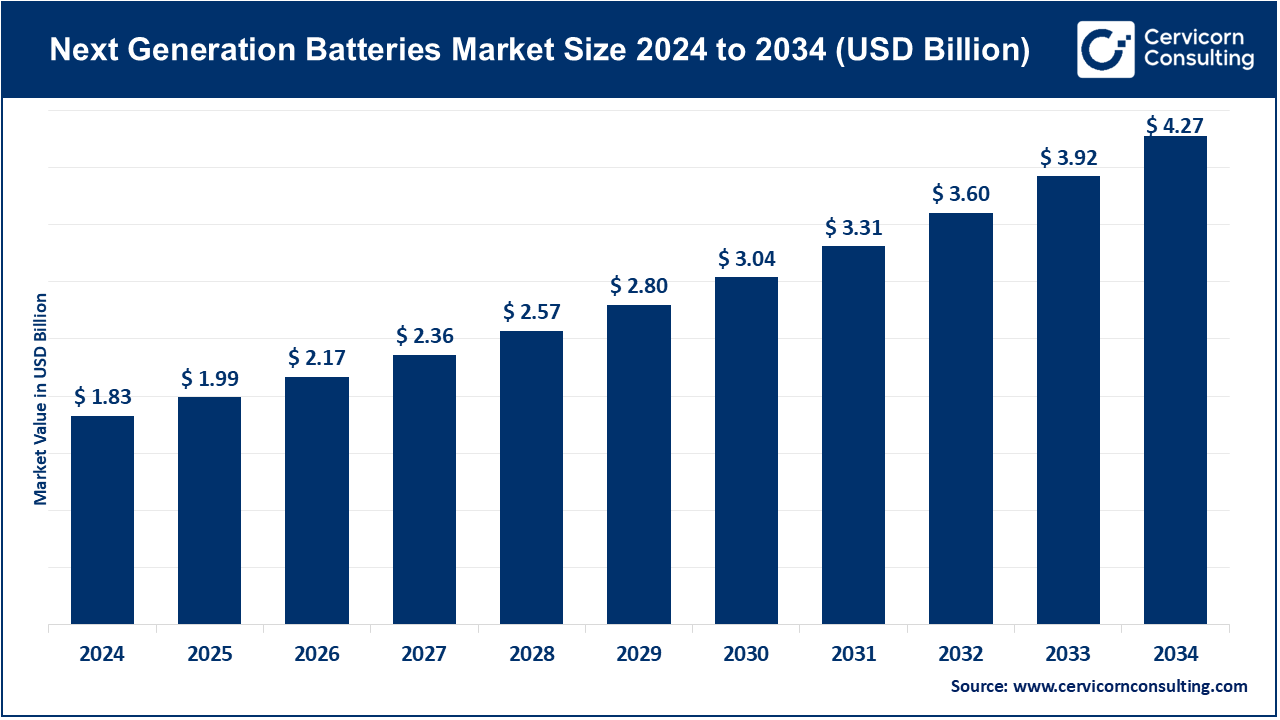

Next Generation Batteries Market Driving to USD 4.27 Bn by 2034

Next Generation Batteries Market Size

The global next generation batteries market was worth USD 1.83 billion in 2024 and is anticipated to expand to around USD 4.27 billion by 2034, registering a compound annual growth rate (CAGR) of 8.84% from 2025 to 2034.

What is the Next Generation Batteries Market?

The next generation batteries market refers to the development, production, and commercialization of advanced battery technologies that surpass the limitations of traditional lithium-ion batteries. These innovations include solid-state batteries, lithium-sulfur batteries, sodium-ion batteries, metal-air batteries, and other chemistries and architectures aimed at enhancing energy density, charging speed, safety, longevity, and environmental sustainability. As the demand for cleaner energy and more efficient energy storage grows across electric vehicles (EVs), renewable energy storage, portable electronics, and grid systems, next generation batteries represent a crucial leap forward in the evolution of battery technology.

Why is the Next Generation Batteries Market Important?

This market is central to the global transition towards electrification and decarbonization. Conventional lithium-ion batteries, while dominant, are limited in terms of energy density, fire risk, and supply chain vulnerabilities. Next generation batteries promise to overcome these constraints, enabling longer-range electric vehicles, safer storage for intermittent renewable sources like solar and wind, and reduced dependency on critical raw materials such as cobalt and nickel. The advancement of these technologies also facilitates the deployment of smart grids and portable devices with higher performance and longer battery lives, making them pivotal for future-proofing energy infrastructure and innovation.

Next Generation Batteries Market Growth Factors

The next generation batteries market is experiencing robust growth driven by increasing demand for electric vehicles, stringent emissions regulations, advancements in material science, and surging investment in clean energy infrastructure. Governments worldwide are prioritizing sustainable energy through grants, subsidies, and research funding, which accelerates battery innovation. Additionally, the growing need for efficient energy storage in grid applications and rising consumer expectations for longer battery life in electronics are pushing OEMs and battery manufacturers to adopt cutting-edge battery technologies. Private sector participation, venture capital backing, and public-private collaborations are further fueling R&D, commercialization, and scale-up of advanced battery solutions.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2621

Top Companies in the Next Generation Batteries Market

1. Panasonic

- Specialization: Lithium-ion and solid-state battery technologies

- Key Focus Areas: Electric vehicles (notably with Tesla), home energy storage, consumer electronics

- Notable Features: Deep partnership with Tesla, R&D in high-capacity solid-state batteries

- 2024 Revenue (approx.): $65 billion (battery division: ~$6.5 billion)

- Market Share (approx.): 8–10% of the advanced battery market

- Global Presence: Operations in Japan, USA, China, Europe, and Southeast Asia

2. Faraday Battery Challenge (UK Government Initiative)

- Specialization: Funding and supporting R&D for next-gen battery tech

- Key Focus Areas: Research in lithium-sulfur, sodium-ion, and solid-state batteries

- Notable Features: Public-private collaboration to accelerate UK battery industry

- 2024 Revenue (approx.): Non-profit, grant-based (~£270 million committed)

- Market Share (approx.): Not applicable (enabler rather than producer)

- Global Presence: UK-based with international research collaboration

3. EnerVenue

- Specialization: Metal-hydrogen batteries

- Key Focus Areas: Grid-scale energy storage, stationary power systems

- Notable Features: NASA-derived technology, 30+ year lifespan, recyclable design

- 2024 Revenue (approx.): ~$50 million

- Market Share (approx.): <1%, but rapidly scaling

- Global Presence: North America, Middle East pilot projects, expanding globally

4. A123 Systems

- Specialization: Lithium iron phosphate (LFP) batteries

- Key Focus Areas: EVs, commercial fleets, industrial applications

- Notable Features: High-power density, thermal stability

- 2024 Revenue (approx.): ~$500 million

- Market Share (approx.): ~1.5%

- Global Presence: USA, China, Germany, South Korea

5. Sakti3 (acquired by Dyson)

- Specialization: Solid-state battery development

- Key Focus Areas: High-density batteries for home appliances, potentially EVs

- Notable Features: Dielectric solid-state design, acquired for internal R&D

- 2024 Revenue (approx.): Integrated in Dyson, no standalone revenue

- Market Share (approx.): Not significant yet

- Global Presence: UK-based, R&D in the US

Leading Trends and Their Impact

- Solid-State Battery Commercialization: Companies like Panasonic, QuantumScape, and Toyota are investing in solid-state batteries to enhance safety and energy density. These batteries reduce flammability risks and support faster charging.

- Sodium-Ion Battery Emergence: With abundant sodium resources and cost advantages, companies such as CATL and Faradion are pioneering sodium-ion solutions. While lower in energy density than lithium-ion, they are ideal for grid storage.

- Metal-Air and Hydrogen Batteries: Firms like EnerVenue and Phinergy are exploring metal-hydrogen and metal-air chemistries for ultra-long lifespan and sustainable alternatives to lithium-based systems.

- Battery Recycling & Circular Economy: Startups and major firms are focusing on closed-loop recycling to recover valuable materials, addressing environmental and supply chain concerns.

- AI & Machine Learning in Battery R&D: AI is accelerating battery material discovery and performance modeling, cutting down the development cycle and optimizing battery designs.

These trends are reducing battery costs, improving sustainability, and enabling mass deployment in EVs and grid storage.

Successful Examples Around the World

- Tesla & Panasonic’s Gigafactories (USA/Nevada): A milestone in lithium-ion battery scale-up, these facilities underpin mass EV production and drive cost per kWh down.

- CATL Sodium-Ion Cells (China): CATL launched sodium-ion battery packs with 160 Wh/kg energy density, deploying them in electric two-wheelers and grid storage.

- EnerVenue Projects (USA & UAE): Pilot grid-scale energy storage projects showcase long-duration, low-maintenance metal-hydrogen batteries.

- Toyota Solid-State Battery Prototype (Japan): Toyota unveiled a prototype EV with a solid-state battery targeting 1,000 km range and 10-minute charge time.

- Faraday Institution (UK): A consortium of academia and industry players accelerating next-gen battery R&D, boosting domestic capabilities.

Regional Analysis and Government Initiatives

North America

- United States: Significant funding through the Inflation Reduction Act and Department of Energy’s Battery Materials Processing Grant. Tesla, QuantumScape, and GM are developing advanced batteries.

- Canada: Investments in battery minerals and gigafactory initiatives to localize supply chains.

Europe

- European Union: The European Battery Alliance (EBA) aims for battery sovereignty, supporting over $100 billion in investment. Countries like Germany and France lead with grants and pilot factories.

- UK: The Faraday Battery Challenge backs pre-commercial R&D to make the UK a global battery hub.

Asia-Pacific

- China: Dominates current production but is pivoting towards sodium-ion and solid-state. Government supports R&D with extensive subsidies and patent creation.

- Japan: Toyota and Panasonic invest heavily in solid-state R&D, with METI grants accelerating battery commercialization.

- South Korea: LG and Samsung are working on high-nickel and solid-state batteries for future EVs.

Latin America

- Chile and Argentina: Rich in lithium, these nations are leveraging resources to establish local battery value chains, encouraged by national policies.

Middle East & Africa

- UAE and Saudi Arabia: Investing in grid-scale battery pilot projects to support renewable energy, with a focus on long-duration storage.

- South Africa: Exploring vanadium redox flow batteries to store solar energy and reduce grid instability.

Government incentives, infrastructure development, and strategic mineral sourcing are shaping regional competitive advantages in the next generation batteries market.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Single-Use Vape Battery Market Size, Growth Trends, and Key Players [2024-2034]