Sustainable Finance Market Size

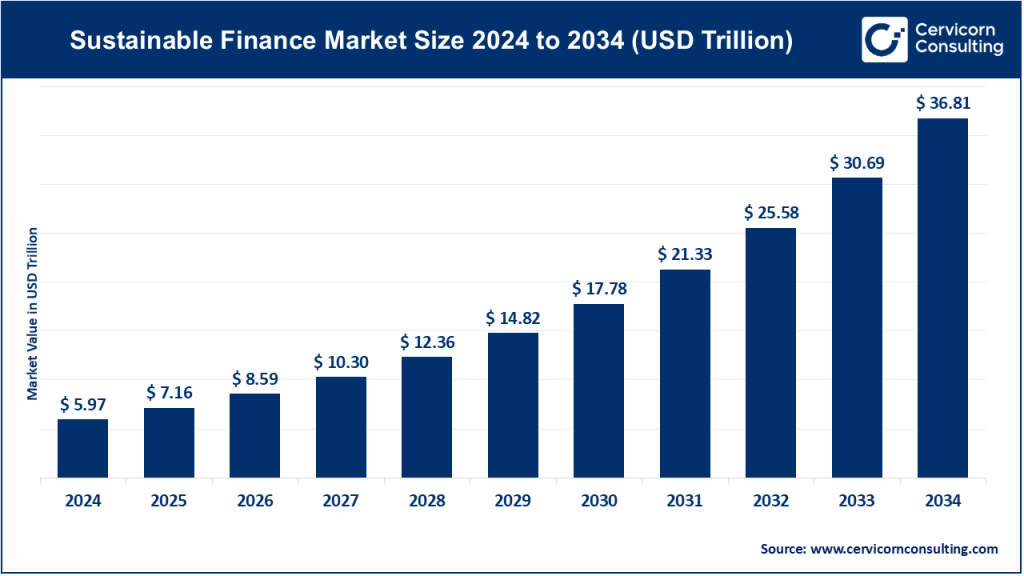

The global sustainable finance market was worth USD 5.97 trillion in 2024 and is anticipated to expand to around USD 36.81 trillion by 2034, registering a compound annual growth rate (CAGR) of 19.94% from 2025 to 2034.

What is the Sustainable Finance Market?

Sustainable finance refers to the integration of environmental, social, and governance (ESG) considerations into financial decision-making processes. It encompasses a range of financial services and products, including green bonds, ESG-focused funds, and sustainability-linked loans, aimed at promoting long-term sustainable development and addressing global challenges such as climate change, social inequality, and corporate governance issues.

Why is Sustainable Finance Important?

The importance of sustainable finance lies in its potential to redirect capital flows towards projects and activities that contribute to environmental preservation, social well-being, and ethical governance. By aligning financial objectives with ESG criteria, sustainable finance supports the transition to a low-carbon economy, fosters inclusive growth, and enhances the resilience of financial systems against ESG-related risks.

Growth Factors Driving the Sustainable Finance Market

The sustainable finance market is experiencing robust growth, driven by several key factors:

-

Regulatory Initiatives: Governments and regulatory bodies worldwide are implementing policies and frameworks to promote sustainable finance. For instance, the European Union’s Sustainable Finance Disclosure Regulation (SFDR) enhances transparency in ESG investments.

-

Investor Demand: There is a growing appetite among investors for ESG-compliant assets, motivated by both ethical considerations and the pursuit of long-term financial returns.

-

Corporate Responsibility: Companies are increasingly recognizing the importance of ESG factors in risk management and corporate strategy, leading to greater issuance of green bonds and sustainability-linked instruments.

-

Technological Advancements: Innovations in data analytics and reporting tools are facilitating better assessment and disclosure of ESG performance, thereby attracting more participants to the sustainable finance market.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2626

Top Companies in the Sustainable Finance Market

Several leading companies are at the forefront of the sustainable finance market, each with specific specializations and global reach:

Refinitiv

- Specialization: Provides ESG data, analytics, and indices to support sustainable investment decisions.

- Key Focus Areas: ESG scoring, sustainable finance analytics, and regulatory compliance tools.

- Notable Features: Offers comprehensive ESG datasets covering thousands of companies globally.

- 2024 Revenue (approx.): Data not publicly disclosed.

- Market Share (approx.): Significant presence in ESG data provision.

- Global Presence: Operates in over 190 countries.

BlackRock, Inc.

- Specialization: Asset management with a strong emphasis on ESG integration.

- Key Focus Areas: ESG-focused ETFs, sustainable investment strategies, and stewardship.

- Notable Features: Offers a wide range of ESG investment products and active engagement with companies on sustainability issues.

- 2024 Revenue (approx.): Data not publicly disclosed.

- Market Share (approx.): One of the largest asset managers globally with a substantial ESG portfolio.

- Global Presence: Operates in over 30 countries.

Acuity Knowledge Partners

- Specialization: Provides research, analytics, and business intelligence services with ESG capabilities.

- Key Focus Areas: ESG research support, data management, and compliance services.

- Notable Features: Offers tailored ESG solutions for financial institutions and corporations.

- 2024 Revenue (approx.): Data not publicly disclosed.

- Market Share (approx.): Not specified.

- Global Presence: Offices in the UK, US, India, and other regions.

Aspiration Partners, Inc.

- Specialization: Provides sustainable banking and investment services to individuals.

- Key Focus Areas: Climate-friendly spending, fossil fuel-free banking, and sustainable investment options.

- Notable Features: Offers a “Plant Your Change” program, planting a tree with every purchase.

- 2024 Revenue (approx.): Data not publicly disclosed.

- Market Share (approx.): Emerging player in sustainable personal finance.

- Global Presence: Primarily operates in the United States.

NOMURA HOLDINGS, INC.

- Specialization: Japanese financial services group with ESG investment offerings.

- Key Focus Areas: Green bonds, ESG research, and sustainable investment products.

- Notable Features: Active in promoting ESG integration in Asia.

- 2024 Revenue (approx.): Data not publicly disclosed.

- Market Share (approx.): Significant presence in Asian markets.

- Global Presence: Operations in over 30 countries.

Leading Trends and Their Impact

Several key trends are shaping the sustainable finance market:

-

Green Bond Growth: Green bond issuance is expected to surpass $500 billion in 2024, reflecting a 20% year-over-year growth.

-

Renewable Energy Investments: Investments in renewable energy projects are increasing, with solar and wind projects delivering annual returns exceeding 12%.

-

Impact Investing: Global impact investing assets under management are projected to reach $1.5 trillion by 2024, focusing on sectors like clean energy and affordable housing.

-

Emerging Market Expansion: Countries like India, Indonesia, and Kenya are leading in sustainable investments, with India expected to issue $20 billion in green bonds in 2024.

Successful Examples of Sustainable Finance Around the World

-

Brazil’s Eco Invest Program: Brazil aims to raise $2 billion through the Eco Invest Brazil program to fund sustainable projects, particularly restoring degraded pastures.

-

UK’s Green Finance Strategy: The UK has implemented a Green Finance Strategy, promoting sustainable finance practices and raising over £26 billion through Green Gilts and Green Savings bonds since 2021.

-

Asian Development Bank’s Green Bonds: In 2023, the Asian Development Bank issued $5 billion in green bonds to support clean energy projects in emerging markets.

Regional Analysis: Government Initiatives and Policies

-

Europe: Europe leads the sustainable finance market, accounting for nearly 50% of global green bond issuance, driven by the EU’s Green Deal initiatives.

-

Asia-Pacific: The region is witnessing rapid growth, with countries like China, Japan, South Korea, and Australia promoting sustainable finance and green investments.

-

North America: The U.S. and Canada are significant players, with increasing demand for responsible investing and corporate sustainability practices.

-

Latin America: Brazil’s initiatives, such as the Eco Invest program, highlight the region’s commitment to sustainable finance.

-

Africa: Efforts like the Beginnings Fund aim to support maternal and infant healthcare through partnerships with governments and global foundations.

These regional initiatives and policies are instrumental in shaping the sustainable finance landscape, encouraging investments that align with ESG principles and contribute to global sustainability goals.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Inland Container Depot Market Size, Share & Growth Forecast 2024–2034