Inland Container Depot Market Size

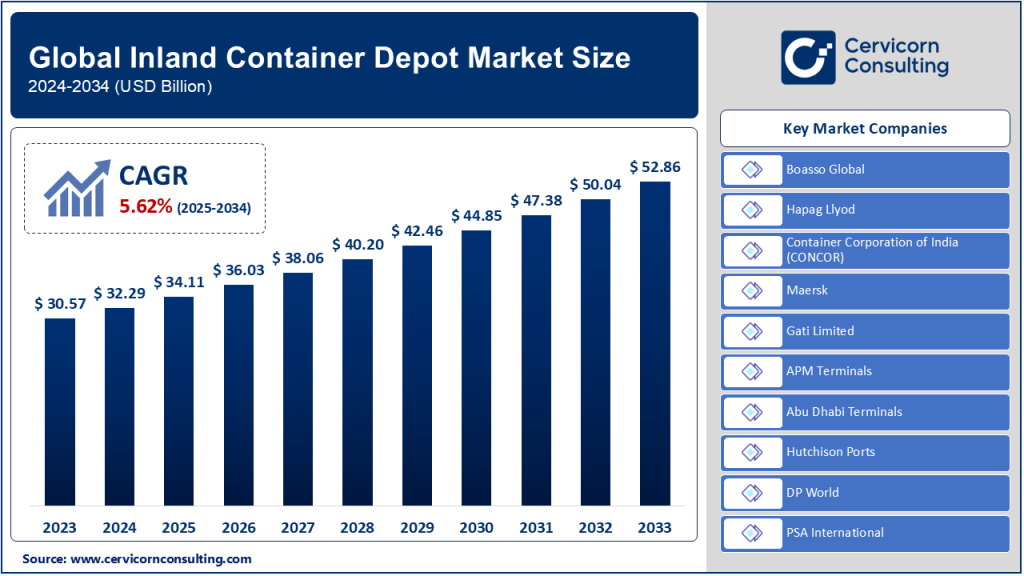

The global inland container depot market was worth USD 30.57 billion in 2024 and is anticipated to expand to around USD 52.86 billion by 2034, registering a compound annual growth rate (CAGR) of 5.63% from 2024 to 2033.

What is the Inland Container Depot Market?

The Inland Container Depot (ICD) market revolves around strategically located dry ports that handle the storage, consolidation, and customs clearance of containerized cargo away from seaports. Often referred to as “dry ports,” ICDs function as extended arms of sea ports, facilitating the import, export, and transshipment of goods through multimodal logistics systems — including rail, road, and inland waterways. They are equipped to handle customs formalities, container storage, and value-added services such as cargo inspection, packaging, and labeling. ICDs are particularly significant for landlocked regions, providing seamless connections between hinterland producers and international maritime trade routes.

Why is the ICD Market Important?

The significance of the Inland Container Depot market lies in its ability to decongest overcrowded seaports, streamline supply chain operations, and provide more cost-effective and efficient cargo handling solutions. ICDs reduce dwell time, expedite customs procedures, and support just-in-time inventory strategies for manufacturers and exporters. For landlocked countries or inland cities far from coastal areas, ICDs are lifelines that provide access to international trade infrastructure. Moreover, with increasing global trade volumes, the ICD market is crucial to enhancing intermodal logistics and achieving sustainable transport solutions, thereby playing a vital role in economic development and globalization.

Inland Container Depot Market Growth Factors

The Inland Container Depot market is propelled by robust global trade growth, increasing urbanization, the rise in containerized cargo, and the need for efficient intermodal freight logistics. Technological advancements like IoT, automation, and digital customs processing have enhanced operational efficiency at ICDs, attracting public and private investments. Additionally, government policies promoting multimodal transport, international trade agreements, and infrastructure development in emerging economies have accelerated market penetration. The growth of e-commerce and the need for integrated logistics solutions in remote or landlocked regions further drive the demand for well-connected inland depots that reduce port congestion and optimize supply chain costs.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2624

Top Companies in the Inland Container Depot Market

1. Boasso Global

- Specialization: Tank container cleaning, depot services, and transportation solutions.

- Key Focus Areas: ISO tank depots, intermodal logistics, environmental compliance.

- Notable Features: Strong presence in North America and Europe; leader in tank container solutions.

- 2024 Revenue: $600 million

- Market Share: ~4.5%

- Global Presence: North America, Europe, expanding into Asia-Pacific.

2. Hapag-Lloyd

- Specialization: Global shipping and inland container logistics services.

- Key Focus Areas: Digital supply chain integration, inland logistics, fleet expansion.

- Notable Features: Comprehensive container management system, strong partnerships with ICDs.

- 2024 Revenue: $23 billion (inland operations est. $1.2 billion)

- Market Share: ~8% in global container logistics.

- Global Presence: Over 120 countries; integrated with many ICDs globally.

3. Container Corporation of India (CONCOR)

- Specialization: Intermodal logistics and container transportation in India.

- Key Focus Areas: Rail-based ICDs, multimodal logistics parks, customs bonded terminals.

- Notable Features: Operates over 60 ICDs; strong government backing; digital freight corridors.

- 2024 Revenue: $850 million

- Market Share: ~60% of India’s ICD market.

- Global Presence: Operations focused in India with international freight forwarding links.

4. Maersk

- Specialization: Integrated container logistics, inland haulage, and terminal operations.

- Key Focus Areas: Sustainable logistics, digital supply chains, end-to-end shipping.

- Notable Features: Owns and operates several inland depots globally; AI-based logistics optimization.

- 2024 Revenue: $48 billion (inland/logistics est. $3.5 billion)

- Market Share: ~12% globally in container logistics services.

- Global Presence: Worldwide, with inland container operations in over 70 countries.

5. Gati Limited

- Specialization: Express distribution, freight forwarding, and logistics solutions.

- Key Focus Areas: Last-mile connectivity, multi-modal transport, freight corridors.

- Notable Features: Operates multiple ICDs in India; focuses on SME logistics.

- 2024 Revenue: $300 million

- Market Share: ~2% of South Asia ICD market.

- Global Presence: India-focused, with strategic alliances in Southeast Asia and the Middle East.

Leading Trends and Their Impact

1. Digitalization of ICDs

The integration of digital tools, including RFID, blockchain, and AI-based scheduling, is optimizing cargo tracking, customs clearance, and space utilization. It reduces operational delays and enhances transparency for all stakeholders.

2. Sustainability and Green Logistics

ICDs are incorporating renewable energy sources, electric container handling equipment, and green warehousing. The focus on low-emission supply chains is becoming central to investment decisions and regulatory compliance.

3. Public-Private Partnerships (PPP)

Governments are increasingly partnering with private logistics companies to develop and operate ICDs, particularly in emerging economies. This trend ensures better infrastructure, operational efficiency, and access to funding.

4. Multimodal Logistics Hubs

ICDs are transforming into full-fledged logistics hubs, offering road, rail, and inland waterway connectivity along with value-added services such as cold chain, packaging, and e-commerce fulfillment.

5. ICD-Enabled Cross-Border Trade

In regions like East Africa and Central Asia, ICDs are acting as vital nodes in cross-border trade, reducing port dependency and expediting inter-country cargo movements.

Impact: These trends are reshaping the ICD market from being mere container storage facilities to integrated, smart, and sustainable logistics ecosystems. They improve cargo throughput, reduce costs, and align with national logistics policies and global ESG goals.

Successful Examples of ICDs Around the World

1. Dry Port of Zaragoza, Spain

- Integrated with Barcelona and Bilbao seaports.

- Known for rapid rail connectivity and customs processing.

- Attracts major retail and automotive exporters.

2. ICD Tughlakabad, India

- Managed by CONCOR.

- Handles over 500,000 TEUs annually.

- Offers extensive rail connectivity and customs services.

3. Naivasha ICD, Kenya

- Developed to reduce congestion at Mombasa Port.

- Connects inland Kenya and neighboring countries via Standard Gauge Railway.

- Supports regional integration under the African Continental Free Trade Area (AfCFTA).

4. Lauterbourg ICD, France

- Close to the Rhine River.

- Key dry port for containers heading to Germany and Switzerland.

- Uses barge and rail to reduce carbon emissions.

5. Chongqing ICD, China

- Strategic link in the Belt and Road Initiative.

- Facilitates container movement from China to Europe via rail.

- Offers customs, quarantine, and bonded warehousing services.

Regional Analysis and Government Initiatives

Asia-Pacific

- Key Markets: India, China, Japan, South Korea, ASEAN countries.

- Government Initiatives:

- India’s PM Gati Shakti plan to boost ICD-linked infrastructure.

- China’s Belt and Road Initiative and New Land-Sea Corridor.

- ASEAN Logistics Connectivity initiatives.

- Trends: Rapid growth in e-commerce, regional FTAs (e.g., RCEP), strong rail-sea networks.

North America

- Key Markets: U.S., Canada, Mexico.

- Government Initiatives:

- U.S. infrastructure bill includes funding for inland ports and intermodal terminals.

- Trade agreements like USMCA facilitate regional ICD utilization.

- Trends: Digitized port systems, growing importance of inland rail terminals.

Europe

- Key Markets: Germany, France, Spain, Netherlands.

- Government Initiatives:

- EU’s TEN-T (Trans-European Transport Network) development includes ICD modernization.

- Emphasis on sustainable, multimodal transport corridors.

- Trends: Rail freight revival, green logistics, integration of river ports with ICDs.

Middle East and Africa

- Key Markets: UAE, Saudi Arabia, South Africa, Kenya.

- Government Initiatives:

- African Continental Free Trade Area (AfCFTA) driving ICD investment.

- UAE Vision 2030 includes development of inland dry ports.

- Trends: Rapid ICD development in landlocked African countries, regional corridor projects (LAPSSET, SGR).

Latin America

- Key Markets: Brazil, Chile, Argentina, Mexico.

- Government Initiatives:

- National logistics strategies promoting multimodal transport.

- Investment in ICDs to support agri-export supply chains.

- Trends: Increased reliance on rail and inland river systems for container movement.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Green Logistics Market Size, Trends, and Forecast (2024-2033)