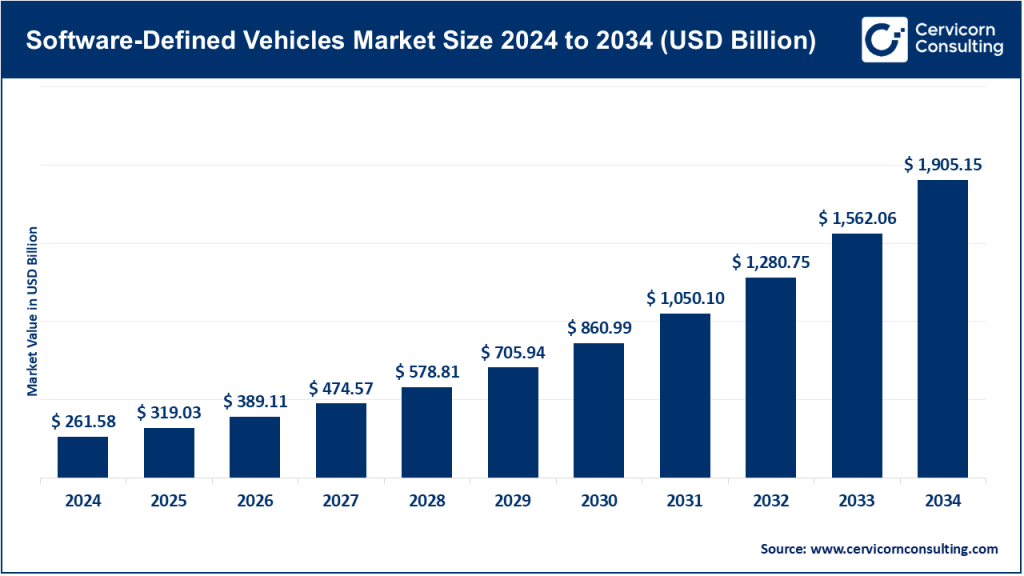

Software-Defined Vehicles Market Size

Software-Defined Vehicles Market — Growth Factors

The SDV market is being driven by several converging factors: automakers’ shift from distributed ECUs to zonal and domain architectures that centralize compute and enable OTA updates; rising consumer demand for connected services, personalization and frequent feature upgrades; the rapid expansion of advanced driver assistance systems (ADAS) and the roadmap toward higher-level automation, which require sophisticated software stacks and vehicle data platforms; the electrification trend, which simplifies powertrain complexity and makes software the differentiator for user experience and energy management.

Greater availability and specialization of automotive-grade semiconductors and edge compute; ecosystems of cloud, mapping, cybersecurity and telematics services that monetize vehicle software and data; regulatory pressure to improve safety and emissions that encourages sensor/software investments; and investor attention and supplier M&A that accelerate software capabilities within traditional Tier-1s and OEMs — all combining to push OEMs, suppliers, and software players to prioritize modular, scalable, and updatable software architectures.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2742

What is the Software-Defined Vehicles Market?

A software-defined vehicle is one where the majority of vehicle features and functionalities are governed or enabled by software running on consolidated, high-performance computing platforms rather than by many disparate hardware controllers. That means functions such as ADAS, vehicle dynamics, infotainment, telematics, powertrain management, and user experience are implemented, updated, and monetized through software layers — often enabling over-the-air (OTA) updates, feature subscriptions, and continuous improvement over the vehicle’s lifecycle. Market research firms report varying sizes due to different definitions and scopes (software content only vs. software + associated services + hardware), but all agree the market is large and growing rapidly as OEMs transition architectures.

Why It Is Important

SDVs change the nature of vehicle value: instead of one-time hardware features, vehicles become platforms for recurring revenue (services, subscriptions, maps, safety features), extendable through OTA updates. For consumers it means a better, personalized, safer driving experience; for OEMs and suppliers it opens new business models and a long-term revenue stream. Strategically, SDVs enable faster innovation cycles, simplified vehicle electrical architectures, improved diagnostics and maintenance, and a convergence with mobility services and data ecosystems — all vital as the industry electrifies and pursues higher levels of autonomy. The shift also elevates cybersecurity and data governance to first-order business and regulatory concerns.

Software-Defined Vehicles Market — Top Companies

Below are curated profiles focusing on specialization, key focus areas, notable features, 2024 revenue (where publicly available), market share notes, and global presence.

Aptiv

- Specialization: Electrical architectures, wiring harness alternatives, high-speed data networks, and system-level SDV platforms (edge-to-cloud solutions).

- Key Focus Areas: Smart Vehicle Architecture (SVA), centralized compute, vehicle networking, safety systems, and enabling OTA/cloud ecosystems.

- Notable Features: Aptiv’s SVA is explicitly marketed to simplify E/E complexity and enable software innovation across vehicle domains.

- 2024 Revenue: Around $19.6–$19.9 billion.

- Market Share & Global Presence: Major Tier-1 with a global footprint supplying North America, Europe, and Asia; its SDV software and architecture offerings make it a leading supplier in vehicle software enablement and electrical architecture modernization.

Continental

- Specialization: Full-stack vehicle electronics, connectivity, ADAS sensors/software, and services for fleet/transport segments.

- Key Focus Areas: Zonal architectures, telematics, real-time data services, and enabling intelligent transport workflows.

- Notable Features: Continental emphasizes data-driven services, real-time vehicle management, and compliance with regulatory requirements for data and safety.

- 2024 Revenue: ~€39.7 billion in 2024.

- Market Share & Global Presence: One of the largest automotive suppliers worldwide with strong presence in Europe, North America, and Asia, and strategically active in SDV initiatives across OEM partnerships.

Ford Motor Company

- Specialization: OEM with growing internal software organization and partnerships for SDV platforms.

- Key Focus Areas: Integrating SDV architectures into Ford’s EV and ICE lineup, scaling OTA capabilities, in-car software ecosystems, and monetization (services/subscriptions).

- Notable Features: Ford is heavily investing in vehicle OS, software services, and OTA, despite recording near-term losses tied to EV/software divisions.

- 2024 Revenue: Approximately $185 billion.

- Market Share & Global Presence: Global OEM with strong presence in North America and Europe; Ford is both a buyer and developer of SDV platforms and partners with suppliers and software firms.

General Motors (GM)

- Specialization: OEM with a strong strategy to build SDV and software-first capabilities across vehicle lines; investing in centralized compute and GM’s software stack.

- Key Focus Areas: Cruise/ADAS integration, vehicle platform software, monetized services, and EV software integration.

- Notable Features: GM emphasizes software as a key differentiator while scaling its EV and autonomous ecosystem.

- 2024 Revenue: Roughly $187 billion.

- Market Share & Global Presence: Major OEM with large North American operations and significant presence in China and Europe; GM’s size makes it a key SDV player.

Marelli

- Specialization: Automotive components and modules (cockpit, HVAC, electronics), historically a significant Tier-1 supplier.

- Key Focus Areas: Cockpit modules, climate systems, powertrain components, and increasingly electronics and software integration for vehicle subsystems.

- Notable Features: Marelli’s portfolio touches many vehicle subsystems being “software-enabled.” However, the company faced financial stress and restructuring in 2024–2025.

- 2024 Revenue: Estimated in the range of USD 8–11 billion.

- Market Share & Global Presence: Extensive global operations (Japan, Europe, North America, Asia), though restructuring is reshaping its near-term position.

Leading Trends and Their Impact

- Shift to Zonal and Centralized Compute Architectures — Reduces wiring complexity, centralizes compute, lowers costs, and accelerates feature development.

- OTA Updates & Monetization — Enables recurring revenue through subscriptions and upgrades; raises cybersecurity needs.

- Convergence of Cloud, Edge, and Data Platforms — Supports mapping, predictive maintenance, telematics, and personalization, creating new ecosystems.

- Acceleration of ADAS and Automated Driving — Requires powerful software stacks and compute, increasing vehicle software value.

- Electrification Synergy — EVs simplify drivetrain complexity, letting software define differentiation (BMS, charging optimization).

- Supply-Chain and Semiconductor Pressure — Centralized compute drives chip demand, making supply a strategic concern.

- Cybersecurity & Regulation — More stringent rules around OTA, data safety, and compliance raise costs and create opportunities for specialized providers.

Successful SDV Examples Around the World

- Tesla (USA): Centralized compute, frequent OTA updates, and monetization through software packages like Full Self-Driving.

- Polestar & Volvo (Sweden/China): Deliver frequent OTA updates with advanced infotainment and connected services.

- Mercedes-Benz & BMW (Germany): Premium OEMs with domain controllers, software ecosystems, and OTA programs.

- GM/Chevrolet (USA): Integrates centralized compute and SDV features across EV fleets, backed by in-house software development.

- Chinese OEMs (BYD, NIO, Xpeng): Fast adoption of OTA, connected services, and advanced ADAS, spurred by competitive local markets.

Global Regional Analysis — Government Initiatives & Policies

North America

- U.S. incentives for EV adoption and federal/state tax credits indirectly promote SDVs.

- Regulatory focus on vehicle cybersecurity and ADAS safety.

- OEMs and suppliers heavily invest in SDV architectures to meet compliance and monetize services.

Europe

- Strong emphasis on safety regulations, data privacy, and emissions reduction.

- Incentives for EV adoption and strict cybersecurity certification for connected vehicles.

- Suppliers like Continental align closely with EU regulatory frameworks.

China & APAC

- Aggressive government support for intelligent connected vehicles and EV adoption.

- Policies encourage localization, cloud/mapping partnerships, and rapid OTA cycles.

- Chinese OEMs have become global leaders in fast SDV feature rollouts.

Latin America, Middle East & Africa

- Adoption remains uneven but fleet telematics and safety/emission initiatives push SDV capabilities in urban areas.

Government Initiatives

- EV incentives and tax credits stimulate SDV adoption.

- Safety and cybersecurity guidance push OEMs to invest in secure software platforms.

- Standards for interoperability encourage harmonization of vehicle architectures and software platforms.

How the Top Companies Fit In

- Aptiv: Leading Tier-1 for SDV architectures and OTA enablement.

- Continental: Offers full-stack software and telematics solutions with a global footprint.

- Ford & GM: OEMs investing heavily in internal SDV platforms and monetization models.

- Marelli: Strong subsystem expertise but currently restructuring.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Low-Carbon Construction Material Market Revenue, Global Presence, and Strategic Insights by 2034