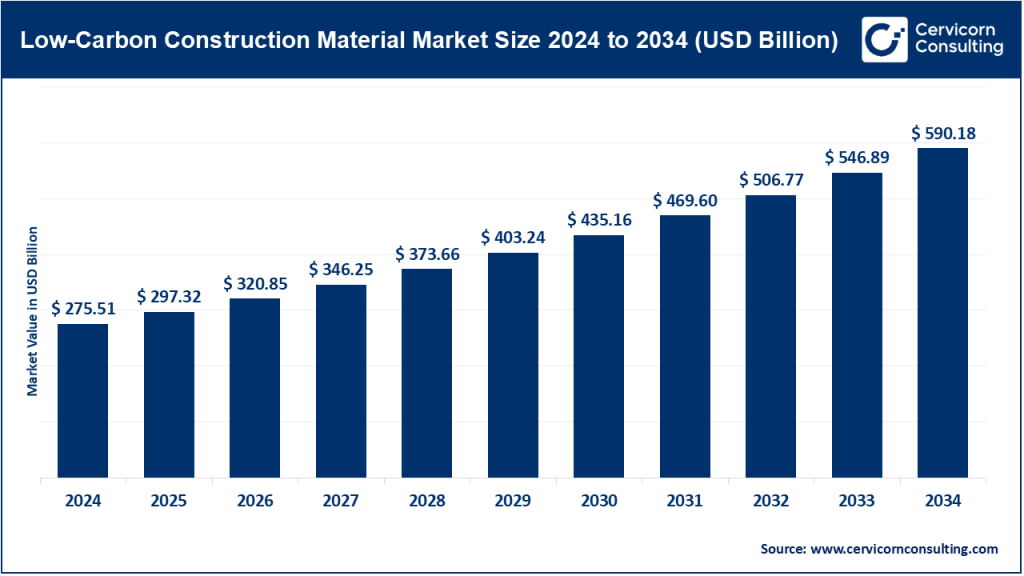

Low-carbon construction material market size

Low-carbon construction material market — Growth Factors

Demand for low-carbon construction materials is being driven by a convergence of forces: corporate and public net-zero targets creating procurement requirements and voluntary green product demand; stricter building codes and embodied-carbon disclosure frameworks (e.g., life-cycle assessment requirements and whole-building LCA in public tenders); scale-up and cost reductions in low-carbon production routes (electrification, hydrogen, and carbon capture & utilization).

Rising investor and insurer scrutiny of ESG and climate risk; breakthroughs in material science (high-strength low-carbon steels, carbon-mineralized concretes, engineered mass timber) that close or reverse performance trade-offs; greater circularity via recycling and secondary raw-material streams; and incentives (grants, tax credits, green public procurement) that de-risk early uptake — together these factors accelerate both supply-side innovation and demand-side adoption, enabling a multi-billion-dollar market expansion through the 2020s and into the 2030s.

What is the low-carbon construction material market?

At its core, this market comprises building materials manufactured, processed or used in ways that materially reduce the embodied carbon associated with construction (that is, the greenhouse gas emissions from raw-material extraction, manufacture, transport and installation). It includes: low-emission steels and aluminium, cement substitutes and low-clinker cements, concrete with carbon-utilization or carbon-reducing admixtures, recycled or secondary-content products (recycled steel, recycled aggregate), bio-based and engineered timber products (mass timber, cross-laminated timber), and novel materials such as carbon-mineralized blocks or eco-plastic lumber. The market is both product-driven (materials suppliers and innovators) and systems-driven (design practices, specification platforms, and carbon accounting services that enable uptake).

Get a Free Sample: https://www.cervicornconsulting.com/sample/2732

Why is it important?

Buildings and construction account for a significant share of global emissions — both operational energy and embodied carbon. While operational emissions have been a focus for decades, the share of total lifecycle emissions tied to embodied carbon is increasing as buildings become more energy efficient. Reducing embodied carbon is therefore critical to meet near-term targets (2030) and long-term net-zero goals. Low-carbon materials enable architects and developers to meet regulatory requirements, qualify for green financing, reduce project life-cycle emissions, and deliver lower-risk assets for investors and occupants. They also create industrial opportunities (new manufacturing, retrofitting plants for lower emissions) and support circular economy principles.

Low-Carbon Construction Material Market — Top Companies (profiles)

ArcelorMittal

Specialization: Steel production, low-carbon steel solutions.

Key focus areas: Electrification, hydrogen-based steelmaking pilots, recycled-content steels, product solutions for lighter structures.

Notable features: One of the largest global steelmakers investing heavily in “smart steels for people and planet”; large R&D programmes for breakthrough technologies and demonstration projects.

2024 Revenue: ≈ $62.4 billion.

Market share: Major global share in flat and long steel markets; exact low-carbon product share evolving as decarbonisation projects scale.

Global presence: Operations across the Americas, Europe, Africa and Asia.

Nucor Corporation

Specialization: North American steel — electric-arc-furnace (EAF) based production.

Key focus areas: Increasing scrap-based EAF capacity (inherently lower carbon than blast furnaces), product portfolio for construction sector.

Notable features: Leader in U.S. re-roll and mini-mill footprint; EAF model positions Nucor well for lower-carbon steel production.

2024 Revenue: Multi-billion-dollar company; revenues reported in annual filings.

Market share & Global presence: Strong U.S./North America presence, expanding downstream capabilities.

Steel Dynamics

Specialization: Steelmaking and metal recycling (EAF).

Key focus areas: Scrap utilization, specialty structural steels for construction, efficiency improvements.

Notable features: Integrated domestic supply chain in the U.S.; investments in low-carbon manufacturing processes.

2024 Revenue: Large public steel company; revenue in annual filings.

Market share & Presence: Significant U.S. market share in structural steel and processing.

CMC

Specialization: Steel and construction products.

Key focus: Transitioning product lines to lower carbon feedstocks/processes.

Notable features: Regional focus on scrap-based products.

2024 Revenue & Market share: Company-specific.

NIPPON STEEL CORPORATION

Specialization: Integrated steelmaker.

Key focus areas: Hydrogen steelmaking, CCS, high-strength steels.

Notable features: Major Asian steel player pursuing advanced decarbonisation technologies.

2024 Revenue & Presence: Large revenues reported; dominant presence in Japan and Southeast Asia.

CelsaGroup

Specialization: Rebar and recycled-content steel.

Key focus areas: Scrap steel, reinforcing bars, regional European supply.

Notable features: High use of scrap; sustainable focus.

2024 Revenue & Presence: Strong European footprint.

HBIS GROUP

Specialization: Major Chinese integrated steel producer.

Key focus areas: Energy efficiency, recycling, decarbonisation roadmaps.

Global presence: China-centric with global exports.

LIBERTY Steel Group

Specialization: Integrated steel, recycling and diversified metals.

Key focus areas: Re-rolling, green steel.

Notable features: Global footprint, remanufacturing strategies.

Tata Steel

Specialization: Integrated steel with diversified products.

Key focus areas: Hydrogen pilots, energy efficiency.

Notable features: Large Indian operations and growing European portfolio.

2024 Info: Reported strong performance in 2023–24.

Vedanta Aluminum and Power

Specialization: Aluminium and power.

Key focus areas: Low-carbon aluminium through renewable power, recycled aluminium.

Notable features: Decarbonisation depends on power mix.

EN+ Group

Specialization: Aluminium and energy.

Key focus areas: Hydropower-based aluminium.

Notable features: Competitive advantage in low-carbon aluminium supply.

Rio Tinto

Specialization: Mining and primary metals.

Key focus areas: Low-carbon aluminium, iron ore, decarbonisation of operations.

2024 Revenue: ≈ $53.7 billion.

Global presence: Mining & processing assets worldwide.

Norsk Hydro ASA

Specialization: Aluminium production and rolled aluminium.

Key focus: Recycled aluminium, low-carbon primary aluminium.

Notable features: Integrated value chain.

Eco-Friendly Plastic Lumber

Specialization: Recycled-plastic lumber.

Key focus areas: Waste plastic diversion, exterior materials.

Notable features: Circular economy approach.

Naftex GmbH

Specialization: Sustainable polymers and composites.

Key focus: Recycled feedstocks for construction.

Mercer Mass Timber LLC

Specialization: Mass timber and engineered wood.

Key focus areas: CLT, glulam, prefabricated timber.

Notable features: Carbon savings when sourced sustainably.

Cemex, S.A.B. de C.V.

Specialization: Cement and concrete.

Key focus areas: Low-clinker cements, CCUS pilots.

Notable features: One of the largest global cement producers.

CarbiCrete

Specialization: Carbon-mineralized concrete blocks.

Key focus areas: Using industrial by-products and CO₂ mineralization.

Notable features: Innovative carbon-utilization approach.

CarbonCure Technologies Inc.

Specialization: Carbon-utilization in concrete.

Key focus areas: Injecting CO₂ into concrete mixes.

Notable features: Demonstrated climate impact through CO₂ savings.

HOLCIM

Specialization: Cement, concrete and building materials.

Key focus areas: Low-carbon cements, recycled aggregates, circular construction.

2024 Revenue: ≈ CHF 16.2 billion in net sales.

Notable features: Global leader with strong sustainability focus.

Leading trends and their impact

- Electrification + EAF adoption in steel — Favors companies with scrap access and renewable power.

- Carbon capture, utilization and storage (CCUS) — Reduces cement/concrete emissions; adoption growing.

- Mass timber — Shifts mid-rise building norms; strong adoption in Canada and Europe.

- Circularity & recycled content — Mandates for recycled steel, aluminium, aggregates drive demand.

- LCA & embodied carbon disclosure — Forces transparency; creates demand for certified products.

- Productization of low-carbon variants — Simplifies procurement, accelerates uptake.

- Finance & incentives — Green public procurement and tax credits close cost gaps.

Successful examples from around the world

- CarbonCure concrete in North America — Used in thousands of projects; measurable CO₂ savings.

- Holcim’s ECOPact and Amrize strategy — Low-carbon cements rolled out globally; North American spin-out sharpened sustainability focus.

- Mass-timber projects in Europe & Canada — Cities like Vancouver and Oslo leading timber approvals.

- Low-carbon aluminium from EN+ and Norsk Hydro — Meeting demand in façades and window systems.

- Public procurement in Scandinavia and France — Policies mandating embodied carbon reductions accelerating adoption.

Global regional analysis — Government initiatives & policies shaping the market

Europe

- Strong embodied carbon disclosure mandates.

- Carbon pricing under EU ETS drives low-carbon products.

North America

- U.S. IRA and Canadian procurement programs funding industrial decarbonisation.

- Growth in mass timber and CCUS projects.

Asia-Pacific

- China, India, Japan deploying national decarbonisation roadmaps.

- Steel majors like HBIS, Tata, Nippon investing in hydrogen, CCS, recycling.

Latin America

- Urban centers experimenting with green procurement.

- Large potential for blended cements and recycled materials.

Middle East & Africa

- Infrastructure expansion paired with renewable potential.

- Early-stage adoption of green cement and aluminium.

Key global policy instruments

- Embodied-carbon disclosure and Environmental Product Declarations (EPDs).

- Carbon pricing and emissions trading systems.

- Tax credits and capital incentives for green technologies.

- Building certification systems evolving to reward embodied carbon reductions.

- Public procurement criteria mandating lower-carbon materials.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Battery Cell Component Market Growth Factors, Key Players, and Global Presence by 2034