Smart Retail Market Size

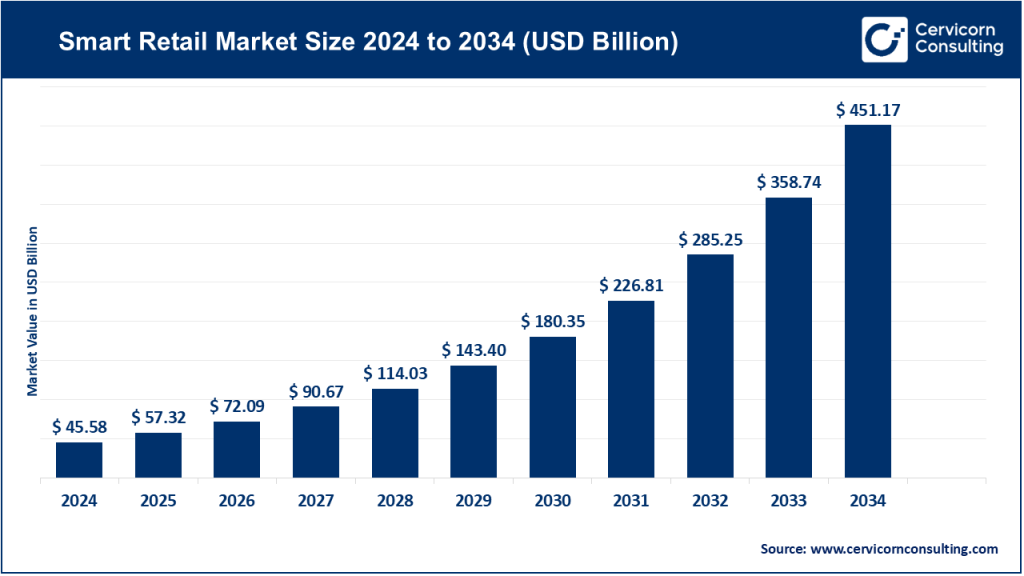

The global smart retail market size was valued at approximately USD 45.58 billion in 2024 to reach around USD 451.17 billion by 2034 at a compound annual growth rate (CAGR) of around 30.4% between 2025 and 2034.

What is the smart retail market?

Smart retail refers to the integration of advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), computer vision, cloud computing, and data analytics into retail operations. It connects physical and digital retail environments, enabling retailers to enhance customer experiences, automate store management, and streamline inventory, logistics, and payment systems. Smart retail leverages data from multiple touchpoints—point-of-sale (POS), sensors, cameras, mobile apps, and e-commerce platforms—to create real-time insights for optimizing sales, operations, and customer engagement. The market covers smart shelves, frictionless checkout, digital signage, smart carts, automated warehouses, and omnichannel commerce platforms that bridge online and offline ecosystems.

Why it is important?

Smart retail is essential because it transforms how businesses interact with customers and manage operations in an increasingly competitive landscape. Consumers now expect convenience, personalization, and speed, while retailers face challenges such as labor shortages, high operational costs, and shrinking profit margins. Smart retail solutions automate processes like checkout, inventory management, and customer analytics, reducing human error and increasing efficiency. They also offer data-driven insights that enable retailers to anticipate demand, customize offerings, and deliver seamless omnichannel experiences. As shopping habits evolve toward digital and contactless interactions, smart retail ensures that retailers remain relevant, agile, and customer-centric.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2780

Smart Retail Market — Growth Factors

The smart retail market is propelled by rising consumer demand for personalized and frictionless shopping experiences, advances in artificial intelligence and computer vision, rapid cost reductions in sensors and connectivity technologies, and growing investment in cloud and edge computing infrastructure. Increasing adoption of omnichannel retailing, labor shortages that encourage automation, and heightened focus on inventory accuracy and loss prevention further accelerate market growth. Additionally, pandemic-induced shifts in consumer behavior toward contactless and self-service models, expanding smart-city initiatives, and the rise of data-driven decision-making in retail have collectively created a strong environment for the widespread deployment of smart retail solutions. Together, these drivers are pushing global retailers to adopt intelligent systems that enhance operational efficiency, improve profitability, and provide customers with seamless digital-physical shopping experiences.

Smart Retail Market — Top Company Profiles

1. Amazon

- Specialization: Cloud computing, AI-powered retail analytics, cashierless stores, e-commerce personalization, and logistics automation.

- Key Focus Areas: Just Walk Out technology, fulfillment center robotics, voice-enabled commerce, retail advertising, and cloud-based AI for retailers through Amazon Web Services (AWS).

- Notable Features: Combines AI, computer vision, and sensor fusion to enable checkout-free shopping; advanced recommendation engines; integration of retail and advertising platforms for omnichannel marketing.

- 2024 Revenue: Approximately USD 638 billion.

- Market Share: While Amazon’s smart retail revenue is not reported separately, it holds a dominant share of the e-commerce and retail technology ecosystem through its in-house and AWS-powered smart retail innovations.

- Global Presence: Operates globally across North America, Europe, Asia-Pacific, and Latin America with both online and physical retail formats.

2. Walmart

- Specialization: Brick-and-mortar retail digitization, in-store automation, robotics, and advanced analytics for supply-chain optimization.

- Key Focus Areas: Smart shelves, in-store robotics, retail media, AI-driven demand forecasting, and omnichannel shopping solutions such as curbside pickup and delivery.

- Notable Features: Large-scale implementation of automation technologies; advanced loss-prevention systems; strong focus on integrating physical and digital retail experiences.

- 2024 Revenue: Approximately USD 648 billion.

- Market Share: Among the largest global retail operators and one of the biggest investors in automation and AI-based retail systems.

- Global Presence: Extensive footprint in the United States and international markets across Asia, Latin America, and Europe.

3. Alibaba

- Specialization: E-commerce platforms, AI-powered logistics, cloud computing, and “New Retail” models that blend online and offline experiences.

- Key Focus Areas: Hema (Freshippo) stores, smart logistics, retail cloud solutions, and data-driven merchant analytics.

- Notable Features: Pioneered the “New Retail” concept; integrates mobile payments, real-time analytics, and fast delivery within physical stores.

- 2024 Revenue: Approximately USD 130 billion.

- Market Share: A leading player in Asia-Pacific’s retail digitization landscape; major influence in shaping AI-driven commerce.

- Global Presence: Headquarters in China with expanding operations and cloud partnerships across Asia, Europe, and North America.

4. Caper AI (Instacart)

- Specialization: AI-powered smart shopping carts, frictionless checkout, and connected in-store experiences.

- Key Focus Areas: Weight and vision sensors for item recognition, seamless payment integration, and unified online-offline data analytics for grocery partners.

- Notable Features: Smart carts that automatically scan, total, and process purchases without the need for checkout lines; integrated analytics tools that improve store layout and product placement.

- 2024 Revenue: As part of Instacart, estimated corporate revenue of around USD 3.3 billion.

- Market Share: A growing presence in smart cart technologies, particularly across North American grocery chains.

- Global Presence: Primarily operates in the United States and Canada with expanding pilot programs in select global markets.

5. NVIDIA

- Specialization: AI chips, GPU computing platforms, and software frameworks enabling machine learning, computer vision, and robotics in retail environments.

- Key Focus Areas: GPU-based edge computing for real-time store analytics, AI model training, retail computer-vision frameworks, and partnerships with retail technology vendors.

- Notable Features: Provides foundational hardware and AI infrastructure that powers smart cameras, recommendation systems, and inventory monitoring solutions used across the retail ecosystem.

- 2024 Revenue: Approximately USD 60.9 billion.

- Market Share: Commands a dominant position in AI accelerator hardware used by smart retail solution providers worldwide.

- Global Presence: Operations span the Americas, EMEA, and Asia-Pacific with partnerships across cloud providers, OEMs, and retail technology developers.

Leading Trends in Smart Retail and Their Impact

- Frictionless Checkout: The adoption of cashier-less technologies and self-checkout systems reduces queues, minimizes labor dependency, and enhances the customer experience. This trend is transforming grocery and convenience store formats, leading to higher operational efficiency and improved conversion rates.

- Edge AI and Real-time Analytics: Edge computing allows data processing to happen closer to where it’s generated—in stores—enabling instant insights into inventory levels, customer movement, and shelf activity. This results in quicker decision-making, improved responsiveness, and reduced latency.

- Personalization and Predictive Marketing: AI models analyze customer data to generate tailored promotions, offers, and recommendations in real time. The impact is higher customer engagement, loyalty, and average basket size.

- Omnichannel Integration: Retailers increasingly unify online and offline shopping journeys through apps, digital wallets, and personalized delivery or pickup options. This integration allows consistent customer engagement and supports hybrid retail experiences.

- Smart Inventory and Demand Forecasting: AI-driven predictive analytics optimize stock levels, reduce waste, and improve product availability. Retailers benefit from cost savings, reduced stockouts, and improved sustainability outcomes.

- In-store Robotics and Automation: Automated cleaning, shelf-scanning, and picking robots are improving efficiency in large retail spaces. This trend helps offset labor shortages and reduces human errors in routine tasks.

- Retail Media Networks: Retailers are monetizing shopper data by creating media platforms that allow brands to advertise directly within their digital ecosystems. This is generating high-margin revenue streams and deepening brand-consumer interactions.

- Sustainability and Green Retail: Smart energy systems, waste-reducing analytics, and efficient logistics support retailers’ environmental goals. Sustainability initiatives are increasingly influencing consumer choices and brand perception.

These trends collectively point toward an increasingly data-driven and automated retail ecosystem, where the boundaries between digital and physical shopping continue to blur. The result is a more responsive, adaptive, and consumer-centric retail industry.

Successful Smart Retail Examples Worldwide

- Amazon Go (United States): A pioneer in cashier-less retail, using computer vision and sensor fusion to enable customers to shop and leave without manual checkout. It redefines convenience retailing and sets new benchmarks for in-store automation.

- Hema (Freshippo) by Alibaba (China): Combines mobile-based shopping, in-store dining, and instant home delivery through integrated logistics systems. Hema stores exemplify the fusion of online and offline experiences, demonstrating the full potential of smart retail.

- Walmart’s Intelligent Retail Lab (United States): Uses computer vision to track product availability and shelf conditions in real time. The lab functions as a testing ground for AI solutions designed to improve operational efficiency and customer satisfaction.

- Carrefour and Microsoft Partnership (Europe): Introduced AI-driven demand forecasting, dynamic pricing, and smart shelf technology across European stores. These efforts significantly reduce food waste and optimize inventory turnover.

- 7-Eleven Japan: Utilizes big data analytics for product assortment optimization, automated reordering, and inventory tracking—an approach critical to the brand’s vast convenience network and rapid replenishment model.

- Instacart with Caper Smart Carts (North America): Enables grocery stores to offer automated checkout experiences integrated with online delivery and loyalty programs, demonstrating how AI-driven shopping carts can merge convenience with data intelligence.

These global examples illustrate how retailers of varying scales leverage smart retail technologies to drive operational excellence and enhance the shopping experience.

Global Regional Analysis — Government Initiatives and Policies

North America

The North American market leads in smart retail innovation, driven by heavy investments from large retailers, technology vendors, and venture capital firms. Governments in the United States and Canada are promoting AI research, 5G deployment, and advanced manufacturing through tax incentives and grants. Privacy regulations, such as the California Consumer Privacy Act (CCPA) and biometric data laws, influence how companies implement in-store analytics. The combination of strong technological infrastructure, regulatory frameworks, and consumer readiness positions North America as a frontrunner in smart retail adoption.

Europe

Europe’s smart retail landscape is shaped by stringent privacy laws like the General Data Protection Regulation (GDPR) and the emerging EU AI Act. These policies ensure that retailers prioritize ethical AI use, transparency, and data protection. European countries also support digital transformation initiatives for small and medium-sized retailers, providing subsidies for automation and digitalization. The region focuses on building trust through privacy-compliant personalization and sustainable retail practices, encouraging the integration of eco-friendly and transparent supply-chain systems.

Asia-Pacific

Asia-Pacific is one of the fastest-growing smart retail markets, fueled by rapid urbanization, digital payment adoption, and government-led smart city programs. China leads with large-scale implementation of AI, robotics, and data-driven retail through “New Retail” initiatives. Japan and South Korea promote automation and robotics in retail and logistics through government incentives. India’s digital commerce and smart city projects are expanding the use of connected retail systems, supported by a growing young consumer base and rising smartphone penetration. The region is emerging as a global innovation hub for smart retail experimentation.

Latin America

In Latin America, governments are promoting digital inclusion and e-commerce infrastructure development. Initiatives encouraging electronic payments and fintech adoption are laying the foundation for smart retail growth. Retailers in Brazil, Mexico, and Chile are introducing self-checkout systems, mobile payment solutions, and real-time analytics to enhance operational efficiency. Although infrastructure challenges persist, growing middle-class populations and digital transformation programs are creating long-term opportunities.

Middle East and Africa

The Middle East, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in technology innovation as part of economic diversification strategies like Saudi Vision 2030 and UAE’s digital transformation initiatives. Retail modernization and smart city projects are driving the deployment of AI, analytics, and automation in malls and large retail chains. In Africa, smart retail adoption is still in early stages but is accelerating through mobile payment innovations and cross-border e-commerce. Governments and private sectors are collaborating to improve logistics, connectivity, and access to digital tools.

Government Initiatives and Regulatory Influence

- Privacy and AI Governance: Global regulatory bodies are introducing policies to ensure transparency, fairness, and data protection in AI-driven retail systems. Retailers are increasingly adopting privacy-preserving analytics, anonymization, and secure data-handling practices to comply with these laws.

- Tax Incentives and Grants: Governments in developed and emerging economies are offering tax breaks and funding programs for AI adoption, automation, and digital infrastructure—encouraging retailers to modernize faster.

- Sustainability Regulations: Climate and sustainability policies are motivating retailers to adopt energy-efficient technologies, reduce food waste through AI-driven demand forecasting, and integrate renewable-energy management into their operations.

- Standardization and Interoperability: Governments and industry bodies are creating technical standards for interoperability between smart devices, sensors, and POS systems. These initiatives lower integration barriers and promote vendor collaboration.

- Labor and Skill Development Policies: Many countries are promoting reskilling programs for retail workers displaced by automation, ensuring that human capital keeps pace with digital transformation.

Strategic Outlook for the Smart Retail Market

The smart retail market is at the intersection of data, automation, and consumer engagement. As global competition intensifies, retailers are moving beyond isolated pilot projects toward enterprise-wide deployment of AI-driven solutions. The integration of sensors, robotics, and advanced analytics is transforming the entire retail value chain—from supply-chain visibility and in-store experience to post-purchase engagement. At the same time, governments and policymakers play a pivotal role by providing regulatory clarity, infrastructure support, and innovation incentives. Together, these forces are creating a global ecosystem where technology, policy, and consumer expectations align to define the future of retail.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Cloud Backup and Recovery Solutions Market Growth Drivers, Trends, Key Players and Regional Insights by 2034