Cloud Backup and Recovery Solutions Market Overview and Forecast

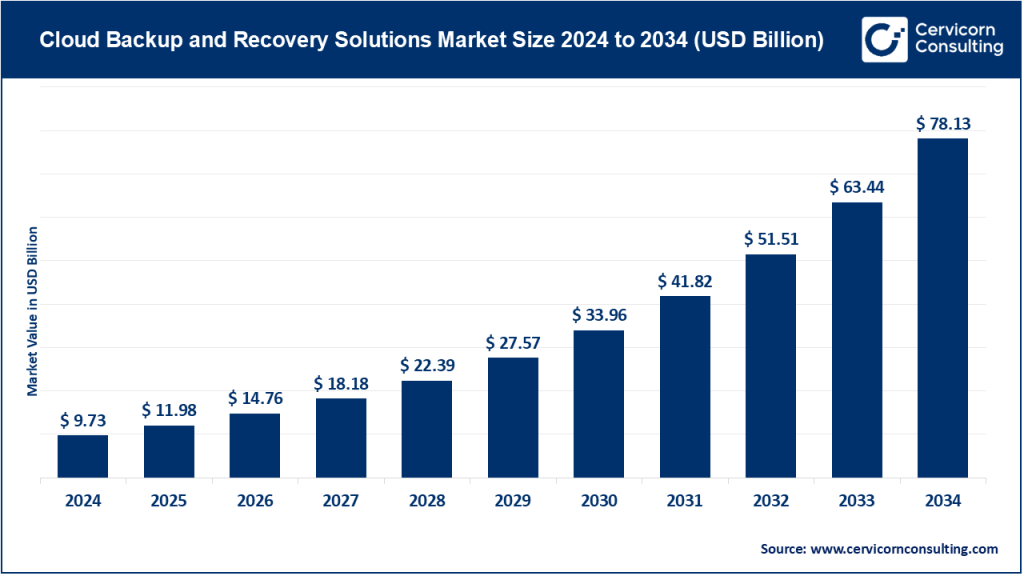

The global cloud backup and recovery solutions market size was valued at approximately USD 9.73 billion in 2024 to reach around USD 78.13 billion by 2034 at a compound annual growth rate (CAGR) of around 23.16% between 2025 and 2034. This expansion reflects a global shift toward digital transformation and increased cloud adoption among enterprises, small- and medium-sized businesses (SMBs), and public institutions.

Factors such as hybrid cloud architectures, compliance regulations, and the ongoing focus on cyber resilience ensure steady demand. Analysts anticipate that by 2034, cloud backup will become an integrated, automated function embedded within most enterprise IT operations rather than a standalone process.

What Is the Cloud Backup and Recovery Solutions Market?

The cloud backup and recovery market encompasses technologies, software, and services that create, manage, and restore copies of data through cloud infrastructure. This includes SaaS-based backup platforms, cloud-native snapshot orchestration, agentless VM backups, and Disaster Recovery-as-a-Service (DRaaS). These tools enable organizations to store data securely in geographically distributed environments while providing rapid restoration during system failures, cyber incidents, or disasters.

Cloud backup solutions typically support multiple deployment models—public, private, and hybrid cloud—and integrate with existing enterprise systems such as virtualization platforms, databases, and business applications. The solutions are used across industries including banking, healthcare, retail, manufacturing, and public administration to ensure compliance, continuity, and operational efficiency.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2772

Why It Is Important

In the digital economy, data is a company’s most valuable asset. Any loss or prolonged downtime can result in massive financial, operational, and reputational damage. Traditional backup systems often lack the flexibility and speed needed for modern workloads. Cloud-based backup and recovery eliminates these limitations by providing continuous replication, immutable storage, and scalable capacity.

It ensures:

- Business continuity during hardware failures, cyberattacks, or natural disasters.

- Regulatory compliance with data protection and privacy mandates.

- Cost optimization through flexible pay-as-you-go pricing.

- Global accessibility and faster recovery times via multi-region replication.

- Security and immutability that safeguard against ransomware or insider threats.

In short, cloud backup and recovery solutions are the foundation of any modern cyber-resilience and continuity strategy.

Market Growth Factors

The cloud backup and recovery solutions market is growing rapidly due to the exponential increase in enterprise data volumes, the surge in ransomware and cyberattacks, and the widespread transition from capital-intensive on-prem infrastructure to subscription-based cloud models. Additional growth drivers include hybrid and multi-cloud adoption, rising compliance and data residency mandates, the integration of artificial intelligence for predictive recovery, and the need for unified management across diverse IT environments. Furthermore, organizations seek to consolidate backup, disaster recovery, and archiving functions into single intelligent platforms, while managed service providers (MSPs) expand their offerings with embedded backup capabilities. Together, these trends are propelling double-digit annual growth across both developed and emerging markets.

Top Companies in the Cloud Backup and Recovery Solutions Market

Below are profiles of leading companies driving innovation, reliability, and adoption in the global market.

Veeam Software

Specialization:

Veeam Software specializes in enterprise backup, recovery, and data management across virtualized, physical, and multi-cloud environments. The company’s software-defined approach offers seamless integration with major cloud providers like AWS, Microsoft Azure, and Google Cloud.

Key Focus Areas:

- Data resilience and ransomware recovery

- Backup for SaaS applications such as Microsoft 365

- Hybrid cloud data protection and instant recovery

Notable Features:

- Advanced immutability and air-gapped backups

- Automated disaster recovery orchestration

- Simplified management through a unified console

2024 Revenue & Market Share:

Veeam reported revenues of approximately USD 1.5 billion in 2024, maintaining a leading global market share of over 15% in the enterprise backup segment.

Global Presence:

Strong channel partner network and customers across North America, Europe, and Asia-Pacific, with data centers and integration partners worldwide.

Dell Technologies

Specialization:

Dell Technologies offers integrated data protection through its Dell EMC division, combining on-premise infrastructure with cloud-enabled recovery solutions.

Key Focus Areas:

- Backup appliances (Data Domain series)

- Cloud tiering and deduplication

- Ransomware recovery and immutable storage

Notable Features:

- Deep integration across Dell servers, storage, and networking

- Comprehensive professional and managed services

- Proven performance at enterprise scale

2024 Revenue & Market Share:

Dell Technologies reported USD 88.4 billion in total revenue in 2024. Its data protection business accounts for a significant portion of enterprise infrastructure investments globally.

Global Presence:

Extensive global footprint serving large enterprises, public institutions, and service providers in over 180 countries.

Commvault

Specialization:

Commvault is a pioneer in software-defined data management and backup solutions. Its SaaS platform, Metallic, provides flexible cloud-native backup and recovery for hybrid and multi-cloud environments.

Key Focus Areas:

- SaaS-based backup for workloads like Microsoft 365, Salesforce, and Kubernetes

- Data governance, compliance, and ransomware protection

- Unified policy-driven management

Notable Features:

- High-speed recovery and granular restore options

- Intelligent automation and anomaly detection

- Seamless migration between cloud and on-prem systems

2024 Revenue & Market Share:

Commvault achieved approximately USD 839 million in FY 2024 revenue, demonstrating consistent subscription growth and strong recurring revenue performance.

Global Presence:

A robust presence in more than 70 countries, with strategic alliances across cloud providers, MSPs, and enterprise technology partners.

Rubrik

Specialization:

Rubrik delivers cloud-native data management and backup solutions with a heavy focus on cybersecurity and ransomware recovery.

Key Focus Areas:

- Cloud-to-cloud and hybrid backup

- Data security and immutability

- Automation and instant recovery orchestration

Notable Features:

- Machine-learning-based threat detection

- Rapid recovery workflows for critical workloads

- Centralized data management across public clouds

2024 Revenue & Market Share:

Rubrik generated around USD 628 million in revenue in 2024, driven by growing annual recurring revenue and strategic partnerships with hyperscale cloud vendors.

Global Presence:

Strong enterprise presence in North America, Europe, and Asia-Pacific, with strategic partnerships including Microsoft and major global systems integrators.

Veritas Technologies

Specialization:

Veritas Technologies provides enterprise-grade data protection, backup, and archiving solutions for large, complex IT environments.

Key Focus Areas:

- Enterprise backup and recovery

- Data compliance and governance

- Hybrid and multi-cloud protection

Notable Features:

- Integrated appliances and software

- Centralized management for heterogeneous systems

- Proven scale for mission-critical workloads

2024 Revenue & Market Share:

Veritas remained one of the top global enterprise data protection providers in 2024, and its merger activity with Cohesity has further expanded its market share and innovation potential.

Global Presence:

Extensive operations across all major continents with strong enterprise and public-sector clientele.

Leading Trends and Their Impact

1. Ransomware Defense and Cyber Resilience

Ransomware has become the single largest catalyst for modernizing backup strategies. Cloud solutions now emphasize immutability, air-gapped storage, and rapid recovery orchestration. Enterprises are integrating backup and security platforms, turning data protection into an essential element of cybersecurity.

2. SaaS-Based Subscription Models

The industry is rapidly moving from perpetual licensing to subscription and “as-a-service” models. This shift allows predictable costs, simplified management, and continuous updates. Vendors benefit from recurring revenue streams, while customers gain scalability and flexibility.

3. Hybrid and Multi-Cloud Integration

Organizations operate across multiple clouds and on-prem systems. Unified control planes that centralize management, automate replication, and maintain consistent retention policies are in high demand. Vendors offering interoperability across diverse ecosystems are gaining competitive advantage.

4. Immutable Storage and Compliance

Immutability—data that cannot be altered once written—has become a standard feature. It supports both ransomware resilience and regulatory compliance. Cloud providers and backup vendors are introducing WORM (write-once-read-many) storage and policy-driven retention tools.

5. Automation and Orchestration

Automated disaster recovery testing, failover orchestration, and policy enforcement are reducing manual effort and error. These capabilities help organizations validate business continuity plans and meet audit requirements efficiently.

6. Artificial Intelligence and Machine Learning

AI-driven analytics are increasingly being embedded into backup platforms to detect anomalies, identify suspicious patterns, and prioritize recovery. AI also enables intelligent tiering and optimization of storage costs.

7. Growth of Managed Service Providers (MSPs)

MSPs are bundling cloud backup and DRaaS into their service portfolios for SMB and mid-market clients. This trend is expanding global market penetration and simplifying adoption for smaller organizations lacking in-house IT resources.

Successful Examples Around the World

1. Financial Sector: Hybrid Cloud Recovery

A major international bank implemented a hybrid cloud data protection framework using immutable cloud repositories and automated failover orchestration. This reduced its recovery time from 48 hours to under 3 hours while satisfying stringent regulatory requirements for data retention and auditability.

2. Retail and E-Commerce: SaaS-Based Backup

A global retail chain adopted a SaaS backup platform to protect its store-level POS systems and centralized databases. By leveraging continuous cloud replication, it ensured transaction continuity during outages and cut downtime costs significantly.

3. Public Sector: Disaster Recovery for Civic Services

Municipal governments in multiple countries have deployed cloud-based DRaaS to protect public-service data and ensure continuity of essential operations such as tax systems, emergency response, and public records. The solutions comply with local data-sovereignty regulations.

4. Technology Startups: Kubernetes and Cloud-Native Protection

A SaaS provider for AI analytics integrated Kubernetes-native backups with object storage replication across regions. This allowed seamless restoration of microservices, improved SLAs, and faster innovation cycles.

These examples reflect the versatility of cloud backup and recovery solutions, which adapt to varying scales, compliance needs, and infrastructure maturity levels.

Global Regional Analysis

North America

North America dominates the cloud backup and recovery market due to advanced IT infrastructure, high cloud adoption, and regulatory emphasis on cybersecurity. The United States and Canada have both implemented national guidelines encouraging organizations to maintain immutable backups and recovery plans against ransomware. Federal agencies emphasize frameworks like NIST and CISA directives, making resilience a compliance requirement across critical infrastructure sectors.

Europe

Europe’s market is shaped by stringent privacy and data-protection regulations such as the General Data Protection Regulation (GDPR). These laws require organizations to maintain secure and recoverable data storage within regional boundaries, driving demand for EU-based cloud backup providers. Countries like Germany, France, and the U.K. are seeing rapid adoption of sovereign cloud initiatives to meet residency and compliance needs. National cybersecurity strategies further encourage investment in resilient backup infrastructures.

Asia-Pacific (APAC)

The Asia-Pacific region is experiencing one of the fastest growth rates, driven by accelerated cloud adoption, digitalization programs, and government mandates on data localization. Initiatives such as “Digital India,” “Smart Nation Singapore,” and “Digital China” are boosting investments in secure cloud infrastructure. Many enterprises are transitioning from traditional storage systems to cloud-native backups that meet both cost and compliance requirements. Increasing cybersecurity threats in APAC are also pushing enterprises toward advanced recovery mechanisms.

Latin America

In Latin America, the market is driven by digital transformation in financial services, telecom, and public sectors. Countries like Brazil, Mexico, and Chile are strengthening data-protection frameworks that encourage cloud backup adoption. Growing awareness of ransomware risks and expanding connectivity infrastructure support market growth.

Middle East and Africa (MEA)

The MEA region is witnessing steady expansion as governments and enterprises pursue digital modernization. National projects in the UAE, Saudi Arabia, and South Africa include cloud adoption frameworks that mandate backup and disaster recovery. Energy, banking, and government sectors are leading adopters due to their focus on cybersecurity and business continuity.

Government Initiatives and Policies Shaping the Market

- Ransomware and Critical Infrastructure Regulations:

Governments globally are mandating resilience standards for critical sectors. Backup and recovery are now recognized as essential components of cybersecurity compliance. - Data Residency and Sovereignty Laws:

Data localization policies in regions like the EU, India, and the Middle East require that certain categories of data remain within national boundaries, driving demand for region-specific cloud storage and recovery options. - Public-Sector Cloud Adoption Frameworks:

Many countries are launching government cloud initiatives (GovClouds) that incorporate built-in backup and recovery systems to secure sensitive public data. - National Cybersecurity Strategies:

Nations are integrating backup and disaster recovery requirements into their cybersecurity frameworks, promoting vendor certification and standardized recovery protocols. - Incentives for SMEs and Cloud Adoption:

Some governments offer financial or technical assistance to help small and mid-size businesses migrate to cloud-based backup platforms, supporting broader digital transformation.

Summary of Market Direction

The global cloud backup and recovery solutions market is transitioning from reactive data protection to proactive cyber resilience. The convergence of security, compliance, and automation technologies is redefining how organizations approach business continuity. Leading vendors—Veeam, Dell Technologies, Commvault, Rubrik, and Veritas—are shaping the next generation of resilient, intelligent, and fully integrated data protection ecosystems.

With strong growth drivers, evolving regulatory landscapes, and rising awareness of ransomware threats, cloud backup and recovery will remain a central pillar of enterprise IT strategy through the next decade.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Stainless Steel Market Growth Drivers, Trends, Key Players and Regional Insights by 2034