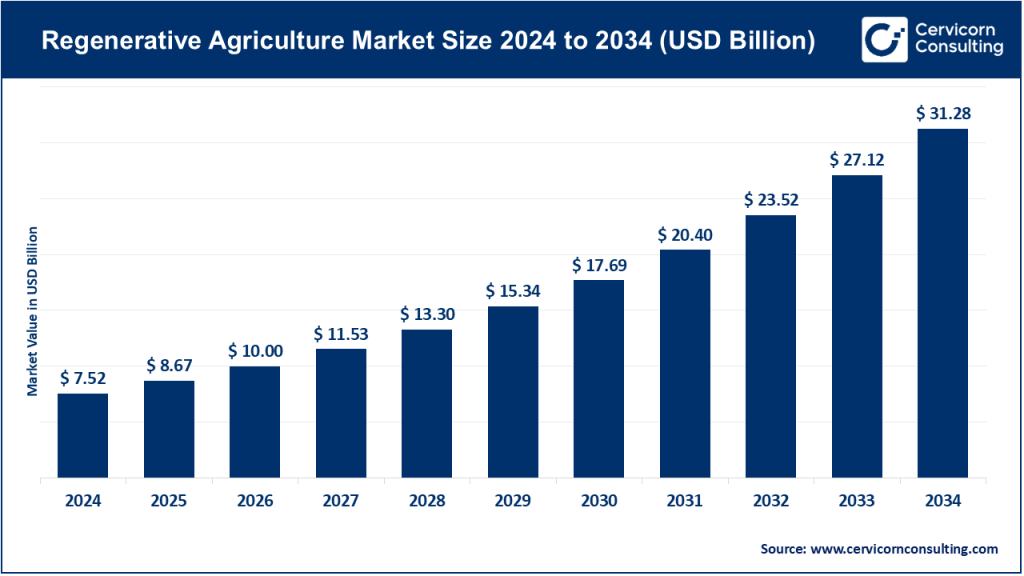

Regenerative Agriculture Market Size

What is the regenerative agriculture market?

The regenerative agriculture market refers to the collection of products, services, technologies, finance mechanisms and advisory offerings that support farming systems designed to restore soil health, increase biodiversity, improve water cycles, and sequester carbon while maintaining or improving farm productivity. That market includes: regenerative practices (no-till, cover cropping, crop rotations, agroforestry, managed grazing), agri-inputs aligned to regen principles (biologicals, composts, biostimulants), monitoring/measurement/verification (MRV) tools and platforms for soil carbon and biodiversity outcomes, farm advisory and transition services, supply-chain sourcing programs, and financial products (carbon credits, transition finance, premiums for regen-sourced commodities). The market spans farmers, agtech companies, verification platforms, food companies and investors assembling incentives and business models to scale the transition.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2749

Why is regenerative agriculture important?

Regenerative agriculture is important because it addresses three intersecting risks and opportunities: (1) climate mitigation & resilience — healthy soils can sequester carbon and reduce vulnerability to drought and erosion; (2) food-system resilience — diversified, biologically active soils often support stable yields over time and reduce dependency on synthetic inputs; and (3) corporate & investor demand — brands and buyers facing net-zero targets are seeking credible ways to reduce agricultural emissions and build sustainable sourcing, which creates revenue streams (supply agreements, carbon credits, premiums) for farmers who transition. The approach therefore aligns environmental goals with farmer economics — when properly designed and financed it can be a win for nature, producers and buyers.

Regenerative agriculture market — Growth Factors

Demand for regenerative agriculture is being driven by a tight feedback loop of corporate net-zero and sustainable sourcing commitments, rising consumer preference for climate-friendly food, growth in ag-biologicals and soil-focused agtech (for monitoring and decision support), expanded corporate and philanthropic funding for farmer transition, and increasingly supportive public policy and incentive programs (including carbon credit registries and cost-share schemes). At the same time, improvements in remote sensing, soil analytics and outcomes verification are lowering transaction costs for measurement and enabling credible monetization (e.g., soil carbon credits and premiums), while rising input costs and climate variability are prompting farmers to adopt practices that reduce fertilizer dependency and improve resilience.

These economic, regulatory and technological forces together create a strong multi-year tailwind for market expansion, even as adoption must overcome barriers like fragmented supply chains, the need for upfront investment by farmers, variable measurement standards and localized agronomic adaptation.

Regenerative Agriculture — Top companies

1) Agreed.Earth

- Company: Agreed.Earth (closely linked to platforms like Agreena in Europe).

- Specialization: SaaS + MRV and carbon-financing solutions that connect farmers with carbon markets and regenerative practice incentives.

- Key focus areas: field-level measurement & verification, farmer finance for transition, issuance and sale of soil carbon credits, and supply-chain partnership programs.

- Notable features: Operates a large soil carbon platform that combines satellite and field data for MRV, with projects seeking third-party certification.

- 2024 revenue / market share: Revenue not publicly disclosed; backed by venture funding and active across millions of hectares in Europe.

- Global presence: Primarily Europe with partnerships across multiple crop systems.

2) Aker Technologies, Inc.

- Company: U.S.-based agtech firm focused on digital agronomy.

- Specialization: Automated crop-scouting technologies and remote sensing systems for below-canopy crop analysis.

- Key focus areas: Reducing blanket pesticide/fertilizer use via targeted data-driven insights.

- Notable features: Developed advanced sensors integrated into digital agronomy stacks; acquired by Intelinair in 2023.

- 2024 revenue / market share: Not disclosed; acquisition folded results into Intelinair.

- Global presence: Primarily North America.

3) Astanor Ventures

- Company: European venture capital and growth investor.

- Specialization: Funding regenerative agriculture, sustainable food systems, and agtech startups.

- Key focus areas: Scaling portfolio companies in regenerative farming, biologicals, foodtech, and supply-chain traceability.

- Notable features: Recognized for building a strong portfolio that accelerates market development.

- 2024 revenue / market share: Not applicable (VC firm).

- Global presence: Europe-based with investments across North America, Asia, and Latin America.

4) Biotrex

- Company: Known for soil microbial analysis and diagnostics.

- Specialization: Soil biological indicators and diagnostic services.

- Key focus areas: Microbial diversity testing, soil health monitoring, and agronomic recommendations.

- Notable features: Focuses on biology-driven soil metrics rather than chemical-only indicators.

- 2024 revenue / market share: Not publicly disclosed.

- Global presence: Japan-based origin, with expansion into Asia and Europe.

5) Carbon Robotics

- Company: U.S.-based robotics company.

- Specialization: Autonomous laser-weeding robots for chemical-free weed control.

- Key focus areas: Specialty crops and large-scale row crops, reducing dependence on herbicides.

- Notable features: Pioneer in laser-based weed management, raising significant venture funding.

- 2024 revenue / market share: Not disclosed; early-stage robotics segment.

- Global presence: North America with pilot projects in Europe and Oceania.

Leading trends and their impact

- Soil carbon MRV and carbon-crediting standardization — Standardized quantification builds buyer confidence, increases credit sales, and enables corporate sourcing.

- Corporate supply-chain commitments — Brands fund farmer transitions through premiums and long-term contracts, accelerating adoption.

- Biologicals & low-input agronomy — Growth in microbial products and composts reduces reliance on synthetic fertilizers and pesticides.

- Precision ag + robotics — Advanced sensing and automation make regenerative practices scalable and reduce labor costs.

- Investor capital — VC firms like Astanor Ventures are fueling rapid innovation and commercialization across the value chain.

Successful examples around the world

- Agreena (Europe): Large-scale soil carbon projects covering millions of hectares with Verra certification in progress.

- Corporate sourcing pilots: Companies like Nestlé, Danone, and General Mills supporting regenerative cocoa, dairy, and grain projects.

- Managed grazing initiatives (U.S. & Australia): Rotational grazing improving soil health and carbon sequestration.

- Precision weed control pilots (North America): Carbon Robotics’ autonomous weeding reducing chemical inputs for specialty crops.

Global regional analysis: Government initiatives & policies shaping the market

North America

- United States: USDA conservation and carbon pilot programs supporting regenerative practices; corporate carbon markets are complementary.

- Canada: Provincial soil-health initiatives and national carbon offset frameworks encourage adoption.

Europe

- European Union: Farm to Fork strategy and CAP reforms promoting sustainability; several national governments supporting soil carbon programs.

- United Kingdom: Public money for ecosystem services incentivizes regenerative methods.

Latin America

- Brazil and Argentina: Large-scale no-till and agroforestry systems; international buyers pushing for sustainable soy, beef, and coffee.

Asia & Oceania

- India: Expanding biologicals market and agroecology programs.

- Australia: National soil carbon programs and regenerative grazing initiatives.

Africa & Middle East

- Africa: Agroecological practices tied to climate resilience projects, supported by NGOs and international development funding.

Policy levers shaping adoption

- Payments for ecosystem services.

- Carbon-market regulations and standardized registries.

- Sustainable public procurement initiatives.

- Research and extension funding.

- Blended finance and transition capital support.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Liquid Packaging Market Revenue, Global Presence, and Strategic Insights by 2034