Liquid Packaging Market Size

Liquid Packaging Market — Growth Factors

The liquid packaging market is being pushed forward by multiple, simultaneous forces: rising consumer demand for ready-to-drink and long-shelf-life beverages (especially in fast-growing markets in Asia-Pacific and Latin America); stronger food-safety and aseptic-packaging needs in dairy and pharma; brand shifts toward lightweight, convenient and on-the-go formats; growing regulatory and retailer pressure for recyclable or renewable-pack solutions (which drives investment in paperboard, mono-polymer and recyclable laminates); innovation in aseptic processing and filling lines that reduce logistics and cold-chain costs; expanding retail penetration and e-commerce (increasing demand for robust, transport-friendly packaging); and cost and supply-chain dynamics pushing converters toward materials and formats that optimise material usage and logistics (e.g., concentrated formats, bag-in-box and recloseable closures).

Together these demand, regulatory, sustainability and manufacturing-technology drivers support steady multi-percent CAGR growth globally while shaping product mix and geographic investment.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2738

What is the liquid packaging market?

The liquid packaging market covers materials, converted packages, filling machinery and related services designed specifically for liquid products — milk, juice, liquid dairy alternatives, edible oils, sauces, liquid pharmaceuticals, personal-care liquids (shampoos, lotions), industrial liquids, and more. Key product formats include: aseptic/gable-top cartons, paperboard cartons with barrier coatings, multi-layer plastic bottles and pouches, bag-in-box systems, drums and IBCs (intermediate bulk containers), and specialized aseptic filling systems. The market spans raw-material producers (paperboard, polymers), converters (carton and bottle makers), equipment suppliers (fillers, sterilizers) and brand owners/retailers.

Why it is important?

Liquid packaging preserves product quality (aseptic cartons and sterilised bottles extend shelf life without preservatives), enables safe global distribution (reducing spoilage and food waste), and supports branding, convenience and regulatory compliance. For manufacturers, the right packaging lowers distribution costs (lighter formats, stackability), reduces returns/spoilage and helps access export markets with differing shelf-life and cold-chain demands. For consumers and policymakers, packaging innovations enable reduced food waste and improved recyclability — a major sustainability and circular-economy priority. Because liquids are sensitive to contamination, oxygen and light, packaging innovation has an outsized effect on public health, greenhouse-gas footprints (through logistics and material substitution) and retail economics.

Liquid Packaging Market — Top Companies

Below are concise profiles for the companies you asked to include: Tetra Pak International S.A., SIG Combibloc Group Ltd., Elopak ASA, Smurfit Kappa Group, Amcor plc. For each: specialization, key focus areas, notable features, 2024 revenue and a note on global presence / footprint.

Tetra Pak International S.A.

Specialization: Aseptic carton packaging and filling systems for dairy, juice and liquid food, plus processing and end-to-end solutions.

Key focus areas: aseptic processing & filling, food-safety engineering, sustainability (recyclable carton solutions, renewable-fiber sourcing), digital services for plant efficiency.

Notable features: long-established market leader in aseptic cartons; integrated approach (packaging + filling lines + services); heavy R&D in food-safety and sustainable material systems.

2024 Revenue: Net sales reported at €12.82 billion (2024).

Market share / positioning: Widely cited as the leading global provider of aseptic carton systems and a dominant player in the liquid food carton segment.

Global presence: Operations and plants in major dairy and beverage regions worldwide; particularly strong in Europe, Latin America and large parts of Asia and Africa.

SIG Combibloc Group Ltd. (SIG)

Specialization: Aseptic carton packs and filling systems focused on beverages and liquid food.

Key focus areas: aseptic carton systems, efficiency in cold-chain reduction, closable formats and sustainability (recyclable fiber-based cartons).

Notable features: strong aseptic expertise, competitive alternative to Tetra Pak; focus on modular filling lines and close collaboration with brand customers.

2024 Revenue: SIG reported approximately €3.3 billion in revenue for FY 2024.

Market share / positioning: Positioned as one of the top-tier carton suppliers globally, often ranked among the top three in aseptic carton market segments.

Global presence: Manufacturing and sales footprint across Europe, the Americas and Asia; strong partnerships with regional beverage companies.

Elopak ASA

Specialization: Pure-Pak carton systems (gable-top and aseptic cartons) and filling machines, with growing focus on sustainable paperboard packaging.

Key focus areas: carton manufacture, filling machines, expansion in the Americas, and strategic moves toward doubling revenue by 2030 with heavier emphasis on replacing single-use plastics.

Notable features: leader in gable-top and aseptic cartons; strong growth in carton volumes and targeted factory expansion.

2024 Revenue: Elopak reported EUR 1,156.6 million (≈€1.16 billion) in group revenues for 2024.

Market share / positioning: A recognized global carton supplier and among the top 3–5 carton manufacturers in food & beverage packaging.

Global presence: Strong in Europe and expanding in the Americas and selected APAC markets.

Smurfit Kappa Group (Smurfit Westrock combination)

Specialization: Corrugated packaging and containerboard solutions; significant influence on liquid packaging supply chains through bag-in-box corrugated solutions and secondary packaging.

Key focus areas: fibre-based packaging, corrugated boxes, sustainability and large-scale global manufacturing.

Notable features: one of the largest global players in fibre-based packaging; strategic merger with WestRock has broadened its product scope and revenue base.

2024 Revenue: Combined net sales in 2024 reported at around US$21.1 billion.

Market share / positioning: Strong leader in fibre/corrugated space; influence on liquid packaging mainly via secondary packaging and integrated customer offerings.

Global presence: Very large footprint across Europe, the Americas, Latin America and growing presence in other regions.

Amcor plc

Specialization: Flexible and rigid plastic packaging, laminated cartons, closures and specialty packaging for food, pharma and consumer goods.

Key focus areas: recyclable mono-materials, lightweighting, barrier films for liquid foods and pharmaceuticals, closures and R&D for circular packaging.

Notable features: diversified portfolio, aggressive M&A, and material innovation.

2024 Revenue: Amcor reported about $13.6 billion in sales for fiscal year 2024.

Market share / positioning: A top-tier global supplier across flexible and rigid liquid packaging formats; often cited alongside carton leaders for beverage and liquid-food packaging solutions.

Global presence: Operations in 40+ countries with a broad plant network across Americas, EMEA and APAC.

Leading trends and their impact

-

Sustainability & circularity: Shifting demand from hard-to-recycle laminates toward recyclable paperboard, mono-polymer and renewable-pack solutions.

-

Aseptic and shelf-life extension: Growth in aseptic carton technologies reduces cold-chain costs and expands product reach.

-

Lightweighting and material substitution: Replacement of heavier glass or multi-layer bottles with cartons, pouches or lightweight plastics.

-

Convenience & format innovation: Resealable spouts, single-serve cartons, pouches and bag-in-box concentrate formats are rising.

-

Digitalisation & Industry 4.0: Smart filling lines, predictive maintenance and traceability adoption across plants.

-

Regional material-policy pressure: Incentives and taxes influencing geographic investments in converting plants.

Successful examples from around the world

-

Tetra Pak’s aseptic expansion in emerging markets — enabled dairy producers to serve wider geographies without costly cold chains.

-

SIG’s modular aseptic lines in Europe and APAC — helped juice brands launch shelf-stable drinks cost-effectively.

-

Elopak’s US expansion — replacing single-use plastic bottles with Pure-Pak cartons.

-

Amcor’s recyclable mono-films and M&A strategy — accelerating rollout of sustainable flexible formats.

-

Smurfit Westrock’s integrated supply chain solutions — improving palletisation efficiency and reducing secondary packaging waste.

Global regional analysis — market dynamics, government initiatives and policies

Asia-Pacific (APAC)

Rapid urbanisation and rising beverage consumption make APAC the fastest-growing market. Governments are piloting extended producer responsibility (EPR) frameworks and plastic-waste management rules, encouraging recyclable cartons and mono-polymer solutions.

Europe

Mature market with high penetration of aseptic cartons. EU Packaging and Packaging Waste Regulation mandates recyclability and recycled content, accelerating adoption of fibre-based systems.

North America

Demand for convenience formats and e-commerce packaging is strong. State-level EPR proposals and bans on certain plastics drive innovation in mono-materials and cartons.

Latin America

High growth in packaged dairy and juice; affordability drives pouch and carton popularity. Government incentives for recycling and public-private collection programs are emerging.

Middle East & Africa (MEA)

Fragmented but growing dairy and fortified drinks markets. Food-safety and waste-reduction rules encourage aseptic cartons and pouches.

Regional policy examples shaping the market

-

EU Packaging and Packaging Waste Regulation (PPWR): mandates recyclability and recycled content.

-

Extended Producer Responsibility (EPR): increasingly adopted in Europe, APAC and North America.

-

National recycling infrastructure incentives: grants and tax incentives in APAC and Europe supporting carton and fibre recycling.

Market structure & competitive notes

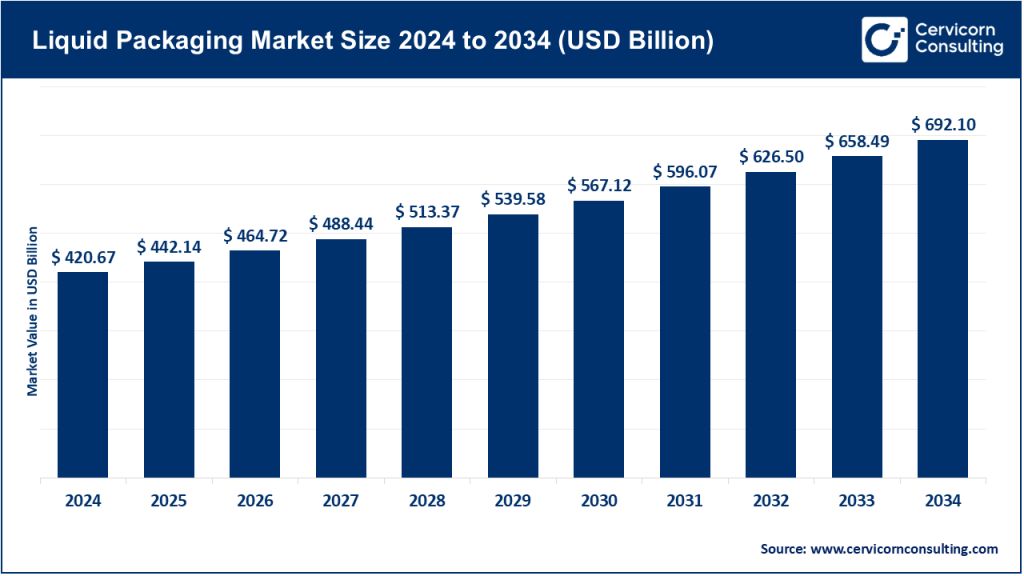

The global liquid packaging market was valued at approximately USD 371.4 billion in 2024, projected to grow steadily over the next decade. Market concentration is highest among aseptic/carton suppliers (Tetra Pak, SIG, Elopak) who dominate carton packaging, while Amcor and Smurfit Westrock lead flexible and corrugated packaging. Fragmentation remains in regional converters, but the top-tier companies drive global innovation and policy alignment.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: India Insurance Market Growth Drivers, Key Players, Trends and Regional Insights by 2034