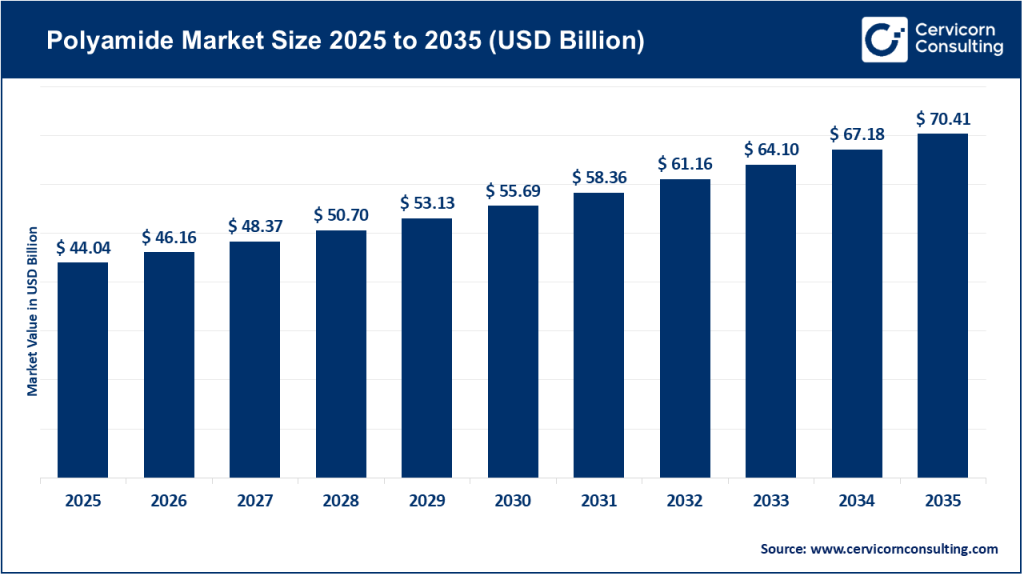

Polyamide Market Size

The global polyamide market size was worth USD 44.04 billion in 2025 and is anticipated to expand to around USD 70.41 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% from 2026 to 2035.

Polyamide Market Growth Factors

The growth of the polyamide market is driven by increasing demand from the automotive sector for lightweight and fuel-efficient components, rapid expansion of the electronics and electrical industries, rising use of high-performance plastics in industrial applications, and growing consumption of synthetic fibers in textiles. Electrification of vehicles, particularly electric vehicles, has accelerated the adoption of heat-resistant and flame-retardant polyamides in battery systems and electronic components. Additionally, urbanization and industrialization in emerging economies, coupled with advancements in polymer engineering, have expanded application scope. Sustainability initiatives, including the development of bio-based and recycled polyamides, further support long-term market growth despite regulatory pressures on conventional chemical manufacturing.

What Is the Polyamide Market?

The polyamide market encompasses the global production, processing, and commercialization of polyamide polymers and compounds. Polyamides are synthetic polymers characterized by repeating amide linkages and include major types such as Nylon 6, Nylon 66, Nylon 11, Nylon 12, and specialty polyamides. These materials are supplied in the form of fibers, resins, films, and compounds tailored for specific performance requirements. The market spans raw material suppliers, resin manufacturers, compounders, and end-use industries, forming a complex and integrated value chain serving both commodity and high-performance applications.

Why the Polyamide Market Is Important

The importance of the polyamide market lies in its ability to support technological advancement, sustainability goals, and industrial efficiency across multiple sectors. Polyamides enable metal replacement in automotive and industrial components, reducing weight and improving energy efficiency. In electronics, they support miniaturization and reliability under high thermal and electrical stress. In textiles, polyamide fibers offer durability, elasticity, and comfort. Furthermore, the development of bio-based and recycled polyamides aligns with global environmental objectives, making the material critical not only for performance but also for achieving circular economy goals.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2882

Key Companies in the Polyamide Market

BASF SE

Specialization:

Engineering plastics, performance materials, specialty polyamides

Key Focus Areas:

Automotive lightweight components, electrical and electronics, industrial applications, sustainable materials

Notable Features:

BASF is one of the world’s largest chemical companies with a strong polyamide portfolio under well-known product families. The company emphasizes innovation, customized material solutions, and low-carbon polyamide grades.

2024 Revenue:

Approximately €65 billion (total company revenue)

Market Share:

BASF holds a leading position in the global polyamide market and is a major contributor to the bio-based polyamide segment.

Global Presence:

Operations and production facilities across Europe, North America, Asia Pacific, South America, and the Middle East.

DuPont de Nemours, Inc.

Specialization:

Engineered materials and high-performance polymers

Key Focus Areas:

Automotive systems, electronics, industrial machinery, advanced engineering plastics

Notable Features:

DuPont leverages deep R&D capabilities to deliver polyamide solutions designed for extreme thermal and mechanical environments.

2024 Revenue:

Approximately USD 12.4 billion (total company revenue)

Market Share:

A significant player in the global engineering plastics and specialty polyamide segment.

Global Presence:

Manufacturing, research, and customer support operations across North America, Europe, and Asia.

Royal DSM N.V. (DSM-Firmenich)

Specialization:

Specialty materials and engineering plastics

Key Focus Areas:

Automotive, medical devices, electronics, sustainable polymer solutions

Notable Features:

DSM emphasizes innovation, sustainability, and advanced material science, integrating polyamides into high-value applications.

2024 Revenue:

Approximately €12.8 billion

Market Share:

Strong presence in specialty and high-performance polyamide applications.

Global Presence:

Active in over 60 countries with a diversified manufacturing and R&D footprint.

Evonik Industries AG

Specialization:

Specialty chemicals and high-performance polyamides

Key Focus Areas:

Automotive, consumer goods, industrial and high-tech applications

Notable Features:

Evonik is known for advanced polyamide brands and customized solutions, including bio-based and recycled grades.

2024 Revenue:

Approximately €15.2 billion

Market Share:

A major contributor to specialty polyamide markets globally.

Global Presence:

Operations in more than 100 countries with production sites across Europe, Asia, and the Americas.

Arkema S.A.

Specialization:

Specialty and bio-based polyamides

Key Focus Areas:

Automotive fuel systems, electronics, optics, advanced materials

Notable Features:

Arkema is a pioneer in bio-based polyamides and focuses strongly on sustainable, high-performance materials.

2024 Revenue:

Approximately €9.5 billion

Market Share:

A leading player in specialty and bio-based polyamide segments.

Global Presence:

Manufacturing and commercial operations in over 55 countries worldwide.

Leading Trends and Their Impact on the Polyamide Market

Sustainability and Bio-Based Materials

The shift toward sustainability is reshaping the polyamide market. Manufacturers are investing in bio-based feedstocks and recycled polyamides to reduce carbon footprints and meet regulatory requirements. This trend enhances brand value and enables compliance with global environmental standards.

Automotive Electrification

Electric vehicles require materials with high thermal stability, flame resistance, and mechanical strength. Polyamides are increasingly used in battery housings, connectors, cooling systems, and structural components, driving consistent demand growth.

Electronics Miniaturization

As electronics become smaller and more powerful, demand for advanced polyamides with superior dielectric and thermal properties increases. This trend supports growth in specialty polyamide grades.

Industrial and Additive Manufacturing

Polyamides are gaining traction in industrial automation and 3D printing due to their strength, flexibility, and design freedom, opening new revenue streams for manufacturers.

Successful Examples of Polyamide Market Applications Around the World

Automotive Lightweighting in Europe and Asia

Automotive manufacturers in Germany, Japan, and South Korea extensively use polyamide components to replace metal parts, reducing vehicle weight and improving fuel efficiency and emissions performance.

Bio-Based Polyamide Adoption in Europe

European industries are leading the adoption of bio-based polyamides in consumer products and automotive applications to meet strict sustainability and emissions regulations.

Technical Textiles Growth in Asia Pacific

Countries such as China and India are witnessing strong demand for polyamide fibers in sportswear, industrial fabrics, and protective clothing, driven by urbanization and rising consumer incomes.

Global Regional Analysis and Government Initiatives

Asia Pacific

Asia Pacific dominates the global polyamide market due to strong manufacturing activity, automotive production, electronics assembly, and government support for industrial development. Policies promoting domestic manufacturing, export growth, and infrastructure development continue to drive demand.

North America

North America benefits from strong R&D ecosystems and government incentives supporting electric vehicles, advanced manufacturing, and sustainable materials. Environmental regulations encourage innovation in recycled and bio-based polyamides.

Europe

Europe’s polyamide market is shaped by stringent environmental regulations and circular economy policies. Government initiatives focused on carbon neutrality and sustainable manufacturing encourage adoption of specialty and bio-based polyamides.

Latin America, Middle East & Africa

These regions represent emerging growth opportunities, supported by industrialization, infrastructure projects, and expanding automotive assembly. Governments are increasingly aligning policies with global quality and sustainability standards, supporting long-term market development.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: AI in Cybersecurity Market Revenue, Trends, and Strategic Insights by 2035