AI in Cybersecurity Market Size

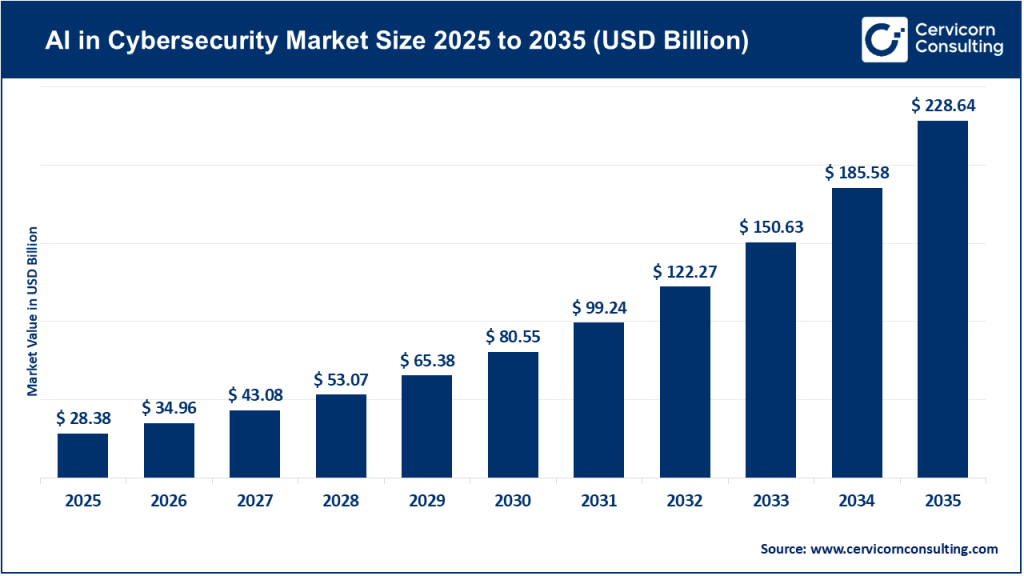

The global AI in cybersecurity market size was worth USD 28.38 billion in 2025 and is anticipated to expand to around USD 228.64 billion by 2035, registering a compound annual growth rate (CAGR) of 23.2% from 2026 to 2035.

What Is the AI in Cybersecurity Market?

The AI in cybersecurity market refers to the ecosystem of technologies, products, and services that leverage artificial intelligence, machine learning, deep learning, and related cognitive computing disciplines to strengthen cybersecurity defenses. These AI-driven solutions are designed to augment or replace traditional security tools by offering enhanced capabilities such as behavioral analytics, real-time anomaly detection, automated response orchestration, threat intelligence synthesis, and predictive risk modeling. Unlike conventional signature-based solutions, AI cybersecurity platforms continuously learn from historical and real-time data, enabling them to recognize patterns, anticipate novel attack methods, and respond to threats with greater speed and accuracy.

Use cases range from AI-powered Security Operations Centers (SOCs) that prioritize and contextualize alerts, to autonomous agents that mitigate threats at machine speed across cloud workloads, endpoints, and networks. As cyberattacks become increasingly automated and sophisticated, AI systems are essential for scaling defenses and reducing manual intervention by human analysts.

Growth Factors for the AI in Cybersecurity Market

The AI in cybersecurity market is expanding swiftly due to a combination of rising cyber threats and the adoption of digital transformation technologies, which have increased vulnerabilities across cloud, network, endpoint, and IoT environments; continuous innovation in machine learning and behavioral analytics that enables proactive threat detection and automated incident response; stringent regulatory requirements for data protection that mandate advanced security controls.

The integration of AI capabilities with existing security infrastructure to enhance efficiency and effectiveness; strategic collaborations and partnerships among hardware, software, and cloud providers to build scalable AI-driven solutions; and the growing demand for predictive analytics and autonomous security operations that can operate at machine speed to mitigate risk, all of which propel broader market penetration across enterprise sectors and geographic regions.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2872

Why Is the AI in Cybersecurity Market Important?

AI in cybersecurity has become vital due to the dramatic rise in cybercrime, ransomware, state-sponsored hacks, supply chain attacks, and sophisticated fraud schemes that exploit vulnerabilities in digital infrastructure. The ever-growing volume of data generated by enterprise systems—and the limited capacity of human security teams to monitor and analyze it—means that AI is no longer an optional enhancement, but a business imperative. AI empowers organizations to transition from reactive to proactive security postures, identifying threats before they cause damage and reducing mean time to detect (MTTD) and mean time to respond (MTTR).

Furthermore, AI enables security technologies to scale in line with cloud adoption, hybrid work models, and edge computing architectures. Regulatory requirements in many jurisdictions also demand demonstrable risk mitigation and data protection strategies, pushing organizations to adopt advanced AI-enabled tools to achieve compliance and safeguard customer trust.

Company Profiles: AI Cybersecurity Market Leaders

Below are detailed profiles of five major companies shaping the AI in cybersecurity landscape:

1. NVIDIA Corporation

- Specialization: High-performance AI hardware and AI acceleration platforms used for cybersecurity data processing and analytics.

- Key Focus Areas: GPU-accelerated threat detection, real-time analytics, AI integration frameworks for security vendors, and support for autonomous AI agents that detect and respond to threats.

- Notable Features: NVIDIA GPUs enable high-throughput data processing critical to large AI models used in cybersecurity tasks. The company also provides AI software stacks and generative AI support that help vendors build intelligent security tools.

- 2024 Revenue & Market Share: While NVIDIA’s core revenue is driven by its AI compute business (not purely cybersecurity), its GPU and AI platform segments are crucial enablers for many cybersecurity solutions.

- Global Presence: Worldwide hardware and software footprint with customers across enterprise, cloud, and government sectors; partnerships with cybersecurity vendors.

2. Intel Corporation

- Specialization: CPU and AI acceleration hardware with embedded security features; AI frameworks for data protection and integrated hardware-based threat defenses.

- Key Focus Areas: AI-enabled endpoint security, silicon-level defenses, machine learning frameworks designed for safer AI deployment in enterprise environments.

- Notable Features: AI in cybersecurity strategy to provide defense-in-depth, device-level monitoring, and visibility into anomalies before they escalate.

- 2024 Revenue & Market Share: A global leader in semiconductors with significant AI and security R&D spending, though specific cybersecurity revenue is part of broader AI and data center segments.

- Global Presence: Presence in major global markets with manufacturing and R&D across multiple regions; partnerships with hardware and AI ecosystem players.

3. CrowdStrike Holdings

- Specialization: Endpoint protection, cloud workload security, and AI-driven threat intelligence.

- Key Focus Areas: AI-powered endpoint detection and response (EDR), proactive threat hunting, and real-time security analytics across devices and cloud assets.

- Notable Features: CrowdStrike’s Falcon platform uses continuous machine learning to detect and prevent known and unknown threats. It also integrates global threat intelligence to anticipate emerging attack patterns.

- 2024 Revenue: Approximately $3.06 billion in 2024 with continued growth into 2025.

- Market Share & Presence: A major cybersecurity vendor with strong market share in endpoint security and expanding global footprint, especially in North America and Europe.

4. Palo Alto Networks

- Specialization: Unified cybersecurity platform including AI-driven network security, cloud security, and threat analytics.

- Key Focus Areas: Comprehensive AI-enhanced security operations through products like Cortex XDR, XSIAM, and advanced automation.

- Notable Features: Broad platform strategy with real-time, AI-enabled threat detection and automated SOC response capabilities.

- 2024/2025 Revenue: Strong performance with revenues hitting multi-billion figures—around $9.14–$9.19 billion for fiscal 2025 and projected to exceed $10 billion in fiscal 2026.

- Market Share & Presence: One of the largest pure-play cybersecurity companies worldwide with a diversified customer base and strong global reach.

5. Fortinet, Inc.

- Specialization: Network security and integrated AI-driven protections across firewalls, secure access, and endpoint systems.

- Key Focus Areas: Secure Access Service Edge (SASE), AI-enhanced threat detection, security fabric integrations.

- Notable Features: Fortinet’s Security Fabric incorporates ML to analyze traffic patterns, detect anomalies, and automate policy adjustments.

- 2024/2025 Revenue: Reported revenue forecasts in the $6.65–$6.85 billion range for 2025, reflecting strong market demand.

- Market Share & Presence: Robust global footprint, particularly in enterprise and service provider markets with strong presence in North America, EMEA, and APAC.

Leading Trends and Their Impact

1. Autonomous AI Agents

Enterprises are increasingly deploying autonomous AI agents that detect threats and respond without human intervention. These agents leverage continuous learning to adapt to evolving attack methods and significantly reduce response times. Collaboration between hardware and cybersecurity vendors to build interoperable agent frameworks is gaining traction.

2. Integration with SOC Workflows

AI-driven guided response tools are transforming security operations centers by prioritizing incidents, reducing false positives, and providing context-aware recommendations, which increases efficiency across global SOC teams.

3. Convergence of AI and Cloud Security

Cloud-native architectures now incorporate AI at every layer of the security stack, enhancing threat visibility across distributed workloads, enabling faster anomaly detection, and automating cloud compliance checks.

4. Predictive and Behavioral Analytics

AI systems analyze vast datasets to detect unusual patterns and predict attacks before they occur. This trend has reshaped investments, with budget allocations shifting toward predictive AI analytics and risk forecasting solutions.

Successful Examples of AI in Cybersecurity Around the World

1. Government AI Cyber Defenses — Europe & U.S.

Major governments have allocated significant funds for AI-powered cybersecurity initiatives to protect critical infrastructure and national security data. These initiatives highlight the strategic importance governments place on AI defenses and public safety in cyberspace.

2. Enterprise Sector: AI-Driven Fraud Detection

Financial institutions across North America and Europe now employ AI systems that analyze transaction behavior in real time, dramatically cutting down fraud losses and strengthening regulatory compliance frameworks.

3. Industry Implementations: Manufacturing and IoT Security

Manufacturers are using AI models to monitor IoT sensor data and detect anomalies indicative of cybersecurity breaches, thereby protecting production lines and intellectual property from sophisticated attacks.

Global Regional Analysis Including Government Initiatives and Policies

North America

North America remains the largest and most advanced market, accounting for roughly 30–40% of global AI cybersecurity revenue. The region’s dominance is driven by high cybersecurity awareness, extensive cloud adoption, and significant private and public sector investments in AI and security research and development.

Government initiatives in the U.S., including federal cybersecurity strategies and funding for AI research, are reshaping the ecosystem, fostering innovation between private cybersecurity firms and national agencies.

Europe

Europe has a strong focus on data protection and compliance, driven by stringent data privacy frameworks and national cybersecurity strategies that promote AI adoption for threat detection and incident reporting. Coordinated funding and policy frameworks aim to build resilient digital infrastructures and harmonize cross-border security enforcement.

Asia-Pacific

Asia-Pacific is one of the fastest-growing regions due to rapid digitalization, the proliferation of mobile and cloud services, and escalating cyber threats. Governments in India, China, Japan, and South Korea are launching national cybersecurity strategies that emphasize AI-driven defenses and public-private collaboration to secure growing digital economies. Adoption is particularly high in sectors such as telecom, e-commerce, and finance.

Latin America and Middle East & Africa

Although currently smaller in overall share, these regions are rapidly increasing their adoption of AI cybersecurity solutions. Government programs and partnerships with global vendors aim to enhance national cyber resilience, with policy frameworks encouraging investment in next-generation security technologies.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: India Battery Energy Storage System Market Revenue, Trends, and Strategic Insights by 2035