Pharmaceutical REMS Market Size

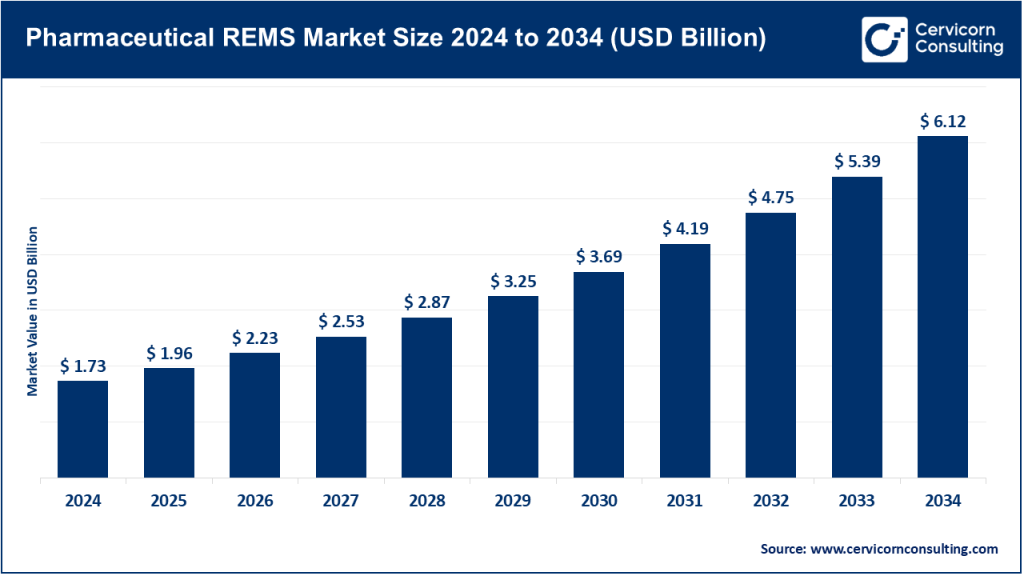

The global pharmaceutical REMS market size was worth USD 1.73 billion in 2024 and is anticipated to expand to around USD 6.12 billion by 2034, registering a compound annual growth rate (CAGR) of 13.64% from 2025 to 2034.

Pharmaceutical REMS Market Growth Factors

The pharmaceutical REMS market is driven by a combination of key growth factors: the increased use of high-risk specialty drugs such as oral oncology agents and opioids that require close monitoring; tightening regulatory oversight globally, particularly in the U.S. and EU; technology advancements like digital compliance platforms and patient registries that improve REMS implementation; a growing emphasis on patient safety and advocacy; increased legal and reputational risks for pharmaceutical firms; and the globalization of drug development and distribution that necessitates uniform risk-mitigation frameworks. These forces collectively reinforce the need for robust, scalable REMS programs and technologies, ensuring ongoing market expansion.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2657

What Is the Pharmaceutical REMS Market?

Risk Evaluation and Mitigation Strategies (REMS) are safety protocols mandated primarily by regulators such as the U.S. Food and Drug Administration (FDA) to ensure that the benefits of certain medications outweigh their potential risks. They are most commonly required for drugs with serious safety concerns such as teratogenicity, risk of abuse, or severe side effects.

The pharmaceutical REMS market encompasses the ecosystem of services, platforms, consulting firms, software tools, and network partners that design, implement, manage, audit, and support these REMS programs. It includes:

- Electronic platforms for provider training, certification, and documentation

- Digital patient registries and monitoring tools

- Data analytics solutions for REMS effectiveness evaluation

- Clinical and pharmacy networks for compliant drug distribution

- Consulting services focused on REMS design and regulatory compliance

Why Is It Important?

REMS programs are essential for ensuring drug safety, particularly for therapies with significant potential side effects or misuse potential. Their importance is driven by several critical needs:

- Patient Safety: REMS helps reduce the risk of serious adverse events through education, monitoring, and safe-use protocols.

- Access to Therapies: REMS allow high-risk drugs to be approved and prescribed under controlled conditions, enabling patients to benefit from powerful therapies that might otherwise be unavailable.

- Regulatory Compliance: Pharma companies must meet strict regulatory requirements to market certain drugs, and REMS provides the structured framework for doing so.

- Litigation Risk Mitigation: By maintaining detailed REMS documentation and proactive risk control, manufacturers reduce their exposure to legal liabilities.

- Market Trust: Strong REMS programs can bolster confidence among physicians, patients, and insurers in adopting new or controversial therapies.

Pharmaceutical REMS Market – Top Companies

Here’s a detailed snapshot of the leading pharmaceutical companies actively participating in the REMS market, their key strengths, focus areas, notable features, estimated 2024 revenue, and global footprint:

| Company | Specialization | Key REMS Focus Areas | Notable Features | 2024 Revenue (Est.) | Global Presence |

|---|---|---|---|---|---|

| Pfizer | Oncology, vaccines, rare disease | Provider certification, patient monitoring for drugs like isotretinoin and oncology therapies | Deep integration with healthcare IT platforms and global drug registries | ~$58.5 billion | U.S., EU, APAC, Latin America |

| Johnson & Johnson | Immunology, oncology, CNS | Injectable biologics, REMS for teratogenic and immunosuppressive drugs | On-site safety programs, nurse/pharmacy networks | ~$54.8 billion | U.S., Canada, EU, Japan, emerging markets |

| AbbVie | Immunology, oncology | Infection risk management, JAK inhibitors, hormone-related therapies | Robust digital dashboards, EMR integration, digital adherence tracking | ~$56 billion | North America, Europe, Asia |

| Merck & Co. | Oncology, vaccines, diabetes | Registry-based REMS for Keytruda and biosimilars | Predictive analytics, remote patient monitoring, digital dashboards | ~$50 billion | Global |

| Roche | Oncology, neurology | REMS for multiple sclerosis and biologics | Integration with infusion management tools, AI-driven risk models | ~$68 billion (including diagnostics) | Europe, U.S., APAC, LATAM |

Leading Trends and Their Impact

1. Digitization of REMS

The move to digital REMS platforms is transforming how these programs are implemented and monitored. Automation enables:

- Easier provider certification

- Faster communication of updates

- Streamlined patient and pharmacist education

- Centralized dashboards for regulators and sponsors

2. Integration with AI & Data Analytics

Companies are embedding machine learning and AI tools to:

- Monitor patient adherence

- Detect emerging safety signals early

- Optimize REMS protocol modifications based on historical data

- Perform trend analyses to identify geographic or demographic risks

3. Global Harmonization

With the globalization of pharmaceutical supply chains, companies are building REMS programs that can scale across regulatory environments. Harmonized frameworks in the U.S., EU, and Japan allow pharma firms to implement base REMS with regional compliance adjustments.

4. Patient-Centered Enhancements

Modern REMS programs increasingly focus on patient engagement. Tools now include:

- Mobile apps for medication tracking

- SMS/email reminders for follow-up appointments or lab tests

- Patient portals with personalized risk education

5. Outsourcing & Strategic Partnerships

Pharma companies are partnering with Contract Research Organizations (CROs), software vendors, and certified pharmacy/clinic networks to operationalize REMS. This outsourcing model helps scale programs cost-effectively and improves time-to-market.

6. Outcome-Based REMS

Regulators are demanding more evidence of REMS effectiveness. This includes quantifiable metrics such as reduced adverse events, improved lab compliance, and reduced misuse rates. It forces companies to build in data collection and evaluation mechanisms from the start.

Global REMS Case Studies

United States: iPLEDGE for Isotretinoin

Among the most famous REMS programs, iPLEDGE monitors isotretinoin (Accutane) prescriptions to prevent birth defects. It requires patient registration, pregnancy tests, provider certification, and monthly reauthorization.

Europe: Thalidomide RMP

EU mandates Risk Management Plans for teratogenic drugs like thalidomide. This includes restricted distribution, patient education, and certification before dispensing.

Japan: Ocrelizumab & Controlled Infusion

The Japanese regulatory body requires careful infusion protocols and registry tracking for drugs like Ocrelizumab. The REMS is supported by specialized hospital systems and risk communication tools.

Canada: Oral Chemotherapies

Canada’s risk minimization program includes national provider training and certification before prescribing oral chemotherapies, helping standardize oncology practices.

India: REMS-Style Systems Emerging

India has been integrating REMS-like controls for export-bound high-risk generics. Programs include drug-specific monitoring and quality certifications tied to international regulations.

Regional Policy Landscape and Market Outlook

North America

- The FDA requires REMS under legal frameworks introduced in the 2007 FDA Amendments Act

- The U.S. remains the largest REMS market due to its high number of specialty drugs, comprehensive regulatory framework, and use of real-world data

- Canada has aligned its policies with the U.S. and Europe to facilitate easier REMS adoption for shared markets

Europe

- The EMA mandates risk management plans (RMPs) for high-risk drugs and increasingly emphasizes digital RMP documentation

- Countries like Germany and France are integrating REMS into electronic prescribing and dispensing platforms

Asia-Pacific

- Japan, South Korea, and Australia maintain high REMS-style regulation for specialty drugs

- China is ramping up post-market surveillance and has begun issuing REMS-like guidance for complex biologics and cancer treatments

- India’s REMS evolution is driven by its role as a major global generics producer. It is investing in pharmacovigilance and compliance infrastructure for international market access

Latin America

- Brazil has launched pilot REMS programs, particularly in oncology and endocrinology

- Other countries such as Mexico and Argentina are beginning to explore REMS-like programs for biological drugs

Middle East and Africa

- Countries in this region are in early stages but are increasingly integrating pharmacovigilance and REMS components as part of international regulatory harmonization

- The growth of cancer and chronic disease treatments is accelerating REMS adoption

India: A REMS Transformation in Progress

India’s pharmaceutical industry is the third largest by volume globally. As the country increases exports to stringent markets, especially the U.S. and EU, REMS compliance is becoming vital. Recent trends include:

- Government subsidies for WHO-GMP and risk-based pharmacovigilance systems

- Investments in digital platforms that support REMS tracking and reporting

- Academic training programs for regulatory affairs and REMS implementation

- REMS support systems bundled into clinical trial management software

India’s transformation positions it as both a consumer and exporter of REMS-compliant medicines.

Summary Table: Key Drivers by Region

| Region | Primary Drivers | Maturity Level |

|---|---|---|

| North America | Regulatory mandates, tech adoption, specialty drug market | High |

| Europe | Digital RMP frameworks, EMA harmonization | High |

| Asia-Pacific | Export-driven compliance, biologic expansion | Medium-High |

| Latin America | Oncology focus, pilot programs | Medium |

| Middle East & Africa | Public health campaigns, global integration | Low-Medium |

Notable Industry Developments

- Major pharmaceutical companies are launching dedicated REMS business units

- Several AI-powered REMS software solutions have emerged in the U.S., offering predictive safety monitoring

- Academic collaborations (e.g., pharma-university partnerships) are leading to REMS training certifications

- M&A activity is increasing among clinical research organizations to build REMS capabilities

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Medical Isotopes Market Size to Hit USD 14.23 Billion by 2034