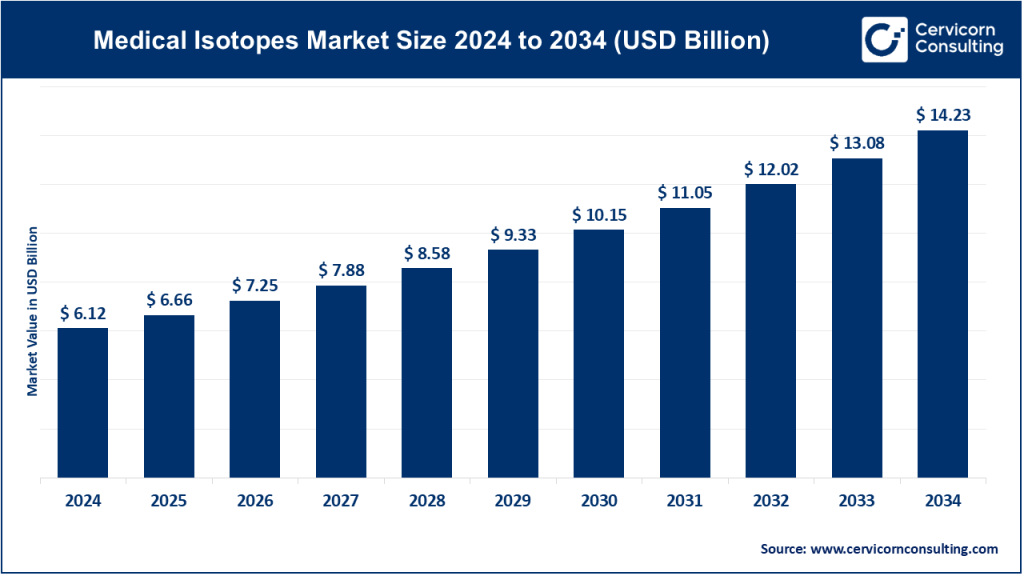

Medical Isotopes Market Size

The global medical isotopes market size was worth USD 6.12 billion in 2024 and is anticipated to expand to around USD 14.23 billion by 2034, registering a compound annual growth rate (CAGR) of 8.80% from 2025 to 2034.

What is the Medical Isotopes Market?

The medical isotopes market encompasses the production, distribution, and application of radioactive isotopes used for diagnostic and therapeutic purposes in healthcare. Medical isotopes, also known as radionuclides, are atoms with unstable nuclei that emit radiation. These isotopes are integral to nuclear medicine, used extensively in procedures such as positron emission tomography (PET), single-photon emission computed tomography (SPECT), and targeted radiotherapy. The market includes a variety of isotopes such as Technetium-99m, Iodine-131, Cobalt-60, Fluorine-18, and Lutetium-177, among others.

Why Is the Medical Isotopes Market Important?

Medical isotopes serve as a cornerstone in modern medical diagnostics and cancer treatment. With rising incidences of oncological and cardiovascular diseases, nuclear medicine offers highly accurate, non-invasive, and cost-effective diagnostic solutions. Over 40 million nuclear medicine procedures are performed annually worldwide, and the demand is rising rapidly. Therapeutic isotopes like Iodine-131 help treat thyroid cancer, while diagnostic isotopes such as Technetium-99m assist in identifying cardiovascular, skeletal, and neurological conditions. Moreover, innovations in theranostics—combining therapy and diagnostics—are revolutionizing personalized treatment. In essence, medical isotopes are pivotal to early disease detection, targeted therapy, and improving patient outcomes.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2654

Growth Factors Driving the Medical Isotopes Market

The medical isotopes market is growing robustly due to several interlinked factors. Rising cancer prevalence, increasing adoption of targeted radiotherapy, expanding geriatric population, and demand for advanced diagnostic tools drive market expansion. Significant technological advancements in cyclotron and nuclear reactor infrastructure, supportive government policies, and investments in radio-pharmaceutical research are propelling the market. The emergence of theranostics, growing applications in neurology and cardiology, increasing use of SPECT and PET imaging, and regional expansions in Asia-Pacific and Latin America also contribute to market growth. Additionally, global supply chain improvements, public-private partnerships, and streamlined isotope production protocols ensure sustainable and scalable market development.

Medical Isotopes Market Top Companies

Here’s a detailed overview of key players in the global medical isotopes market:

1. Isotopen Technologien München (ITM)

- Specialization: Targeted radionuclide therapies and diagnostics

- Key Focus Areas: Theranostic isotope production (Lutetium-177), supply chain innovations, radiopharmaceutical development

- Notable Features: Vertical integration, GMP-compliant manufacturing, and logistics partnerships for isotope transport

- 2024 Revenue: Estimated at USD 410 million

- Market Share: Approximately 7.5% of the global market

- Global Presence: Operates across Europe, North America, and expanding rapidly into Asia-Pacific

2. Mallinckrodt Pharmaceuticals

- Specialization: Diagnostic imaging agents and radiopharmaceuticals

- Key Focus Areas: Production of Technetium-99m generators, Iodine isotopes, and bulk radioisotopes

- Notable Features: One of the largest global suppliers of medical isotopes; established reactor partnerships

- 2024 Revenue: Estimated at USD 1.2 billion (radiopharma segment)

- Market Share: Holds around 21% of the global market

- Global Presence: Strong footprint in North America, Europe, and Middle East

3. Eczacıbaşı-Monrol Nuclear Products

- Specialization: Radiopharmaceutical production and radiotracer development

- Key Focus Areas: PET radiopharmaceuticals, local cyclotron operations, and supply chain optimization in emerging markets

- Notable Features: Advanced regional logistics hubs; strong R&D collaborations with academic centers

- 2024 Revenue: Estimated at USD 130 million

- Market Share: Roughly 2.4% globally

- Global Presence: Dominant in Turkey, Eastern Europe, Middle East, and North Africa

4. Canadian Nuclear Laboratories (CNL)

- Specialization: Medical isotope research, development, and nuclear reactor-based production

- Key Focus Areas: Molybdenum-99 (Mo-99) production, innovation in isotope delivery systems, strategic nuclear science initiatives

- Notable Features: Historic role in global Mo-99 supply; close government collaboration; isotope recovery technologies

- 2024 Revenue: Estimated at USD 290 million (nuclear medicine division)

- Market Share: About 5.2% globally

- Global Presence: Core operations in Canada, partnerships in USA, UK, and Asia

5. Curium

- Specialization: Diagnostic and therapeutic radiopharmaceuticals

- Key Focus Areas: High-purity PET/SPECT tracers, radiolabeled therapies, and advanced radiochemistry platforms

- Notable Features: World’s largest nuclear medicine company by procedure volume; centralized manufacturing hubs

- 2024 Revenue: Estimated at USD 1.4 billion

- Market Share: Estimated 24%, making it the global leader

- Global Presence: Active in over 70 countries, robust network across Europe, Americas, and Asia

Leading Trends and Their Impact

1. Theranostics Expansion

The convergence of diagnostics and therapeutics—theranostics—has created personalized treatment pathways, particularly in oncology. Isotopes like Lutetium-177 and Actinium-225 are being used in radioligand therapy for prostate and neuroendocrine cancers, fueling market demand.

2. Cyclotron Adoption Over Reactors

Compact cyclotrons are replacing nuclear reactors for producing isotopes such as Fluorine-18, ensuring on-demand and localized production, reducing dependency on aging reactors, and mitigating supply chain risks.

3. Government-Backed R&D and Subsidies

Governments are offering grants, tax credits, and regulatory fast-tracks for radioisotope research and infrastructure, particularly in North America and Europe, fostering innovation and market security.

4. Private-Public Partnerships (PPPs)

Collaborations between government labs and private firms (e.g., Mallinckrodt + U.S. DOE) are improving isotope accessibility and affordability, especially for underserved markets.

5. Digital Integration and AI in Nuclear Medicine

AI-enhanced image reconstruction, dose optimization algorithms, and integration of medical isotopes with digital twin patient models are reshaping how nuclear medicine is delivered and personalized.

Successful Global Examples of Medical Isotope Use

Netherlands: NRG Petten Reactor

The High Flux Reactor (HFR) in Petten supplies over 60% of Europe’s medical isotopes. It is critical for Mo-99 production and sets standards in reactor-based isotope reliability and regional coordination.

United States: NorthStar Medical Radioisotopes

NorthStar’s accelerator-based Mo-99 production technique received FDA approval and transformed U.S. self-sufficiency, reducing reliance on foreign sources and stabilizing isotope availability nationwide.

India: BRIT (Board of Radiation & Isotope Technology)

Operated under the Department of Atomic Energy, BRIT provides affordable isotopes to hospitals across India. It plays a crucial role in rural diagnostics and low-cost cancer treatment options.

South Korea: KAERI

Korea Atomic Energy Research Institute has advanced production of radiopharmaceuticals and integrated them into national health programs, significantly improving access to nuclear medicine in East Asia.

Global Regional Analysis: Government Initiatives and Policies Shaping the Market

North America

- United States: The U.S. Department of Energy (DOE) and National Nuclear Security Administration (NNSA) have prioritized domestic Mo-99 production through non-HEU (Highly Enriched Uranium) means. The FDA’s fast-track approvals and funding to firms like SHINE Medical Technologies and NorthStar have revitalized local production.

- Canada: CNL and Nordion are leading the transition from reactor-based isotope generation to cyclotron models. Government support for research at Chalk River Labs is a cornerstone of Canada’s strategy.

Europe

- Germany, Netherlands, and France dominate reactor-based isotope production. The European Commission’s SAMIRA Action Plan (Strategic Agenda for Medical Ionising Radiation Applications) ensures policy harmonization, sustainability, and funding for radiopharmaceutical innovation.

- UK: Post-Brexit, the UK is investing in independent isotope production capabilities and forming international supply chain pacts.

Asia-Pacific

- India: The Department of Atomic Energy ensures state-subsidized isotope supply through BRIT and BARC. India is also exporting isotopes to neighboring countries.

- China: Accelerated hospital construction and investment in radiopharmaceutical manufacturing have placed China as a growing regional force. The government encourages local isotope cyclotron units within cancer care centers.

- Japan: Emphasizing innovation, Japan is exploring alpha-emitting isotopes and integrating medical isotopes with AI-based diagnostics.

Latin America

Countries like Brazil and Argentina are investing in national cyclotron facilities and training centers to reduce import dependence. Regional organizations like ARCAL (Regional Cooperation Agreement) provide technical assistance and resource sharing.

Middle East and Africa

South Africa’s SAFARI-1 reactor historically played a key role in global Mo-99 supply. Government plans to modernize it and boost isotope production are underway. Israel is also emerging as a niche innovator in radiopharmaceutical R&D. However, access and affordability remain key challenges across the African continent, mitigated in part by IAEA-led initiatives.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Injection Pen Market Size Worth USD 92.36 Billion by 2034