Passenger Cars Market Size

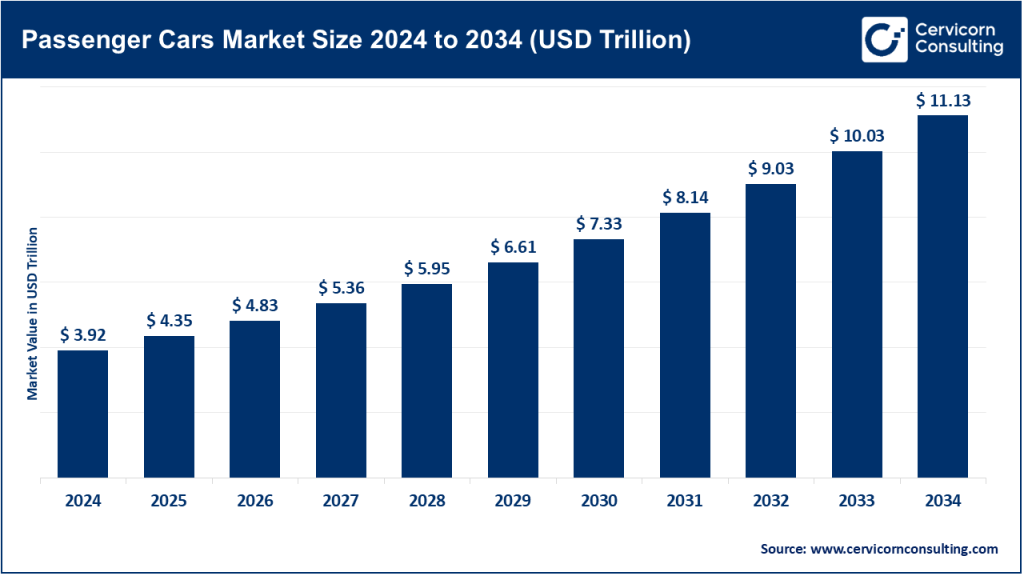

The global passenger cars market size was worth USD 3.92 trillion in 2024 and is anticipated to expand to around USD 11.13 trillion by 2034, registering a compound annual growth rate (CAGR) of 16.10% from 2025 to 2034.

1. What Is the Passenger Cars Market?

The passenger cars market involves the design, manufacture, distribution, and sale of motor vehicles primarily used for transporting passengers. This includes a wide range of vehicles such as hatchbacks, sedans, SUVs, crossovers, compact cars, and electric vehicles (EVs). It is one of the largest global industries, serving both consumer and fleet segments across economy and luxury categories.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2655

2. Why Is the Passenger Cars Market Important?

- Economic Driver: Valued at approximately USD 1.73 trillion in 2024, the market forms a major part of the global economy.

- Employment Generator: Millions of jobs are supported across manufacturing, sales, logistics, finance, and aftermarket services.

- Mobility Enabler: Passenger cars are critical for personal mobility, especially in regions with limited public transit.

- Innovation Engine: Automotive advances fuel innovations in AI, connectivity, electrification, and materials.

- Environmental Stakeholder: The sector is central to climate action, as governments and companies aim to reduce emissions through EVs and fuel efficiency improvements.

3. Market Growth Factors

The passenger car market is being fueled by rising middle-class incomes, urbanization, easier vehicle financing, and technological evolution. Electrification, autonomous driving, digital connectivity, and demand for safety features are rapidly transforming consumer preferences. Regulatory pressure on emissions, along with government subsidies for EVs, is also accelerating adoption. Infrastructure development, increasing environmental awareness, and changing ownership models are further driving market expansion. Asia-Pacific continues to lead growth, thanks to a burgeoning urban population and increased production capabilities.

4. Market Size & Forecast

- 2024 Market Value: ~USD 1.73 trillion

- Forecast CAGR (2024–2034): 5.6%–7.8%

- 2034 Market Size Projection: USD 2.99 – 3.98 trillion

Regional Highlights:

- Asia Pacific: Largest market (~62% share); led by China and India

- North America: Rapid growth (~19–20% CAGR), strong EV adoption

- Europe: Strong policy support for EV transition

5. Top Companies in the Passenger Car Market

Ford Motor Company

- Focus: Mass-market ICE & EVs (e.g., Mustang Mach-E, F-150 Lightning)

- Strategy: Electrification roadmap targeting 50% EV sales by 2030

- 2024 Revenue: ~USD 158 billion

- Global Presence: Strong in North America, expanding in Europe and Asia

General Motors (GM)

- Focus: ICE and EV (Ultium platform for EVs)

- Strategy: All-EV transition by 2035 for core brands

- 2024 Revenue: ~USD 187 billion

- Global Presence: Strong in North America and China

AUDI AG

- Focus: Premium ICE, EVs (e-tron series)

- Strategy: Expanding EV lineup; luxury digital experience

- 2024 Revenue: ~EUR 60 billion

- Global Presence: Europe, China, North America

Kia Motors Corporation

- Focus: ICE, hybrid, and electric vehicles

- Strategy: Cost-effective EVs, smart features, emerging market growth

- 2024 Revenue: ~USD 57 billion

- Global Presence: Korea, India, Europe, Americas

Groupe Renault

- Focus: ICE, hybrid, EVs (ZOE, Megane E-Tech)

- Strategy: Joint venture with Geely to expand hybrid/ICE capacity

- 2024 Revenue: ~USD 62.3 billion

- Global Presence: Europe, Latin America, parts of Asia

6. Key Trends and Their Impact

🔋 Electrification Surge

- EV sales reached ~17 million units in 2024.

- OEMs such as BYD, Tesla, GM, and Ford are leading the transition.

- Impact: Reconfigures supply chains, boosts lithium demand, and accelerates infrastructure investment.

🔄 Hybrid Resurgence

- Hybrids are increasingly popular as transitional technology.

- Automakers like Toyota and Hyundai are expanding hybrid offerings.

- Impact: Provides a lower-cost, lower-emission alternative to full EVs.

🤖 ADAS & Autonomous Technologies

- Widespread integration of safety features like adaptive cruise control, lane assist, and parking automation.

- Connectivity improvements through 5G and over-the-air updates.

- Impact: Enhanced safety and convenience, with growing revenue from software services.

🌏 Asia Pacific Momentum

- Dominant contributor to global sales and production.

- India and Southeast Asia represent new frontiers of growth.

- Impact: Companies are localizing production and designing models specific to these markets.

📜 Regulatory Influence

- Policies in the U.S., EU, and China are pushing for EV mandates and emissions reduction.

- Emission targets and ICE phaseouts are reshaping manufacturer strategies.

- Impact: OEMs must invest in EV R&D and retool production or face heavy penalties.

📱 New Ownership Models

- Subscriptions, shared mobility, and flexible leasing are gaining popularity.

- Especially relevant in urban centers and among younger consumers.

- Impact: Shifts revenue models toward usage-based services and fleet partnerships.

7. Successful Global Examples

🇨🇳 BYD Auto (China)

- Delivered 4.27 million vehicles in 2024, dominating the EV and plug-in hybrid segments.

- Vertical integration of battery production and aggressive global expansion.

- Key Lesson: Deep government alignment and integrated supply chains drive growth.

🇺🇸 Ford Motor Company (U.S.)

- Rapid EV deployment with successful models like Mustang Mach-E and F-150 Lightning.

- Strategic partnerships and factory retooling for electric platforms.

- Key Lesson: Leveraging legacy ICE strength while investing in future platforms ensures continuity.

🇫🇷 Renault–Geely Alliance (Europe–Asia)

- Collaborative venture to scale hybrid and ICE engine technologies.

- Cost-sharing enables competitive pricing and global distribution.

- Key Lesson: Strategic alliances mitigate transition risks and optimize R&D costs.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Fuel Cell Market Size to Reach USD 48.85 Billion by 2034