Fuel Cell Market Size and Forecast

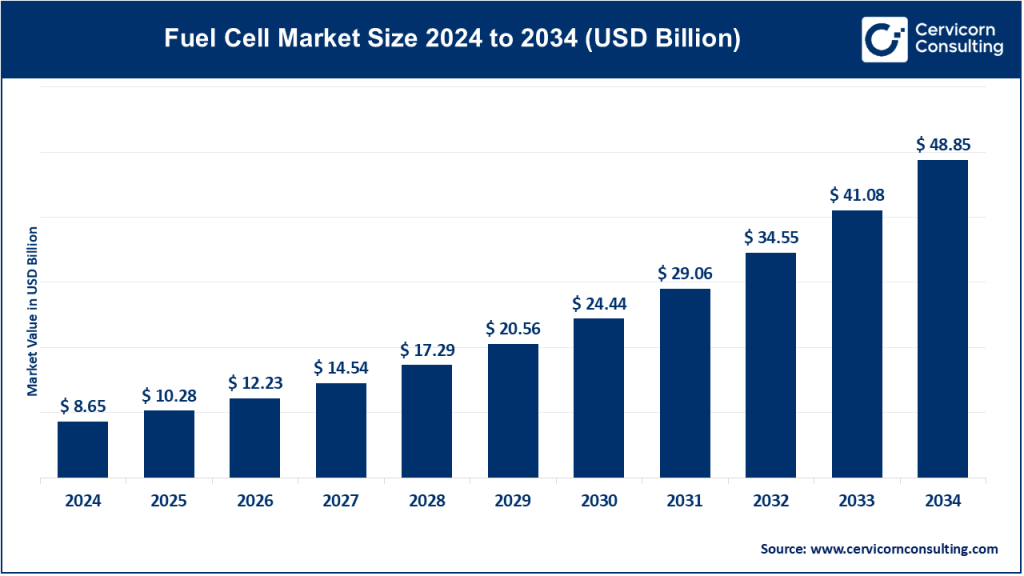

The global fuel cell market size was worth USD 8.65 billion in 2024 and is anticipated to expand to around USD 48.85 billion by 2034, registering a compound annual growth rate (CAGR) of 18.90% from 2025 to 2034.

What Is the Fuel Cell Market?

The fuel cell market refers to the global ecosystem of companies, technologies, applications, and infrastructure centered around fuel cell systems. A fuel cell is an electrochemical device that converts hydrogen (or other fuels) and oxygen into electricity, heat, and water through a clean reaction, without combustion. There are various types—Proton Exchange Membrane (PEM), Solid Oxide (SOFC), Phosphoric Acid (PAFC), Molten Carbonate (MCFC)—each suited to different applications such as transportation (passenger and heavy-duty vehicles), stationary power generation, portable devices, and material handling.

The market includes everything from fuel cell stacks and systems to balance-of-plant components, hydrogen production, storage and dispensing infrastructure, R&D services, and its integration into sectors like automotive, power, military, and backup power.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2653

Why Is It Important?

- Zero‑emission energy: Fuel cells emit only water and heat, offering a near-zero carbon alternative crucial for decarbonizing industries and transportation.

- Advantages over batteries: For long-range, heavy-duty, and continuous operations (e.g., buses, trucks, remote power), they offer faster refueling and lighter weight than battery alternatives.

- Diverse scalability: From portable power and backup systems to large-scale utility and industrial operations, fuel cells adapt to many use cases.

- Enabler of hydrogen economy: As hydrogen production and distribution scale up—particularly green hydrogen—fuel cells become central to energy systems.

- Energy security: Fuel cell systems offer on‑site generation capability, reducing dependence on centralized grids—key for remote areas, military applications, and critical infrastructure.

- Industrial modernization and investment: With the global push toward e-mobility, climate targets, and supportive policies, fuel cells are now a nexus of industrial and environmental progress.

Growth Factors

The fuel cell market is growing rapidly, driven by several synergistic forces: increasing global demand for clean, distributed, and reliable energy; tighter emissions regulations worldwide; rising adoption of fuel cell electric vehicles (such as buses, heavy-duty trucks, and forklifts); global expansion of hydrogen infrastructure; decreasing costs of PEM and other fuel cell systems due to scale and technological advances; government incentives and subsidies for clean hydrogen, refueling stations, and carbon reduction strategies; industrial electrification trends; and strategic investment from legacy automakers and energy giants. These factors, combined with growing energy security concerns and corporate sustainability commitments, underpin a robust Compound Annual Growth Rate (CAGR) of approximately 20 to 30 percent in the coming decade, with analysts projecting the global fuel cell market to grow from around USD 7 to 9 billion in 2024 to as much as USD 95 billion by 2033 or 2034.

Fuel Cell Market – Key Companies

1. Ballard Power Systems

- Specialization: PEM fuel cell stacks and systems for heavy-duty transport (buses, trucks, marine, rail) and stationary backup power.

- Key Focus Areas: Heavy Vehicle Mobility, Stationary, Emerging/Other markets.

- Notable Features: Leading player in PEM stacks, extensive deployment in transit buses, strategic manufacturing in Texas.

- 2024 Revenue: USD 69.7 million.

- Market Share: A top PEM stack supplier globally; heavy-duty bus segment showed 51 percent growth in 2024.

- Global Presence: Headquartered in Canada; R&D worldwide; operations in North America, Europe, and Asia.

2. Bosch

- Specialization: Hydrogen fuel cell stacks and system engineering across automotive and stationary sectors.

- Key Focus Areas: Automotive partnerships, hydrogen infrastructure, stationary energy, Chinese market.

- Notable Features: Strategic collaboration with PowerCell for Chinese auto market.

- 2024 Revenue: EUR 90.3 to 90.5 billion in total group sales.

- Market Share: Significant player in the OEM and industrial fuel cell space.

- Global Presence: Headquartered in Germany; global R&D and deployment footprint.

3. Horizon Fuel Cell Technologies

- Specialization: PEM-based micro fuel cell stacks for portable devices, educational kits, micro-power, backup power systems.

- Key Focus Areas: Niche portable power, education and demo systems.

- Notable Features: Unique micro-stack core and educational product focus.

- 2024 Revenue: Approximately USD 6.4 million globally; Shanghai subsidiary approximately USD 9 million.

- Market Share: Dominant in micro and portable fuel cell systems.

- Global Presence: Headquartered in Singapore; operations in North America, Europe, and Asia.

4. ElringKlinger

- Specialization: PEM low-temperature systems, fuel cell stacks, balance-of-plant components, heavy engineering.

- Key Focus Areas: Automotive, industrial applications, stack technology.

- Notable Features: Full-stack production, focused investments through EKPO joint venture.

- 2024 Revenue: EUR 1.803 billion group-wide.

- Market Share: Major player in PEM stacks for mobility applications.

- Global Presence: German HQ; operations in Europe, North America, and Asia.

5. Hydrogenics (Cummins)

- Specialization: PEM and alkaline fuel cell systems; hydrogen electrolysers.

- Key Focus Areas: Transportation, stationary power, hydrogen generation.

- Notable Features: Combined electrolyzer and fuel cell integration.

- 2024 Revenue: Not disclosed separately (part of Cummins).

- Market Share: Key player in integrated hydrogen solutions.

- Global Presence: Headquartered in Canada; global installations via Cummins network.

Leading Trends and Their Impact

Hydrogen Infrastructure Build-Out

Massive investment in refueling stations and hydrogen hubs, particularly in the US and EU, is enabling fuel cell applications in public transport and industrial logistics.

OEM Investment and Alliances

Automakers such as Toyota, BMW, Hyundai, and others are bringing fuel cell vehicle platforms to market, particularly targeting heavy-duty transport where batteries face performance limitations.

Policies and Incentives

Global subsidies, tax credits, and regulations are accelerating adoption. Examples include the US Inflation Reduction Act, Section 45V tax credit for clean hydrogen, and EU Fit-for-55 legislation.

Decarbonization Push

Fuel cells are increasingly viewed as essential to decarbonizing hard-to-electrify sectors such as shipping, rail, aviation, long-haul trucking, and backup power for data centers.

Global Success Stories

- South Korea: Fuel cell technology powers over 300 megawatts of grid-connected electricity in the country’s clean energy programs. Hyundai’s NEXO is one of the best-selling hydrogen-powered vehicles globally.

- California (USA): Home to more than 50 hydrogen refueling stations and growing. The state supports light- and heavy-duty vehicle programs using fuel cells in its clean air initiatives.

- Germany: Strong industrial collaboration (e.g., Bosch, Daimler) and public investment in hydrogen corridors for logistics and trains using fuel cell technologies.

- China: Rapid expansion of fuel cell bus fleets in cities like Zhangjiakou and Yantai, with state-backed subsidies and production targets for hydrogen fuel cell vehicles.

Government Initiatives by Region

North America

- The US Department of Energy has allocated billions for hydrogen hubs and clean hydrogen production.

- The Infrastructure Investment and Jobs Act includes provisions for building out hydrogen refueling infrastructure.

Europe

- The European Union’s Hydrogen Strategy supports a 40 GW electrolyzer target by 2030, integrating fuel cells into energy and transport systems.

- National hydrogen strategies in Germany, France, and the Netherlands prioritize stationary and mobility applications.

Asia-Pacific

- Japan’s Basic Hydrogen Strategy promotes fuel cell vehicle infrastructure and residential fuel cell systems (ENE-FARM).

- South Korea’s Hydrogen Economy Roadmap targets 6.2 million hydrogen vehicles and 1,200 refueling stations by 2040.

- China’s 14th Five-Year Plan includes fuel cell industrial parks, tax benefits, and regional clusters.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: E-Bike Market Size to Hit USD 149.23 Billion by 2034