Injection Pen Market Size

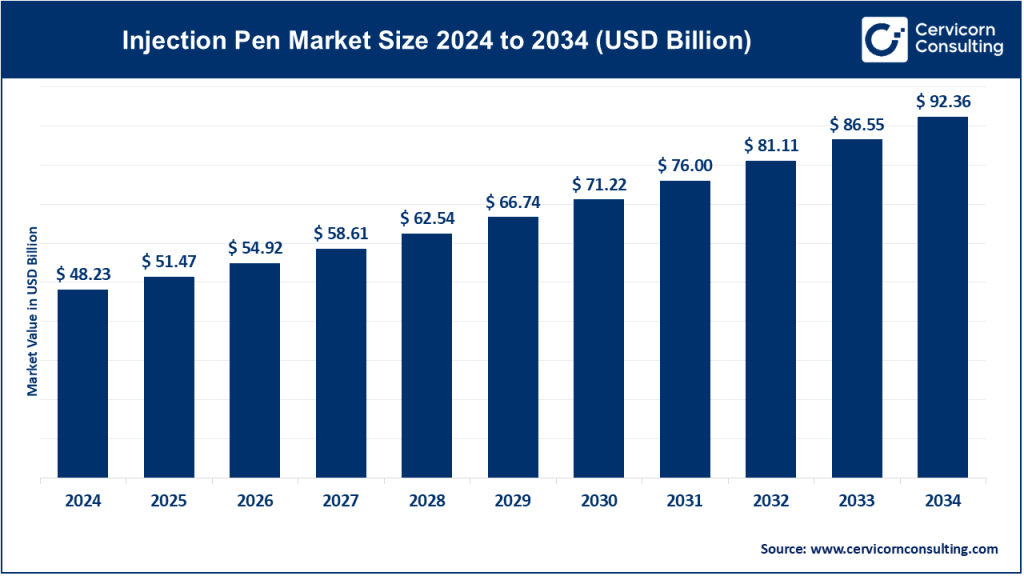

The global injection pen market size was worth USD 48.23 billion in 2024 and is anticipated to expand to around USD 92.36 billion by 2034, registering a compound annual growth rate (CAGR) of 6.71% from 2025 to 2034.

What is the Injection Pen Market?

The injection pen market comprises medical devices—either disposable or reusable—designed to deliver precise dosages of medications such as insulin, GLP‑1 agonists, growth hormones, fertility treatments, osteoporosis drugs, and epinephrine. These pens replace traditional syringes/vials for self-administration. They offer convenience, accuracy, multi-use cartridges, and often patient-friendly features like pre-filled doses, easy dial systems, Bluetooth connectivity, adherence reminders, and ergonomic design. Introduced in the late 1990s, injection pens have evolved with smart features, bridging pharmacotherapy with digital health ecosystems.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2651

Injection Pen Market Growth Factors

Growing incidence of chronic diseases like diabetes, obesity, cardiovascular disorders, cancer, and osteoporosis, due to aging populations, sedentary lifestyles, and poor diets, is increasing demand for frequent, self-administered injections. Technological innovation—especially the emergence of smart pens equipped with sensors, Bluetooth, dose reminders, and app integration—has greatly enhanced patient adherence and clinician engagement. Government incentives, supportive reimbursement policies, and R&D investments further catalyze market expansion. Environmental sustainability concerns favor reusable devices. Together, these factors are propelling market growth at a projected 6–8 % CAGR, with the global market expected to grow from about USD 47 billion in 2024 to USD 74–80 billion by 2029–2033.

Why Is the Injection Pen Market Important?

Clinical effectiveness & quality of life – Pens enable accurate, painless, and easy self-injection. This is especially critical for insulin-dependent diabetics, where dose precision and compliance affect health outcomes.

Health system efficiency – By enabling home administration with fewer clinic visits, pens reduce healthcare burden and costs.

Technological innovation hub – The market drives smart device integration—app data, remote monitoring, dose reminders—fusing medical devices with digital health.

Environmental & economic benefits – Reusable pens cut plastic waste and are cost-effective over time. Volume production by major firms boosts global access to essential therapies across different regions.

Leading Trends & Their Impact

- Smart pens & connectivity: Integration with Bluetooth, apps, and dose tracking—like Medtronic’s InPen and Eli Lilly’s Tempo—has improved adherence monitoring and enabled clinician engagement.

- Continuous innovation in pen design: Upgrades like Sanofi SoloSTAR 2’s larger display and ergonomic features, and compact pediatric pens from Ypsomed, boost usability.

- Disposable pen dominance: In 2024, disposable pens made up 70–75 % of sales due to their safety, convenience, and affordability .

- Sustainability and reusable pens: Driven by plastic waste concerns, reusable pens led the market with ~70 % share in 2024 and growing .

- Expansion beyond diabetes: Auto‑injectors for epinephrine, osteoporosis, and asthma (e.g., Tezspire’s pen by AstraZeneca/Amgen) are diversifying applications .

- Regulatory & reimbursement support: Governments and payers are backing pens—especially smart and reusable ones—through funding, approvals, and policies.

- Emerging market localization: Expansion in Asia including India and China, with localized inexpensive pen programs, boosts volume and access.

Global Regional Analysis & Government Initiatives

North America

- Dominates the market with ~45% share due to high chronic disease prevalence, infrastructure, and reimbursement support.

- Government funding for digital health and chronic disease management supports smart pen adoption.

Europe

- Holds ~30% market share with strong uptake of reusable and connected pens. Sustainability policy drives reuse and recycling initiatives.

- EU funding helps digital health integration in diabetes care.

Asia‑Pacific

- Experiences the fastest growth. Massive diabetes burden and rising disposable incomes drive demand.

- China has funded local manufacturing; India’s National Health Mission deployed 3 million pens in tier‑2/3 cities.

Latin America & Middle East/Africa

- Slower, but growing via government programs targeting insulin access and chronic disease management.

- Latin American health ministries include pens in subsidized diabetes care plans.

Global Injection‑Pen Market: Top Companies

1. Novo Nordisk

- Specialization: Reusable pen systems for insulin, GLP‑1 (Ozempic, Wegovy), growth hormones.

- Key Features: Smart features (e.g., FlexTouch Smart), dose tracking, global production scale.

- 2024 Revenue & Share: Total pharma revenue ~USD 42.1 billion; injection‑pen share ~25–29% globally.

- Presence: Operates in 168 countries with production across 9 countries including recent expansion in France & Denmark.

2. Eli Lilly

- Specialization: Reusable, disposable, and digital pens for insulin and GLP‑1 (Mounjaro, Zepbound).

- Key Features: Smart pens with integration (Tempo), innovative injection systems (HumaPen), recently approved once‑weekly insulin in development.

- 2024 Revenue & Share: ~18–22% market share; combined GLP‑1 sales of USD 6.2 billion in Q1 2025 .

- Presence: Markets in 125+ countries, increasing focus on emerging regions.

3. Sanofi

- Specialization: Disposable pens for insulin (Lantus, Toujeo), plus fertility & growth hormone devices.

- Key Features: User-centric improvements (SoloSTAR 2), broader digital ecosystem plans.

- 2024 Revenue & Share: ~20–24% market share.

- Presence: ~100 manufacturing sites in 41 countries; presence in 170+ countries.

4. Merck KGaA

- Specialization: Pen injectors for fertility and osteoporosis treatments, plus industrial pharma partnerships.

- Revenue & Share: Among top-7 global players, though distinct market share not specified.

- Presence: Global reach via pharma partnerships; key in non‑diabetes injectables.

5. Ypsomed Holding AG

- Specialization: Autoinjectors and pens for diabetes, GLP‑1, pediatric and zero-carbon footprint designs.

- Key Features: Compact, user-friendly pens; next-gen connectivity; contract manufacturing (e.g., Novo’s CagriSema pen).

- Revenue & Share: Holds ~10–13% of pen market; invested USD 120 million in R&D.

- Presence: Worldwide contracts (31 GLP‑1 clients), zero-carbon autoinjectors .

Notable Features & Specializations

- Novo Nordisk’s FlexTouch Smart: Bluetooth-enabled with app tracking and dose reminders.

- Eli Lilly’s Tempo: Smart button, mobile app, pre-filled insulin pen delivering real-time dosing data.

- Sanofi SoloSTAR 2: Enhanced display and simplified dose dial boosting ease for visually impaired or elderly users.

- Ypsomed’s pediatric and eco pens: Child-friendly compact forms, low-carbon footprint autoinjectors.

- Merck’s fertility/osteoporosis injectables: Auto-injector pens for non-diabetes therapies (e.g., Tezspire).

2024 Revenue Breakdowns & Market Share

- Novo Nordisk: DKK 290 billion (~USD 42.1 billion) total revenue; approx. 25–29% of injection-pen market.

- Eli Lilly: Estimated 18–22% market share; Q1 2025 GLP‑1 sales USD 6.2 billion.

- Sanofi: 20–24% share; major insulin pen brands.

- Ypsomed: 10–13% share; USD 120 million R&D investment.

- Merck KGaA: Significant presence among top seven global players.

Other notable market contributors include Becton Dickinson, Medtronic, AstraZeneca, Owen Mumford, Biocon, and regional manufacturers.

Successful Global Examples

- Medtronic’s InPen (U.S.): First FDA-approved smart insulin pen with CGM integration—enhanced patient outcomes via real-time monitoring.

- Eli Lilly Tempo (Global rollout): Smart pen ecosystem featuring app, pre-filled pen, button; recognized for improving dose reporting and engagement.

- Sanofi SoloSTAR 2 (Europe): Upgraded pen for caregivers and elderly; improved usability spurred adoption.

- Ypsomed + Novo partnership: Production of Novo’s CagriSema obesity drug pen, enabling large-scale deployment.

- China/India low‑cost disposable pens: India’s NHM distribution (3 million pens); China’s government support for local manufacturing.

- Europe’s sustainability push: Reusable pen adoption at ~70% share; recycling programs in Sweden & Netherlands cut 200+ tons of plastic waste.

- EpiPen’s public‑access rollout (U.S.): Mylan/Pfizer secured legislation and widespread distribution, making epinephrine pens common in public spaces.

Leading Trends & Their Impact

- Smart/Connected Pens

- Enhanced adherence and clinical oversight via app integration.

- Savvy healthcare payers increasingly reimburse digital-capable pens.

- Disposable Favored in Emerging Markets

- Low initial cost, safety, and simplicity drive wide rural/low-income adoption.

- Reusable & Sustainable Options

- Growing eco-consciousness drives reusable pen preference and recycling infrastructure.

- Regulatory Support

- Governments and payers backing advanced, self-care devices to ease healthcare costs.

- Diversification of Applications

- Expansion into auto‑injectors for asthma, fertility, osteoporosis enhances market scope.

- Localized Manufacturing

- India and China backing local production reduces supply barriers—boosting regional adoption.

Global Regional Analysis: Policy & Drivers

- North America: Strong reimbursement for chronic disease management; digital health grants support smart pen use.

- Europe: Environmental and health regulation back reusable pen adoption; EU digital health funding fosters innovation.

- Asia‑Pacific: National health missions subsidize pens; China invests in domestic manufacturing; India distributes millions via NHM.

- Latin America: Diabetes programs include pen devices in coverage; partnerships with NGOs drive availability.

- Middle East/Africa: Pilot initiatives deploy pens in public health, especially for type 1 diabetes management.

Leading Examples & Case Studies

- AstraZeneca/Amgen Tezspire Pen: FDA-approved asthma auto-injector for self-use aged ≥12; showcases expansion into respiratory care.

- Phillips-Medisize Disposable Pens: Global manufacturing for pharma clients, enabling scalable production of auto-injectors.

- Eco-pen programs: Scandinavian recycling pilots reduced medical plastic waste by 200+ tons; reused pens mitigate environmental footprint.

- Mounjaro UK Pen Launch: MHRA-approved GLP-1 injector, broadening weight-loss drug adoption in Europe.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Biopharmaceutical Market Size, Revenue Outlook & Global Impact (2025–2034)