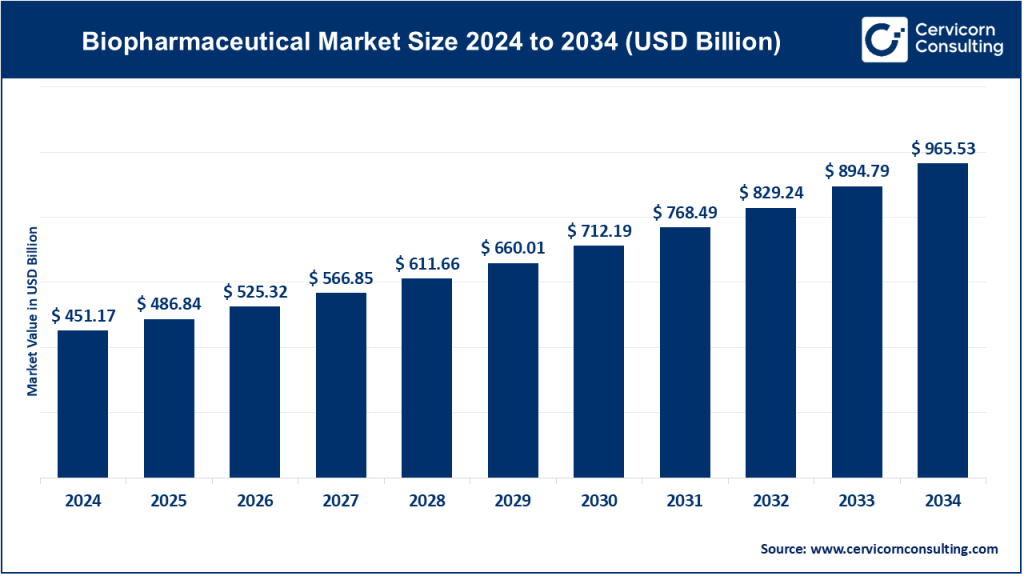

Biopharmaceutical Market Size

The global biopharmaceutical market size was worth USD 451.17 billion in 2024 and is anticipated to expand to around USD 965.53 billion by 2034, registering a compound annual growth rate (CAGR) of 7.9% from 2025 to 2034.

What is the Biopharmaceutical Market?

The biopharmaceutical market refers to the industry segment involved in the development, manufacturing, and commercialization of medical drugs produced using biotechnology. These products are typically derived from biological sources such as living organisms, tissues, or cells and include monoclonal antibodies, recombinant proteins, gene therapies, vaccines, and cell therapies. Unlike traditional pharmaceuticals that are chemically synthesized, biopharmaceuticals are biologically engineered to provide targeted therapeutic effects and are widely used in the treatment of chronic and life-threatening diseases including cancer, autoimmune disorders, infectious diseases, and genetic conditions.

Why is the Biopharmaceutical Market Important?

The biopharmaceutical market is at the heart of modern medicine’s evolution, playing a crucial role in improving life expectancy, disease management, and personalized treatment options. It represents the cutting-edge frontier of medical innovation, enabling precision medicine and breakthroughs that were previously inconceivable. The global burden of chronic diseases, aging populations, unmet medical needs, and the rise of pandemic threats such as COVID-19 have emphasized the value of biotech-driven treatments. Moreover, biopharmaceuticals significantly contribute to economic growth, high-skilled employment, and public health resilience, making the sector not only a scientific but also a socioeconomic pillar of global healthcare systems.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2650

Biopharmaceutical Market Growth Factors

The biopharmaceutical market is experiencing robust growth driven by multiple synergistic factors, including the increasing global prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders, a surge in the aging population requiring long-term therapies, advances in biotechnology and genomics enabling targeted and personalized treatments, increasing investment in R&D by both public and private sectors, regulatory support for orphan drugs and fast-track approvals, the rise of biosimilars as cost-effective treatment alternatives, and expanding access to healthcare in emerging markets. Moreover, the post-COVID-19 era has reinforced the importance of rapid vaccine development and scalable therapeutic production, catalyzing further innovation and infrastructure development in the biopharma domain.

Top Companies in the Biopharmaceutical Market: Specialization, Focus, Revenue, Market Share & Global Reach

Below is a detailed overview of the leading global biopharmaceutical companies, highlighting their unique strengths, focus areas, and financial performance in 2024.

1. F. Hoffmann-La Roche Ltd (Switzerland)

- Specialization: Oncology, Immunology, Neuroscience, Infectious Diseases

- Key Focus Areas: Personalized medicine, companion diagnostics, monoclonal antibodies

- Notable Features: Strong integration of diagnostics with therapeutics; high R&D spending; global leader in oncology

- 2024 Revenue: ~$74 billion

- Market Share: ~7.5% of the global biopharmaceutical market

- Global Presence: Operates in over 100 countries; major R&D centers in Basel, Germany, China, and the U.S.

2. Novartis AG (Switzerland)

- Specialization: Oncology, Gene Therapy, Cardiovascular, Immunology

- Key Focus Areas: Cell and gene therapies, biosimilars, ophthalmology

- Notable Features: Pioneer in CAR-T therapy; strong generics arm through Sandoz (recently spun off)

- 2024 Revenue: ~$55 billion

- Market Share: ~5.5%

- Global Presence: Active in over 140 countries with major hubs in Switzerland, India, and the U.S.

3. AbbVie Inc. (USA)

- Specialization: Immunology, Oncology, Neuroscience, Aesthetics

- Key Focus Areas: Autoimmune diseases (e.g., Humira, Rinvoq, Skyrizi), neuroscience expansion via Allergan acquisition

- Notable Features: Dominant portfolio in autoimmune therapy; expanding aesthetic medicine segment

- 2024 Revenue: ~$61 billion

- Market Share: ~6.3%

- Global Presence: More than 70 countries; manufacturing hubs in the U.S. and Europe

4. Johnson & Johnson Services, Inc. (USA)

- Specialization: Immunology, Infectious Diseases, Oncology, Vaccines

- Key Focus Areas: Preventive vaccines, immunotherapies, surgical innovations

- Notable Features: Diversified business model; successful COVID-19 vaccine program

- 2024 Revenue: ~$89 billion (pharmaceutical segment ~$54 billion)

- Market Share: ~6.5%

- Global Presence: Present in over 150 countries with a vast manufacturing and R&D network

5. Merck & Co., Inc. (USA)

- Specialization: Oncology (Keytruda), Vaccines, Infectious Diseases

- Key Focus Areas: Cancer immunotherapy, antiviral treatments, vaccine innovation

- Notable Features: Global leader in checkpoint inhibitors; high revenue from HPV and COVID vaccines

- 2024 Revenue: ~$62 billion

- Market Share: ~6.4%

- Global Presence: Operations in more than 130 countries; R&D centers in the U.S., UK, and Asia

Leading Trends and Their Impact on the Biopharmaceutical Market

1. Personalized and Precision Medicine

- Leveraging genomic data and biomarkers to tailor treatments to individual patients.

- Impact: Higher efficacy, reduced side effects, growing niche market opportunities.

2. Biosimilars and Biobetters

- Growth in biosimilars due to expiring biologic patents and cost containment needs.

- Impact: Increased competition, reduced drug prices, expanded access to therapies.

3. Cell and Gene Therapy Revolution

- Gene-editing platforms (e.g., CRISPR) and CAR-T therapies are reshaping treatment paradigms.

- Impact: Potential curative solutions for previously untreatable genetic disorders.

4. AI and Digital Health Integration

- AI in drug discovery, digital twins in clinical trials, and remote patient monitoring.

- Impact: Faster development cycles, improved trial outcomes, cost efficiencies.

5. Sustainable Biomanufacturing

- Focus on green chemistry, single-use systems, and closed-loop facilities.

- Impact: Reduced carbon footprint, compliance with ESG mandates.

Successful Biopharmaceutical Market Examples Around the World

1. United States (mRNA Vaccines)

- Pfizer-BioNTech and Moderna revolutionized vaccine development with mRNA technology during the COVID-19 pandemic.

- Impact: Enabled rapid, scalable immunization campaigns globally.

2. Switzerland (Oncology)

- Roche’s portfolio in oncology (Herceptin, Avastin, Perjeta) remains dominant in cancer care.

- Impact: Established benchmarks for targeted cancer therapies and diagnostics.

3. South Korea (Biosimilars)

- Samsung Biologics and Celltrion have emerged as global leaders in biosimilar manufacturing.

- Impact: Provided cost-effective therapeutic alternatives in global markets.

4. China (Biotech Infrastructure)

- WuXi Biologics has built one of the world’s largest biopharmaceutical CDMO operations.

- Impact: Accelerated global drug development timelines with scalable platforms.

5. India (Contract Manufacturing and Vaccines)

- Serum Institute of India is the world’s largest vaccine manufacturer by volume.

- Impact: Played a critical role in global vaccination efforts, especially in developing countries.

Global Regional Analysis: Market Trends and Government Policies

North America

- Market Share: ~45% of global revenue

- Key Drivers: High R&D investment, presence of major biopharma hubs (Boston, San Diego), strong IP protection

- Government Support: Orphan Drug Act, FDA fast-track approvals, NIH grants

Europe

- Market Share: ~25%

- Key Drivers: Strong public-private partnerships, active biotech clusters (UK, Germany, Switzerland)

- Policies: EMA’s centralized regulatory framework, subsidies for rare disease research

Asia-Pacific

- Market Share: ~20% and rapidly growing

- Key Drivers: Expanding middle-class, local biomanufacturing, tech innovation

- Government Initiatives:

- China: Made in China 2025, streamlined CFDA approvals

- India: Biotech Parks, National Biopharma Mission

- Japan: Regenerative medicine fast-track system

Latin America

- Market Share: ~5%

- Key Drivers: Rising healthcare access, generic-biologic hybrids

- Policies: ANVISA reforms (Brazil), price regulation and subsidy schemes

Middle East & Africa

- Market Share: <5% but growing

- Key Drivers: Rising public-private collaborations, increasing clinical trials

- Government Actions:

- UAE: Biotech innovation hubs in Abu Dhabi

- South Africa: Public health investment in biologics for HIV and TB

Government Initiatives and Policies Shaping the Market

- U.S. – Prescription Drug User Fee Act (PDUFA)

Enables FDA to fast-track drug approval timelines in exchange for user fees, accelerating market access for biopharmaceuticals. - EU – Horizon Europe Program

Funds cross-border collaborative R&D in life sciences, fostering innovation in personalized medicine and biotechnology. - China – National Health Commission Reform

Incentivizes domestic biologic innovation and speeds up regulatory approvals to match international standards. - India – National Biopharma Mission

Aims to create a globally competitive biopharmaceutical industry by providing funding, infrastructure, and regulatory guidance. - Global – WHO’s Prequalification Program

Helps biosimilar products from developing countries gain international credibility and access global procurement markets.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Regulatory Affairs Market Size, Trends, Forecasts and Competitive Landscape 2034