Home Medical Equipment Market Size

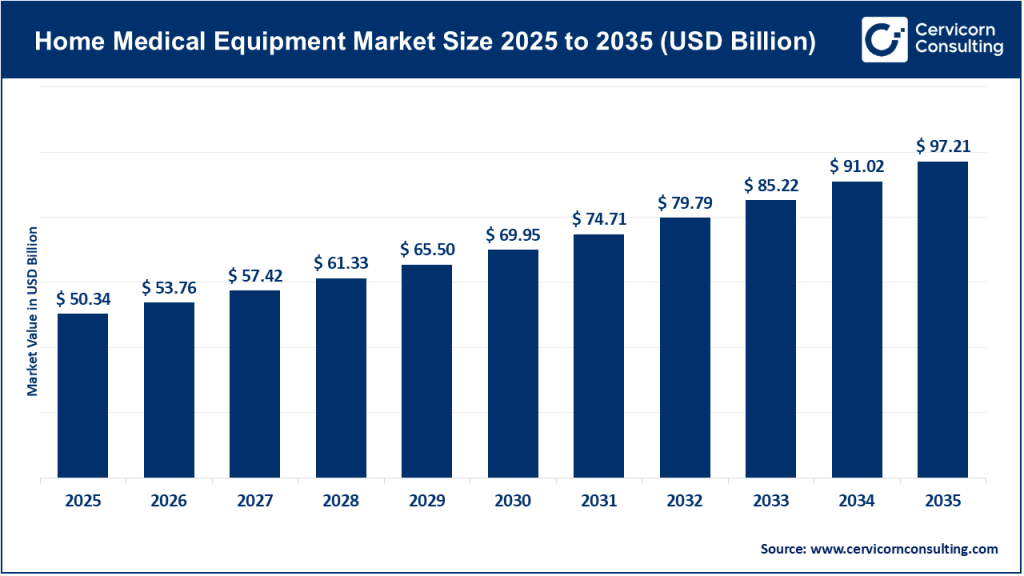

The global home medical equipment market size was worth USD 50.34 billion in 2025 and is anticipated to expand to around USD 97.21 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% from 2026 to 2035.

Home Medical Equipment Market Growth Factors

The home medical equipment (HME) market is expanding steadily due to the convergence of multiple drivers: a rapidly aging global population, a rising prevalence of chronic diseases such as diabetes, COPD, cardiovascular disorders and sleep apnea, and the global shift toward care-at-home ecosystems designed to reduce hospital burden and improve patient comfort. Advancements in medical technologies—such as portable oxygen systems, miniaturized infusion pumps, connected monitoring devices, and AI-powered diagnostic algorithms—have enabled safe, accurate, and continuous care outside hospitals. Healthcare payers and governments increasingly support at-home care by improving reimbursement for durable medical equipment (DME), home dialysis, oxygen therapy, and remote patient monitoring.

Meanwhile, patients and caregivers prefer receiving care in familiar surroundings, which improves convenience, autonomy, and mental well-being. Combined with falling device costs, better connectivity, and improved service infrastructure, these trends underpin consistent growth across the global HME market.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2815

What is the Home Medical Equipment Market?

The home medical equipment market includes medical devices, systems, consumables, and related services used to diagnose, monitor, or treat health conditions in a patient’s home rather than in hospitals or clinics. This broad category covers durable medical equipment (DME) such as wheelchairs, hospital beds, CPAP devices, walkers, and oxygen concentrators; advanced therapeutic and monitoring devices such as home infusion pumps, home dialysis machines, and wearable cardiac monitors; and point-of-care diagnostic tools that allow patients to perform tests at home.

Additionally, the market includes the services that support home care, including installation, maintenance, training for caregivers, clinical home visits, and remote monitoring platforms. As healthcare moves toward decentralized, patient-centric models, HME has become one of the most important components of long-term care, elderly care, chronic disease management, and rehabilitation.

Why the Home Medical Equipment Market is Important

The importance of the home medical equipment market lies in its ability to transform how healthcare is delivered. For patients, HME brings comfort, independence, and better continuity of care. It reduces the need for frequent hospital visits, minimizes exposure to infections, and improves overall well-being—especially for people managing long-term conditions. For healthcare systems, HME reduces the financial and operational burden on hospitals by lowering readmission rates and supporting early discharge. Payers—both private insurers and public health systems—benefit from lower treatment costs and better outcomes due to improved compliance with treatment.

For manufacturers, the HME market offers strong long-term growth potential driven by demographic trends, subscription-based revenue models, and expanding adoption of connected, data-driven devices. In short, the HME market is a central driver in reshaping future healthcare delivery.

Top Home Medical Equipment Market Companies

Below are detailed profiles of the top companies shaping the global HME landscape. The list includes company specialization, key focus areas, major features, 2024 revenue, market share context, and global presence.

1. Abbott Laboratories

Specialization:

Medical devices and diagnostics, especially continuous glucose monitoring (CGM), cardiac monitoring, and home-based testing.

Key Focus Areas:

- Diabetes care (FreeStyle Libre CGM)

- Remote cardiac monitoring

- Point-of-care testing

- Minimally invasive diagnostics

Notable Features:

- One of the world’s leading CGM brands

- Strong pipeline of connected home diagnostics

- Extensive integration with digital health platforms

2024 Revenue:

Approximately USD 41.9 billion (total company revenue).

Market Share:

A major player in home glucose monitoring and home diagnostics; specific HME market share is not individually reported.

Global Presence:

Strong distribution across North America, Europe, Asia-Pacific, Latin America, and Africa.

2. 3B Medical, Inc. (React Health)

Specialization:

Respiratory and sleep therapy devices, including CPAP masks, oxygen therapy accessories, and related components.

Key Focus Areas:

- CPAP interfaces

- Respiratory therapy equipment

- Accessories and replacement components

Notable Features:

- Known for affordability and wide product range

- Strong position in CPAP consumables and accessories

- Supplier for global respiratory therapy distributors

2024 Revenue:

As a private company, estimates vary, with industry approximations in the USD 170–180 million range.

Market Share:

Significant share in the sleep and respiratory consumables segment; exact HME percentage not publicly reported.

Global Presence:

U.S.-based with international distribution partners across Europe, Asia, and Latin America.

3. Becton, Dickinson and Company (BD)

Specialization:

Large-scale medical technology with significant offerings in medication delivery and home infusion support.

Key Focus Areas:

- Infusion pumps and sets

- Home infusion consumables

- Diagnostic collection systems

- Connectivity solutions for treatment monitoring

Notable Features:

- One of the largest medical device makers in the world

- Critical role in home infusion and injection-based therapies

- Strong supply chains serving home health providers

2024 Revenue:

Approximately USD 20.2 billion.

Market Share:

A dominant supplier in medication delivery and infusion products used in home settings.

Global Presence:

Worldwide operations covering the Americas, Europe, Middle East, Africa, and Asia-Pacific.

4. Drive DeVilbiss Healthcare

Specialization:

A leading provider of durable home medical equipment including respiratory, mobility, and sleep therapy devices.

Key Focus Areas:

- Oxygen concentrators and ventilators

- Nebulizers

- Mobility aids (walkers, wheelchairs)

- Homecare DME solutions

Notable Features:

- Recognized brand in respiratory and mobility segments

- Offers a large variety of homecare products

- Strong supply network in retail and clinical DME channels

2024 Revenue:

Private-company estimates vary widely; considered one of the largest DME manufacturers in North America.

Market Share:

Strong presence in respiratory therapy and mobility equipment segments globally.

Global Presence:

Primary presence in North America and Europe with expanding distribution in Asia-Pacific and Latin America.

5. Boston Scientific Corporation

Specialization:

Advanced interventional medical devices with increasing emphasis on home-compatible monitoring and remote follow-up.

Key Focus Areas:

- Cardiac rhythm management

- Neuromodulation

- Implantable monitors

- Remote follow-up systems

Notable Features:

- Strong innovation pipeline

- Remote monitoring tools for cardiac implants

- Leader in arrhythmia and cardiovascular care

2024 Revenue:

Approximately USD 16.7 billion.

Market Share:

Strong share in cardiac rhythm and remote monitoring solutions; exact HME portion not reported.

Global Presence:

Large global footprint in the Americas, Europe, Asia, and Middle East.

Leading Trends in the Home Medical Equipment Market and Their Impact

1. Remote Patient Monitoring (RPM) Growth

The combination of wearable sensors, Bluetooth devices, smartphone apps, and cloud analytics has triggered massive adoption of RPM. It reduces unnecessary clinical visits, enables early detection of deteriorations, and improves patient compliance. This is driving demand for connected HME across chronic disease categories.

2. Device Miniaturization and Portability

Compact designs in oxygen concentrators, infusion pumps, and dialysis machines are expanding the feasibility of home treatment. Portability increases patient freedom and widens the eligible population for at-home therapies.

3. AI & Predictive Analytics Integration

AI-powered insights are supporting clinicians in anticipating health declines. Predictive analytics in home cardiac monitoring or glucose management plays a crucial role in lowering readmission rates.

4. Rise of Home Infusion & Home Dialysis

Home infusion therapy is growing rapidly because it reduces hospital dependency and is preferred by patients. Home dialysis is becoming mainstream with better machines, patient training, and insurer support.

5. Expanding Reimbursement Coverage

Governments and insurers have broadened coverage for telehealth, RPM, and DME. Coverage decisions have a direct and immediate impact on demand for HME equipment.

6. Service-Based Models & Integrated Care

Manufacturers are transitioning from pure hardware providers to end-to-end service partners—integrating device + monitoring + home nursing support. This model increases recurring revenue and customer lifetime value.

Successful Examples of Home Medical Equipment Deployment Worldwide

1. Home Dialysis Programs

Countries such as the U.S., UK, Canada, Australia, and parts of Europe have successfully implemented large-scale home dialysis programs. These models show improved patient autonomy, fewer complications, and better quality of life.

2. Home Infusion Therapy

Highly successful in the U.S. and expanding globally, home infusion allows treatments including antibiotics, chemotherapy, biologics, and parenteral nutrition to be administered at home. Providers offer device supply, nursing, and monitoring services.

3. Remote Cardiac Monitoring

Cardiac implants with home telemetry systems have transformed how arrhythmia patients are managed. Remote monitoring reduces hospital visits and enables continuous oversight of cardiac rhythms.

4. Home Oxygen Therapy

Countries with strong home respiratory therapy infrastructure—such as the U.S., UK, Germany, and Japan—have demonstrated improved patient outcomes with long-term home oxygen therapy supported by portable concentrators.

Global Regional Analysis & Government Policies Shaping the Market

North America

- Strongest regulatory and reimbursement framework for home medical equipment.

- Medicare and private insurers support DME, home oxygen, CPAP therapy, and RPM.

- Policies promoting early discharge and remote monitoring accelerate adoption.

Impact: High penetration of home oxygen, mobility devices, infusion pumps, and remote monitoring.

Europe

- Strong chronic-care infrastructure; home care widely integrated in Western Europe.

- Digital health strategies and remote monitoring reimbursement expanding.

- Varying coverage levels across countries but overall a supportive policy environment.

Impact: Rapid adoption of connected HME in countries with favorable reimbursement (Nordics, Germany, UK).

Asia-Pacific

- Fastest-growing region driven by large populations, rising chronic disease rates, and improving healthcare infrastructure.

- China’s regulatory reforms and manufacturing incentives support HME expansion.

- Japan and Australia have well-established home care systems.

Impact: High growth in home respiratory therapy, DME, glucometers, and telehealth-enabled devices.

Latin America

- Growing demand in urban centers; fragmented reimbursement.

- Public–private partnerships and NGO-supported home care programs are expanding.

Impact: Increasing adoption of home oxygen, DME, mobility products, and diabetic monitoring tools.

Middle East & Africa

- Emerging adoption of homecare services in GCC countries.

- Slow but steady adoption in Africa driven by diabetes and respiratory disease rise.

Impact: Gradual expansion, with high potential in urban areas.

Cross-Regional Policy Themes

- Reimbursement expansion is the strongest catalyst for HME adoption.

- Digital health regulatory frameworks are increasingly emphasizing device interoperability and cybersecurity.

- Governments are incentivizing technologies that reduce hospital burden and improve home-based chronic care.

- Telehealth normalization post-pandemic continues to drive connected HME growth.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Confectionery Market Revenue, Global Presence, and Strategic Insights by 2034