Confectionery Market Size

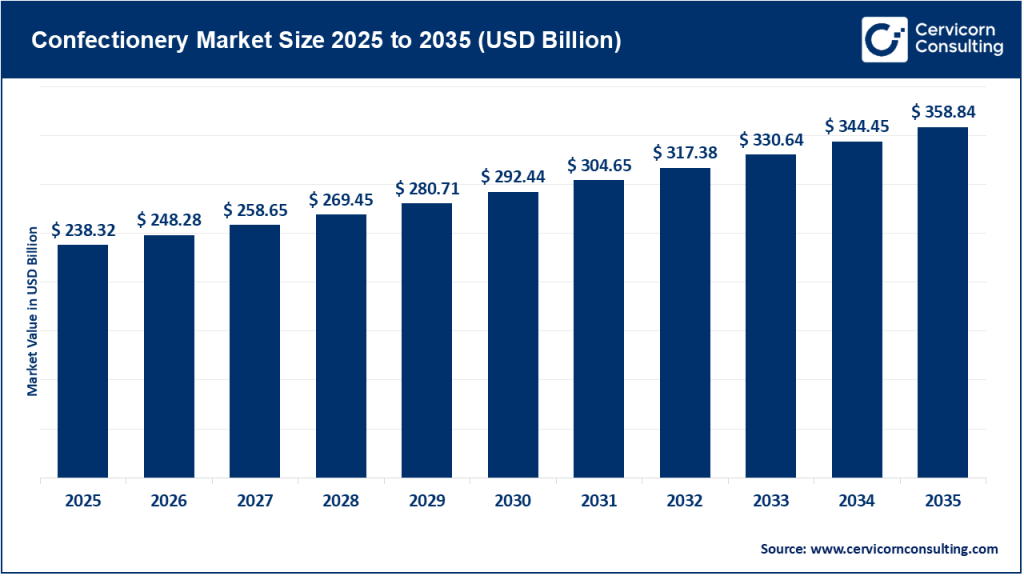

The global confectionery market size was worth USD 238.32 billion in 2025 and is anticipated to expand to around USD 358.84 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% from 2025 to 2034.

What is the Confectionery Market?

The confectionery market encompasses the production, distribution, and sale of sweet-based food products including chocolates, candies, gums, mints, toffees, caramels, and other sugar-based treats. It forms a vital segment of the global food and snack industry, with both traditional and innovative offerings driving consumption across all age groups. This market is divided into two primary categories: chocolate confectionery and non-chocolate confectionery (sugar candies, gummies, mints, and gums). Key players operate across multiple channels such as supermarkets, convenience stores, online platforms, and duty-free outlets, reflecting the product’s widespread accessibility and appeal.

Beyond satisfying sweet cravings, the confectionery sector plays a cultural role — shaping celebrations, gifting traditions, and everyday indulgence worldwide. From festive chocolates to seasonal candies, confectionery products are integral to consumer habits and social customs, making this market both economically and emotionally significant.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2808

Why It Is Important

The confectionery industry is more than a category of sweet delights — it’s an economic engine and an innovation driver. Economically, it fuels retail margins, supports vast manufacturing and supply-chain ecosystems, and sustains employment across agriculture, production, packaging, logistics, and marketing sectors. For consumers, confectionery offers affordable indulgence, comfort, and a sense of reward, contributing to emotional well-being and lifestyle rituals.

Strategically, the category acts as a launchpad for technological innovation in food formulation, sustainability practices, and marketing creativity. Confectionery companies often pioneer advancements in packaging, shelf merchandising, and responsible sourcing, influencing broader food industry standards. As global populations urbanize and disposable incomes rise, the confectionery sector continues to expand its footprint, balancing indulgence with healthier formulations and sustainable operations.

Confectionery Market — Growth Factors

Global confectionery market growth is fueled by increasing disposable incomes, urban lifestyles, and evolving snacking habits. As consumers seek quick indulgence, convenience, and comfort, demand for both chocolate and sugar confectionery rises across developed and emerging economies. Premiumization and gifting trends drive higher-value purchases, while innovation in flavors, textures, and packaging sustains consumer excitement. Health-conscious reformulations, such as sugar-free, organic, and functional ingredient options, attract a broader audience. E-commerce expansion and digital marketing amplify reach, while sustainability initiatives — like ethically sourced cocoa and eco-friendly packaging — enhance brand loyalty. Despite challenges from fluctuating raw material costs, sugar taxes, and labeling regulations, the sector remains resilient, demonstrating consistent value growth and adaptability across regions.

Confectionery Market — Top Companies

1. The Hershey Company

- Specialization: Chocolate and non-chocolate confectionery, with an expanding portfolio into salty snacks.

- Key Focus Areas: North American leadership, innovation, seasonal marketing, and selective international expansion across India, Mexico, Brazil, and Malaysia.

- Notable Features: Home to iconic brands such as Hershey’s, Reese’s, and Kisses; strong merchandising and seasonal offerings.

- 2024 Revenue: Approximately USD 11.2 billion.

- Market Share & Global Presence: Market leader in the U.S. chocolate segment with growing global operations in select emerging markets.

2. Mondelez International, Inc.

- Specialization: Global snacking powerhouse with a robust confectionery portfolio spanning chocolate, gum, and candy alongside biscuits.

- Key Focus Areas: Premiumization, emerging market expansion, sustainability in cocoa sourcing, and cross-category innovations between biscuits and chocolate.

- Notable Features: Global leadership with iconic brands like Cadbury, Toblerone, Milka, and Trident; strong omnichannel distribution network.

- 2024 Revenue: Around USD 36.4 billion.

- Market Share & Global Presence: Operates in more than 150 countries, holding leading confectionery shares across Europe and emerging markets.

3. Nestlé S.A.

- Specialization: Diversified food and beverage conglomerate with a significant confectionery division (KitKat, Smarties, Aero).

- Key Focus Areas: Product innovation, sustainable sourcing, and leveraging global brand equity across premium chocolate lines.

- Notable Features: Combines R&D strength with extensive distribution; introduces functional and low-sugar confectionery variants.

- 2024 Revenue: Total group sales of approximately CHF 91.4 billion; confectionery segment contributed about CHF 8.4 billion.

- Market Share & Global Presence: One of the top global food companies with confectionery operations across 185+ countries.

4. Ezaki Glico Co., Ltd.

- Specialization: Japanese confectionery and snacks manufacturer best known for Pocky and other biscuit-based products.

- Key Focus Areas: Flavor innovation, cultural integration, and international expansion across Asia and Western markets.

- Notable Features: Pioneer of stick-style confectionery; strong brand resonance through “Pocky Day” and frequent limited-edition releases.

- 2024 Revenue: Approximately ¥331.1 billion.

- Market Share & Global Presence: Market leader in Japan and expanding presence in Southeast Asia and North America.

5. Meiji Co., Ltd.

- Specialization: Confectionery, dairy, and nutrition-based food products.

- Key Focus Areas: Product diversification, quality leadership, and premium chocolate innovation.

- Notable Features: Trusted Japanese household brand emphasizing craftsmanship and R&D excellence.

- 2024 Revenue: Around ¥1,105.5 billion.

- Market Share & Global Presence: Strong dominance in Japan with steady international growth in Asia-Pacific markets.

Leading Trends and Their Impact

- Premiumization and Craft Chocolate Expansion:

Consumers increasingly prefer artisanal, single-origin, and premium chocolate experiences. This shift is driving up margins for luxury confectionery while encouraging mass brands to develop high-end sub-brands and gift collections. - Health-Conscious and Functional Confectionery:

Demand for low-sugar, vegan, organic, and functional sweets (fortified with vitamins or protein) continues to grow. Brands are investing in reformulation to cater to dietary needs without compromising taste. - Sustainability and Ethical Sourcing:

Transparency in cocoa sourcing, fair-trade practices, and eco-friendly packaging are shaping brand reputation. Companies like Nestlé and Mondelez are investing heavily in traceability and carbon-neutral initiatives. - Digitalization and E-Commerce Growth:

Online gifting, personalized packaging, and direct-to-consumer models are redefining distribution. Digital campaigns and influencer collaborations boost engagement among younger demographics. - Seasonal and Cultural Customization:

Regional celebrations like Halloween, Diwali, Lunar New Year, and Christmas drive seasonal spikes in sales. Custom packaging and limited-edition launches help sustain brand relevance year-round. - Regulatory Compliance and Reformulation Pressure:

Governments worldwide are enforcing sugar taxes and front-of-pack labeling requirements, pushing companies toward innovation in natural sweeteners, portion control, and new formats.

Successful Examples of Confectionery Market Innovations

- Japan’s Pocky (Ezaki Glico):

Pocky’s success lies in constant flavor innovation, cultural marketing, and product portability. Its integration into Japanese pop culture, coupled with strategic international branding, has made it an enduring global icon. - United Kingdom’s Cadbury (Mondelez):

Cadbury maintains brand loyalty through heritage storytelling, festive campaigns, and continual flavor evolution. Its ability to merge nostalgia with novelty drives sustained market leadership. - United States’ Reese’s (Hershey):

Reese’s seasonal and limited-edition formats — from Halloween pumpkins to Christmas trees — demonstrate how strategic timing and product creativity fuel annual sales growth. - Switzerland’s Lindt (Not listed but relevant):

Lindt’s focus on premium ingredients and global retail boutiques illustrates the success of luxury confectionery, appealing to affluent consumers seeking indulgence with craftsmanship. - Emerging Market Example — India’s Amul & Parle:

Local brands combining affordability with familiarity dominate the growing mass-market confectionery segment in India, showing how regional adaptation is key to scale.

Global Regional Analysis

North America

North America remains a mature but resilient market for confectionery, led by the U.S. and Canada. Consumers favor premium and nostalgic brands, while portion-controlled packs and healthier alternatives gain traction. Halloween, Valentine’s Day, and Easter continue to generate significant seasonal revenue spikes. Although sugar taxes are limited, consumer awareness of sugar intake influences reformulation and labeling strategies. Companies like Hershey and Mondelez focus on merchandising innovation and digital engagement to maintain share.

Europe

Europe’s confectionery market is defined by quality consciousness, tradition, and regulatory evolution. Premium chocolate and ethical sourcing are dominant trends in Western Europe, while Eastern Europe offers cost-competitive growth opportunities. Several countries have introduced or proposed taxes on high-sugar foods, prompting companies to adapt recipes or reduce portion sizes. European Union sustainability frameworks are also pressuring companies to adopt recyclable packaging and reduce carbon footprints.

Asia-Pacific

Asia-Pacific represents the fastest-growing region in the confectionery market. Rising incomes, westernized snacking habits, and the gifting culture in China, India, and Japan drive expansion. Japan’s sophisticated consumer base demands continuous innovation, while India’s vast youth demographic fuels volume-driven growth. Government initiatives such as India’s Food Safety and Standards Authority (FSSAI) nutrition labeling and restrictions on marketing to children are reshaping marketing strategies. In China, cross-border e-commerce and gifting during festivals like the Mid-Autumn Festival boost premium chocolate demand.

Latin America

Latin America offers a blend of growth potential and regulatory challenge. Brazil and Mexico are large consumption markets, but sugar taxes and inflationary pressures influence pricing. Colombia’s implementation of a sugar tax in 2023 signals a regional shift toward public health-driven policy. Manufacturers respond with sugar-free or low-calorie alternatives and stronger local partnerships to manage logistics and cost efficiency.

Middle East & Africa

Emerging economies in the Middle East and Africa provide long-term growth avenues. Young populations, urbanization, and tourism boost confectionery demand. Duty-free sales at airports and regional festivals like Eid and Ramadan drive spikes in premium gifting chocolates. However, economic volatility and limited cold-chain infrastructure pose logistical challenges. Governments are beginning to explore health-driven labeling and import regulation reforms, which could reshape future product offerings.

Government Initiatives and Policies Shaping the Market

- Sugar Taxes and Fiscal Policies:

A growing number of countries are implementing sugar taxes on high-sugar foods and beverages. These measures aim to reduce sugar consumption but also impact pricing and demand. Manufacturers are countering with smaller pack sizes, price repositioning, and reformulated recipes to stay compliant and competitive. - Front-of-Pack Labeling (FOPL) Regulations:

Clear nutritional labeling is becoming mandatory in many markets, including India, the EU, and Latin America. Transparent labeling aims to empower consumers but challenges companies to balance attractiveness with compliance. - Health Claims and Advertising Controls:

Restrictions on advertising confectionery to children are tightening worldwide. Regulations limit cartoon branding, promotional offers, and influencer marketing targeting minors. These restrictions push brands toward responsible marketing and adult-oriented innovation. - Sustainability and Traceability Regulations:

Governments and NGOs are demanding deforestation-free cocoa sourcing, ethical labor practices, and carbon footprint disclosures. Major players are adopting blockchain-enabled traceability systems and investing in farmer welfare programs to meet evolving sustainability standards. - Packaging Waste Management:

Circular economy policies, such as extended producer responsibility (EPR), are influencing how confectionery companies manage packaging. Brands are shifting toward biodegradable wrappers and recyclable materials to align with environmental regulations and consumer expectations.

Industry Response to Market Dynamics

- Reformulation and Health Innovation:

Companies are developing reduced-sugar, high-fiber, or functional confectionery lines to meet new health standards and consumer demand for guilt-free indulgence. - Portfolio Diversification:

To offset raw material price fluctuations, manufacturers are diversifying into adjacent snack categories like biscuits, baked treats, and nutritional bars. - Digital Transformation:

Online stores, personalized gifting options, and AI-driven marketing campaigns are now central to brand growth strategies. - Sustainable Supply Chains:

Investments in traceable cocoa sourcing, renewable energy in factories, and recyclable packaging reinforce long-term brand equity. - Localized Product Innovation:

Regional adaptation — from matcha-flavored chocolates in Japan to masala-infused candies in India — demonstrates how localization sustains relevance in culturally diverse markets.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Smart Gas Meter Market Revenue, Global Presence, and Strategic Insights by 2034