Full Service CRO Market Size

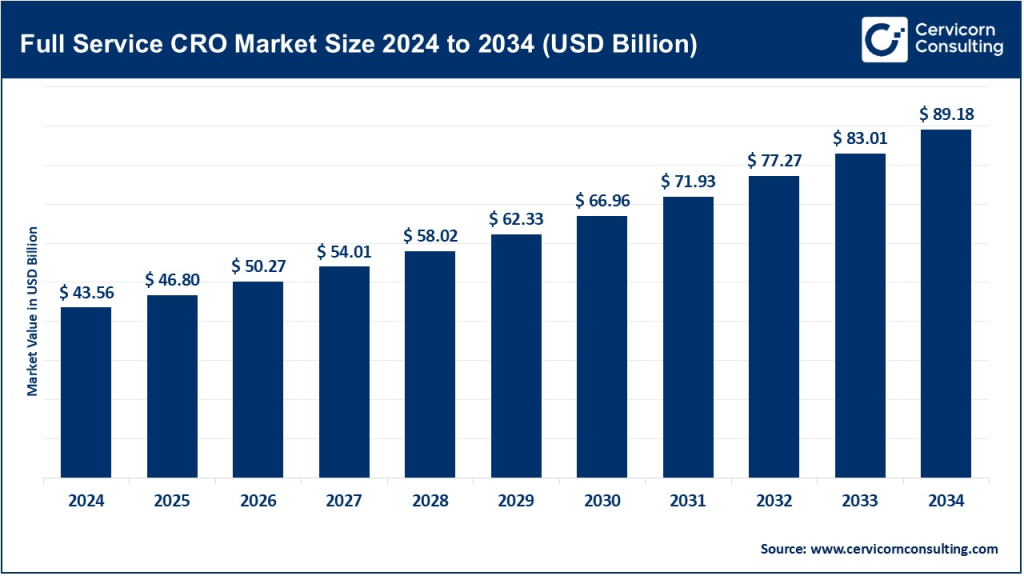

The global full service CRO market size was worth USD 43.56 billion in 2024 and is anticipated to expand to around USD 89.18 billion by 2034, registering a compound annual growth rate (CAGR) of 7.42% from 2025 to 2034.

What Is the Full Service CRO Market?

The Full‑Service Clinical Research Organization (CRO) market includes companies that offer comprehensive clinical trial support to pharmaceutical, biotech, and medical device firms. These CROs manage everything from early-stage protocol development to post-marketing surveillance. Their services typically cover study design, site management, patient recruitment, data management, statistical analysis, regulatory consulting, laboratory services, and medical imaging. Full-service CROs act as strategic partners, ensuring global coordination, regulatory compliance, and efficient execution of complex clinical trials.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2615

Full Service CRO Market Growth Factors

The full-service CRO market is rapidly growing due to increased outsourcing of pharmaceutical R&D, the rising complexity of clinical trials (especially in gene and cell therapies), the adoption of decentralized clinical trials through digital platforms, cost benefits of conducting trials in emerging markets, growing use of artificial intelligence and big data in trial management, and a surge in investments for personalized medicine and rare disease drug development.

Why Is It Important?

- Cost & Efficiency

Full-service CROs help reduce overhead for sponsors by offering centralized resources and infrastructure, lowering costs while maintaining quality. - Specialized Expertise

These CROs bring deep therapeutic knowledge, especially in high-growth areas like oncology and rare diseases, and have regulatory expertise across diverse geographies. - Speed to Market

Their global networks and digital capabilities—such as AI-driven recruitment and remote monitoring—shorten development cycles, getting therapies to patients faster. - Regulatory Navigation

Full-service CROs understand the intricacies of FDA, EMA, and ICH regulations and help sponsors navigate audits, submissions, and compliance. - Innovation Partnering

CROs are increasingly involved in real-world data integration, decentralized trials, and adaptive designs, supporting the push for more innovative, patient-centric trials.

Top Companies in the Full Service CRO Market

Below are profiles of five major full-service CROs and their core offerings:

1. Medpace

- Specialization & Focus: Offers centralized services including imaging, bioanalytical labs, and Phase I clinical trials.

- Notable Features: Maintains in-house capabilities, allowing tighter control over timelines and data quality.

- 2024 Revenue: Estimated around US$920 million.

- Market Share & Presence: Medium-scale but globally recognized for operational excellence and therapeutic expertise.

2. Laboratory Corporation of America Holdings (LabCorp / Covance)

- Specialization & Focus: Comprehensive services from preclinical testing to post-market surveillance.

- Notable Features: One of the largest providers of central laboratory services globally.

- 2024 Revenue: Total company revenue ~$14 billion; Covance clinical development division contributes significantly.

- Market Share & Presence: Strong foothold in North America and expanding in Europe and Asia-Pacific.

3. ICON plc

- Specialization & Focus: End-to-end trial services with focus on real-world evidence and decentralized clinical trials.

- Notable Features: Known for operational depth and global reach; strengthened by acquisition of PRA Health Sciences.

- 2024 Revenue: Estimated ~$4 to $5 billion.

- Market Share & Presence: Extensive operations in 55 countries; strong presence in both commercial and government-sponsored trials.

4. IQVIA Inc.

- Specialization & Focus: Data science-driven CRO offering full-service clinical development and analytics.

- Notable Features: Market leader in data analytics and artificial intelligence for trials.

- 2024 Revenue: Nearly US$15 billion.

- Market Share & Presence: Largest global CRO; serves top-tier pharma and biotech clients across all regions.

5. Syneos Health

- Specialization & Focus: Integrated clinical and commercial solutions for biopharma companies.

- Notable Features: Combines CRO services with commercialization, offering a full product lifecycle partnership.

- 2024 Revenue: Around US$4.4 billion.

- Market Share & Presence: Focused on North America and Europe, with growing presence in Asia-Pacific.

Leading Trends & Their Market Impact

Decentralized Clinical Trials (DCTs)

CROs are increasingly managing hybrid and fully remote trials using wearables, e-consent, and remote monitoring. These models reduce participant burden and accelerate enrollment timelines.

AI & Big Data Integration

Artificial intelligence is used to optimize protocol design, predict recruitment outcomes, and flag non-compliance. Big data analytics improve trial feasibility and site selection.

Therapeutic Specialization

CROs are aligning their services around high-growth therapeutic areas like oncology, neurology, and rare diseases, helping sponsors execute highly targeted and personalized trials.

Global Trial Expansion

Trials are expanding rapidly in Asia-Pacific, Eastern Europe, and Latin America due to lower costs, faster enrollment, and improving regulatory environments.

Real‑World Evidence (RWE)

CROs are integrating electronic health records, insurance claims data, and wearable devices to support post-approval monitoring and supplement clinical trial data.

M&A & Consolidation

The industry is consolidating, with large CROs acquiring niche firms to expand their capabilities, geographic reach, and digital infrastructure.

Talent Shift & Offshoring

CROs are relocating operations such as data management and biostatistics to countries like India and the Philippines to reduce costs and access skilled labor.

Successful Global Examples

IQVIA’s AI-Driven Enrollment

Using predictive analytics, IQVIA has reduced screening times and improved enrollment accuracy, especially in complex oncology trials.

ICON-PRA Consolidation

The merger created a CRO with deeper digital and decentralized trial capabilities, helping sponsors run global trials more efficiently.

Medpace’s End-to-End Lab Integration

By offering centralized lab, imaging, and early-phase services under one roof, Medpace ensures consistent data quality and faster trial execution.

Parexel’s AI Partnerships

Collaborations with AI firms allow Parexel to forecast trial risk, improve protocol design, and enhance patient engagement strategies.

Global Regional Analysis

North America

- Market Share: Accounts for nearly 45% of the full-service CRO market.

- Growth Drivers: High clinical trial activity, advanced healthcare infrastructure, and early adoption of digital trial technologies.

- Policy Support: Strong backing from the FDA for decentralized trials and data standardization.

Europe

- Market Share: Contributes around 30% of global revenues.

- Growth Drivers: Increasing R&D investments, active EMA engagement, and expanding biotech pipelines.

- Policy Support: Harmonization of clinical trial processes under the EU Clinical Trials Regulation.

Asia-Pacific

- Market Share: Fastest-growing region with a CAGR exceeding 8%.

- Growth Drivers: Lower trial costs, increasing patient populations, and improving regulatory environments.

- Policy Support: Streamlined regulatory processes in countries like India and China.

Latin America and Middle East / Africa

- Market Share: Emerging markets with increasing trial activity.

- Growth Drivers: Rapid healthcare development, government interest in clinical research, and diverse patient populations.

- Challenges: Infrastructure limitations and regulatory complexities still exist in parts of these regions.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Pharmaceutical REMS Market Size, CAGR, Opportunities, and Forecast by 2034