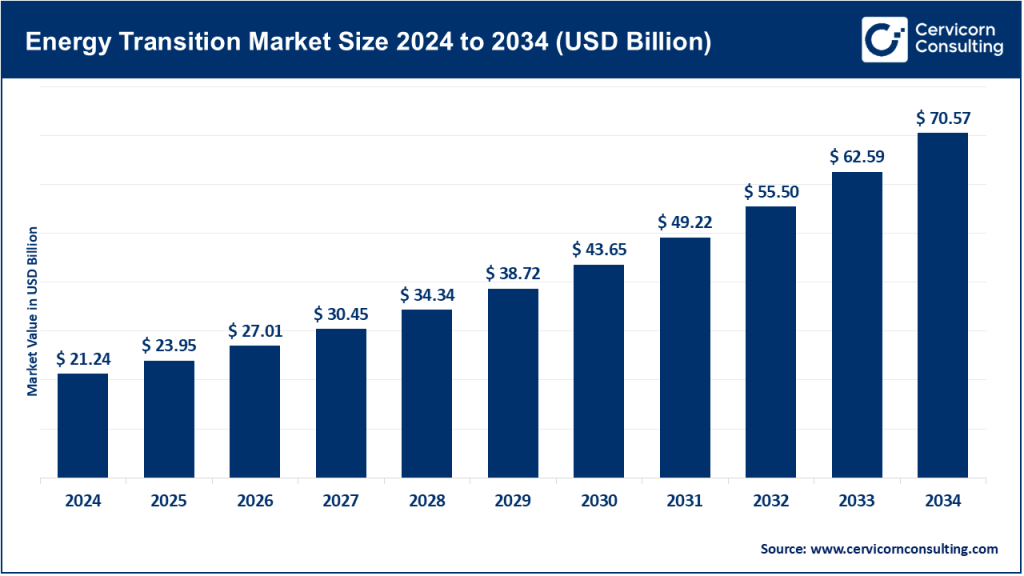

Energy Transition Market Size

Growth Factors

Rapid technological cost declines (especially solar photovoltaics and lithium-ion batteries), large public subsidies and tax incentives (spurring project finance), corporate net-zero commitments and ESG-driven capital flows, increasing electrification of transport and industry, grid modernization needs to integrate variable renewables, energy security concerns after geopolitical shocks (which favor domestic clean energy), advances in long-duration storage and hydrogen for hard-to-abate sectors, and falling unit costs through learning curves and scale — together create a reinforcing growth loop for the energy transition market. These factors are amplified by new market structures (capacity markets, clean energy credits), cross-sector digitalization (AI for grid optimization), and global supply-chain investments that make deployment faster and cheaper.

What is the Energy Transition Market?

Put simply: it’s the market for the technologies, services, finance, and policy instruments required to decarbonize energy supply and use. That includes building and operating solar and wind farms, deploying batteries and other storage, upgrading transmission and distribution systems, electrifying vehicles and buildings, producing and distributing low-carbon fuels like green hydrogen, and selling software and services that stitch all of those pieces together. It is not a single product market but a system-of-markets that interact (power generation, networks, storage, transport, industry).

Why the Energy Transition Market Is Important

The energy transition market sits at the intersection of climate risk, economic opportunity, and national security. Rapid decarbonization of energy is essential to limit global warming, reduce air pollution (and associated health costs), and secure long-term energy supply. Economically, the transition is a major engine of industrial investment, job creation, and technology competition (manufacturing solar, batteries, electrolyzers). Strategically, countries view domestic renewable capacity, storage, and flexible grids as a way to increase energy independence and buffer against fossil-fuel price shocks. In short: it’s where climate goals meet economic growth and geopolitical resilience.

Energy Transition Market — Top Companies

Below are concise profiles for the five utilities requested, focusing on specialization, key focus areas, notable features, 2024 revenue, market share (relative to this peer group), and global presence.

1) Exelon Corporation

- Specialization: Regulated electric utilities and competitive power generation with notable exposure to nuclear, distribution utilities, and energy services.

- Key focus areas: Grid modernization, clean generation (including operating low-carbon nuclear fleet), customer electrification programs, and utility-scale investments supporting reliability and resilience.

- Notable features: Largest regulated electric utility parent in the U.S. by customer base; strong emphasis on regulated earnings stability and large-scale capital programs for grid investments.

- 2024 revenue: $23.028 billion.

- Market share (peer group): ~18.5%.

- Global presence: Primarily U.S.-centric with multiple regulated utilities across states.

2) Duke Energy Corporation

- Specialization: Large investor-owned utility focused on generation, transmission/distribution, and regulated customer service across the U.S. Southeast and Midwest.

- Key focus areas: Grid modernization, renewables and storage procurement, electrification, and regulated capital investment in resilience and decarbonization.

- Notable features: Large service territory with integrated generation and distribution; actively procuring renewables and storage to meet state clean energy mandates.

- 2024 revenue: $30.357 billion.

- Market share (peer group): ~24.4%.

- Global presence: U.S.-focused utility operations.

3) Pacific Gas and Electric Company (PG&E)

- Specialization: Investor-owned utility serving Northern & Central California with electric and natural-gas services.

- Key focus areas: Wildfire mitigation, grid hardening and undergrounding, renewables integration, customer electrification, and large capital investment programs tied to California’s ambitious climate policies.

- Notable features: Serves ~16 million people; very active in safety, resilience, and decarbonization initiatives; subject to strict state regulatory scrutiny.

- 2024 revenue: $24.419 billion.

- Market share (peer group): ~19.7%.

- Global presence: U.S.-focused, primarily in California.

4) Southern Company

- Specialization: Regulated electric utilities and competitive generation across the U.S. Southeast.

- Key focus areas: Grid modernization, new low-carbon generation (including nuclear projects), renewables, and customer energy solutions.

- Notable features: Large regional presence, major investments in nuclear energy (Vogtle project), and active policy engagement on decarbonization.

- 2024 revenue: $26.7 billion.

- Market share (peer group): ~21.5%.

- Global presence: U.S.-centric but with industry-wide influence in nuclear and grid innovation.

5) American Electric Power (AEP)

- Specialization: Regulated electric utility and transmission owner/operator with a large U.S. footprint.

- Key focus areas: Transmission expansion, renewables integration through PPAs and partnerships, and grid resilience for extreme weather.

- Notable features: One of the largest U.S. transmission owners; focuses on interregional lines enabling renewables integration.

- 2024 revenue: $19.721 billion.

- Market share (peer group): ~15.9%.

- Global presence: Primarily U.S.-based with transmission-heavy operations.

Combined Peer Group Context

Together these five firms represent a large share of regulated utilities driving the energy transition in the U.S. They are central to building grid infrastructure, integrating renewables, and enabling electrification. Their combined 2024 revenues offer a snapshot of capital flowing through the utility sector into transition-related investments.

Leading Trends in the Energy Transition and Their Impact

- Rapid cost declines for wind, solar, and batteries — shifting investment from fossil assets to renewables+storage and enabling faster electrification.

- Grid modernization and transmission buildout — critical to integrate renewables at scale; creates new revenue streams for utilities.

- Electrification of transport and heat — increases demand growth, requiring smarter distribution planning and managed charging.

- Policy and tax-credit acceleration — incentives like the U.S. IRA reshape project economics and attract global capital.

- Green hydrogen and long-duration storage — opening pathways for industrial decarbonization and seasonal balancing.

- Digitalization and AI for grid operations — improving forecasting, reducing curtailment, and optimizing system efficiency.

- Local, decentralized generation and community energy — distributed solar, storage, and microgrids enhance resilience but add regulatory complexity.

Successful Examples of the Energy Transition Around the World

- Germany — Energiewende: Policy-driven shift that has enabled renewables to contribute more than half of power generation, proving long-term commitments can reshape national energy systems.

- Uruguay — rapid renewable uptake: Achieved ~98% renewable electricity through auctions and integrated planning, a global success story in rapid decarbonization.

- Denmark — wind leadership: Pioneered offshore wind, showing how market integration and flexibility can enable high renewable penetration.

- Costa Rica — near 100% renewables: Reliance on hydro, wind, and geothermal allows Costa Rica to generate most of its power from clean sources, setting a global benchmark.

Global Regional Analysis — Government Initiatives and Policies

North America (U.S. & Canada)

- United States: The Inflation Reduction Act (IRA) introduced major tax credits and incentives for renewables, EVs, hydrogen, and domestic manufacturing.

- Canada: Federal carbon pricing, green bonds, and clean electricity regulations support renewables and hydrogen initiatives.

Europe

- European Green Deal and Fit-for-55: Ambitious climate targets driving renewable deployment, grid investment, and industrial decarbonization.

- REPowerEU: Accelerates diversification away from fossil fuels and strengthens energy security.

China & East Asia

- China: Largest global investor in renewables, batteries, and grid modernization. National plans focus on massive renewable scaling by 2035.

India & South Asia

- India: Aggressively scaling solar and wind through auctions; launching the National Green Hydrogen Mission to promote industrial decarbonization and domestic electrolyzer production.

Latin America

- Uruguay and Costa Rica: Leaders in renewable integration. Broader region benefits from auctions and resource-rich renewable potential.

Africa

- Increasing focus on solar, storage, and mini-grid solutions, with international financing playing a critical role in deployment.

Key Policy Levers Shaping the Market

- Tax credits, auctions, and procurement rules that influence project economics.

- Grid planning and interconnection reforms that unlock large-scale renewable deployment.

- Local manufacturing and content requirements to strengthen domestic supply chains.

- Hydrogen and storage roadmaps to decarbonize hard-to-abate sectors.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Offshore Wind Market Trends, Growth Drivers and Leading Companies 2024