Dairy Products Market Size

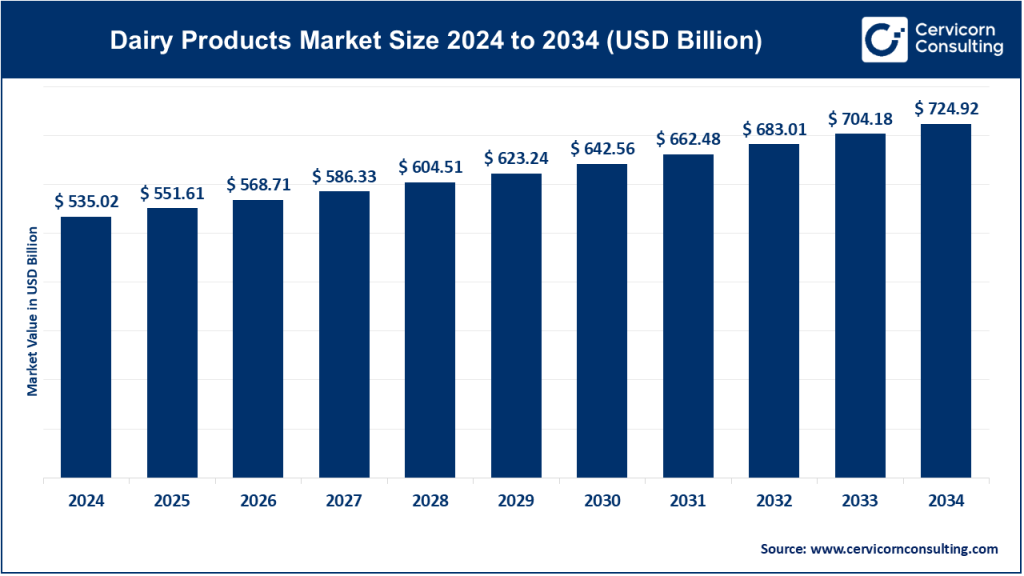

The global dairy products market size was worth USD 535.02 billion in 2024 and is anticipated to expand to around USD 724.92 billion by 2034, registering a compound annual growth rate (CAGR) of 3.09% from 2025 to 2034.

What Is the Dairy Products Market?

The dairy products market encompasses the entire value chain of milk and milk-derived foods—from raw milk production and collection to processing, distribution, and retail. It includes consumer dairy items such as fluid milk, cheese, yogurt, butter, cream, ice cream, milk powders, and specialty dairy; industrial dairy ingredients such as whey, casein, and milk solids used in confectionery and packaged foods; as well as logistics, cold-chain, and supply systems required to maintain product quality and shelf-life. The market also integrates farmers, cooperatives, processors, ingredient suppliers, distributors, retailers, foodservice operators, and regulators.

Why Is the Dairy Products Market Important?

Dairy plays a vital role in human nutrition, economic development, employment generation, and food security. Nutritionally, dairy provides high-quality protein, calcium, vitamins (A, D, B12), and essential minerals that support growth, bone health, and overall well-being. Economically, the dairy sector sustains millions of smallholder farmers globally and forms a major agro-industrial segment powering rural economies. Its integration with logistics, processing, packaging, and retail makes dairy a crucial part of national food systems, particularly in emerging and densely populated regions. Many governments consider dairy a strategic sector because it secures nutritional needs and supports rural livelihoods.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2369

Dairy Products Market Growth Factors

The dairy products market is expanding due to rising urbanization, increasing disposable incomes, evolving dietary preferences, and growing demand for protein-rich, convenient, and fortified foods. Adoption of advanced processing technologies such as ultra-filtration, UHT processing, and precision fermentation is improving product quality and extending shelf-life, enabling wider geographic reach. Premiumization trends—organic dairy, lactose-free products, probiotic yogurts, and high-protein beverages—are pushing consumers toward higher-value offerings. Governments are strengthening dairy infrastructure through subsidies, modernization programs, cold-chain development, and cooperative support. Meanwhile, sustainability, animal welfare concerns, and methane-reduction initiatives are reshaping production practices. Despite feed price volatility and trade fluctuations, integration, consolidation, and investments in digitalized supply chains continue to drive efficiency and global expansion.

Top Companies in the Dairy Products Market

Below are profiles of the leading global companies—Nestlé, Danone, Lactalis, Arla Foods, and FrieslandCampina—featuring specialization, key focus areas, notable features, 2024 revenue, market share relevance, and global presence.

1. Nestlé S.A.

Specialization:

A diversified global food and beverage company with a strong dairy portfolio including powdered milk, chilled dairy desserts, creamers, and nutrition products.

Key Focus Areas:

Health and wellness innovation, infant nutrition, sustainable sourcing, reformulation of healthier dairy products, and broad global distribution.

Notable Features:

Largest food company globally with extensive R&D capabilities, strong brand equity, and presence in almost every food and beverage category.

2024 Revenue:

Approximately CHF 91.4 billion (company-wide global revenue).

Market Share & Global Presence:

Operates in nearly 185 countries, with strong market share in powdered milk, infant nutrition, dairy beverages, and value-added dairy categories. Its dairy footprint is particularly strong in Europe, Asia, and Latin America.

2. Danone S.A.

Specialization:

Focused heavily on fresh dairy, yogurt, plant-based alternatives, medical nutrition, and bottled water. One of the world’s largest manufacturers of fresh fermented dairy products.

Key Focus Areas:

Probiotic and functional yogurt, plant-dairy hybrid innovations, balanced nutrition, and sustainable agriculture.

Notable Features:

Pioneer in probiotic dairy; strong brand families such as Activia, Actimel, and Danone yogurt; major investments in plant-based product lines.

2024 Revenue:

Approximately €27.38 billion (total company revenue).

Market Share & Global Presence:

Strong positions in Europe, North America, Latin America, and parts of Asia. A leading player in yogurt and fresh dairy with strong influence in health-oriented consumer segments.

3. Lactalis Group

Specialization:

A pure dairy giant with an enormous portfolio covering cheese, milk, butter, cream, yogurt, and milk powders. Active in branded and private-label dairy.

Key Focus Areas:

Global acquisitions, scale efficiency, cheese diversification, and strengthening milk supply networks.

Notable Features:

Frequently recognized as the largest dairy company in the world based solely on dairy revenue. Owns well-known brands across Europe, the Americas, the Middle East, and Africa.

2024 Revenue:

More than €30 billion in 2024.

Market Share & Global Presence:

Strong dairy market leadership in Europe and significant presence in the U.S., Latin America, Middle East, and Asia. Extensive export operations and vertically integrated supply chains.

4. Arla Foods amba

Specialization:

A major European dairy cooperative producing milk, cheese, butter, milk powders, and branded dairy products.

Key Focus Areas:

Farmer-owned cooperative governance, sustainability, protein innovation (e.g., Arla Protein line), and expanding international markets.

Notable Features:

Owned by thousands of dairy farmers across Denmark, Sweden, Germany, and the UK. Known for sustainable farming programs and high-quality milk standards.

2024 Revenue:

Approximately €13.8 billion.

Market Share & Global Presence:

Large market share in Northern Europe with growing exposure in the Middle East, Africa, and Asia. Strong brand recognition in cheese and premium dairy.

5. FrieslandCampina N.V.

Specialization:

Dairy cooperative specializing in milk, cheese, infant formula ingredients, and consumer dairy products.

Key Focus Areas:

Nutritional ingredients for infant and medical nutrition, sustainability, and cooperative supply chain enhancements.

Notable Features:

Deep expertise in milk powder, whey ingredients, high-value nutrition solutions, and consumer dairy in Europe and Asia.

2024 Revenue:

Approximately €12.9 billion.

Market Share & Global Presence:

Strong European footprint with significant exports to Asia and the Middle East. Major player in the global infant nutrition ingredient market.

Leading Trends in the Global Dairy Products Market and Their Impact

1. Health, Wellness, and Premiumization

Consumers increasingly prefer products that are healthier, cleaner-label, and functionally beneficial. Demand for lactose-free dairy, high-protein yogurt, Greek yogurt, probiotic beverages, and fortified milk is rising sharply.

Impact: Companies investing in R&D, nutrition science, and premium packaging capture higher margins and better brand loyalty.

2. Plant-Based Competition and Hybrid Dairy

Plant-based beverages (almond, oat, soy, coconut) continue to grow, influencing dairy manufacturers to diversify into hybrid and plant-forward innovations.

Impact: Dairy companies are adapting portfolios, reducing risk, and expanding consumer reach while defending market share.

3. Sustainability and Low-Emission Dairy Farming

Pressure to reduce methane emissions, improve animal welfare, and adopt regenerative agricultural practices is reshaping supply chains.

Impact: Firms investing early in sustainability gain access to eco-conscious consumers and compliant retail partners but face higher operating costs.

4. Vertical Integration and Consolidation

Large dairy firms and cooperatives are expanding through mergers, acquisitions, and supply-chain integration.

Impact: Improved cost efficiency, stronger bargaining power with retailers, and more reliable milk supply.

5. Digital Transformation and Smart Dairy Farming

AI-driven herd monitoring, automated milking systems, and data-driven feed optimization are revolutionizing dairy farms.

Impact: Higher productivity and better milk yields, although requiring significant upfront investment.

6. Biosecurity, Testing, and Risk Management

Disease outbreaks and supply disruptions have prompted governments to increase testing, animal health monitoring, and farm-level risk interventions.

Impact: Strengthened food safety systems but increased compliance burden for farmers and processors.

Successful Examples of Dairy Markets Around the World

1. The Netherlands – High-Efficiency Dairy Chain

The Netherlands showcases one of the world’s most efficient dairy ecosystems, driven by advanced R&D, high-yield herds, strong cooperatives, and a powerful export strategy via companies like FrieslandCampina.

2. New Zealand – Export Powerhouse

New Zealand’s pasture-based dairy model and cooperative system (led by Fonterra) allow it to dominate global exports of milk powder, butter, and cheese. Its high-quality milk and low-cost production ensure competitive advantage.

3. India – The World’s Largest Milk Producer

India’s dairy sector is built on cooperative strength, especially through Amul and NDDB. Government-led initiatives such as Operation Flood and subsequent modernization programs have significantly increased milk availability and empowered millions of dairy farmers.

4. Europe – Specialty Cheese and High-Value Dairy

France, Italy, and Switzerland produce globally renowned cheeses backed by protected origin labels. These premium dairy niches command high margins worldwide.

Global Regional Analysis with Government Initiatives and Policies

North America

- The United States supports dairy farmers with programs like Dairy Margin Coverage and risk-management initiatives to protect against price volatility.

- Significant investments in dairy biosecurity, testing, and animal health help stabilize production and maintain supply chain continuity.

- Focus on sustainability and methane reduction programs encourages adoption of anaerobic digesters and improved feed technologies.

Europe

- The Common Agricultural Policy (CAP) supports dairy farmers with subsidies, direct payments, and environmental compliance requirements.

- Policies encourage sustainable grazing, reduction of emissions, and modernization of dairy farms.

- Many countries provide additional national-level support to strengthen cooperatives and processing capacity.

India and South Asia

- India operates large-scale dairy development programs like the National Dairy Plan, the Dairy Infrastructure Development Fund, and state-level modernization initiatives.

- Policies focus on improving breeding, veterinary care, feed availability, cold-chain expansion, and cooperative efficiency.

- Rising urbanization and processed dairy demand are driving massive investments in processing plants and distribution networks.

East & Southeast Asia

- China invests heavily in dairy modernization, food safety, and large-scale dairy farm development.

- Import policies shape global flows of milk powder, whey, and infant nutrition ingredients.

- Southeast Asian countries support domestic dairy via subsidies, local farm development schemes, and foreign investment partnerships.

Africa

- Governments are promoting dairy self-sufficiency through breeding programs, smallholder training, and investments in chilling centers.

- East African countries, particularly Kenya and Uganda, are improving milk collection systems and upgrading local processing capacity.

Latin America

- Countries like Brazil and Argentina emphasize dairy export growth through improved farm productivity and infrastructure enhancements.

- Policy efforts include rural credit programs, quality standards enforcement, and export competitiveness initiatives.

How Policies & Trends Influence Industry Growth

- Farmers and Cooperatives: Benefit from modernization funds, quality incentives, and risk-management programs, but must adapt to environmental and welfare compliance requirements.

- Processors / Manufacturers: Gain from scale, premiumization, and supply stability, but face high costs for sustainability upgrades and advanced processing technologies.

- Retailers and Foodservice: Increasingly demand traceability, eco-labelling, and consistent quality, shaping supplier behavior.

- Investors: Look to macro trends like CAP cycles, trade agreements, and emerging-market consumption patterns to identify long-term opportunities in dairy.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Patient Monitoring Devices Market Revenue, Global Presence, and Strategic Insights by 2034