Patient Monitoring Devices Market Size

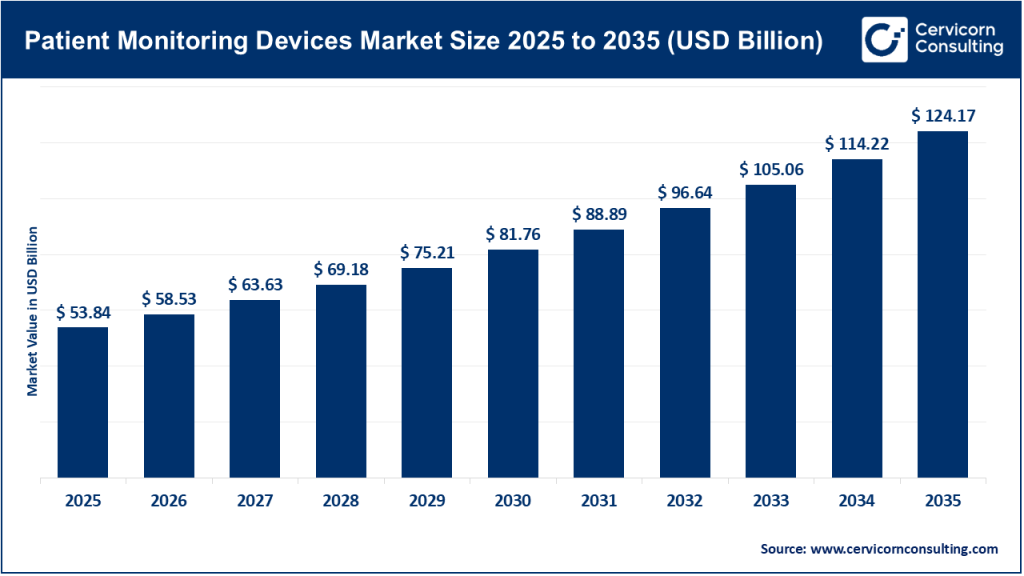

The global patient monitoring devices market size was worth USD 53.84 billion in 2025 and is anticipated to expand to around USD 124.17 billion by 2035, registering a compound annual growth rate (CAGR) of 8.72% from 2026 to 2035.

What Is the Patient Monitoring Devices Market?

The patient monitoring devices market comprises a wide range of technologies designed to measure, record, and communicate essential physiological parameters. These include bedside multi-parameter monitors, wearable sensors, ambulatory cardiac monitors, pulse oximeters, ECG systems, respiratory monitors, BP monitors, fetal monitoring systems, and advanced software platforms for real-time data aggregation and analysis.

These devices serve critical roles in various settings:

- Intensive care units

- Operating rooms

- Emergency departments

- Hospital wards

- Ambulatory centers

- Long-term care facilities

- Home-based remote patient monitoring (RPM)

Market valuations place its worth in the tens of billions of dollars, with strong and steady growth driven by rising digital health investments, the expansion of remote monitoring, and increasing chronic disease prevalence.

Patient Monitoring Devices Market — Growth Factors

The patient monitoring devices market is expanding rapidly due to global aging populations, rising chronic diseases, increased hospitalization rates, and the medical community’s push for continuous monitoring and early-warning systems. Technological advancements such as AI, miniaturized sensors, wireless connectivity, and predictive analytics are further accelerating demand. The shift toward value-based care, home-based patient management, and telehealth adoption is broadening the use of wearable and remote monitors. Additionally, evolving reimbursement policies, increased digital health adoption, government support for remote monitoring programs, and investments in connected-care ecosystems are collectively fueling strong market expansion across all major regions.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2811

Why Is Patient Monitoring Important?

Patient monitoring devices are essential for three major reasons:

- Early Detection of Deterioration: Continuous monitoring identifies abnormal patterns faster than manual assessments, reducing the risk of complications, cardiac arrest, sepsis progression, or respiratory failure.

- Improved Clinical Decision-Making: Real-time data supports more accurate decisions, enhances triage, and reduces uncertainty — especially in critical and emergency care.

- Care Beyond the Hospital: Remote patient monitoring and wearable devices allow healthcare providers to track chronic conditions at home, reducing hospital stays, improving patient adherence, and cutting overall healthcare costs.

With data-driven care becoming standard, monitoring devices are now core infrastructure in modern healthcare delivery.

Top Companies in the Patient Monitoring Devices Market

Below is a detailed breakdown of top companies, including their specialization, notable features, 2024 revenue (company-wide unless specified), market share context, and global footprint.

1. Boston Scientific Corporation

Specialization:

A global leader in cardiovascular devices, electrophysiology tools, and implantable technologies. Patient monitoring relevance includes cardiac diagnostics, monitoring accessories, implantable rhythm devices, and data-integrated procedural systems.

Key Focus Areas / Notable Features:

- Cardiovascular diagnostics

- Electrophysiology mapping technologies

- Integrated cath lab and EP lab monitoring systems

- Strong R&D innovation pipeline

2024 Revenue:

Approximately $16.7 billion.

Market Share & Global Presence:

Boston Scientific has a significant global presence across the Americas, Europe, and Asia-Pacific. While not a pure monitoring company, its cardiac technologies and procedural monitoring systems play a vital supporting role in cardiovascular care worldwide.

2. Hill-Rom Holdings, Inc. (Now part of Baxter International)

Specialization:

Hospital care solutions including patient monitoring systems, vital-sign devices, data-enabled hospital beds, nurse-call systems, and workflow solutions. Hill-Rom also includes legacy Welch Allyn technologies.

Key Focus Areas / Notable Features:

- Point-of-care vital signs monitors

- Connected-care hospital bed platforms

- Nurse-call and alarm management

- Acute-care workflow integration

2024 Revenue (Parent Company — Baxter International):

Approximately $10.6 billion from continuing operations.

Market Share & Global Presence:

Hill-Rom’s legacy assets, under Baxter branding, are widely deployed across hospitals in North America, Europe, and Asia. Their devices form an integrated ecosystem in many acute-care environments.

3. Natus Medical Incorporated

Specialization:

A global specialist in neurodiagnostics, neonatal monitoring, EEG systems, and hearing-screening devices.

Key Focus Areas / Notable Features:

- Neurodiagnostic monitoring

- NICU cerebral and physiological monitoring

- Auditory screening and diagnostics

- Strong presence in specialized neurological equipment

2024 Revenue:

Estimated in the range of $350–$400 million based on available industry summaries.

Market Share & Global Presence:

Natus is dominant in neurodiagnostic and newborn screening markets. It maintains a strong presence across North America, Europe, and parts of Asia-Pacific, supplying critical monitoring tools to hospitals and neonatal centers.

4. Abbott Laboratories

Specialization:

A global leader in diagnostics, continuous glucose monitoring (CGM), cardiovascular diagnostics, and point-of-care monitoring. Abbott’s FreeStyle Libre is one of the world’s most widely adopted CGM systems.

Key Focus Areas / Notable Features:

- Continuous glucose monitoring

- Remote patient monitoring

- Cardiac diagnostic sensors

- Large diagnostics and consumer-health portfolio

2024 Revenue:

Approximately $42 billion.

Market Share & Global Presence:

Abbott is a leading global force in diabetes care, diagnostics, and chronic disease monitoring, with major market share in North America, Europe, and emerging markets. The FreeStyle Libre platform is a commercial benchmark for wearable monitoring success.

5. Edwards Lifesciences Corporation

Specialization:

A leader in structural heart therapies and historically a major player in hemodynamic monitoring (critical care monitoring sensors and systems).

Key Focus Areas / Notable Features:

- Structural heart devices (TAVR, mitral and tricuspid therapies)

- Cardiac surgical solutions

- Hemodynamic monitoring (until sale of the business division)

2024 Revenue:

Approximately $4.1 billion.

Market Share & Global Presence:

Edwards Lifesciences maintains a strong global footprint in cardiovascular care. Its critical-care monitoring unit was sold to another major medical technology company, reshaping its position in the monitoring landscape but reinforcing its focus on structural heart innovations.

Leading Trends in the Patient Monitoring Devices Market and Their Impact

1. Remote and Wearable Monitoring Becomes Mainstream

Remote patient monitoring (RPM) adoption skyrocketed following the global telehealth boom. Wearable devices now track heart rate, glucose, oxygen saturation, respiratory patterns, mobility, and more.

Impact:

- Reduced hospital readmissions

- Better chronic disease management

- Increased patient engagement

- New recurring-revenue subscription models

- Regulatory pressure to secure patient data

2. AI and Predictive Analytics Transform Monitoring

AI algorithms now analyze streams of patient-monitoring data to detect early signs of deterioration, predict sepsis, or identify abnormal cardiac rhythms.

Impact:

- Earlier interventions in ICUs and wards

- Reduced clinical workload

- Improved accuracy vs. manual reviews

- Higher regulatory scrutiny for AI algorithms

3. Miniaturization and Wearable Sensor Fusion

Advances in microelectronics and low-energy sensors allow multi-parameter measurements through a single wearable patch or compact device.

Impact:

- Wider adoption in step-down units and home care

- Better patient comfort and mobility

- Greater demand for long-lasting batteries and wireless standards

4. Interoperability and Integration with EHR Systems

Hospitals increasingly require monitoring devices to integrate seamlessly with electronic health records and clinical dashboards.

Impact:

- Improved workflow efficiency

- More comprehensive patient records

- Competitive advantage for vendors with open APIs

5. Market Consolidation and M&A

Large medtech firms continue to acquire smaller monitoring innovators, reshaping competitive dynamics.

Impact:

- Faster scale-up of connected ecosystems

- Larger companies dominate procurement

- Innovation accelerates as portfolios expand

Successful Patient Monitoring Device Deployments Worldwide

1. Global Rollout of Continuous Glucose Monitoring (CGM)

Devices like Abbott’s FreeStyle Libre have changed diabetes care globally through real-time glucose tracking and remote data sharing.

Success Indicators:

- Improved glycemic control

- Fewer clinic visits

- Massive global adoption in Europe, the U.S., and Asia

2. Integrated Hospital Monitoring Systems (Hill-Rom/Baxter)

Hospitals using integrated beds, vital-sign monitors, and nursing workflow systems report improved response times and workload reduction.

Success Indicators:

- Fewer alarm-fatigue issues

- Better patient positioning and fall detection

- Automated vital-sign transfer to EHRs

3. Neonatal Neurodiagnostic Monitoring (Natus Medical)

NICUs worldwide use Natus’s EEG and cerebral monitoring systems to detect neonatal seizures early.

Success Indicators:

- Faster diagnosis

- Reduced neurological injury risks

- Enhanced newborn survival outcomes

4. AI-Driven Early Warning Systems in Hospitals

Advanced hospitals in the U.S., U.K., and Europe use AI to detect patient deterioration from streaming vital-sign data.

Success Indicators:

- Earlier sepsis detection

- Reduced ICU transfers

- Improved clinician confidence

Global Regional Analysis — Government Initiatives and Policies

North America (U.S. & Canada)

United States

Key policies shaping the market:

- Medicare reimbursement for Remote Patient Monitoring (RPM)

- FDA’s regulatory framework for AI-based and digital monitoring tools

- Incentives for healthcare digitalization

Market Impact:

The U.S. is one of the fastest-growing RPM and wearable monitoring markets.

Canada

- National focus on telehealth expansion

- Provincial digital health programs driving adoption

Market Impact:

Growing adoption of monitoring in rural and elderly care programs.

Europe

European Union

- Stricter MDR regulations requiring clinical validation

- Investments in digital health infrastructure

- National telehealth reimbursement policies in countries like Germany, U.K., and France

Market Impact:

Strong growth for clinically validated, interoperable monitoring systems.

Asia-Pacific

China, India, Japan, South Korea

- Government-funded telemedicine expansion

- Rapid digital health adoption to manage aging populations

- Support for AI-enabled and home-based monitoring solutions

Market Impact:

Asia-Pacific is one of the strongest emerging markets for wearables, RPM, and hospital-based monitoring equipment.

Latin America

- Public hospital modernization programs

- Growing demand for maternal-fetal monitoring

- Remote monitoring initiatives in rural areas

Market Impact:

Adoption is rising, driven by cost-effective solutions and donor-supported healthcare programs.

Middle East & Africa (MEA)

- Countries like UAE and Saudi Arabia investing in cutting-edge digital hospitals

- Africa adopting basic monitoring tools through NGO and government partnerships

Market Impact:

High variability, but increasing emphasis on long-term digital health strategies and connected hospitals.

Additional Market Insights

- The global patient monitoring devices market is widely estimated around $50+ billion in 2024, with strong growth projected through 2030 and beyond.

- Subsegments such as continuous glucose monitors, portable wearables, and remote monitoring platforms exhibit the fastest growth rates.

- Company revenue numbers provided above refer to total corporate revenues, not solely monitoring-specific product lines.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: AI in Data Management Market Revenue, Global Presence, and Strategic Insights by 2034