Construction Equipment Market Size

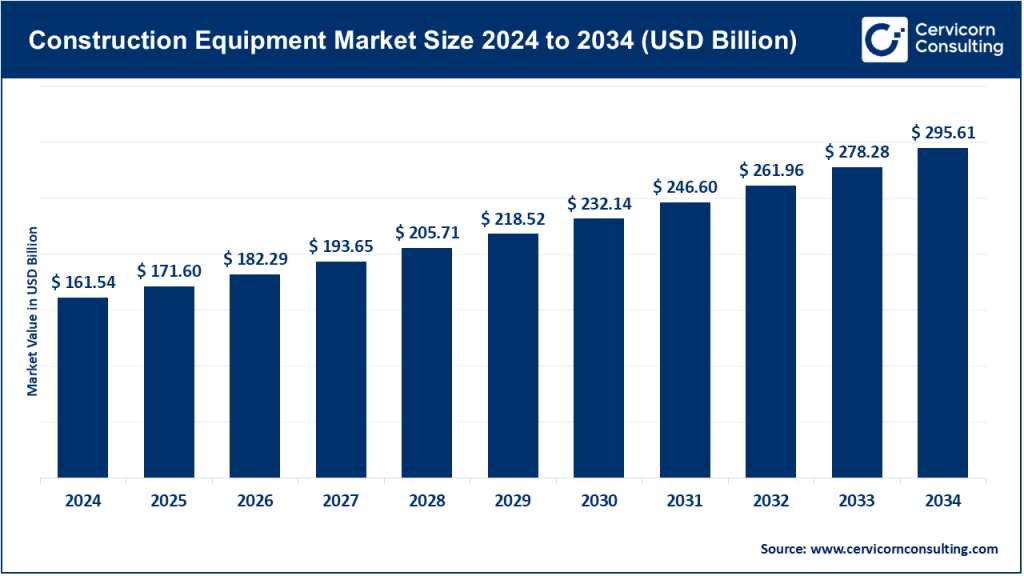

The global construction equipment market size was worth USD 161.54 billion in 2024 and is anticipated to expand to around USD 295.61 billion by 2034, registering a compound annual growth rate (CAGR) of 6.23% from 2025 to 2034.

Construction Equipment Market Growth Factors

The global construction equipment market is experiencing robust growth, driven by several key factors. Urbanization and rapid infrastructure development, particularly in emerging economies, are fueling demand for construction machinery. Technological advancements, such as automation, telematics, and electric-powered equipment, are enhancing operational efficiency and reducing environmental impact. Government initiatives promoting sustainable construction practices and investing in large-scale infrastructure projects further bolster market expansion. Additionally, the rise of the construction equipment rental market offers cost-effective solutions for companies, contributing to the industry’s growth.

What is the Construction Equipment Market?

The construction equipment market encompasses a wide range of machinery used in construction, mining, and other heavy industries. This includes excavators, loaders, cranes, bulldozers, and specialized equipment for tasks like material handling, earthmoving, and demolition. These machines are essential for the efficient and safe completion of construction projects, ranging from residential buildings to large-scale infrastructure developments.

Why is the Construction Equipment Market Important?

The construction equipment market plays a pivotal role in the global economy. It supports the development of critical infrastructure, including roads, bridges, and utilities, which are fundamental to economic growth and urbanization. Moreover, advancements in construction equipment technology contribute to increased productivity, safety, and sustainability in construction practices. The market also creates numerous employment opportunities across manufacturing, maintenance, and operational sectors.

Top Companies in the Construction Equipment Market

- Caterpillar Inc.

- Specialization: Manufactures a broad range of construction and mining equipment, including excavators, loaders, and bulldozers.

- Key Focus Areas: Innovation in automation, telematics, and electric-powered machinery.

- Notable Features: Strong global dealer network and comprehensive after-sales services.

- 2024 Revenue: Approximately $16.2 billion in the fourth quarter, with a year-over-year decline of 5%.

- Market Share: Consistently ranks as the top construction equipment manufacturer globally.

- Global Presence: Operates in over 190 countries with a vast network of dealers and service centers.

- CNH Industrial America LLC

- Specialization: Produces construction equipment under brands like CASE and New Holland.

- Key Focus Areas: Development of compact and heavy construction machinery, with an emphasis on fuel efficiency and operator comfort.

- Notable Features: Integration of advanced technology for enhanced machine performance and reduced emissions.

- 2024 Revenue: Reported a slight decline in global construction equipment sales to $237.6 billion, with CNH Industrial being a significant contributor.

- Market Share: Holds a substantial share in the North American and European markets.

- Global Presence: Manufacturing facilities and operations across Europe, North America, and Latin America.

- Deere & Company

- Specialization: Known for its John Deere line of construction equipment, including backhoes, skid-steer loaders, and motor graders.

- Key Focus Areas: Advancements in precision agriculture technology and integration of smart construction solutions.

- Notable Features: Strong brand reputation for durability and performance.

- 2024 Revenue: Part of the broader $237.6 billion global construction equipment sales, with Deere being a key player.

- Market Share: Significant presence in the North American market, with expanding operations in Asia and Europe.

- Global Presence: Extensive dealer network and manufacturing plants worldwide.

- Doosan Corporation

- Specialization: Offers a range of construction equipment, including excavators, wheel loaders, and articulated dump trucks.

- Key Focus Areas: Development of environmentally friendly machinery and expansion into emerging markets.

- Notable Features: Commitment to innovation and sustainability in product development.

- 2024 Revenue: Part of the global construction equipment sales, with Doosan contributing to the overall market figures.

- Market Share: Noted for its strong presence in the Asian market and growing influence in Europe and North America.

- Global Presence: Manufacturing and R&D facilities in South Korea, China, and other regions.

- Escorts Limited

- Specialization: Produces a variety of construction and agricultural equipment, including tractors and material handling machines.

- Key Focus Areas: Emphasis on cost-effective solutions and catering to the Indian and emerging markets.

- Notable Features: Strong domestic market presence and focus on innovation tailored to regional needs.

- 2024 Revenue: Contributed to the overall market figures, with specific revenue details not disclosed.

- Market Share: Significant share in the Indian market, with increasing exports to neighboring countries.

- Global Presence: Primarily based in India, with expanding operations in Asia and Africa.

Leading Trends and Their Impact

- Automation and Telematics: The integration of automation and telematics in construction equipment enhances operational efficiency, reduces downtime, and improves safety.

- Electric and Hybrid Machinery: The shift towards electric and hybrid construction equipment is driven by environmental concerns and government regulations, leading to reduced emissions and operational costs.

- Smart Construction Solutions: The adoption of smart technologies, including IoT and AI, enables real-time monitoring and predictive maintenance, optimizing equipment utilization.

- Rental Market Growth: The increasing preference for renting construction equipment allows companies to access advanced machinery without significant capital investment, promoting flexibility and cost savings.

Successful Examples Worldwide

- Oslo, Norway: Implemented a mandate requiring all city-managed construction projects to be free from toxic emissions, leading to a significant reduction in noise levels and air pollution.

- Sany Group, China: Aggressively expanded into global markets, with projections to reach 30,000 electric truck sales in 2025, aiming for half of its truck sales to be overseas by 2030.

Global Regional Analysis

North America

- Market Dynamics: Urbanization and infrastructure development are key drivers of market growth.

- Government Initiatives: Significant investments in infrastructure projects, including roads, bridges, and public transportation systems, are expected to boost demand for construction equipment.

Europe

- Market Dynamics: Emphasis on sustainable construction practices and adoption of electric machinery.

- Government Initiatives: Policies promoting green construction and reducing emissions are influencing equipment manufacturing and usage.

Asia-Pacific

- Market Dynamics: Rapid urbanization and industrialization, particularly in countries like China and India, are driving market expansion.

- Government Initiatives: Supportive policies for infrastructure development and adoption of advanced construction technologies.

Latin America & Africa

- Market Dynamics: Growing demand for construction equipment due to infrastructure development and urbanization.

- Government Initiatives: Investments in public infrastructure projects are expected to increase equipment demand.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Software-defined Hardware Market Growth Drivers, Trends, Key Players and Regional Insights by 2034