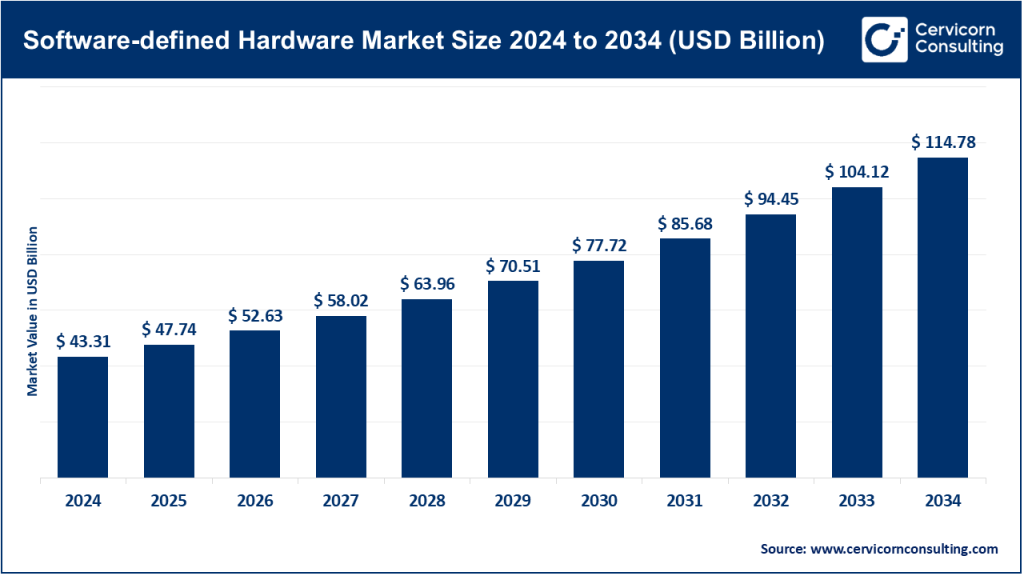

Software-defined Hardware Market Size

What is the software-defined hardware market?

“Software-defined hardware” (SDH) refers to hardware platforms whose behavior, capabilities, and resource allocation are defined, orchestrated, and updated primarily via software rather than through fixed-function silicon or rigid firmware. In practice this includes reconfigurable compute fabrics (FPGAs and adaptive SoCs), programmable network and storage elements, AI accelerators with programmable pipelines, and heterogeneous systems that expose fine-grained programmability through software stacks, runtime layers, APIs, and orchestration tools.

The model flips the old hardware-first paradigm: instead of designing chips that hard-code specific functions, vendors deliver flexible hardware plus software toolchains and runtime platforms so a single device can be repurposed for different workloads, upgraded in the field, or tuned to application-specific pipelines. This enables higher utilization, faster time-to-value for new features, and tighter integration between application logic and underlying silicon.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2740

Why is software-defined hardware important?

Software-defined hardware matters because modern workloads — cloud services, edge inference, 5G network functions, robotics, accelerated analytics, and large-scale generative AI — demand both high performance and rapid adaptability. SDH lets organizations (1) deploy specialised accelerators quickly without tape-outs, (2) update device behavior via software patches and models (reducing lifecycle risk), (3) share physical resources across multiple tenants or workflows (improving utilization and reducing cost), and (4) unify orchestration across heterogeneous fleets (cloud, edge, on-prem). For enterprises and cloud providers, these traits translate to faster product development, responsiveness to new algorithms, improved TCO, and the ability to deliver differentiated services that evolve with software rather than being locked into static silicon choices.

Software-Defined Hardware Market — Growth Factors

The SDH market is being propelled by a confluence of forces: explosive demand for AI/ML workloads that favour specialized, programmable accelerators; cloud providers’ need for flexible, multi-tenant hardware stacks; telco and private-5G rollouts that require programmable network functions (CNFs/NFVs) instead of fixed ASICs; rising edge compute use cases (autonomous vehicles, robotics, industrial IoT) that demand low-latency, field-upgradable accelerators; improved toolchains (compilers, ML runtimes like ONNX/TVM) that make reconfigurable hardware easier to program.

Growing interest in hardware-software co-design for energy efficiency and performance; vendor consolidation and platform integrations that reduce deployment friction; and public policy and capital flows (CHIPS Acts, semiconductor incentives) that expand capacity and R&D for programmable silicon — all combining to produce robust CAGR forecasts for software-defined and related SDx markets.

Software-Defined Hardware — Top Companies

Below are profiles of some leading companies shaping the SDH market. For each company I list specialization, key focus areas, notable features, reported 2024 revenue, and global presence notes.

NVIDIA Corporation

-

Specialization: High-performance GPUs and AI accelerators; full stack from silicon to software (CUDA, cuDNN, Triton, NeMo ecosystems).

-

Key focus areas: Data-center AI acceleration, inference/training racks, networking (Mellanox integration), software stacks for model deployment and orchestration.

-

Notable features: Industry-leading performance for large model training/inference, extensive developer ecosystem and software maturity, DGX/Hopper/Grace family and platform integrations.

-

2024 Revenue: ~$60.9 billion.

-

Market share / positioning: Dominant share in discrete AI GPU accelerators and strong cloud provider adoption for AI workloads.

-

Global presence: Headquarters in the U.S.; global sales and data-center ecosystem across North America, Europe, APAC, and partnerships with hyperscalers worldwide.

Intel Corporation

-

Specialization: x86 CPUs, data-center accelerators, networking, and formerly major FPGA/programmable assets (Altera lineage).

-

Key focus areas: Heterogeneous datacenter compute, integrated accelerators, programmable fabrics via partnerships, and expanding foundry/IDM investments.

-

Notable features: Strong CPU franchise, broad IP portfolio across compute and network silicon, vertical integration with fabrication ambitions.

-

2024 Revenue: ~$53.1 billion.

-

Market share / positioning: Longstanding leader in general-purpose server CPUs; pivoting to regain competitiveness in AI acceleration and programmable hardware.

-

Global presence: Global operations including major fabs and R&D centers in North America, Europe, and Asia.

Advanced Micro Devices (AMD)

-

Specialization: x86 CPUs (EPYC/Ryzen), GPU accelerators (Radeon/Instinct), adaptive SoCs (in part via Xilinx acquisition).

-

Key focus areas: Data-center CPUs and accelerators, adaptive computing via FPGA/ACAP tech (Xilinx integration), optimized server platforms for AI and cloud.

-

Notable features: Competitive CPU performance gains, growing data-center traction, and programmable logic capability via Xilinx assets now consolidated into AMD’s stack.

-

2024 Revenue: ~$25.8 billion.

-

Market share / positioning: Rapidly expanding share in data-center CPU and GPU segments; Xilinx acquisition gives AMD stronger footing for software-defined, adaptive compute.

-

Global presence: U.S. headquarters, global design centers and partnerships; major presence among cloud providers and enterprise OEMs.

Qualcomm Technologies, Inc.

-

Specialization: Mobile SoCs (Snapdragon), embedded AI, edge acceleration for phones, XR, automotive SoCs and networking platforms.

-

Key focus areas: On-device AI, efficient edge inference, automotive and IoT silicon, software toolchains for mobile/edge AI.

-

Notable features: Strong power-efficiency optimization for on-device ML, extensive IP licensing and mobile ecosystem penetration.

-

2024 Revenue: ~$39.0 billion.

-

Market share / positioning: Leader in smartphone SoCs and an important player in edge-AI and embedded programmable silicon.

-

Global presence: Global OEM relationships (Samsung, Xiaomi, etc.), R&D and partnerships across Americas, Asia and Europe.

Xilinx (part of AMD)

-

Specialization: Field-programmable gate arrays (FPGAs), adaptive SoCs, and development toolchains for reconfigurable computing.

-

Key focus areas: Reconfigurable acceleration for communications, data-center inference, industrial and aerospace/defense applications.

-

Notable features: Mature FPGA ecosystem, Peta-scale programmable fabrics, and strong position in networking and telco infrastructure.

-

2024 Revenue: Consolidated into AMD’s totals; standalone run-rates historically around $4–5 billion prior to full integration.

-

Global presence: Strong in telecoms, defense, enterprise networking, and data-center markets worldwide.

Leading trends and their impact

-

AI and Model Proliferation (Training + Inference): The surge in large language models and generative AI has accelerated demand for programmable accelerators that can be upgraded as model architectures evolve. This benefits GPU vendors with rich software ecosystems and FPGA/ACAP vendors that offer in-field reconfigurability.

-

Hardware-Software Co-Design & Abstractions: Toolchain advances (compilers, ML runtimes, abstraction layers) make software-defined hardware more accessible, reducing engineering overhead and enabling broader developer adoption.

-

Network Softwarization (SDN/NFV) & 5G Private Networks: Telecoms moving functions into software running on general-purpose and programmable accelerators expand the SDH addressable market for FPGAs and programmable NICs.

-

Edge & On-Device AI: Power-efficient, programmable edge SoCs and NPUs are pushing intelligence to endpoints (phones, IoT, vehicles).

-

Consolidation and Vertical Integration: Large cloud providers and hyperscalers are partnering with or designing custom silicon (and accompanying software) to ensure optimized stacks; legacy semiconductor companies are acquiring adaptive compute firms to combine strengths.

-

Ecosystem Play & Managed Platforms: Vendors that can offer both programmable hardware and mature software orchestration (libraries, model compilers, monitoring, and security) are favored by enterprises — shifting competition from pure silicon metrics to platform breadth and developer productivity.

Successful examples of software-defined hardware in production

-

Hyperscaler AI Racks & Accelerators: Cloud providers deploy racks composed of GPUs and programmable networking that are instantiated for different tenants and workloads; these are effectively software-defined resources orchestrated by software.

-

Telco Virtualized RAN and vBNFs on FPGAs: Operators running virtualized radio access networks (vRAN) use FPGAs and programmable NICs to accelerate PHY layer and packet processing while retaining the ability to update algorithms via software.

-

Automotive Domain Controllers & Over-the-Air Updates: Modern vehicles incorporate domain controllers with programmable accelerators for ADAS and cockpit AI; vendors enable new features through software updates on top of programmable silicon.

-

Edge AI Appliances in Retail and Manufacturing: Devices performing real-time inference (quality inspection, inventory tracking) rely on programmable edge NPUs and runtime frameworks, enabling rapid adaptation to new models or workflows via software pushes.

Global regional analysis including government initiatives and policies shaping the market

North America

The U.S. has aggressively funded semiconductor manufacturing and R&D via the CHIPS and Science Act, unlocking tens of billions in incentives, facility grants, and tax credits to onshore production and advanced packaging — efforts that indirectly boost SDH by improving domestic manufacturing, encouraging R&D in programmable silicon, and strengthening supply chains. State and federal grants to major fabs further catalyze the ecosystem by securing supply and encouraging investments in advanced packaging and heterogeneous integration.

Europe

The European Chips Act aims to rebuild regional chip capabilities (with an ambition to increase the EU’s share of advanced semiconductors). The act mobilizes around €43 billion in funding for R&D, design, and manufacturing — an environment that should accelerate adoption of programmable fabrics in automotive, industrial, and telecom sectors across the bloc.

Asia-Pacific

A dominant manufacturing base (Taiwan, South Korea, Japan, China) continues to supply most wafer fabrication and packaging. Regional industrial policies — from Japan’s foundry partnerships to South Korea’s and China’s large national investments — sustain supply. APAC is both a production hub and major demand center for edge AI, mobile SoCs, and SDH deployments (automotive, consumer electronics).

India, Middle East & Latin America

Emerging policy actions (PLI schemes in India for electronics and semiconductors, sovereign investment funds in the Middle East) aim to nurture local design and manufacturing ecosystems. While nascent compared to the US/EU/APAC programs, these initiatives lower barriers for SDH adoption in enterprise telco and government digitalization projects.

How policy shapes SDH adoption

Public incentives expand fabrication, encourage advanced packaging and chiplet ecosystems, and underwrite R&D programs — all of which reduce supply-side constraints and stimulate vendors to invest in programmable silicon and tooling. Conversely, export controls and national security restrictions can complicate cross-border deployment strategies for SDH vendors and customers.

Enterprise adoption models

Enterprises evaluate SDH options on a blend of technical metrics (latency, throughput, power), software maturity (toolchains, SDKs), lifecycle support (upgrades, security patches), and operational models (managed hardware, cloud-hosted accelerators, on-prem appliances). Successful adopters design pilots around clear ROI drivers (e.g., inference throughput gains, lower energy per inference) and prioritize platforms that integrate with existing orchestration systems (Kubernetes, cloud APIs, and model deployment pipelines).

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: India Consumer Electronics Market Growth Drivers, Key Players, Trends and Regional Insights by 2034