Automotive Software Market Size

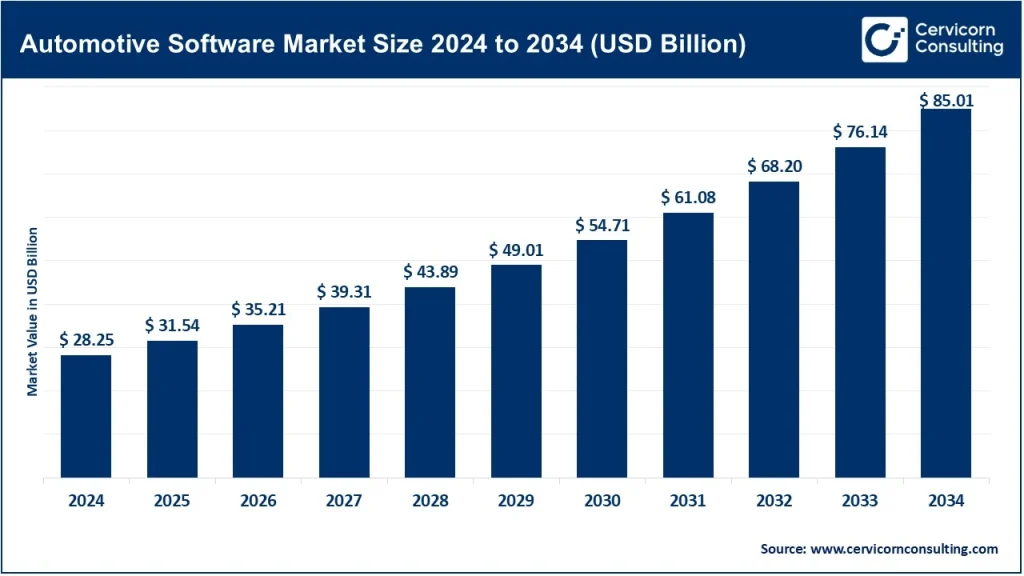

The global automotive software market size was worth USD 28.25 billion in 2024 and is anticipated to expand to around USD 85.01 billion by 2034, registering a compound annual growth rate (CAGR) of 11.65% from 2025 to 2034.

What is the Automotive Software Market?

The automotive software market encompasses the development, deployment, and management of software systems that power modern vehicles and the entire automotive value chain. It includes embedded software controlling engine functions, safety systems, and infotainment; middleware that ensures real-time communication between electronic control units (ECUs); cloud-based solutions managing vehicle data, telematics, and connected services; and enterprise systems supporting automotive design, manufacturing, and retail operations. Automotive software enables advanced driver assistance systems (ADAS), autonomous driving capabilities, predictive maintenance, vehicle connectivity, and digital retail experiences. The market spans automakers (OEMs), Tier-1 suppliers, cloud service providers, and specialized automotive technology companies that deliver solutions to make vehicles safer, smarter, and more efficient.

Automotive Software Market Growth Factors

The automotive software market is witnessing rapid expansion driven by the global shift toward software-defined vehicles (SDVs), rising adoption of electric vehicles (EVs), and the increasing integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies. The growing need for real-time data analytics, vehicle connectivity, and over-the-air (OTA) updates is fueling software investments by automakers. Governments mandating stricter emission and safety standards, consumer demand for connected experiences, and OEM strategies to generate new recurring revenue streams from software subscriptions are also accelerating market growth. In addition, the increasing complexity of vehicle architectures, cybersecurity requirements, and cloud-based lifecycle management solutions further boost demand for advanced automotive software across all regions.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2803

Why the Automotive Software Market is Important

Software has become the defining element of modern vehicles. Beyond mechanical engineering, software determines how a car drives, connects, and interacts with its user and surroundings. It ensures safety through ADAS and autonomous functionalities, supports sustainability by optimizing EV energy consumption, and enhances user experience through infotainment and navigation. From an industrial perspective, software enables automakers to transition from traditional manufacturing to continuous innovation and service-driven models. It allows automakers and suppliers to collect, analyze, and monetize data, providing recurring revenue beyond vehicle sales. For dealers and fleets, software improves operational efficiency, predictive maintenance, and customer satisfaction. In essence, software is the core that binds vehicles, infrastructure, and consumers—transforming the automotive industry into a digitally connected ecosystem.

Automotive Software Market Top Companies

1. Cox Automotive

Specialization & Key Focus Areas:

Cox Automotive specializes in digital retailing, inventory management, fleet solutions, and vehicle remarketing. Its platforms such as Manheim, Dealertrack, and vAuto streamline dealership operations, automate workflows, and provide comprehensive data insights.

Notable Features:

The company’s platforms integrate end-to-end dealer management systems, analytics, and vehicle valuation tools that enhance decision-making for dealers and consumers. Its data-driven platforms power digital transformation across the automotive retail and remarketing ecosystem.

2024 Revenue & Market Share:

Cox Automotive is among the top vendors in the automotive software segment, with a dominant market share in dealership management and digital retailing platforms. In 2024, the company continued expanding its digital retail and mobility technology portfolio.

Global Presence:

Headquartered in the U.S., Cox Automotive operates across North America, Europe, Australia, and select Asian markets, serving dealers, manufacturers, and fleet operators globally.

2. Microsoft Corporation

Specialization & Key Focus Areas:

Microsoft provides cloud computing, data analytics, and artificial intelligence (AI) solutions through Azure, enabling connected vehicle platforms, digital twins, and smart manufacturing for automotive companies.

Notable Features:

Microsoft’s “Azure Connected Vehicle Platform” allows automakers to deliver personalized driver experiences, telematics, and real-time updates. Its tools support SDV development, simulation, and data-driven product design.

2024 Revenue & Market Share:

While Microsoft doesn’t report automotive-specific revenue, its Azure cloud services are used by major automakers worldwide, including Volkswagen, General Motors, and Stellantis. Its strong partnerships make it a critical player in mobility and automotive digitalization.

Global Presence:

Microsoft operates in more than 190 countries, with a global data center network that supports automotive clients in Europe, North America, and Asia-Pacific.

3. SAP SE

Specialization & Key Focus Areas:

SAP is a leader in enterprise software for automakers and suppliers, providing ERP, supply chain, manufacturing, and customer relationship management solutions. It helps integrate vehicle lifecycle data across design, production, and after-sales operations.

Notable Features:

SAP’s automotive solutions offer end-to-end process visibility, integrating manufacturing execution systems with customer and product data. Its platforms also support sustainability reporting and compliance tracking.

2024 Revenue & Market Share:

In 2024, SAP’s cloud and software business achieved strong growth, with a substantial portion driven by the automotive vertical. The company is a preferred enterprise software vendor for major OEMs and Tier-1 suppliers worldwide.

Global Presence:

Headquartered in Germany, SAP serves global automotive clients across Europe, the Americas, and Asia-Pacific with extensive local partnerships and implementation networks.

4. CDK Global

Specialization & Key Focus Areas:

CDK Global provides dealer management systems (DMS), customer relationship management (CRM), service, parts, and inventory management software for automotive retailers and OEMs.

Notable Features:

Its DMS platform integrates all dealership functions—sales, finance, parts, and service—into a single digital environment. It enables seamless customer experiences and real-time insights for dealerships.

2024 Revenue & Market Share:

CDK Global remains a leading vendor in dealership software with thousands of clients globally. Despite a major cybersecurity event in 2024, the company maintained its market leadership and demonstrated operational resilience.

Global Presence:

CDK primarily serves North America but has growing market penetration in Europe and other international regions through partnerships and acquisitions.

5. Reynolds and Reynolds

Specialization & Key Focus Areas:

Reynolds and Reynolds provides dealership software solutions for digital retail, finance and insurance (F&I), and customer relationship management. It also offers document management and electronic signature solutions for dealerships.

Notable Features:

Known for its comprehensive DMS suite, Reynolds helps dealerships digitize workflows, streamline operations, and improve customer engagement through automation and data analytics.

2024 Revenue & Market Share:

The company holds a significant market share in the dealership management systems sector, competing closely with CDK and Cox Automotive. It continues to invest in AI-driven workflow optimization.

Global Presence:

Reynolds operates primarily in North America but serves dealers globally through its international distribution and service partners.

Leading Trends and Their Impact

- Software-Defined Vehicles (SDVs):

Automakers are transitioning toward SDVs where software governs most vehicle functionalities. Centralized computing through domain and zonal controllers replaces fragmented ECUs, enabling faster updates and feature deployment. This trend drives massive demand for automotive operating systems, middleware, and cybersecurity solutions. - Over-the-Air (OTA) Updates and Cybersecurity:

OTA updates are now standard for modern vehicles, enabling feature upgrades, bug fixes, and performance enhancements without dealership visits. This trend heightens the need for robust cybersecurity frameworks to prevent breaches and ensure compliance with safety regulations. - Cloud-Native Vehicle Platforms:

Automotive companies are using cloud-based platforms for data storage, analytics, and real-time vehicle connectivity. Cloud infrastructure allows automakers to deliver new digital services, predictive maintenance, and vehicle-to-infrastructure (V2X) communication. - Dealer Digitalization:

Dealerships are embracing digital retail solutions to meet the demand for online vehicle purchasing, inventory visibility, and seamless financing. Dealer management systems are now essential for end-to-end digital transactions and customer experience management. - AI and Machine Learning in Automotive Software:

AI-driven analytics are transforming vehicle diagnostics, predictive maintenance, and driver personalization. Machine learning algorithms enable adaptive cruise control, lane-keeping, and autonomous decision-making. - Open Source and Collaborative Development:

OEMs are increasingly participating in open-source initiatives to accelerate software innovation, share common frameworks, and reduce development costs. This collaboration fosters faster standardization across the industry. - Ecosystem Marketplaces for Automotive Software:

OEMs and technology providers are developing software marketplaces that allow developers and suppliers to distribute and integrate automotive software modules. This encourages interoperability and shortens time-to-market for new vehicle features.

Successful Examples Around the World

- General Motors’ SDVerse Marketplace:

GM’s SDVerse platform, launched with partners Magna and Wipro, acts as a B2B marketplace for trading automotive software components. It demonstrates a major shift toward open ecosystems where automakers and suppliers collaborate on shared digital solutions. - Cox Automotive Digital Retail Platforms:

Cox’s Dealertrack and Manheim systems have revolutionized dealership operations by connecting financing, vehicle listing, and remarketing in real time. These platforms are now considered global benchmarks in dealership software. - Microsoft Azure Connected Vehicle Platform:

Microsoft’s connected vehicle solutions enable automakers like Volkswagen and Stellantis to build digital ecosystems for in-car services, telematics, and data analytics. These partnerships exemplify how cloud infrastructure supports global SDV initiatives. - SAP Automotive Cloud Solutions:

SAP’s software supports OEMs such as BMW and Mercedes-Benz in integrating supply chains, production, and aftersales data. Its enterprise applications form the digital backbone for automotive manufacturing. - CDK and Reynolds Dealership Systems:

Together, CDK and Reynolds have digitized thousands of dealerships worldwide, enabling paperless operations, integrated financing, and data-driven service management.

Global Regional Analysis and Government Policies

North America (U.S. & Canada)

Market Drivers:

North America leads the automotive software market due to advanced technology adoption, a mature dealer network, and the rapid growth of electric and connected vehicles. U.S. automakers are investing heavily in SDVs and digital services to diversify revenue streams.

Government Initiatives:

U.S. authorities are implementing strict vehicle cybersecurity, data privacy, and safety regulations. Policies aimed at securing connected vehicle software and hardware components are driving domestic innovation and vendor diversification.

Europe

Market Drivers:

Europe’s focus on sustainability, safety, and digital transformation fuels automotive software adoption. Major automakers such as Volkswagen, BMW, and Mercedes-Benz are investing in proprietary operating systems and software-driven architectures.

Government Initiatives:

The European Union enforces strict CO₂ emission standards, advanced safety requirements, and data protection regulations like GDPR. These policies stimulate demand for compliance and cybersecurity software, as well as local software development for EVs and SDVs.

Asia-Pacific

Market Drivers:

Asia-Pacific, led by China, Japan, and South Korea, is the fastest-growing region in the automotive software market. The surge in EV adoption, government subsidies, and advancements in 5G connectivity are key growth enablers.

Government Initiatives:

China’s national policies promote EVs and connected vehicle ecosystems, offering tax breaks and R&D incentives. Local OEMs are investing in homegrown software stacks to reduce dependency on foreign vendors, fueling domestic software innovation.

Latin America, Middle East & Africa

Market Drivers:

These regions are gradually adopting digital automotive solutions as vehicle ownership rises and fleet management becomes more sophisticated. Telematics and dealership automation are gaining traction.

Government Initiatives:

Governments are supporting digital transformation in logistics and fleet management, offering incentives for telematics and emissions monitoring systems. However, market adoption is uneven due to economic disparities and infrastructure challenges.

Risk Factors and Strategic Considerations

- Cybersecurity and Data Privacy:

With increasing connectivity, vehicles face higher cyber risks. Any breach could impact vehicle safety and consumer trust, making cybersecurity a critical investment area. - Regulatory Compliance:

Evolving government standards related to data, emissions, and safety demand agile and compliant software architectures, particularly in global supply chains. - Supply Chain Localization:

Geopolitical factors and import restrictions are prompting companies to localize software development and manufacturing to ensure regulatory compliance and resilience. - Talent and Skills Shortage:

The automotive sector faces a shortage of embedded software and AI engineers, pushing companies to invest in upskilling programs and strategic partnerships. - Integration Complexity:

The increasing number of software systems per vehicle raises integration challenges. Vendors must ensure interoperability across ECUs, cloud services, and third-party applications.

Summary

The automotive software market stands at the center of the transformation from mechanical vehicles to intelligent, connected, and software-defined machines. With top companies like Cox Automotive, Microsoft, SAP, CDK Global, and Reynolds and Reynolds leading innovation across cloud, retail, and embedded systems, the industry is undergoing a paradigm shift. Government regulations, cybersecurity standards, and consumer expectations for connectivity are collectively driving investments and reshaping the automotive landscape. As automakers embrace digital ecosystems, the next decade will see vehicles evolve into dynamic platforms for continuous software innovation, connectivity, and user-centric mobility experiences.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Automotive Airbags & Seatbelts Market Growth Drivers, Trends, Key Players and Regional Insights by 2034