Automotive Airbags & Seatbelts Market Size

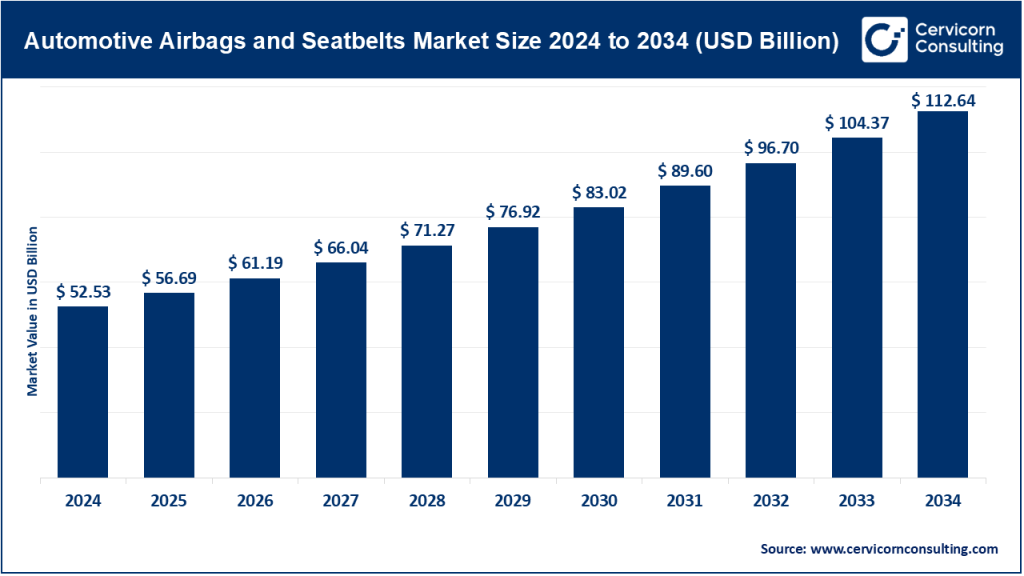

The global automotive airbags and seatbelts market size was worth USD 52.53 billion in 2024 and is anticipated to expand to around USD 112.64 billion by 2034, registering a compound annual growth rate (CAGR) of 7.93% from 2025 to 2034.

What Is the Automotive Airbags & Seatbelts Market?

The automotive airbags and seatbelts market encompasses the design, manufacture, integration, and sale of passive restraint systems in vehicles. “Seatbelts” include webbing, buckles, retractors, pretensioners, and load limiters, while “airbags” include inflators, cushions, sensors, control modules (airbag control units or ACUs), and integrated systems such as front, side, curtain, knee, and center airbags.

Customers include OEMs (vehicle manufacturers), fleets, and aftermarket service providers. Demand is influenced by vehicle production volumes, safety regulations, technological advancements, and replacement cycles.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2793

Why the Market Is Important

Airbags and seatbelts are the backbone of occupant protection. Together they dramatically reduce fatal and severe injuries, complementing active safety systems like ABS, ESC, and ADAS. These passive systems protect occupants when preventive measures fail. In addition to saving lives, effective restraint systems enhance brand reputation, improve crash-test ratings, and lower insurance costs — all crucial for automakers operating in a safety-conscious global market.

Growth Factors

The global automotive airbags and seatbelts market is propelled by a convergence of regulatory mandates, consumer awareness, and rapid technological innovation. Governments across regions are tightening safety laws, mandating airbags and seatbelt reminders even in entry-level vehicles. Rising global vehicle ownership, particularly in emerging economies, is expanding the total addressable market. Advances in sensor technology, adaptive inflation algorithms, and occupant-detection systems are enabling “smart” restraint systems. Electrification and the emergence of new vehicle platforms open design opportunities for creative airbag placement and integration. Additionally, the growing emphasis on safety ratings, insurance incentives, and post-sales replacement demand supports sustained market expansion.

Top Companies in the Automotive Airbags & Seatbelts Market

1. Autoliv Inc.

- Specialization: The world’s largest dedicated supplier of passive safety systems, including airbags, seatbelts, inflators, and electronic control units.

- Key Focus Areas: Advanced inflators, multi-chamber and center airbags, integrated seatbelt systems, occupant sensing, and intelligent deployment algorithms.

- Notable Features: Renowned for innovation and reliability, Autoliv’s systems are credited with saving thousands of lives annually. The company leads in multi-chamber airbag technology and advanced textile engineering.

- 2024 Revenue: Autoliv reported strong full-year results for 2024, with revenue primarily derived from its airbags and seatbelt segments.

- Global Presence: Operations in 25 countries, with major manufacturing and R&D centers in Europe, North America, and Asia.

2. ZF Friedrichshafen AG

- Specialization: A global leader in driveline, chassis, and safety systems. ZF’s Passive Safety division designs and produces seatbelts, airbags, and electronic control units.

- Key Focus Areas: Integration of passive safety systems with ADAS, electronic pretensioners, and mechatronic components for next-generation mobility.

- Notable Features: Pioneers in linking active and passive safety — for example, coordinating braking with seatbelt tensioning during pre-crash scenarios.

- 2024 Revenue: Group-level sales of approximately €41.4 billion in 2024 across all business segments.

- Global Presence: Over 160,000 employees and manufacturing facilities in 40+ countries, with extensive collaborations with global OEMs.

3. Joyson Safety Systems

- Specialization: One of the largest global suppliers of automotive safety products, producing airbags, seatbelts, steering wheels, and control units.

- Key Focus Areas: Fully integrated safety modules, scalable production, and next-generation inflator technology.

- Notable Features: Formed from a merger of several leading safety brands, the company emphasizes global manufacturing synergy and innovation.

- 2024 Revenue: The company posted solid revenues supported by expanding operations in Asia, Europe, and North America.

- Global Presence: Headquarters in Auburn Hills, Michigan, with more than 50 engineering and manufacturing sites worldwide.

4. Hyundai Mobis Co., Ltd.

- Specialization: A top-tier systems supplier and part of Hyundai Motor Group, focusing on airbags, seatbelts, electronics, and integrated safety modules.

- Key Focus Areas: Integration of passive safety with ADAS and EV-specific architectures; development of rear-seat airbags and pedestrian protection systems.

- Notable Features: Combines software, electronics, and mechanical design for holistic safety; invests heavily in R&D and AI-based occupant detection.

- 2024 Revenue: Hyundai Mobis reported strong 2024 financial results, driven by module sales, including safety systems.

- Global Presence: Production and R&D facilities in Korea, China, India, Europe, and North America, supplying both Hyundai Kia Motors and external OEMs.

5. Robert Bosch GmbH

- Specialization: A diversified technology company with a major focus on mobility solutions, sensors, and safety electronics.

- Key Focus Areas: Airbag control units, crash-detection sensors, seatbelt pretensioners, and integration of passive safety with advanced driver-assistance systems.

- Notable Features: Strong semiconductor and sensor capabilities allow Bosch to deliver highly reliable and predictive safety solutions.

- 2024 Revenue: Bosch Group recorded total sales of €90.3 billion in 2024 across all divisions.

- Global Presence: Operations in 60+ countries, serving virtually every major automaker.

Leading Trends and Their Market Impact

1. Smart and Adaptive Restraint Systems

Airbags and seatbelts are becoming increasingly intelligent. Adaptive inflators and load limiters adjust deployment based on occupant weight, position, and crash severity. Occupant detection systems and AI-based algorithms ensure optimal deployment timing. Impact: Enhanced safety outcomes and reduced injury risk, particularly for children and smaller occupants, while creating new revenue opportunities for suppliers offering software-driven safety systems.

2. Integration with ADAS and Vehicle Networks

Passive safety components are now linked to ADAS and vehicle sensors to initiate pretensioning or pre-inflation when a collision is imminent. Impact: This convergence blurs the line between active and passive safety, enabling new forms of predictive protection but also demanding closer OEM-supplier collaboration.

3. New Airbag Configurations

Center airbags (to protect occupants from side-to-side collisions), pedestrian airbags (deployed externally), and rear-seat airbags are being introduced. Impact: Product diversification expands market size and supports premium-segment differentiation.

4. Electrification and Lightweighting

EVs and hybrids alter vehicle structures, battery placements, and crash dynamics. Airbag modules and seatbelt systems must adapt to different cabin geometries and materials. Impact: Drives demand for compact, lightweight components and specialized EV-compatible safety modules.

5. Regional Manufacturing Shift to Asia-Pacific

Asia-Pacific, particularly China and India, has become the largest production hub due to rapid motorization and stricter local safety mandates. Impact: Suppliers expand manufacturing capacity and tailor product pricing for cost-sensitive segments while maintaining compliance with international standards.

6. Sustainability and Circular Economy Practices

Manufacturers are incorporating recycled materials and energy-efficient production methods in restraint systems. Impact: Aligns safety component manufacturing with OEM carbon-neutrality goals and regulatory sustainability benchmarks.

Successful Examples Around the World

- Autoliv’s Multi-Chamber Airbag Deployment: Autoliv’s innovations, including the multi-chamber airbag, have been adopted by global OEMs, reducing chest and head injuries in side impacts.

- Bosch’s Predictive Airbag Control Units: Bosch developed sensor-based algorithms capable of detecting crash severity earlier, allowing airbags to deploy faster and more precisely.

- ZF’s Integrated Safety Platform: ZF’s systems combine braking, steering, and restraint control — exemplifying how active and passive systems can work in harmony to prevent or mitigate collisions.

- Hyundai Mobis’ Rear-Seat Airbags: Hyundai Mobis introduced advanced rear-seat airbags that deploy between rear passengers, reducing head-to-head impact risk.

- Joyson’s Global Modular Integration: Joyson’s integrated airbag modules streamline OEM assembly lines, offering standardized designs that lower production complexity across multiple platforms.

These implementations illustrate how innovation in airbags and seatbelts directly translates to real-world injury reduction and improved safety ratings.

Regional Analysis — Government Initiatives and Policies

North America

The United States and Canada enforce strict seatbelt and airbag regulations. NHTSA mandates frontal airbags and encourages seatbelt reminders in all passenger vehicles. Crash-testing programs such as the IIHS Top Safety Pick + award influence consumer preferences and push OEMs toward enhanced safety systems. In addition, insurance companies offer discounts for vehicles equipped with advanced restraint technologies, promoting market penetration.

Europe

The European Union mandates compliance with UNECE Regulations 94 and 95 for occupant protection. Euro NCAP ratings continue to push manufacturers to adopt more airbags and advanced seatbelt systems, including pretensioners and load limiters. Government initiatives under the “Vision Zero” program, aiming to eliminate road fatalities, support rapid adoption of multi-airbag configurations and integrated restraint electronics.

Asia-Pacific

This region represents the fastest-growing market for airbags and seatbelts. China has implemented mandatory front airbags in all new vehicles and is expanding side and curtain airbag requirements. India’s Bharat NCAP safety rating program, launched to enhance consumer awareness, is accelerating OEM adoption of six-airbag standards. Japan and South Korea continue to lead with high safety norms, integrating smart sensors and adaptive restraints in nearly all new vehicles.

Latin America

While regulations vary across countries, Brazil, Argentina, and Chile have introduced mandates for frontal airbags and three-point seatbelts. Regional programs such as Latin NCAP are driving awareness and pushing for parity with European and North American standards. However, enforcement challenges persist, creating a mixed landscape with both high-end and entry-level vehicles showing differing safety equipment levels.

Middle East & Africa

Regulatory enforcement is still developing, but several Gulf Cooperation Council (GCC) states have tightened vehicle safety import standards, requiring airbags and seatbelts in all passenger vehicles. South Africa’s alignment with UNECE regulations is expected to boost safety-system demand.

Government Programs and Incentives

- NCAP Programs: Euro NCAP, ASEAN NCAP, China NCAP, and Latin NCAP drive OEM competition for safety ratings.

- Mandatory Equipment Rules: Expansion of laws mandating airbags, seatbelt reminders, and child restraint anchors across multiple countries.

- Local Manufacturing Incentives: Governments encourage localization through tax benefits and subsidies, helping suppliers reduce import dependency and costs.

- Public Safety Campaigns: “Click It or Ticket” in the U.S. and similar initiatives worldwide have boosted seatbelt usage, increasing replacement and maintenance demand.

Notes on Market Structure and Data Interpretation

- Revenue Attribution: Some companies (e.g., Autoliv) focus almost exclusively on airbags and seatbelts, whereas others (ZF, Bosch, Hyundai Mobis) generate these revenues as part of larger divisions. Market-specific sales data may therefore represent proportional estimates.

- Segmentation: The market is typically segmented by component (airbags vs. seatbelts), technology (frontal, side, curtain, knee, pretensioner), vehicle type (passenger, commercial, electric), and region.

- Regional Growth Leaders: Asia-Pacific accounts for the majority of volume growth; North America and Europe remain technology leaders; Latin America and Africa represent emerging opportunities through regulatory alignment.

- Future Outlook: Integration of restraint systems with in-cabin monitoring, AI-driven safety algorithms, and sustainable materials will define the next phase of the market.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Medical Affairs Outsourcing Market Revenue, Global Presence, and Strategic Insights by 2034