Automotive Aluminum Extrusion Market Size

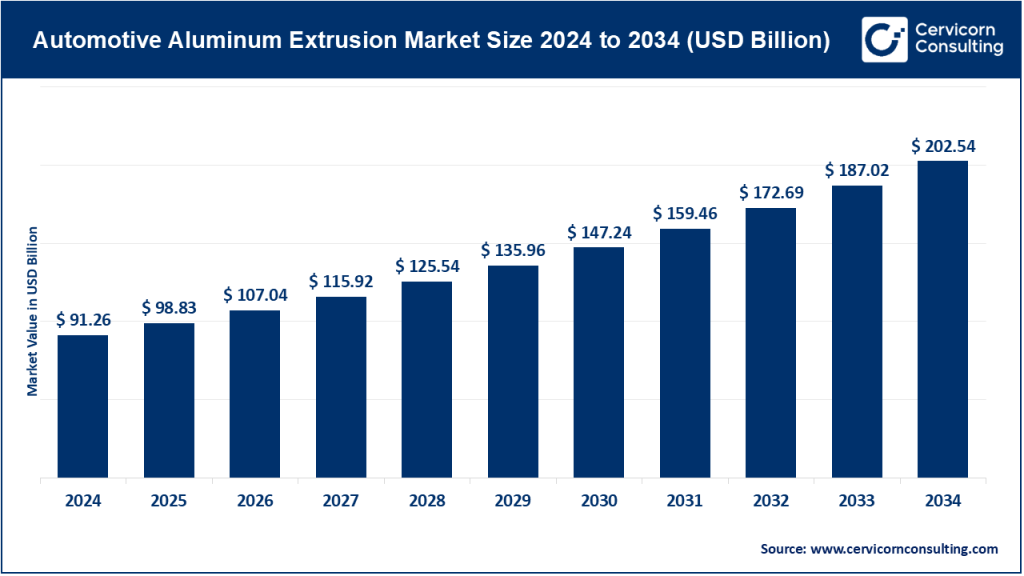

The global automotive aluminum extrusion market size was worth USD 91.26 billion in 2024 and is anticipated to expand to around USD 202.54 billion by 2034, registering a compound annual growth rate (CAGR) of 8.4% from 2025 to 2034.

What Is the Automotive Aluminum Extrusion Market?

The automotive aluminum extrusion market encompasses the production and application of aluminum profiles formed by forcing heated aluminum billets through shaped dies. These extruded products are then utilized in various automotive components such as crash management systems, roof rails, chassis members, body-in-white structures, electric vehicle battery enclosures, and heat exchangers. The process enables manufacturers to create complex cross-sections with high structural integrity and reduced mass.

Extrusions play a pivotal role in both conventional and electric vehicle designs. They help achieve the dual objective of improved performance and reduced environmental impact by lowering overall vehicle weight, enhancing fuel efficiency, and optimizing energy consumption in EVs. The versatility of aluminum extrusions allows automakers to design innovative, high-strength, corrosion-resistant, and recyclable vehicle structures.

Why the Automotive Aluminum Extrusion Market Is Important

The automotive aluminum extrusion market has become increasingly vital to the automotive ecosystem for several reasons:

- Lightweighting and Efficiency: Reducing vehicle weight by using aluminum extrusions directly enhances fuel efficiency and extends EV range, contributing to lower emissions and compliance with global environmental standards.

- Safety and Durability: Aluminum extrusions possess excellent crash energy absorption properties, providing high safety standards without compromising weight reduction goals.

- Sustainability: Aluminum can be recycled repeatedly without losing its properties, making it a preferred material for automakers pursuing circular economy goals.

- Design Flexibility: The extrusion process allows manufacturers to produce customized shapes and cross-sections tailored for specific functions, offering flexibility in structural design and assembly.

- Cost Optimization: While the initial cost of aluminum may be higher than steel, reduced assembly time, energy savings, and improved recyclability lower the total lifecycle cost.

The combination of these advantages positions the aluminum extrusion industry as a key enabler of next-generation vehicle manufacturing strategies.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2712

Automotive Aluminum Extrusion Market Growth Factors

The automotive aluminum extrusion market is expanding due to a convergence of critical growth factors. Rising electric vehicle production globally is increasing demand for lightweight and high-performance materials for battery enclosures, motor housings, and crash protection systems. Governments worldwide are enforcing stricter fuel economy and emission regulations, compelling automakers to replace heavier steel components with aluminum-based alternatives. The growing importance of sustainability and circular economy principles is further accelerating the adoption of recycled and low-carbon aluminum extrusions.

In addition, advances in metallurgy, extrusion technology, and bonding processes are enabling greater application of aluminum across structural and aesthetic components. The expansion of automotive manufacturing in Asia-Pacific and new trade policies in North America and Europe are prompting investment in regional extrusion capacity. Together, these factors are propelling the market’s growth through innovation, sustainability, and regulatory alignment.

Top Companies in the Automotive Aluminum Extrusion Market

1. Bonnell Aluminum

Specialization:

Bonnell Aluminum, a division of Tredegar Corporation, specializes in engineered aluminum extrusions serving multiple industries, including automotive, construction, and transportation.

Key Focus Areas:

The company focuses on providing precision-engineered extrusions, fabrication, and value-added finishing processes tailored to the automotive sector. Its emphasis lies in lightweight solutions for vehicle structures and interior components.

Notable Features:

Bonnell’s strength lies in its integrated approach—combining extrusion, fabrication, machining, and assembly to deliver ready-to-use parts for OEMs. It also invests heavily in operational efficiency and process improvement to enhance throughput and reduce waste.

2024 Revenue:

As part of Tredegar Corporation, Bonnell contributed significantly to Tredegar’s extrusion segment performance, which recorded stable volume growth and improved EBITDA in 2024.

Market Share & Global Presence:

Bonnell maintains a solid regional presence in North America and serves major Tier-1 suppliers and automotive OEMs. Though primarily a regional player, it is recognized for its high engineering precision and customer service excellence.

2. Constellium

Specialization:

Constellium is a leading global manufacturer of rolled and extruded aluminum products used across automotive, aerospace, and packaging industries.

Key Focus Areas:

The company’s automotive division develops crash management systems, structural body components, and battery enclosures. Its focus is on producing high-strength, lightweight materials that improve vehicle safety and efficiency.

Notable Features:

Constellium is renowned for its innovation in high-strength aluminum alloys, advanced joining techniques, and recycling systems. It collaborates closely with major global automakers to co-design optimized aluminum solutions.

2024 Revenue:

Constellium reported total revenues of approximately USD 7.3 billion in 2024, with its automotive structures segment contributing significantly.

Market Share & Global Presence:

Constellium holds a leading market share in Europe and North America, with growing operations in Asia. The company’s extensive R&D network and customer partnerships position it as a technology leader in automotive aluminum extrusions.

3. ALCOA Corporation

Specialization:

ALCOA Corporation is one of the world’s largest aluminum producers, engaged in mining, refining, smelting, and fabrication. Its downstream operations support various industries, including automotive manufacturing.

Key Focus Areas:

The company focuses on low-carbon aluminum solutions and developing new alloys that meet automaker sustainability and lightweighting requirements.

Notable Features:

ALCOA’s leadership in green aluminum production enables OEMs to achieve carbon-neutral goals. It maintains strong relationships with automotive customers through its innovative product range and secure raw material supply chain.

2024 Revenue:

ALCOA reported consolidated revenue of about USD 11.9 billion in 2024.

Market Share & Global Presence:

As a global industry leader, ALCOA’s influence extends across the Americas, Europe, and Asia. Although its extrusion business represents a portion of total operations, its upstream capacity and sustainability initiatives make it a strategic partner for global OEMs.

4. Press Metal Aluminium Holdings

Specialization:

Press Metal Aluminium Holdings is Southeast Asia’s largest aluminum producer, operating across the full value chain from smelting to downstream extrusion and fabrication.

Key Focus Areas:

The company’s automotive segment focuses on developing extruded profiles for structural components, electric vehicle battery housings, and heat exchangers.

Notable Features:

Press Metal’s competitive advantage lies in its vertical integration, advanced production capabilities, and cost-efficient operations. The company continues to invest in technology and capacity expansion to serve global markets.

2024 Revenue:

Press Metal recorded revenue of RM 14.9 billion in 2024, supported by strong global demand and increased downstream sales.

Market Share & Global Presence:

Press Metal commands a dominant position in Southeast Asia and is expanding its presence across Asia-Pacific and the Middle East. It is becoming a key supplier for global automotive OEMs seeking regional diversification.

5. Hydro Extrusions (Norsk Hydro)

Specialization:

Norsk Hydro is a global aluminum company offering primary metal, rolled products, and extrusions. Its Hydro Extrusions division supplies a vast range of automotive and industrial products.

Key Focus Areas:

Hydro focuses on sustainable aluminum solutions, particularly low-carbon and recycled aluminum products used in EV battery enclosures, crash structures, and structural frames.

Notable Features:

Hydro has been at the forefront of producing “green aluminum” using renewable energy sources. Its advanced extrusion plants provide customized solutions for automotive manufacturers worldwide.

2024 Revenue:

Hydro reported strong upstream performance and steady extrusion sales in 2024. Despite market challenges, the company maintained leadership through its focus on green and circular aluminum.

Market Share & Global Presence:

Hydro is among the top global suppliers of extruded aluminum, with operations across Europe, North America, and Asia. Its sustainability-oriented brand has made it a preferred partner for automotive OEMs focusing on ESG goals.

Leading Trends and Their Market Impact

1. Surge in Electric Vehicle Production

The rapid growth of EVs is driving demand for specialized extruded aluminum profiles for battery enclosures, crash management systems, and lightweight chassis. Automakers are redesigning platforms around extruded aluminum structures to meet performance and safety requirements.

2. Focus on Sustainability and Circular Economy

OEMs are prioritizing low-carbon materials and recycled aluminum to meet corporate sustainability goals. Suppliers offering “green aluminum” with traceable emissions data are gaining competitive advantages.

3. Advanced Alloy and Bonding Technologies

New high-strength alloys and improved welding, riveting, and adhesive techniques enable extrusions to replace steel in more applications. This expands the design possibilities and reduces overall vehicle mass.

4. Regionalization of Supply Chains

Trade policies and tariffs are motivating companies to localize production. North America and Europe are seeing a resurgence in domestic extrusion capacity to comply with local content requirements and reduce logistic dependencies.

5. Automation and Digital Manufacturing

Extrusion plants are increasingly adopting robotics, artificial intelligence, and real-time monitoring systems to enhance productivity, maintain consistency, and meet automotive precision standards.

Impact:

These trends collectively accelerate innovation and investment in extrusion technology, sustainability, and production efficiency. Suppliers that combine digital manufacturing, green materials, and customer-centric design will dominate the next phase of market evolution.

Successful Global Examples

- European EV Programs:

Constellium’s collaboration with European automakers has led to the large-scale adoption of extruded aluminum crash management systems and battery frames, setting benchmarks for lightweight vehicle design. - North American Pickup Truck Platforms:

Bonnell Aluminum’s engineered extrusions are widely used in light truck chassis and structural systems, contributing to vehicle safety and fuel efficiency improvements. - Southeast Asian Expansion:

Press Metal’s integrated operations in Malaysia and expansion into regional automotive supply demonstrate how vertical integration supports both cost control and sustainability. - Green Aluminum in Scandinavia:

Hydro’s use of renewable energy and low-carbon production processes in Norway has enabled automakers to source sustainable materials without compromising quality or strength.

Regional Market Analysis and Government Policies

North America

- Demand Drivers:

Strong growth in electric vehicle manufacturing, the rise of lightweight trucks and SUVs, and government incentives for domestic EV production are boosting demand for aluminum extrusions. - Policies:

U.S. and Canadian regulations promoting fuel efficiency, EV adoption, and domestic sourcing are encouraging investment in local extrusion facilities. Trade measures and tariffs have also influenced production localization.

Europe

- Demand Drivers:

High EV penetration, stringent carbon emission standards, and circular economy regulations are driving demand for lightweight and recyclable materials. - Policies:

The European Green Deal and EU automotive emission directives support the integration of low-carbon aluminum and recycled materials into vehicle manufacturing.

Asia-Pacific

- Demand Drivers:

China, India, and Southeast Asia are leading global vehicle production. Rapid urbanization and government incentives for electric vehicles are propelling extrusion demand. - Policies:

China’s EV subsidies and industrial modernization programs support aluminum-intensive vehicle production. India’s “Make in India” and renewable energy initiatives are also contributing to regional capacity expansion.

Latin America, Middle East & Africa

- Demand Drivers:

Increasing automotive assembly operations, infrastructure development, and growing middle-class demand are creating opportunities for aluminum extrusions. - Policies:

Local governments are implementing import substitution and investment incentives to encourage regional extrusion manufacturing and reduce dependency on imports.

Strategic Insights for Industry Stakeholders

- OEM Partnerships:

Automakers and extruders must collaborate early in the design phase to optimize profiles for strength, weight, and cost. - Investment in Green Technology:

Low-carbon aluminum and renewable-powered smelting will be critical differentiators for global suppliers. - Technological Innovation:

Automation, advanced alloys, and 3D extrusion modeling will redefine manufacturing efficiency. - Regional Manufacturing Hubs:

Establishing localized extrusion facilities near major OEM production centers will reduce logistics costs and support sustainability goals. - Talent and R&D Development:

As design complexity increases, investment in skilled engineers and R&D centers will determine long-term competitiveness.

Summary

The automotive aluminum extrusion market is undergoing a transformative phase characterized by sustainability, innovation, and electrification. From EV platforms to crash structures, extrusions are integral to the future of mobility. Global leaders such as Bonnell Aluminum, Constellium, ALCOA, Press Metal Aluminium Holdings, and Hydro Extrusions are pioneering this evolution through strategic investments, technological innovation, and a commitment to low-carbon manufacturing.

With governments emphasizing emission reduction and resource efficiency, the automotive aluminum extrusion market will remain a cornerstone of the industry’s journey toward lightweight, sustainable, and high-performance mobility.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Electric Vehicle Battery Management System Market Revenue, Global Presence, and Strategic Insights by 2034