Electric Vehicle Battery Management System Market Size

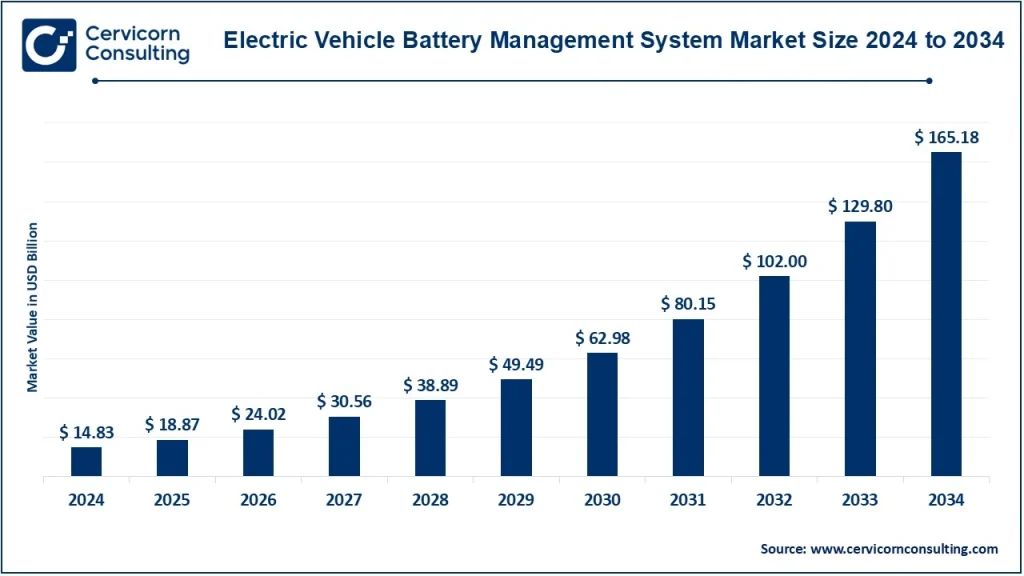

The global electric vehicle battery management system market size was worth USD 14.83 billion in 2024 and is anticipated to expand to around USD 165.18 billion by 2034, registering a compound annual growth rate (CAGR) of 30.12% from 2025 to 2034.

Market Growth Factors

The electric vehicle battery management system (EV BMS) market is being driven by a combination of strong technological, economic, and regulatory forces. Rapid electrification of global passenger and commercial vehicle fleets is increasing the need for reliable and intelligent battery management. Declining lithium-ion cell costs are enabling broader EV adoption across multiple vehicle segments, while rising safety standards and functional safety requirements have made advanced BMS technology essential. In addition, continuous innovation in high-accuracy algorithms for state-of-charge and state-of-health estimation, combined with the adoption of high-voltage and distributed architectures, demands more sophisticated battery control and monitoring systems. Regulatory pressure related to emissions, range accuracy, recyclability, and end-of-life management is further accelerating the need for data-driven BMS solutions. Government incentives, such as tax credits and local manufacturing policies, are strengthening domestic supply chains and encouraging investments in R&D. Collectively, these factors are propelling the EV BMS market from a hardware-centric segment to a holistic ecosystem encompassing software, analytics, cloud connectivity, and lifecycle management.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2556

What is an Electric Vehicle Battery Management System (BMS)?

A Battery Management System (BMS) is the central electronic control unit that monitors, regulates, and safeguards rechargeable battery packs used in electric vehicles. It functions as the “brain” of the battery, ensuring optimal performance, safety, and efficiency throughout the vehicle’s operation. Key BMS functions include monitoring cell voltages and temperatures, estimating the state of charge (SoC) and state of health (SoH), balancing cells to maintain uniform voltage levels, and protecting against electrical or thermal anomalies such as overcharging, over-discharging, or overheating. The BMS communicates continuously with the vehicle control unit, charger, and powertrain systems to coordinate energy delivery and regenerative braking.

Modern BMS solutions also incorporate advanced analytics, thermal management algorithms, cybersecurity protocols, and over-the-air (OTA) update capabilities. These enhancements improve long-term reliability and enable predictive maintenance, providing automakers and end-users with data-driven insights to maximize battery life and vehicle performance. In short, the BMS ensures that each cell within the battery pack operates safely and efficiently, extending the lifespan of the most expensive component in an EV—the battery itself.

Why is a BMS Important?

The importance of a BMS in electric vehicles can be summarized through three key pillars: safety, performance, and economic value.

Safety: Lithium-ion batteries are highly energy-dense and can become volatile if operated outside safe voltage or temperature ranges. The BMS continuously monitors all cells to prevent conditions that could lead to thermal runaway or electrical failure, ensuring the safety of passengers and vehicle systems.

Performance: The BMS directly impacts vehicle range, power output, and charging efficiency by optimizing how the battery delivers and stores energy. Accurate SoC and SoH measurements allow the vehicle to predict range accurately, improve energy regeneration, and enable faster, safer charging.

Economic Value: Batteries represent a significant share of an EV’s cost. The BMS helps maximize return on investment by preventing premature cell degradation, balancing usage across the pack, and facilitating repurposing for second-life applications. Furthermore, advanced BMS data supports warranty management, predictive maintenance, and grid integration opportunities such as vehicle-to-grid (V2G) systems. Without a capable BMS, modern electric vehicles would be unsafe, less efficient, and economically impractical to operate.

Electric Vehicle Battery Management System Market — Top Companies

DENSO Corporation

Specialization: DENSO is a global Tier-1 automotive supplier specializing in power electronics, thermal systems, and vehicle control electronics. Its BMS solutions are integrated into complete EV architectures for major automakers.

Key Focus Areas: DENSO focuses on BMS integration with vehicle thermal management, control systems, and functional safety compliance.

Notable Features: The company’s advanced integration capabilities allow seamless communication between the BMS, power electronics, and drivetrain.

2024 Revenue: DENSO reported consolidated revenue of approximately ¥7,144.7 billion in fiscal year 2024.

Market Share & Global Presence: With operations in over 30 countries, DENSO has extensive relationships with OEMs worldwide, giving it strong presence across the EV supply chain.

Elithion, Inc.

Specialization: Elithion is a U.S.-based specialist company dedicated solely to battery management systems. It designs modular and customizable BMS hardware and software for electric vehicles and stationary storage.

Key Focus Areas: The company’s flagship products, including the Lithiumate Pro family, focus on high-voltage applications, active cell balancing, and real-time monitoring.

Notable Features: Known for innovation and flexibility, Elithion offers scalable BMS platforms adaptable to various chemistries such as LiFePO4 and NMC.

2024 Revenue: As a privately held firm, Elithion’s financial data is undisclosed, but it is recognized as a key niche player within specialized EV and energy storage markets.

Market Share & Global Presence: Elithion serves a global customer base through OEM partnerships and integrators, with a strong focus on the North American and European markets.

Exide Industries

Specialization: Exide Industries is India’s largest battery manufacturer, producing both lead-acid and lithium-ion batteries. It provides energy storage systems, EV battery packs, and BMS-integrated solutions.

Key Focus Areas: The company’s focus areas include OEM supplies for electric two-wheelers, passenger vehicles, and industrial applications. Exide is investing heavily in lithium-ion gigafactories and BMS development.

Notable Features: Extensive manufacturing capabilities and distribution networks enable Exide to dominate the Indian battery market while expanding into the EV segment.

2024 Revenue: Exide Industries reported consolidated revenues of around ₹16,770 crore (approximately USD 2.0 billion) for FY2023–24.

Market Share & Global Presence: Exide commands a leading share in India and is building partnerships to expand into Europe and Asia-Pacific as part of the country’s growing EV ecosystem.

EnerSys

Specialization: EnerSys is a U.S.-based global leader in industrial battery systems, providing motive power and energy storage solutions for multiple applications including EVs.

Key Focus Areas: The company’s BMS products support energy management for material-handling equipment, industrial EVs, and stationary systems.

Notable Features: EnerSys combines advanced battery design with intelligent management systems that enable superior performance and safety in industrial-grade batteries.

2024 Revenue: EnerSys reported net sales of approximately USD 3.8 billion in fiscal year 2024.

Market Share & Global Presence: With a footprint spanning the Americas, Europe, and Asia-Pacific, EnerSys maintains a strong position in motive and reserve power segments, providing reliable BMS-enabled solutions for fleet electrification.

GS Yuasa Corporation

Specialization: GS Yuasa is a Japanese battery manufacturer known for producing lithium-ion and lead-acid batteries for automotive and industrial applications.

Key Focus Areas: The company’s operations include EV traction battery systems, industrial battery management, and advanced BMS integration for hybrid and electric vehicles.

Notable Features: GS Yuasa’s BMS technology is recognized for its high reliability, meeting stringent automotive safety and performance standards.

2024 Revenue: The company reported consolidated net sales of approximately ¥580.3 billion in FY2024.

Market Share & Global Presence: With operations across Japan, Europe, and Asia, GS Yuasa is a major global supplier in both OEM and aftermarket battery sectors.

Johnson Matthey

Specialization: Johnson Matthey (JM) is a British multinational focusing on sustainable technologies, catalysts, and advanced battery materials. Though not a direct BMS manufacturer, JM’s battery materials and cell technologies play a crucial role in battery performance and indirectly influence BMS requirements.

Key Focus Areas: The company focuses on cathode materials, fuel cell components, and circular battery value chains.

Notable Features: JM’s research in energy materials and emissions control positions it as a vital contributor to the EV battery ecosystem.

2024 Revenue: The company reported total sales (excluding precious metals) of about £3.5 billion in FY2024.

Market Share & Global Presence: Operating in over 30 countries, JM’s material technologies and collaborations make it an influential player in the broader battery industry.

Leading Trends and Their Impact

-

Software-Defined BMS and OTA Updates:

The evolution of BMS from fixed-function hardware to software-defined platforms enables real-time updates, predictive analytics, and enhanced cybersecurity. This allows manufacturers to improve performance and reliability throughout the vehicle’s life. -

Distributed Modular Architecture:

Next-generation EVs are adopting distributed BMS architectures with module-level controllers. This design improves scalability, fault isolation, and serviceability while enabling higher voltage and larger capacity systems. -

Integration of Thermal and Electrical Management:

Future EVs demand seamless coordination between electrical and thermal control. Integrating these systems within the BMS enhances energy efficiency, reduces charging time, and extends battery life in varying climates. -

AI-Driven Predictive Analytics:

Artificial intelligence and machine learning are increasingly being used to predict battery degradation, optimize usage, and estimate remaining useful life (RUL). This reduces warranty costs and improves consumer confidence. -

Vehicle-to-Grid (V2G) and Second-Life Applications:

BMS solutions are being adapted to support bidirectional charging and repurposed battery packs. This facilitates energy storage integration with grids, helping balance renewable energy supply and demand. -

Supply Chain Localization and Compliance:

Policies like the U.S. Inflation Reduction Act and EU Battery Regulation require traceability and local manufacturing. BMS systems are now designed to log manufacturing origin, lifecycle data, and recycling information to meet compliance requirements.

Successful Examples of BMS Implementation Worldwide

Tesla (USA): Tesla’s vertically integrated approach to battery design includes proprietary BMS algorithms that enhance performance, range, and safety. Its BMS monitors every cell in real time, adjusts thermal conditions, and leverages fleet data to continually refine battery performance.

BYD (China): BYD’s “Blade Battery” technology is paired with an integrated BMS that optimizes lithium iron phosphate (LFP) chemistry for safety and longevity. This integration has helped BYD become one of the world’s largest EV manufacturers.

Volkswagen and Bosch (Europe): European OEMs increasingly collaborate with Tier-1 suppliers like Bosch and DENSO to co-develop BMS platforms that meet stringent EU safety and recyclability regulations.

NIO (China): NIO’s advanced BMS enables fast battery swapping and cloud-connected monitoring, demonstrating how software intelligence can enhance flexibility and customer experience.

Stationary Energy Storage Projects (Europe): Repurposed EV batteries from automakers such as Renault and Nissan are deployed in grid storage applications using adaptive BMS systems to ensure safety and performance during second-life usage.

Global Regional Analysis — Government Initiatives and Policies Shaping the Market

North America

The United States and Canada are experiencing strong growth in EV production due to the Inflation Reduction Act (IRA) and related initiatives promoting domestic manufacturing. Tax incentives for locally produced EVs and batteries have attracted significant investment in gigafactories. This regulatory environment favors BMS manufacturers that can ensure component traceability and compliance with U.S. supply chain rules. The focus on grid integration and energy resilience also opens opportunities for V2G-enabled BMS technologies.

Europe

Europe continues to lead with stringent emission norms, battery recycling directives, and sustainable manufacturing standards. The European Union’s “Fit for 55” policy, which targets a 55% reduction in emissions by 2030, is pushing automakers to electrify faster. European OEMs demand BMS solutions that emphasize safety, reliability, and end-of-life tracking. Companies are increasingly localizing production through partnerships supported by the European Battery Alliance.

China

China remains the largest EV market globally, driven by aggressive New Energy Vehicle (NEV) policies, purchase subsidies, and domestic supply chain dominance. Local cell manufacturers such as CATL and BYD integrate BMS functions directly into their battery packs, allowing economies of scale and rapid innovation. Continuous government incentives and strong demand ensure sustained BMS growth, with domestic standards influencing global practices.

India

India’s FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme and Production-Linked Incentive (PLI) programs have accelerated local EV manufacturing. The Indian government’s focus on localizing cell production and BMS design is encouraging domestic companies like Exide and Tata AutoComp to build indigenous BMS capabilities. The growing adoption of two- and three-wheel EVs, combined with industrial fleet electrification, makes India a key emerging market for BMS solutions.

Japan and South Korea

Japan’s established automotive sector and Korea’s advanced battery industry position both nations as leaders in BMS innovation. Companies such as DENSO, Panasonic, LG Energy Solution, and Samsung SDI are at the forefront of integrating smart BMS platforms into next-generation EVs. Both countries also emphasize recycling and circular battery ecosystems, ensuring continuous BMS demand throughout the battery lifecycle.

Rest of Asia-Pacific, Middle East, and Africa

Emerging markets are investing in EV infrastructure and localized manufacturing. Southeast Asian countries like Thailand and Indonesia are promoting EV adoption through tax exemptions and battery industry incentives. These policies are expanding the regional market for BMS manufacturers offering affordable yet reliable solutions suited for tropical climates and cost-sensitive customers.

Market Overview and Insights

Industry reports estimate that the global electric vehicle BMS market was valued in the low single-digit billion-dollar range in 2024 and is expected to grow at a compound annual growth rate (CAGR) exceeding 18–20% through 2034. Growth is being fueled by the rapid expansion of EV production, increased penetration of high-energy-density batteries, and new use cases in hybrid and heavy-duty vehicles.

While major automotive Tier-1 suppliers dominate the high-end BMS market, several specialized companies and startups are focusing on software, analytics, and AI-driven control. This diversification is broadening the competitive landscape and fostering collaborations across hardware, software, and energy management segments.

The industry is evolving from discrete hardware systems to cloud-connected, AI-driven BMS platforms that offer complete lifecycle management—from manufacturing to recycling. The future of the EV BMS market lies not only in managing battery performance but also in enabling connected energy ecosystems that support mobility, storage, and sustainability goals.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Combined Heat and Power Market Revenue, Global Presence, and Strategic Insights by 2034