Medical Affairs Outsourcing Market Size

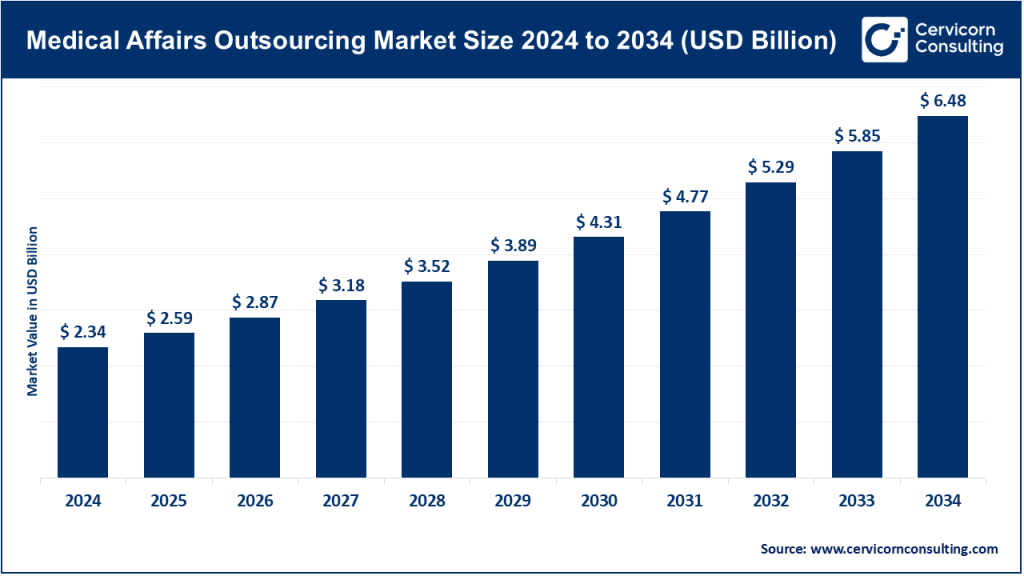

The global medical affairs outsourcing market size was worth USD 2.34 billion in 2024 and is anticipated to expand to around USD 6.48 billion by 2034, registering a compound annual growth rate (CAGR) of 10.72% from 2025 to 2034.

Growth Factors

The medical affairs outsourcing market is being propelled by several converging forces: rising R&D and regulatory complexity that requires specialized medical and scientific expertise; an expanding number of late-stage and post-marketing studies including real-world evidence work; greater need for stakeholder engagement and localized field presence through MSLs; pressure on sponsors to shorten time-to-market and control operating costs by using flexible outsourcing models such as functional service provision (FSP), project-based, and strategic partnerships; adoption of digital and data analytics tools to support evidence generation and omnichannel medical communications; regulatory and transparency requirements that increase documentation and publication demands; and geographic expansion of clinical activity into emerging markets where local regulatory expertise and in-market medical teams are required. Together these drivers are accelerating outsourcing adoption and creating demand for specialist medical-affairs providers with global footprints and therapeutic depth.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2788

What Is the Medical Affairs Outsourcing Market?

Medical affairs outsourcing refers to contracting external organizations — CROs, specialized medical affairs agencies, technology-enabled vendors, and consultancies — to deliver one or more medical affairs activities on behalf of a sponsor. Services commonly outsourced include medical strategy development, medical communications and publications, scientific engagement, medical information services, advisory board management, medical and regulatory writing, post-marketing safety and pharmacovigilance support, real-world evidence and epidemiology studies, and medical education programs. Outsourcing models range from single-project engagements to long-term FSP arrangements where the vendor supplies dedicated staff embedded within the sponsor’s medical affairs organization. The global medical affairs outsourcing market was valued at several billion USD in 2024 and is expected to maintain strong double-digit growth through 2034.

Why Is Medical Affairs Outsourcing Important?

Outsourcing medical affairs is important for several reasons. First, it gives sponsors rapid access to deep therapeutic expertise and experienced medical-science personnel without the time and fixed cost of hiring full-time staff. Second, it provides flexible capacity during peak project phases such as product launches, submission cycles, and major advisory boards, enabling sponsors to scale up or down. Third, specialized vendors bring proven processes, regulatory know-how, and quality systems across jurisdictions — lowering risk and improving output quality. Fourth, vendors with global footprints support local language, compliance, and cultural needs in regions where the sponsor lacks presence. Finally, outsourcing allows sponsors to focus internal resources on core R&D strategy and portfolio decisions while entrusting executional and tactical medical affairs functions to external partners, accelerating commercialization and maximizing value from evidence generation.

Top Medical Affairs Outsourcing Companies

Below are five leading players in the medical affairs outsourcing market — each with distinct capabilities and market positions. Figures and summaries reflect company-reported data and publicly available industry analyses.

1) Parexel

- Specialization: Full-service CRO with strong medical affairs, regulatory, HEOR, market access, and clinical operations capabilities. Parexel offers medical strategy, regulatory writing, publication planning, and MSL/FSP services.

- Key Focus Areas: Integrated medical strategy across the development lifecycle, regulatory submissions, scientific communications, and advisory board facilitation.

- Notable Features: Reputation for regulatory consulting and deep therapeutic expertise; strong consulting arm (Parexel Consulting) that bridges clinical and commercial medical strategy.

- 2024 Revenue: Parexel is privately held and historically reports annual revenues exceeding USD 2 billion.

- Market Share: Among the top global CROs and a major medical affairs outsourcing provider, though sub-segment market share is not separately reported.

- Global Presence: Worldwide presence across North America, Europe, Asia-Pacific, and emerging markets with a strong clinical and regulatory network.

2) ICON plc

- Specialization: Large full-service CRO with integrated Clinical & Scientific/Medical Affairs solutions. ICON’s offering includes protocol design input, medical writing, scientific communications, and evidence generation.

- Key Focus Areas: Early and late-phase development medical strategy; therapeutic area expertise in oncology, immunology, and rare diseases; integration of clinical and real-world data for medical insights.

- Notable Features: Strong global infrastructure, large support for regulatory submissions, and integrated development services.

- 2024 Revenue: Approximately USD 8.28 billion.

- Market Share: Among the largest suppliers of outsourced medical affairs services globally, with particular strength in integrated clinical-to-medical solutions.

- Global Presence: Operations across North America, Europe, Asia-Pacific, Latin America, and the Middle East.

3) Syneos Health

- Specialization: Fully integrated biopharmaceutical solutions organization combining clinical, medical affairs, and commercialization services. Syneos offers MSL programs, medical strategy, publication planning, and market access support.

- Key Focus Areas: Medical affairs plus commercialization — supporting both scientific engagement and market launch activities; real-world evidence and data analytics for medical insights.

- Notable Features: Hybrid model combining clinical and commercial teams, enabling end-to-end product support from development to market.

- 2024 Revenue: Historically around USD 5–6 billion annually, with steady growth across therapeutic sectors.

- Market Share: Major player in global medical affairs outsourcing, especially in integrated commercialization programs.

- Global Presence: Strong North American footprint plus Europe and Asia-Pacific offices offering field medical and advisory services.

4) Covance (Labcorp Drug Development)

- Specialization: Labcorp Drug Development combines central lab, bioanalytical, clinical development, and medical affairs capabilities.

- Key Focus Areas: Central lab services integrated with medical strategy, regulatory writing, and post-marketing studies; strong lab and data capabilities supporting biomarker and real-world evidence programs.

- Notable Features: One of the largest laboratory footprints in the world, extensive real-world and clinical data assets, and expertise in decentralized and hybrid trial support.

- 2024 Revenue: Labcorp’s consolidated revenue was approximately USD 13.01 billion, with the Drug Development segment representing a significant portion.

- Market Share: Top-tier provider by virtue of laboratory scale and integrated offerings.

- Global Presence: Extensive global operations in more than 100 countries with strong assets in North America, Europe, and Asia-Pacific.

5) Medpace

- Specialization: Full-service CRO known for strong therapeutic expertise, integrated labs, and medical/regulatory services. Medpace provides embedded medical affairs teams, medical writing, regulatory affairs, and real-world evidence services.

- Key Focus Areas: Embedded medical leadership in trials, global regulatory strategy, clinical pharmacology, and post-marketing evidence generation.

- Notable Features: Proprietary central labs and imaging/bioanalytical capabilities, clinically integrated medical leadership model, and strong site relationships.

- 2024 Revenue: Approximately USD 2.11 billion.

- Market Share: A leading mid-to-large CRO with strengths in therapeutic specialization and clinical-to-medical continuity.

- Global Presence: Global operations with growing Asia-Pacific presence and regional medical leadership teams.

Leading Trends and Their Impact

1. Shift to Strategic Partnerships

Sponsors are moving from transactional outsourcing toward long-term strategic partnerships and FSP models that embed medical experts within sponsor teams. This fosters collaboration, improves knowledge transfer, and enhances evidence generation efficiency.

2. Rise of Real-World Evidence (RWE)

The growing demand for RWE, registries, and pragmatic studies is reshaping medical affairs. Vendors with combined epidemiology, data science, and clinical expertise are in high demand.

3. Digital and Omnichannel Engagement

Virtual advisory boards, remote HCP engagement, AI-assisted literature monitoring, and digital MSL tools are becoming standard. These innovations increase reach and efficiency but require strong compliance frameworks.

4. Regulatory and Transparency Requirements

Evolving FDA guidance, EU Clinical Trial Regulation (CTR), and regional transparency laws have expanded documentation workloads. Vendors with experienced regulatory writers and cross-border compliance expertise are increasingly valuable.

5. Emerging Markets and Localization

Asia-Pacific, Latin America, and the Middle East are experiencing a surge in clinical and post-marketing activities. Vendors with multilingual and region-specific medical affairs teams are gaining market share.

6. Consolidation and M&A

The outsourcing sector continues to consolidate, with large CROs acquiring niche medical affairs firms. This trend broadens service offerings but reduces the number of independent boutique providers.

Successful Examples Worldwide

- Parexel: Supported global product launches by providing integrated regulatory writing and medical strategy services, helping sponsors reduce submission timeframes.

- Labcorp/Covance: Delivered combined laboratory and medical writing solutions for biomarker-based programs, demonstrating how integrated lab and medical capabilities streamline submissions.

- ICON: Provided medical affairs support for early translational research, aligning safety data with publication and communication strategy.

- Medpace: Expanded embedded medical leadership teams across Asia-Pacific to provide regional expertise and support multinational clinical programs.

These examples highlight how vendors with the right blend of medical, regulatory, and data expertise enable faster development cycles, stronger evidence packages, and effective engagement with healthcare professionals worldwide.

Global Regional Analysis and Government Initiatives

North America (U.S. & Canada)

North America holds the largest share of the medical affairs outsourcing market, driven by a concentration of pharmaceutical and biotech companies, advanced R&D infrastructure, and frequent product launches. The U.S. Food and Drug Administration’s guidance on decentralized trials, real-world evidence, and transparency has encouraged sponsors to collaborate with partners who understand complex compliance requirements.

Europe

Europe’s demand for medical affairs outsourcing is propelled by multi-country clinical trial operations and growing emphasis on transparency. The European Union Clinical Trials Regulation (CTR) harmonizes trial authorization and reporting across member states, creating opportunities for vendors with EU-wide regulatory and multilingual capabilities.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market. Rising R&D investment, expanding trial networks, and supportive regulatory reforms in countries such as India, China, Japan, and South Korea have transformed the region into a hub for clinical and medical affairs outsourcing. India’s New Drugs and Clinical Trials Rules and ongoing procedural updates are improving CRO and sponsor collaboration efficiency.

Latin America and Middle East & Africa

These regions are gaining importance as sponsors seek diverse patient populations and cost-effective study environments. However, regulatory heterogeneity and language diversity necessitate strong local partnerships. Governments are increasingly harmonizing ethics and review processes to attract international sponsors, which in turn expands outsourcing opportunities for regional vendors.

How Sponsors Choose Their Partners

- Therapeutic Expertise and Scientific Credibility: Vendors must demonstrate deep knowledge in specific disease areas and strong relationships with key opinion leaders.

- Regulatory and Local-Market Knowledge: Multinational programs require vendors fluent in local regulations and language.

- Integrated Capabilities: Providers with in-house labs, data analytics, and real-world evidence tools are preferred.

- Flexible Resourcing: Options for FSP, project-based, or hybrid outsourcing models are key for scalability.

- Compliance and Quality Systems: Proven records in GCP, GVP, and audit readiness build client trust.

- Digital Capabilities: Ability to execute omnichannel HCP engagement and scientific data management enhances competitiveness.

Final Notes

The medical affairs outsourcing market is entering a phase of maturity marked by digital transformation, regulatory sophistication, and strategic integration. Sponsors are increasingly outsourcing core medical functions to trusted partners who combine global scale with therapeutic expertise and compliance excellence. Vendors investing in specialized medical leadership, data analytics, and region-specific capabilities will be best positioned to capture growth as the life sciences industry continues to evolve toward evidence-based, globally connected medical strategies.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Humanoid Robot Market Growth Drivers, Trends, Key Players and Regional Insights by 2034