Aluminum Castings Market Size

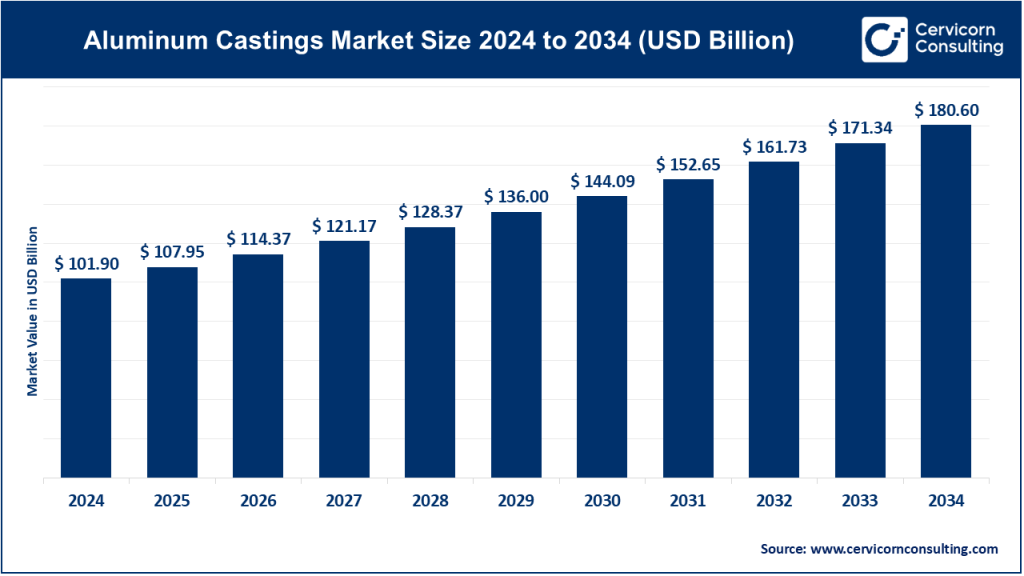

The global aluminum castings market size was worth USD 101.90 billion in 2024 and is anticipated to expand to around USD 180.60 billion by 2034, registering a compound annual growth rate (CAGR) of 5.89% from 2025 to 2034.

What is the Aluminum Castings Market?

The aluminum castings market consists of manufacturers, metal foundries, and engineering companies that produce components made by casting molten aluminum into molds. These operations include various casting processes such as high-pressure die casting (HPDC), low-pressure die casting, sand casting, permanent mold casting, and investment casting. After casting, components are often machined, heat-treated, and assembled before being supplied to end-use industries.

Products range from small precision parts used in consumer electronics to large structural elements in automobiles, aircraft, and industrial machinery. Aluminum casting manufacturers serve diverse sectors such as:

- Automotive & EVs

- Aerospace & Defense

- Consumer Electronics

- Electrical & Power Equipment

- Industrial Machinery

- Construction & Infrastructure

The market’s size in 2024 is valued in the tens of billions of USD globally, depending on the specific subsegments included.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2384

Why is the Aluminum Castings Market Important?

Aluminum castings support critical aspects of the global industrial economy. Their importance stems from several factors:

1. Lightweighting Imperative

Aluminum is 33% the weight of steel. This makes cast aluminum components essential for reducing vehicle fuel consumption, extending EV battery range, and improving aircraft fuel efficiency.

2. Excellent Thermal & Electrical Conductivity

Electronics, LED lighting systems, power modules, inverters, and EV battery systems rely on aluminum castings to dissipate heat efficiently.

3. High Corrosion Resistance

Cast aluminum components are widely used in marine, construction, and outdoor applications due to their resistance to environmental degradation.

4. Cost-Effective Mass Production

Casting provides the ability to create complex geometries at high volume and relatively low cost, making it ideal for automotive and industrial use.

5. Sustainability & Circularity

Aluminum can be recycled repeatedly without losing properties. Many casting manufacturers now use up to 70–90% recycled content, supporting global decarbonization.

Aluminum Castings Market Growth Factors

The aluminum castings market is growing due to increasing adoption of lightweight components in automotive and electric vehicles, rising demand from aerospace for high-performance structural parts, and expanding use in consumer electronics requiring advanced thermal management. Growth is further propelled by advances in casting technologies—such as vacuum die casting, automation, simulation-based design, and additive-manufacturing-assisted tooling—which allow production of more complex and precise components. Additionally, global shifts toward sustainability, recycling, and low-carbon materials are boosting the demand for recycled aluminum castings. Policy support, including stricter emissions regulations, fuel economy standards, and clean manufacturing incentives, is also driving manufacturers to substitute steel with aluminum, while urbanization and infrastructure development in emerging economies continue to support overall market expansion.

Top Aluminum Casting Market Companies – Profiles & 2024 Snapshot

Below are the leading companies in the aluminum castings and aluminum supply ecosystem, including their specialties, focus areas, notable features, 2024 revenue, market share insights, and global presence.

1. Alcoa Corporation

Specialization

Global leader in bauxite, alumina, primary aluminum, and value-added aluminum cast products.

Key Focus Areas

- Advanced aluminum alloys

- Low-carbon aluminum solutions

- Automotive & industrial cast products

Notable Features

- Operates a global casthouse network

- Pioneer in sustainable aluminum technologies

- Known for proprietary casting alloys

2024 Revenue

Approximately USD 11.9 billion.

Market Share

Major player in upstream aluminum and cast products, especially in North America and Europe.

Global Presence

Operations in North America, Europe, South America, and Australia.

2. Rio Tinto

Specialization

Major mining and metals company producing bauxite, alumina, and aluminum; feeds the casting industry.

Key Focus Areas

- Primary aluminum production

- Low-carbon smelting technology

- Global raw material supply

Notable Features

- One of the world’s largest diversified mining companies

- Focus on decarbonization and renewable-powered smelting

2024 Revenue

Strong financial performance for 2024, with aluminum division reporting significant year-on-year growth.

Market Share

Dominant upstream supplier; not a direct producer of cast components.

Global Presence

Bauxite mines, refineries, and smelters across Australia, Canada, Africa, and Europe.

3. Norsk Hydro ASA

Specialization

Fully integrated aluminum company offering primary aluminum, extrusions, and recycled aluminum for casting.

Key Focus Areas

- Green and low-carbon aluminum

- Recycling technologies

- Automotive & industrial alloy innovation

Notable Features

- Industry leader in sustainable aluminum

- Strong European market position for low-carbon alloys

2024 Revenue

Reported higher adjusted earnings with strong performance in recycled and low-carbon aluminum.

Market Share

Major supplier of aluminum alloy feedstock to casting companies across Europe and beyond.

Global Presence

Operations in Europe, the Americas, and Asia.

4. Nemak S.A.B. de C.V.

Specialization

World leader in aluminum die casting and engineered automotive components.

Key Focus Areas

- Electric vehicle structural components

- Battery housings and e-motor housings

- Lightweight engine and chassis systems

Notable Features

- Strong global footprint in automotive manufacturing

- Known for advanced die casting and e-mobility solutions

2024 Revenue

Approximately USD 4.9 billion.

Market Share

One of the largest suppliers of automotive aluminum castings globally.

Global Presence

Around 40 manufacturing facilities across North America, Europe, and Asia.

5. Dynacast

Specialization

Precision die casting specializing in aluminum, zinc, and magnesium parts.

Key Focus Areas

- Tight-tolerance components

- Consumer electronics & medical devices

- Small, high-precision cast parts

Notable Features

- Known for miniaturized, complex geometries

- Strong engineering and tooling capabilities

2024 Revenue

Not publicly disclosed (private company).

Market Share

Niche leader in precision casting for high-tech applications.

Global Presence

Facilities across North America, Europe, and Asia.

Leading Trends Shaping the Aluminum Castings Market

1. Automotive Lightweighting and EV Transition

Demand for aluminum castings is soaring due to EV components like:

- Battery housings

- Motor housings

- Structural castings

- Inverter & power electronics casings

These parts require high strength, thermal conductivity, and precision.

2. Decarbonization and Low-Carbon Aluminum

Companies increasingly use renewable energy and recycled materials to produce “green aluminum.” Markets are rewarding:

- Certified low-carbon aluminum

- High-recycled-content castings

- Cleaner smelting technologies

Europe and North America lead in this transition.

3. Advanced Casting Technologies

Modern innovations include:

- Vacuum die casting

- Squeeze casting

- High-pressure die casting upgrades

- Enhanced mold simulations

- Real-time quality AI systems

- Additive manufacturing for tooling

These technologies reduce scrap, improve tolerances, and allow thinner, more complex parts.

4. Circular Economy and Recycling

Aluminum recycling requires just 5% of the energy used for primary smelting. Manufacturers now:

- Increase recycled content

- Optimize scrap return systems

- Use closed-loop remelting

This reduces production costs and emissions.

5. Reshoring and Localized Manufacturing

Global supply chain disruptions and carbon taxes are pushing manufacturers to relocate casting operations closer to:

- EV assembly plants

- Aerospace manufacturing hubs

- Electronics clusters

North America and Europe see increasing reshoring investments.

6. Alloy Innovations

New alloys offer:

- Higher ductility

- Better strength-to-weight ratios

- Superior high-temperature stability

Innovations support both EVs and aerospace.

Successful Global Examples of Aluminum Castings Market Applications

1. Nemak’s EV Battery Housings

Nemak supplies large, complex battery housings for major electric vehicle platforms, showcasing advanced die-casting capabilities.

2. Alcoa’s Specialty Alloy Cast Products

Alcoa’s casthouses supply proprietary casting alloys used widely in automotive and industrial applications.

3. European Low-Carbon Aluminum Foundries

European foundries leverage renewable-powered smelters to produce castings with 70–80% lower carbon footprints.

4. Dynacast Precision Electronics Components

Dynacast delivers high-tolerance die-cast aluminum parts for medical devices, telecommunications equipment, and microelectronics.

Global Regional Analysis & Government Policy Influence

North America

Drivers

- Strong EV adoption

- Inflation Reduction Act incentives

- Automotive lightweighting regulations

- Investments in domestic manufacturing

Policies

- Clean energy tax credits

- Incentives for low-carbon materials

- Vehicle emissions and fuel economy standards

These support new casting facilities and recycled aluminum production.

Europe

Drivers

- Strict carbon regulations

- Rapid green manufacturing shift

- Global leadership in recycling technologies

Policies

- EU ETS (carbon pricing)

- Fit-for-55 emissions package

- Circular economy directives

- Recycled content requirements

Europe is rapidly becoming a hub for green aluminum castings.

Asia Pacific

Drivers

- China’s dominance in aluminum production

- Growing automotive manufacturing

- Expansion of electronics industry

Policies

- Carbon trading system expansion

- Energy efficiency standards

- Industrial modernization incentives

Asia remains the world’s largest producer and consumer of aluminum castings.

Latin America

Drivers

- Strong automotive supply chain linkages

- Significant smelting and casting capacity

Policies

- Manufacturing incentives

- Trade agreements with North America and Europe

Countries like Mexico (home to Nemak) serve as key export hubs.

Middle East & Africa

Drivers

- Rising upstream aluminum production

- Abundant renewable energy for smelting

- Growing industrial diversification

Policies

- Investments in integrated aluminum ecosystems

- Industrialization strategies

The region is increasingly competitive for clean aluminum production.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Metaverse Market Revenue, Global Presence, and Strategic Insights by 2034