AI in the Anti-Money Laundering Market Size

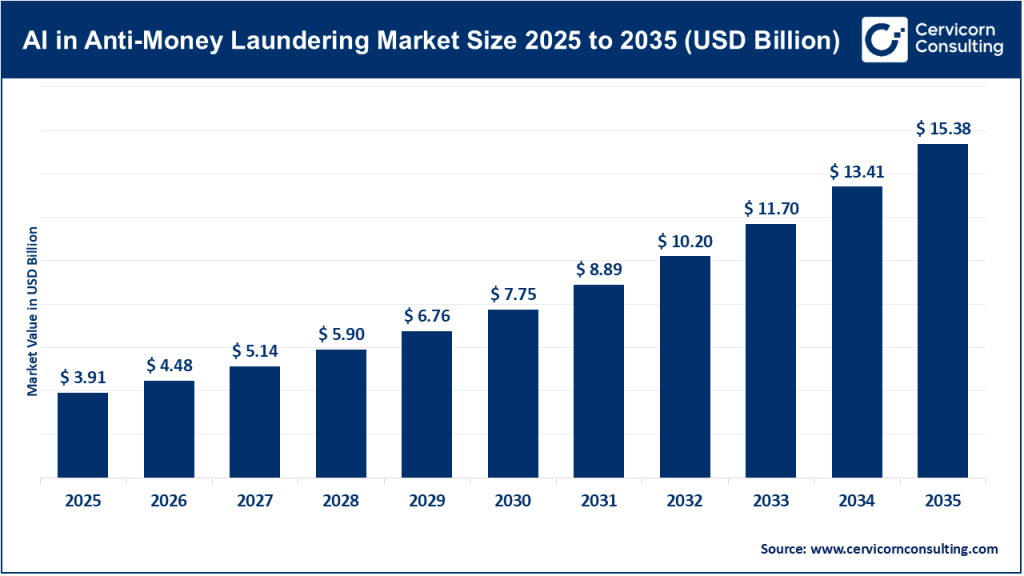

The global AI in anti-money laundering market size was worth USD 3.91 billion in 2025 and is anticipated to expand to around USD 15.38 billion by 2035, registering a compound annual growth rate (CAGR) of 14.7% from 2026 to 2035.

What Is AI in the Anti-Money Laundering Market?

Artificial Intelligence (AI) in the Anti-Money Laundering (AML) market refers to the use of advanced technologies such as machine learning, deep learning, natural language processing (NLP), and predictive analytics to detect, prevent, and investigate financial crimes, particularly money laundering and related illicit activities. Traditional AML systems rely heavily on static, rule-based mechanisms that trigger alerts based on predefined thresholds. While effective in earlier stages of financial digitization, these systems struggle to cope with today’s massive transaction volumes, complex laundering methods, and real-time payment ecosystems.

AI-driven AML solutions dynamically analyze vast datasets including transactional histories, customer profiles, behavioral patterns, and external data sources. These systems learn from historical and real-time data to identify anomalies, hidden relationships, and evolving criminal tactics. By automating transaction monitoring, customer risk scoring, suspicious activity detection, and regulatory reporting, AI significantly improves accuracy, scalability, and responsiveness across the AML value chain.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2859

AI in Anti-Money Laundering Market Growth Factors

The growth of the AI in anti-money laundering market is driven by increasingly stringent global regulations, rising financial crime complexity, and the limitations of traditional rule-based AML systems that generate high false positives and operational inefficiencies. Rapid digitization of banking, insurance, payments, and fintech services has led to exponential growth in transaction volumes, making manual monitoring impractical and costly. Regulatory authorities across major economies are imposing stricter compliance requirements, higher penalties for non-compliance, and greater expectations for real-time monitoring and transparency, compelling financial institutions to adopt AI-powered AML solutions. Additionally, the expansion of digital payments, cross-border transactions, cryptocurrencies, and embedded finance has created new laundering risks that require adaptive, data-driven detection models capable of learning and evolving continuously.

Why AI in Anti-Money Laundering Is Important

AI has become a critical enabler in modern AML frameworks due to its ability to address long-standing challenges in financial crime prevention.

Improved Detection Accuracy:

AI models analyze complex transaction patterns and customer behaviors to identify suspicious activities that traditional systems often miss. This reduces false positives and ensures that compliance teams focus on high-risk cases.

Real-Time Monitoring:

AI enables continuous, real-time surveillance of financial transactions, allowing institutions to detect and respond to suspicious activities as they occur rather than after the fact.

Operational Efficiency:

Automation of alert generation, investigation workflows, and reporting significantly reduces manual workloads, operational costs, and investigation timelines.

Scalability:

AI systems can handle massive transaction volumes across multiple channels and geographies without proportional increases in staffing or infrastructure.

Adaptability to Emerging Threats:

Machine learning models evolve with new data, helping organizations stay ahead of increasingly sophisticated money laundering techniques.

Company Profiles: AI and AML-Relevant Players

Shift Technology

Company: Shift Technology

Specialization: AI-driven decision automation for fraud detection, compliance analytics, and risk management.

Key Focus Areas:

• Financial crime detection and fraud analytics

• Automated pattern recognition

• AI-enabled investigation workflows

Notable Features:

Shift Technology uses advanced AI models to analyze complex datasets, delivering explainable insights that support regulatory audits. Its platform integrates seamlessly with existing systems and provides high-accuracy risk assessments.

2024 Revenue & Market Share:

While specific revenue figures are not publicly disclosed, Shift Technology has achieved unicorn valuation status, indicating strong market positioning and adoption across regulated financial services.

Global Presence:

Operations span over 25 countries with a strong footprint in Europe, North America, and Asia-Pacific.

Bestow

Company: Bestow

Specialization: Insurtech platform leveraging AI for underwriting and digital policy administration.

Key Focus Areas:

• AI-based underwriting

• Customer risk assessment

• Digital onboarding

Notable Features:

Bestow applies data science and automation to streamline underwriting and reduce manual processes. Its AI capabilities support identity verification and risk profiling.

2024 Revenue & Market Share:

The company has demonstrated strong revenue growth through partnerships and platform expansion, though AML-specific revenue is not separately reported.

Global Presence:

Primarily focused on the U.S. market with expanding digital partnerships.

AML Relevance:

While not a dedicated AML provider, Bestow’s AI-driven risk assessment capabilities contribute to compliance-adjacent functions such as KYC and fraud prevention.

Snapsheet

Company: Snapsheet

Specialization: Digital claims management and workflow automation platform.

Key Focus Areas:

• Claims processing automation

• Fraud detection integrations

• Data-driven decision support

Notable Features:

Snapsheet enables insurers to digitize claims workflows and integrate analytics and fraud detection tools to identify abnormal patterns.

2024 Revenue & Market Share:

The company holds a significant share in the digital claims technology segment, with strong adoption among insurers.

Global Presence:

Predominantly active in North America with expanding international reach.

AML Relevance:

Snapsheet’s analytics capabilities support fraud and suspicious activity detection, aligning with AML objectives in financial services.

BriteCore

Company: BriteCore

Specialization: Cloud-based core insurance platform with analytics and automation.

Key Focus Areas:

• Policy administration

• Claims and billing management

• Embedded analytics and AI insights

Notable Features:

BriteCore integrates advanced analytics dashboards and AI-enabled reporting to enhance operational transparency and risk visibility.

2024 Revenue & Market Share:

Recognized as a leading insurtech provider with over 100 insurer clients.

Global Presence:

Strong presence in North America with growing international deployments.

AML Relevance:

Although not a dedicated AML solution, BriteCore’s data analytics and reporting capabilities support compliance monitoring and fraud risk assessment.

Next Insurance

Company: Next Insurance

Specialization: Embedded digital insurance for small businesses.

Key Focus Areas:

• AI-assisted underwriting

• Digital policy distribution

• Risk-based pricing

Notable Features:

Next Insurance uses data analytics and automation to deliver fast, scalable insurance solutions.

2024 Revenue & Market Share:

The company serves hundreds of thousands of customers and has achieved multi-billion-dollar valuation.

Global Presence:

Primarily focused on the U.S. market with scalable digital infrastructure.

AML Relevance:

Next Insurance’s risk modeling and customer data analytics can feed into compliance ecosystems where AML and fraud detection intersect.

Leading Trends in the AI in AML Market and Their Impact

1. Real-Time Transaction Monitoring

Financial institutions are increasingly adopting AI systems capable of analyzing transactions instantly. This shift enables faster intervention, reduces downstream losses, and improves regulatory compliance.

Impact:

Shorter investigation cycles, reduced alert fatigue, and improved compliance outcomes.

2. Explainable AI (XAI)

Regulators demand transparency in AI-driven decisions. Explainable AI ensures that financial institutions can justify alerts and decisions during audits.

Impact:

Greater regulatory trust and broader adoption of AI AML systems.

3. AI Integration with Crypto and Digital Assets

As digital assets gain traction, AI-driven AML tools are expanding to monitor blockchain transactions and decentralized finance activities.

Impact:

Enhanced visibility into high-risk, opaque transaction networks.

4. NLP-Based Adverse Media Screening

Natural language processing enables automated scanning of news, reports, and public data sources to identify reputational and behavioral risks.

Impact:

More comprehensive customer risk profiling and proactive compliance.

Successful Examples of AI in AML Around the World

Global Banking Institutions:

Major multinational banks have implemented AI-based AML platforms that significantly reduce false positives and improve detection accuracy, leading to faster case resolution and reduced compliance costs.

Fintech Platforms:

Digital payment providers and fintech firms use AI-driven monitoring systems to manage high-volume, cross-border transactions and detect sophisticated laundering schemes.

Regulatory Authorities:

Some regulators are piloting AI tools to analyze suspicious activity reports and identify systemic financial crime patterns across institutions.

Global Regional Analysis Including Government Initiatives and Policies

North America

North America leads AI AML adoption due to strict regulatory frameworks and advanced financial infrastructure. Governments enforce rigorous reporting standards, pushing institutions to modernize AML systems.

Government Initiatives:

Authorities encourage advanced analytics and automation to enhance transparency and enforcement.

Europe

European countries emphasize data privacy, explainability, and cross-border collaboration in AML frameworks.

Policy Influence:

Regional AML directives and regulatory harmonization drive AI adoption while ensuring accountability.

Asia-Pacific

Rapid growth in digital payments and financial inclusion initiatives is accelerating AI AML adoption.

Government Role:

Regulatory sandboxes and digital finance policies support innovation while strengthening AML compliance.

Middle East & Africa

Emerging fintech ecosystems and alignment with international AML standards drive demand for AI-based compliance tools.

Policy Impact:

Central bank regulations promote modernization of AML infrastructure.

Latin America

Rising financial crime risks and expanding digital banking services encourage investment in AI AML technologies.

Government Initiatives:

Regulatory reforms focus on improving transparency and cross-border cooperation.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Distributed Cloud Market Revenue, Global Presence, and Strategic Insights by 2035