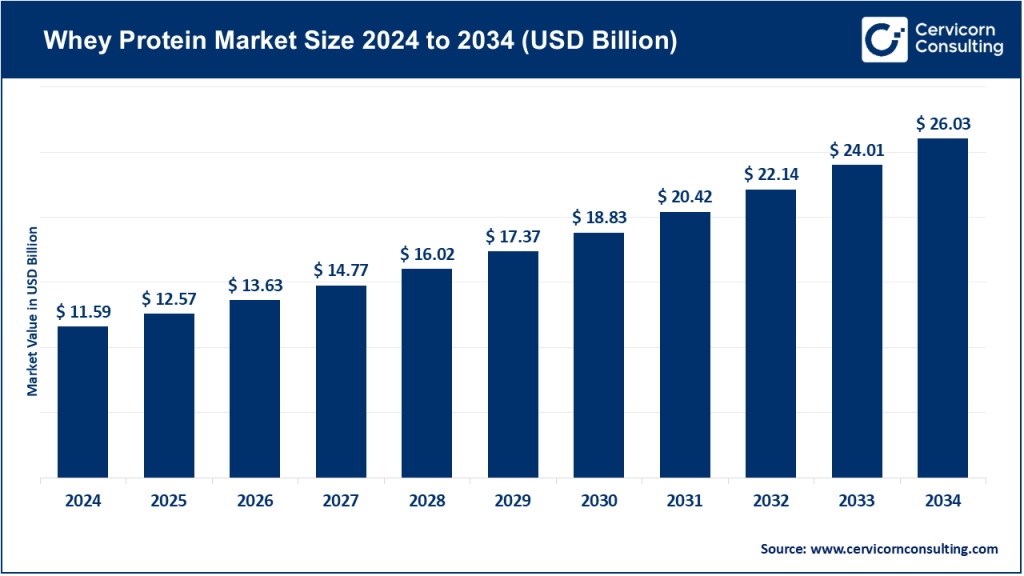

Whey Protein Market Size

Whey Protein Market — Growth Factors

The whey protein market is expanding due to the convergence of consumer health awareness, technological advancements, and supply-chain developments. Rising demand for high-quality protein in sports nutrition, clinical nutrition, weight management, and everyday foods has fueled growth, along with the popularity of convenient protein-fortified products such as RTD beverages, bars, and snacks. Innovations in protein isolation and hydrolysis technologies have enabled higher purity and better solubility, supporting new applications. Premiumization trends, clean-label demand, and expanded use of whey in infant and clinical nutrition further drive adoption.

On the supply side, improvements in fractionation and drying technologies, growing investment in dairy ingredient plants in emerging markets, and sustainability pressures that push processors to valorize co-products and reduce emissions are shaping the sector. Collectively, these factors ensure steady market expansion and rising opportunities for both established and emerging players.

What is the Whey Protein Market?

Whey protein is derived from whey, the liquid by-product that remains after milk is curdled and strained during cheese or casein production. The whey protein market encompasses the processing, sale, and application of whey proteins in various forms:

- Whey Protein Concentrate (WPC): Protein content between 35–80%, used widely in food and beverage applications.

- Whey Protein Isolate (WPI): High-purity form with ≥90% protein, favored in sports nutrition and clinical foods.

- Whey Protein Hydrolysate (WPH): Pre-digested protein with enhanced absorption, used in infant and medical nutrition.

- Specialized Fractions: Lactoferrin, α-lactalbumin, β-lactoglobulin for infant formula, healthcare, and niche markets.

The market covers ingredient production, branded consumer products, and B2B distribution. It sits at the intersection of dairy farming, advanced food technology, and global nutrition trends.

Why the Whey Protein Market is Important

- Nutritional Benefits: Whey protein is a complete protein, rich in essential amino acids, particularly leucine, which is crucial for muscle synthesis and recovery.

- Versatility: It functions as both a nutritional ingredient and a functional food additive, offering emulsification, foaming, and water-binding properties.

- Economic Value: By converting whey (traditionally a waste product) into high-value proteins, dairy processors increase profitability and sustainability.

- Wide Market Applications: From fitness enthusiasts to infants and the elderly, whey protein is used across multiple demographics.

- Sustainability: Utilizing whey reduces waste in dairy production, aligning with sustainability goals and regulatory requirements.

Whey Protein Market — Top Companies

Below are detailed profiles of the leading players in the whey protein market, including specialization, key focus areas, notable features, 2024 revenue context, market share highlights, and global presence.

1. Glanbia Nutritionals (Glanbia plc)

- Specialization: Sports and performance nutrition, whey protein isolates, and custom blends.

- Key Focus Areas: High-performance proteins, RTD beverage applications, formulation support for nutrition brands.

- Notable Features: Strong partnerships with sports nutrition brands; vertically integrated ingredient supply.

- 2024 Revenue: Nutritionals division contributed significantly to group revenue in 2024.

- Global Presence: Extensive operations in North America, Europe, and Asia.

2. Arla Foods (Arla Foods Ingredients – AFI)

- Specialization: Whey fractions for infant and clinical nutrition.

- Key Focus Areas: α-lactalbumin, lactoferrin, and specialty protein ingredients.

- Notable Features: Cooperative model ensures full supply chain traceability.

- 2024 Revenue: AFI reported revenue exceeding €1 billion in 2024.

- Global Presence: Strong presence in Europe with exports to Asia and North America.

3. FrieslandCampina

- Specialization: Dairy ingredients including whey proteins and milk powders.

- Key Focus Areas: Infant nutrition and sustainable dairy production.

- Notable Features: Cooperative structure with 10,000+ member farmers.

- 2024 Revenue: Group revenue around €12.9 billion.

- Global Presence: Strong presence in Europe and Asia.

4. Hilmar Ingredients (Hilmar Cheese Company)

- Specialization: Large-scale whey protein concentrates, isolates, and lactose.

- Key Focus Areas: High-volume B2B supply of whey ingredients.

- Notable Features: One of the largest U.S. whey processors with a focus on efficiency.

- 2024 Revenue: Private company; revenues estimated in the billions.

- Global Presence: Strong U.S. base with global exports.

5. Fonterra Co-operative Group

- Specialization: Dairy proteins, milk powders, and whey derivatives.

- Key Focus Areas: Infant nutrition, foodservice, and B2B ingredient sales.

- Notable Features: New Zealand cooperative with a large export business.

- 2024 Revenue: Continued strong performance in dairy ingredients.

- Global Presence: Major supplier to Asia, Middle East, and the Americas.

6. Dairy Farmers of America (DFA)

- Specialization: Whey protein concentrates and milk powders.

- Key Focus Areas: Domestic U.S. ingredient markets and cooperative supply.

- Notable Features: Strong sustainability focus and carbon reduction projects.

- 2024 Revenue: Multi-billion cooperative with steady growth.

- Global Presence: U.S. focus with international exports.

7. Murray Goulburn Co-operative (now part of Saputo)

- Specialization: Historically dairy ingredients including whey proteins.

- Key Focus Areas: Integrated into Saputo’s ingredient and consumer dairy business.

- Notable Features: Legacy assets now drive Saputo’s global presence.

8. Synlait Milk Limited

- Specialization: Infant formula and nutritional milk powders.

- Key Focus Areas: Traceability, specialty proteins, and clinical nutrition.

- Notable Features: Strong emphasis on supply chain transparency.

- 2024 Revenue: ~NZD 1.6 billion in FY24.

- Global Presence: Export-oriented, especially to Asia.

9. Agropur Inc.

- Specialization: Dairy ingredients including whey proteins.

- Key Focus Areas: North American markets with strong R&D capability.

- Notable Features: Cooperative structure with large milk intake.

- 2024 Revenue: Significant though not separately disclosed for ingredients.

- Global Presence: North America with export reach.

10. Saputo Inc.

- Specialization: Cheese, milk, and whey ingredients.

- Key Focus Areas: Global ingredient and branded dairy portfolio.

- Notable Features: Acquisitions (including Murray Goulburn) expand reach.

- 2024 Revenue: Multi-billion annual revenues across segments.

- Global Presence: Strong in North America, Europe, Oceania.

11. Kerry Group

- Specialization: Taste & nutrition solutions, including whey proteins.

- Key Focus Areas: Functional ingredients, protein fortification, and custom blends.

- Notable Features: Broad global R&D network and partnerships.

- 2024 Revenue: ~€7–8 billion in 2024.

- Global Presence: Active in over 150 countries.

12. Lactalis Group

- Specialization: Consumer dairy and whey ingredients.

- Key Focus Areas: Whey derivatives, global dairy leadership.

- Notable Features: Largest dairy company in the world.

- 2024 Revenue: Exceeded €30 billion in 2024.

- Global Presence: Europe, Americas, Africa, Asia.

Leading Trends and Their Impact

- Premiumization: Rising consumer willingness to pay for clean-label, high-purity proteins drives higher margins.

- Fractionation of whey: Demand for lactoferrin and α-lactalbumin boosts investments in new facilities.

- RTD formats: Heat-stable whey systems fuel innovation in protein beverages.

- Sustainability: Reduced carbon footprint and traceability are now commercial imperatives.

- Asia-centric demand growth: Rapid expansion in infant nutrition and fitness markets in China, India, and Southeast Asia.

- Evolving regulations: New health-claim rules in the U.S. and Europe affect marketing and product development.

Successful Examples Around the World

- Arla Foods Ingredients: Commercial success with premium whey fractions for infant formula and clinical nutrition.

- Glanbia Nutritionals: Strong partnerships with sports nutrition brands showcasing how co-development delivers market share.

- Fonterra & Synlait: New Zealand exporters successfully serving premium infant nutrition markets in Asia.

- Lactalis & Kerry: Scale and innovation allow these groups to supply both commodity and premium whey segments globally.

Global Regional Analysis and Policies

North America

- Demand: Sports nutrition, clinical foods, functional snacks.

- Policy: FDA’s 2024 “healthy” nutrient-claim rules affect labeling of whey-fortified foods.

Europe

- Demand: Infant and medical nutrition, sustainability-driven markets.

- Policy: EU Farm-to-Fork and Green Deal influence sustainability compliance and dairy production.

Asia-Pacific

- Demand: Explosive growth in infant nutrition and protein-fortified snacks.

- Policy: Governments in China and India supporting dairy sector modernization and protein fortification.

Latin America & Africa

- Demand: Growing middle classes driving protein consumption.

- Policy: Dairy development programs improving milk supply chains.

India (Deep Dive)

- Demand: Expanding sports nutrition and functional food market driven by young demographics.

- Policy: Government dairy development schemes (e.g., Revised National Dairy Development Program) modernize dairy infrastructure and encourage whey protein production, reducing reliance on imports.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: AI in Food Safety Market Trends, Growth Drivers and Leading Companies 2024