U.S. Life Science Tools Market Size

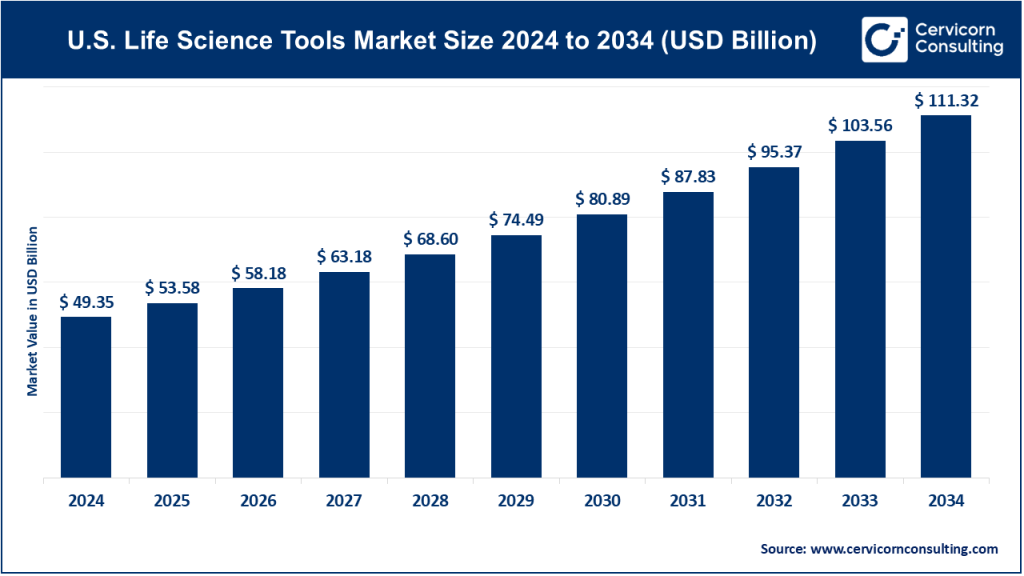

The U.S. life science tools market was worth USD 49.35 billion in 2024 and is anticipated to expand to around USD 111.32 billion by 2034, registering a compound annual growth rate (CAGR) of 7.98% from 2025 to 2034.

What is the U.S. Life Science Tools Market?

The U.S. life science tools market encompasses a wide range of instruments, consumables, reagents, and software solutions used in biotechnology, pharmaceutical research, genomics, proteomics, and other life science applications. These tools facilitate scientific discoveries, drug development, molecular diagnostics, and personalized medicine, enabling researchers and clinicians to advance healthcare and biological understanding. The market includes products such as next-generation sequencing (NGS) platforms, polymerase chain reaction (PCR) instruments, chromatography systems, mass spectrometry devices, and bioinformatics solutions.

Why is the U.S. Life Science Tools Market Important?

The life science tools market plays a crucial role in advancing biomedical research, drug discovery, and precision medicine. It underpins key developments in healthcare, from cancer genomics to vaccine development and regenerative medicine. Given the increasing demand for personalized treatments and biomarker discovery, life science tools provide essential capabilities for academic institutions, pharmaceutical companies, and healthcare providers. Furthermore, they support critical research initiatives related to infectious diseases, neurological disorders, and chronic illnesses. As a result, the market is integral to driving innovations in healthcare and improving patient outcomes.

Growth Factors Driving the U.S. Life Science Tools Market

The U.S. life science tools market is driven by several factors, including rapid advancements in genomics and molecular diagnostics, increased investments in pharmaceutical and biotechnology research, and government funding for life sciences. The rising prevalence of chronic diseases, growing demand for precision medicine, and expansion of biopharmaceutical manufacturing further fuel market growth. Additionally, technological innovations such as automation, artificial intelligence (AI) in drug discovery, and miniaturization of laboratory instruments enhance efficiency and scalability, making life science tools more accessible to researchers and healthcare professionals.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2558

U.S. Life Science Tools Market: Top Companies and Their Key Focus Areas

1. Illumina

- Specialization: Genomic sequencing and array-based technologies

- Key Focus Areas: Next-generation sequencing (NGS), genetic analysis, personalized medicine

- Notable Features: Industry leader in DNA sequencing technology, enabling breakthroughs in cancer research and rare disease diagnostics

- 2024 Revenue (approx.): $4.5 billion

- Market Share (approx.): 15%

- Global Presence: Strong presence in North America, Europe, and Asia-Pacific

2. Thermo Fisher Scientific

- Specialization: Laboratory instruments, reagents, consumables, and analytical technologies

- Key Focus Areas: Mass spectrometry, chromatography, clinical diagnostics, bioprocessing

- Notable Features: Comprehensive portfolio supporting pharmaceutical, biotech, and academic research

- 2024 Revenue (approx.): $45 billion

- Market Share (approx.): 20%

- Global Presence: Operates in over 150 countries

3. Agilent Technologies

- Specialization: Analytical instruments, software, and services

- Key Focus Areas: Genomics, proteomics, chemical analysis, pharmaceutical testing

- Notable Features: Leader in chromatography and mass spectrometry solutions

- 2024 Revenue (approx.): $7 billion

- Market Share (approx.): 10%

- Global Presence: Strong footprint across the Americas, Europe, and Asia-Pacific

4. Bio-Rad Laboratories

- Specialization: Life science research and clinical diagnostics

- Key Focus Areas: PCR, flow cytometry, western blotting, digital PCR (dPCR)

- Notable Features: Innovations in multiplex assays and high-precision PCR technologies

- 2024 Revenue (approx.): $3 billion

- Market Share (approx.): 7%

- Global Presence: Operates in more than 40 countries

5. PerkinElmer

- Specialization: Analytical and diagnostic solutions for life sciences and applied markets

- Key Focus Areas: Genomics, newborn screening, drug discovery, environmental testing

- Notable Features: Strength in neonatal and infectious disease screening technologies

- 2024 Revenue (approx.): $4 billion

- Market Share (approx.): 8%

- Global Presence: Established network in North America, Europe, and Asia-Pacific

Leading Trends and Their Impact on the U.S. Life Science Tools Market

1. Integration of Artificial Intelligence (AI) and Machine Learning (ML)

- AI-driven algorithms are revolutionizing drug discovery, image analysis, and personalized medicine.

- Predictive analytics enhance the efficiency of genomics research and biomarker discovery.

2. Expansion of CRISPR and Gene Editing Technologies

- CRISPR advancements are enabling gene therapy and genetic disorder treatment research.

- Increasing applications in agriculture, cancer therapy, and regenerative medicine.

3. Adoption of Single-Cell Analysis

- Single-cell sequencing is transforming precision medicine by enabling granular insights into cell behavior.

- Supports cancer research, immunology, and neurological disease studies.

4. Rise of Automation and Lab-on-a-Chip Technologies

- High-throughput screening and automated workflows increase lab efficiency.

- Miniaturized diagnostic platforms are making molecular testing more accessible.

5. Growth of Biopharmaceutical R&D and Contract Research Organizations (CROs)

- Increased outsourcing of drug discovery and preclinical research to CROs.

- Rising investment in biologics and cell & gene therapies.

Successful Examples of the U.S. Life Science Tools Market

1. Illumina’s Role in Advancing Genomics

- Illumina’s sequencing technology has enabled large-scale genomic projects, including the All of Us Research Program.

- Its platforms have significantly reduced sequencing costs, making personalized medicine feasible.

2. Thermo Fisher’s COVID-19 Response

- Developed high-throughput PCR testing solutions to combat the pandemic.

- Supplied diagnostic kits and reagents globally, supporting mass testing efforts.

3. Agilent’s Contribution to Cancer Research

- Pioneered biomarker discovery and precision oncology tools.

- Mass spectrometry systems aid in proteomics research for targeted therapies.

4. Bio-Rad’s Digital PCR Innovations

- Developed highly accurate digital PCR (dPCR) systems for detecting rare genetic mutations.

- Used in liquid biopsy applications for cancer diagnosis and monitoring.

5. PerkinElmer’s Advancements in Neonatal Screening

- Leading provider of newborn screening solutions for metabolic and genetic disorders.

- Technologies used in over 100 countries to detect early-onset diseases.

Government Initiatives and Policies Shaping the Market

1. National Institutes of Health (NIH) Funding

- The NIH allocates billions in research funding to advance genomics, drug discovery, and precision medicine.

- Supports various programs like the Human Microbiome Project and Cancer Moonshot.

2. FDA Regulations and Approvals

- The U.S. Food and Drug Administration (FDA) oversees regulatory pathways for life science tools and diagnostics.

- Streamlined approvals for breakthrough technologies under the 21st Century Cures Act.

3. Biomedical Advanced Research and Development Authority (BARDA)

- Provides funding for biothreat preparedness, vaccine development, and diagnostic tool innovation.

- Supports public-private partnerships in the life sciences sector.

4. Precision Medicine Initiative

- Encourages the integration of genomics, big data, and AI into clinical research.

- Aims to tailor medical treatments based on individual genetic profiles.

5. Tax Incentives for R&D

- Government tax credits promote biotech and pharmaceutical research investments.

- Encourages innovation in life science tools and laboratory advancements.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Generic Drugs Market Growth, Trends and Forecast from 2024 to 2033