U.S. Clinical Trials Market Growth

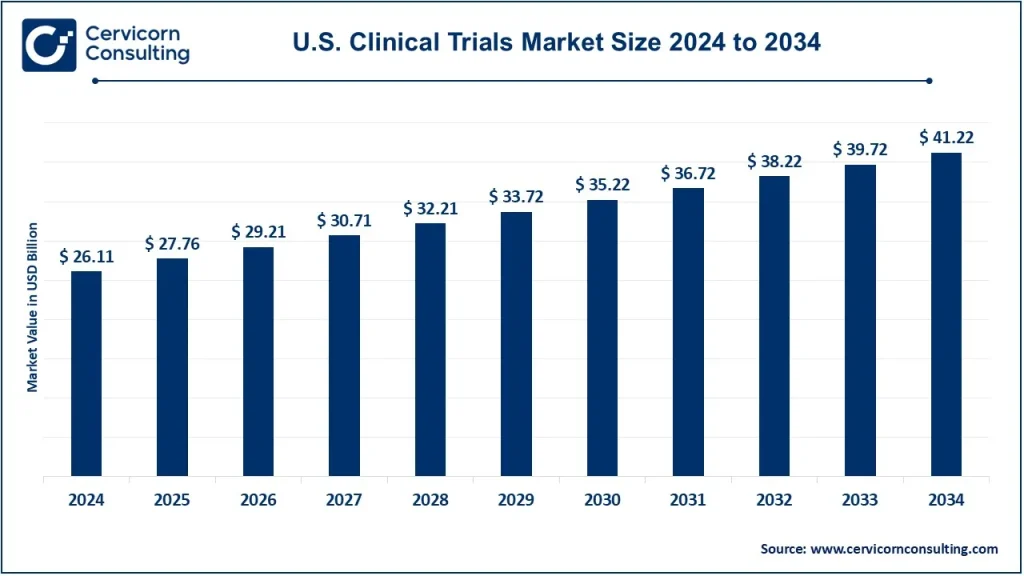

The global U.S. clinical trials market was worth USD 26.11 billion in 2024 and is anticipated to expand to around USD 41.22 billion by 2034, registering a compound annual growth rate (CAGR) of 4.61% from 2025 to 2034.

The U.S. clinical trials market is growing due to several key factors, including advancements in precision medicine, increasing investments from pharmaceutical and biotechnology companies, technological innovations in trial design and execution, rising demand for rare disease treatments, and a favorable regulatory framework that accelerates drug approvals. Additionally, the integration of artificial intelligence (AI) and decentralized clinical trials (DCTs) has significantly improved patient recruitment, retention, and overall efficiency in conducting trials.

What is the U.S. Clinical Trials Market?

The U.S. clinical trials market encompasses the research, development, and testing of new drugs, medical devices, and treatment protocols before they receive regulatory approval. Clinical trials are conducted in phases, from early-stage testing (Phase I) to large-scale efficacy trials (Phase III) and post-marketing studies (Phase IV). The U.S. plays a pivotal role in global clinical research due to its extensive healthcare infrastructure, skilled workforce, and strong regulatory oversight by the U.S. Food and Drug Administration (FDA).

Why is the U.S. Clinical Trials Market Important?

Clinical trials are critical for the advancement of medicine, as they provide the necessary evidence to support the safety and efficacy of new treatments. The U.S. market is particularly significant because it sets global standards for clinical research, offers a diverse patient population, and fosters collaborations between academic institutions, contract research organizations (CROs), and pharmaceutical companies. Additionally, clinical trials contribute to economic growth by generating jobs and attracting foreign investment.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2520

U.S. Clinical Trials Market Top Companies

IQVIA

- Specialization: Data analytics, contract research, and real-world evidence solutions.

- Key Focus Areas: Oncology, neurology, immunology, and rare diseases.

- Notable Features: AI-driven patient recruitment, decentralized trials, and global site networks.

- 2024 Revenue (approx.): $16 billion

- Market Share (approx.): 15%

- Global Presence: Operations in over 100 countries, including the U.S., Europe, and Asia-Pacific.

Fortrea Inc.

- Specialization: Comprehensive clinical trial services, including biometrics and regulatory affairs.

- Key Focus Areas: Cardiovascular, metabolic disorders, and infectious diseases.

- Notable Features: Adaptive trial designs and real-world data integration.

- 2024 Revenue (approx.): $3.5 billion

- Market Share (approx.): 5%

- Global Presence: Strong presence in North America and Europe.

PAREXEL International Corporation

- Specialization: Full-service CRO with expertise in regulatory consulting and Phase I-IV trials.

- Key Focus Areas: Oncology, rare diseases, and cell and gene therapy.

- Notable Features: Patient-centric trial models and AI-powered analytics.

- 2024 Revenue (approx.): $4.7 billion

- Market Share (approx.): 6%

- Global Presence: Active in the U.S., Europe, and emerging markets.

Thermo Fisher Scientific Inc.

- Specialization: Laboratory services, bioanalytical solutions, and trial logistics.

- Key Focus Areas: Immunology, infectious diseases, and personalized medicine.

- Notable Features: High-throughput screening technologies and global supply chain solutions.

- 2024 Revenue (approx.): $44 billion

- Market Share (approx.): 10%

- Global Presence: Extensive footprint in the U.S., Europe, and Asia-Pacific.

Charles River Laboratories

- Specialization: Preclinical and early-phase research.

- Key Focus Areas: Oncology, neuroscience, and rare diseases.

- Notable Features: Advanced animal model research and gene therapy capabilities.

- 2024 Revenue (approx.): $4 billion

- Market Share (approx.): 4%

- Global Presence: Operates in the U.S., Canada, Europe, and Asia-Pacific.

Leading Trends and Their Impact

Decentralized Clinical Trials (DCTs)

DCTs leverage remote monitoring, telemedicine, and wearables to improve patient participation and retention. This trend reduces costs and expands access to underrepresented populations.

Artificial Intelligence and Big Data Analytics

AI-driven analytics enhance trial efficiency by optimizing patient recruitment, predicting outcomes, and identifying biomarkers for personalized treatments.

Precision Medicine and Biomarker-Driven Trials

A shift towards targeted therapies requires advanced biomarker research and genetic profiling, leading to more efficient and effective trials.

Regulatory Harmonization

Collaboration between the FDA and global regulatory bodies is streamlining approval processes, reducing redundancy, and accelerating drug development.

Increased Focus on Rare Diseases and Orphan Drugs

Government incentives and patient advocacy efforts are driving investment in rare disease research, leading to more orphan drug approvals.

Successful Examples of U.S. Clinical Trials Around the World

COVID-19 Vaccine Development (Pfizer-BioNTech, Moderna)

The rapid clinical trials for COVID-19 vaccines set new benchmarks for efficiency, with mRNA technology revolutionizing vaccine development.

CAR-T Cell Therapy (Novartis, Gilead Sciences)

Innovative cell therapy trials led to groundbreaking treatments for blood cancers, with global regulatory approval following U.S.-based trials.

CRISPR Gene-Editing Clinical Trials (Editas Medicine, Intellia Therapeutics)

Gene-editing therapies tested in the U.S. are paving the way for revolutionary treatments for genetic disorders.

Alzheimer’s Disease Treatment (Biogen’s Aduhelm, Eisai’s Leqembi)

Clinical trials in the U.S. have led to novel treatments for Alzheimer’s, offering hope for millions worldwide.

Regional Analysis: Government Initiatives and Policies Shaping the Market

North America (U.S.)

The U.S. government supports clinical trials through agencies such as the National Institutes of Health (NIH) and the FDA’s Accelerated Approval Program. Policies like the 21st Century Cures Act facilitate faster drug development and patient access.

Europe

The European Medicines Agency (EMA) has aligned its regulatory framework with the FDA, promoting cross-border clinical trials and digital innovation in trial management.

Asia-Pacific

China and India are emerging as key players in clinical research, with regulatory reforms improving trial efficiency. Government-backed initiatives in Japan promote regenerative medicine trials.

Latin America

Brazil and Mexico are investing in clinical trial infrastructure, offering cost-effective solutions for global sponsors.

Middle East & Africa

Governments in Saudi Arabia and the UAE are encouraging clinical research through funding programs and regulatory incentives, aiming to position the region as a hub for innovative trials.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Direct-to-Consumer Genetic Testing Market Explosive Growth in 2025